Getting Started with New Silver

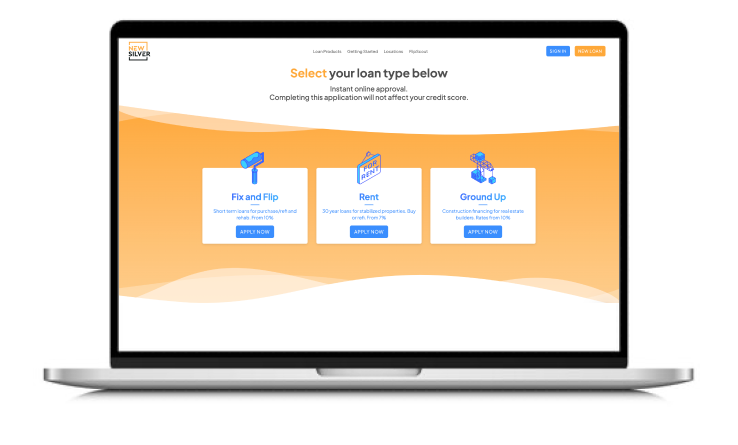

Made Easy In Three Steps

Learn about Loan Products and Requirements

Get answers to Frequently Asked Questions

Apply online and get approved in 5 minutes

1. Loan Products and Requirements

Fix & Flip

For real estate investors who want to buy, renovate and resell /refi their property within 12 months. Minimum loan amount is $100,000 and minimum as-is value is $100,000. Single family and multi-family up to 4 units and condos are acceptable. Credit 650+ is required.

Rent

Perfect for investors who want to buy or refinance a stabilized (no rehab) property. Short term rentals and vacation property accepted. 30 year fixed and other programs available.

Minimum loan amount is $150,000 and credit 660+. 1-8 units.

Ground Up

Perfect for experienced investors who want to start a new construction project. Term up to 24 months Minimum loan amount is $100,000. Single family and multi-family up to 4 units and condos are acceptable. Credit 650+. At least 2 previous similar experience required.

If you don't meet the minimum credit or experience requirement, you can add a co-borrower guarantor. We require at least one of the guarantors to have a FICO score of 650+, or 680 and above if there is no previous fix and flip experience.

2. Get answers to Frequently Asked Questions

No. We only finance business purpose loans for non owner occupied properties.

Yes.

Read more here.

No.

Read more here.

Read more here.

Read more here.

Read more here.

Read more here.

Read more here.

We have closed loans in under 5 business days on a rush basis however, it could take 10 business days or longer, depending on the area.

No, we only finance residential property.

No.

Read more here.

More FAQs are available in our self-service portal

3. Apply online and get approved in 5 minutes

After you have read about our loan programs and the frequently asked questions, you can start the online application and get approved online in 5 minutes.