A Short Summary

Hard money lenders provide real estate investors with a great alternative to traditional loans. Hard money lenders are geared towards lending to real estate investors, which means that the loans terms are typically suited to fix and flip projects, rental property purchases or construction projects. Real estate investors often choose hard money lenders as they offer a number of benefits:

- Fast closing: Hard money loans allow investors the opportunity to get funding in a matter of days, as opposed to weeks or even months with traditional mortgage lenders. This can be the difference between closing a deal or losing it, due to the competitive nature of the real estate investing field. This makes hard money lenders a very attractive option for real estate investors.

- Favorable loan terms: Many of the loan terms offered by hard money lenders on their hard money loans are favorable for real estate investors. For example, hard money lenders offer short term loans, and interest-only options. For fix and flip investors, short-term loans that require interest-only payments are ideal, as they can use the sale of the property to pay off the principal loan amount.

- Lenient lending criteria: Hard money lenders have less stringent lending criteria than traditional mortgage lenders, which makes these loans more appealing for real estate investors who don’t qualify for conventional loans. The borrower’s personal finances are of less importance in these loans, and the deal is the main focus. Which makes hard money lenders an important funding solution for investors.

For real estate investors who are looking for hard money lenders, we’ve outlined some of the best hard money lenders for 2023 below so that they can find the right hard money loans. 3 of the best hard money lenders on this list are New Silver, Asset Based Lending, and Lima One Capital.

Hard Money Lenders

New Silver Lending

Overview

New Silver is one of the best hard money lenders for real estate investors, providing funding in as little as 5 days. New Silver sets itself apart from other hard money lenders by harnessing technology to improve the investor’s journey, from property search to sale.

New Silver offers a variety of hard money loans, to suit various investment goals and strategies. Each loan comes with its own set of qualification criteria, which are similar to what other hard money lenders require, but in general the lender requires a minimum credit score of around 650 and a down payment.

When it comes to hard money lenders, New Silver offers particularly attractive features for investors:

- Instant proof of funds letter: These are issued as soon as the hard money loans have been approved, to help investors beat the competition.

- Instant term sheets: Term sheets are provided immediately as well, which allows investors to see the terms of the loan right away.

- Fully online process: From finding an investment property to getting funding and closing the deal, borrowers can do the entire hard money loans process online.

- FlipScout: The lender’s free platform called FlipScout can be used to find good investment properties using reliable data and insights.

- Latest technology: New Silver harnesses the power of the blockchain to securitize hard money loans and use the latest technology to offer real estate investors a more efficient way of lending.

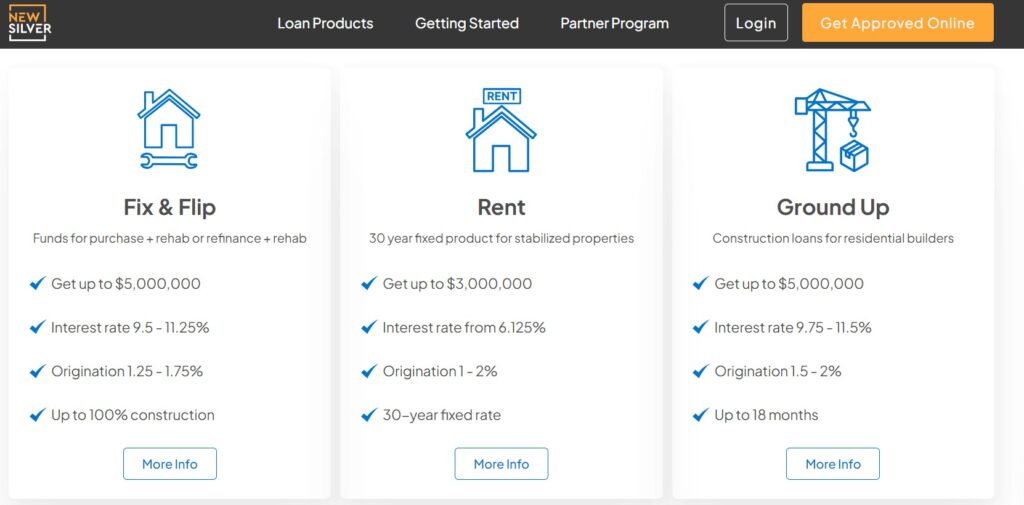

Hard Money Loan Products

New Silver’s fix and flip hard money loans are short term loans of 24 months that are geared towards investors who are purchasing property, renovating it and then flipping it again. The interest rates on these hard money loans begins at 9.25%. The minimum loan amount is $100,000 and the maximum that can be borrowed is $5,000,000. New Silver’s speed of closing on the fix and flip loans (just 5 business days) makes them one of the best hard money lenders.

Rent

The rent hard money loans offered by hard money lenders like New Silver are long-term loans suited to investors who are purchasing a property to rent out. These loans are 30-year loans with fixed interest rates that are amortized. The interest rates on these loans begins at 6.375%, and the minimum FICO score is RENT_FICO]. The minimum loan amount is $150,000 and the maximum is $3,000,000.

Ground Up

The ground up loan product that New Silver offers investors is ideal for residential builders. It is a 24-month loan, that offers up to 100% financing for construction and up to 90% Loan-To-Cost (LTC). The interest rates on these loans starts at 10.5%, and the minimum credit score required is 650.

Lending One

Overview

LendingOne is a direct lender for real estate investors, with loans that are tailored to each investor’s strategy and is among the best hard money lenders for 2023. LendingOne offers real estate loans to part-time investors, large landlords, developers and real estate funds. The lender offers real estate collateral loans which means that the property itself is used as collateral on the loans. This lowers the risk for the lender and enables them to offer better loan terms to borrowers.

Hard Money Loan Products

Fix and flip loans

LendingOne’s fix and flip hard money loans cover both the financing for the property purchase and the renovations up to 90%. Financing is provided within 1 week and interest-only payments are available for the first 24 months.

Rent loans

There are 2 options for those who are purchasing properties to rent out. The RentalOne hard money loans are for investors who need funding over a longer period, so these loans are 30-year amortized loans with fixed interest rates. The Portfolio Pro loan is for investors with a larger rental property portfolio.

Fix to rent loans

These hard money loans are aimed at investors who are buying a property in order to renovate it and then rent it out. The Fix to Rent loans offer the benefits of the Fix and Flip loan, after which borrowers can roll onto a 30-year rental loan.

Multi-family bridge loans

These loans offer funding for investors who are adding value to apartment buildings by taking on new projects. These loans can be used for purchasing, recapitalization, refinancing (including cash out), upgrades and/or seasoning.

New construction loans

Lending One offers ground up construction loans which are between 12 and 24 months. These require interest-only payments for a period of time and are applicable for single-family detached properties, condos, townhomes, multi-family properties

Investor select landlord loans

The investor select rental loan program was created for landlords who own less than 10 investment properties and have a full-time W-2 job. These loans cover the purchase of a rental property, or cash-out and rate/term refinances for currently owned properties.

Lima One

Overview

Lima One Capital is a private lender offering investment property loans for various investing strategies. Borrowers can work together on their deals with the in-house team of experts at Lima One, which speeds up the hard money lending process and cuts out any middlemen. Each loan product has different requirements, but a general rule of thumb for this lender is that borrowers will need to have a minimum FICO score of 650.

Hard Money Loan Products

Fix and flip loans

Within the fix and flip loan category there are 3 options to suit different investing needs. Fix and flip loans are available in 13, 19 and 24-month terms, for 1-4 unit residential properties. Fix to rent loans are offered to investors buying properties to upgrade and then rent out, so these have longer loan terms. Bridge loans can be used for single investment property loans and portfolio blanket loans, and they offer up to 80% LTV.

Construction loans

Lima One offers new construction loans for builders who are ready to begin a ground-up project, or a tear-down. Up to 85% LTC is offered, along with 70% LTV. Loans begin at $100,000 and the maximum amount that can be borrowed is $3 million. The lender also has a Build to Rent loan product which offers longer loan terms.

Rental loans

Lima One has 3 rental loan options. The single rental property loan product is a loan for a single property with a maximum value of $1 million, and the loan terms are 5, 10 or 30 years. Portfolio rental loans are available for investors who have 2 or more rental properties. Lima One also has short term loans with multiple structures available for rental properties.

Multi-family loans

For investors who are purchasing multi-family properties, turn-key tenant properties or those who are holding and cashing out on multi-family properties over the long-term, Lima One has 3 loan options. The value-add bridge loan, the stabilized bridge loan and long-term hold loans.

Asset Based Lending (Abl1)

Overview

ABL (Asset Based Lending) is one of the prominent hard money lenders focused on helping small business owners, real estate investors, and commercial contractors finance their business activities. These loans are tailored to each person’s needs and ABL provides hard money lending in over 29 states across the US.

Hard Money Loan Products

Fix and flip loans

ABL’s fix and flips loans are geared towards the purchase and rehab of 1-6 single family or multi-family residential or mixed-use properties. Investors can borrow up to $3.5 million, with no pre-payment penalties. The minimum credit requirement for these loans is a FICO score of 660.

New construction loans

ABL’s new construction loans are used for land acquisition and construction or rebuilding of existing property. Previous experience is an essential element when applying for these loans. New construction loans can be used for single family, multi-family, and mixed-use properties.

Cash out refinance

For investors who have already built up equity in a property, a cash out refinance loan is a good alternative and some hard money lenders, such as ABL, can provide this. This equity can be used to finance the purchase of 1-4 family residential or mixed-use properties. There is no experience level required for these loans, and the minimum credit score requirement is 680.

Rental property loans

Investors of any experience level can use ABL’s rental property loans to finance the purchase of rental properties. A minimum credit score of 620 is required for these loans which offer an advance of up to 80% of the current value of the home.

We Lend

Overview

We Lend is one of the top private money lenders for real estate investors, with the aim of delivering low-cost capital as quickly as possible. We Lend provides funding in 3-7 business days, with proof of funds letters and a valuable network of real estate professionals that they connect investors with.

Hard Money Loan Products

Fix and flip loans

With no upfront fees or bank statements and tax returns needed, borrowers can use We Lend’s fix and flip loans to fund their next house flip in 3-7 business days. These loans provide up to 90% of the purchase price and 100% of the renovation costs.

Fix and finance loans

We Lend’s fix and finance loans are available for those who are purchasing a property that they want to renovate and then rent out. These loans allow for both the purchase and the property upgrades to be done, by converting to a rental loan once the upgrades have been completed.

Rental loans

Rental loans provided by We Lend are 30-year loans that are either 5/1 or 7/1 adjustable interest rates. These loans don’t require tax returns or a debt-to-income ratio. Funding for rental loans is provided by We Lend within 14 business days.

Construction loans

Investors who are purchasing properties that need major construction can use We Lend’s construction loans. No upfront fees or bank statements are required for these loans, and a substantial amount of the construction costs are covered by the loan.

Bridge loans

These loans are for investors who need financing for temporary purposes, until they have secured more permanent financing. These loans are similar to the rest in that there are no upfront fees required and they are closed in 3 to 7 business days.

Commercial multi-family loans

We Lend offers commercial multi-family loans for real estate investors who are purchasing a property with multiple units, to rent out. Proof of funds will be provided, alongside the flexible terms on offer. Funding can take about 14 days on these loans.

Do Hard Money

Overview

Do Hard Money is a hard money lender for real estate investors primarily, but they also provide various other services which are accessible by filling in details and answering questions. Do Hard Money has flexible hard money lending guidelines, starting at 5-month loan terms and going up to 12 months. The minimum ARV (After Repair Value) on loans starts at $70,000.

Hard Money Loan Products

Fix and flip

Do Hard Money offers fix and flips loans to investors who have no experience, and those who have very little funds to use as a down payment. As such, the lender takes on a considerable amount of risk to offer 100% financing loans for house flipping with little to no down payment.

BRRR

Investors who are looking to buy, rehab, rent and refinance properties, Do Hard Money has a loan product to suit this. A minimum credit score of 660 is required to qualify for BRRR loans with this lender. Borrowers can get access to financing for 100% of the purchase price and the rehab.

Wholesale

For those who are wholesaling real estate, Do Hard Money not only offers loans for this purpose, but also the software to find, evaluate and market the properties. They also have a buyer’s list which can be used to facilitate the deal.

Kiavi

Overview

Kiavi (previously known as Lending Home) is an equal housing lender that provides capital to real estate investors in the form of hard money lending. Borrowers can get funding from $100,000 to $1.5 million from this hard money lender. The origination fee is typically around 0.5% of the principal amount across the board.

Hard Money Loan Products

Bridge (fix and flip) loans

For investors who are purchasing properties in order to renovate them and resell them, Kiavi’s bridge loans can be used. Borrowers can get funding from $100,000 to $1.5 million. Borrowers can get up to 90% of the purchase price and up to 75% of the after-repair value on these loans. Loan terms range between 12, 18 and 24 months.

DSCR rental loans

Kiavi offers 30-year rental loans that are either 5/1 ARM or 7/1 ARM, both of which are fully amortized. Borrowers can get up to 80% LTV on the rental loan products, and single-family homes, PUDs and 2-to-4-unit properties are all options for funding. There are interest-only options available on the rental loans for those who may require it.

Rental portfolio loans

For investors who are looking to grow their portfolio, the rental portfolio loans allow for 5 or more properties to be consolidated under one loan. These loans are customizable with 10 and 30-year options, and up to 75% LTV. They start at $500,000 and there are interest-only options available.

BridgeWell Capital

Overview

Bridgewell Capital is one of the prominent private money lenders for real estate investments, offering funding in as little as 10 days from start to finish. The lender offers 6 different loan products for each investing strategy. Bridgewell Capital, much like many other hard money lenders requires a minimum down payment of 20% of the property’s purchase price on loans. Bridgewell Capital has funded over $500 million since it began in 2008.

Hard Money Loan Products

Rental loans

Bridgewell Capital’s rental loans are offered for the purchase of rental properties or refinancing in order to purchase rental properties. A minimum down payment of 25% is required, and investors can use up to 65% of the home’s value on a cash-out refinance loan. These loans are 5-year loans for single or 1-2 unit properties.

Fix to flip loans

The fix and flip loans offered by Bridgewell Capital offer up to 100% coverage for the rehab costs, and up to 75% ARV. Fix and flip loans can be closed in 10 days. No interest is charged on rehab funds that haven’t been drawn.

Commercial loans

Bridgewell Capital offers loans for the purchase of commercial properties, which include mixed use, office, retail, and flex industrial properties. The lender offers flexible loans for this and will work with each borrower on their individual deal. The minimum loan amount offered is $150,000 and the maximum is $2 million.

Fix to rent loans

These loans are much like the fix and flip loans on offer, however the loan becomes a longer-term loan once the property rehab has been completed. Fix to rent loans can also close in 10 days and don’t charge interest on any rehab funds that have not been used.

Cash out refinance

Cash-out refinancing loans allow investors to tap into equity that they already have in a property and use this to free up capital to invest with. The minimum amount for these loans is $100,000, and the maximum that can be borrowed is $1 million. A minimum credit score of 650 is required to qualify for these loans.

Multi-family loans

The multi-family loans provided by hard money lenders like Bridgewell Capital are useful for investors who are buying multi-family properties of 5 or more units. There is no middleman and Bridgewell Capital gives investors access to over 100 institutional capital loan programs for multi-family properties.

Rehab Financial Group

Overview

Rehab Financial Group one of the leading hard money lenders offering different loans to qualified real estate investors, with a focus on rehab investment opportunities. The lender offers income-based loans, experience-based loans and DSCR loans. The minimum loan value that RFG offers is $50,000 and the maximum amount that investors can borrow is $3 million.

Hard Money Loan Products

Income-based loans

Within this category RFG offers two loans, the 100% Fix and Flip Premier loan and the Core Ground Up Construction loan. The 100% Fix and Flip Premier loan offers funding for 100% of the property purchase amount and rehab, as well as up to 70% ARV. The Core Ground Up Construction loan is geared for investors who need 100% of their construction costs covered before switching to a long-term loan.

Experience-based loans

The two products that RFG offers under this category are the Stated Product Fix and Flip Premier loan, and the Stated Ground Up loan. The Stated Product Fix and Flip Premier loan is a short-term loan aimed at active investors who are flipping houses and are looking to leverage 90% financing. While the Stated Ground Up loan is similar to the Core Ground Up Construction loan but this option is tailored to investors with varying credit scores and gives them different ARV options.

DSCR loans

The 30-year Rental Refinance and Purchases loan falls under the DSCR category. The loan has 5/1 ARM with 10-year interest-only options. This loan is suitable for investors who are using money from an existing loan to purchase a rental property.

Fund That Flip

Overview

Fund That Flip is a hard money lender offering accredited investors and borrowers’ financial solutions for their real estate investing needs. The platform has a Residential Bridge Note Fund for accredited investors to invest in a pool of short term loans backed by real estate. For borrowers, the platform has 5 loan products available and Fund That Flip has earned its place among the best hard money lenders in 2025.

Hard Money Loan Products

Fix and flip loan

Fund That Flip is known for their fix and flip loans, offered with short loan terms and fast closing. These loans are ideal for investors who are doing short fix and flip projects, where real estate deals are found and purchased quickly, in order to rehab and re-sell for a profit.

Fix and rent loan

Fix and rent loans from Fund That Flip are aimed at being a solution for the renovation process and the purchase of the property, with the intent of paying it back in the short-term.

New construction loan

For tear down or new construction projects, hard money lenders like Fund That Flip can be useful. Their new construction hard money loans can fund 100% of the construction costs. Not all the funds will be released initially, some may be kept in escrow and released as they are needed during the project.

Cash-out refinance loan

For those who have already created equity in their home, these loans are a good solution because they allows these borrowers to leverage the equity in their property to make home improvements.

Bridge loan

Whether you have a project under contract or are still working on the details, Fund That Flip is one of the hard money lenders offering bridge loans to those who need funding for their next real estate investing project.

These hard money loans start at $100,000 and interest rates start at 9.99%. Hard money lenders require a significant down payment typically, however the down payment required for this loan is 10% of the purchase price, and interest-only payment options are available.