The Short Answer

ABL (Asset Based Lending) is a hard money lender, focused on helping small business owners, real estate investors, and commercial contractors finance their business activities. Loans are tailored to each person’s needs and the lender operates in over 29 states across the US. ABL offers the following loans:

- Fix and flip

- New construction

- Cash out refinance

- Rental property

Jump To

Intro To Asset Based Lending

What Type of Loans Does ABL Offer?

ABL offers a variety of loans for small business owners, real estate investors, and commercial contractors with different investing strategies and business activities. This makes them a versatile lender with loan products that appeal to a wide range of investors. Let’s take a look at each loan product that ABL has to offer.

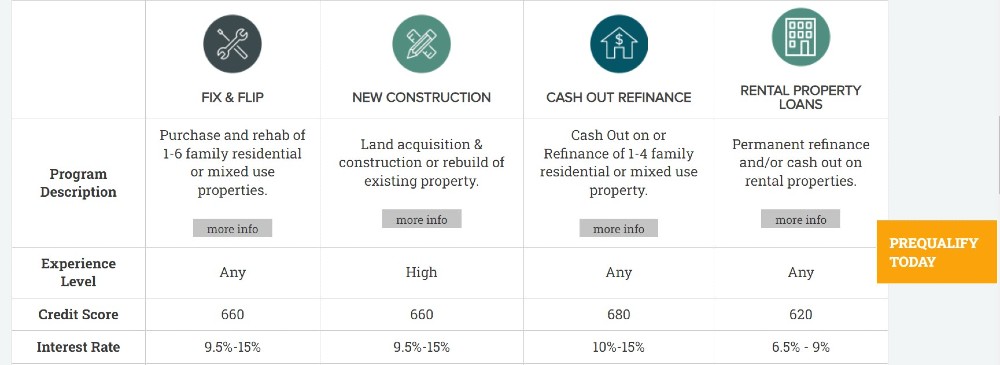

1. Fix and Flip

Asset Based Lending’s fix and flip loans are aimed at investors who plan to purchase and rehab 1-6 single family or multi family residential or mixed-use properties. Investors with any level of experience can apply for a fix and flip loan. The minimum credit score requirement is 660, and at the time of writing the interest rates on this loan range from 9.5% to 15%. There is no pre-payment penalty on these loans and loan amounts begin at $75,000 and go up to $3.5 million. ABL’s fix and flip loans are 12 months long with the option of extending.

2. New Construction

ABL’s new construction loans are used for land acquisition and construction or rebuilding of existing property. Those who are applying for these loans will need a high level of experience and a credit score of at least 660. At the time of writing, the interest rates on the new construction loan are between 9.5% and 15%. New construction loans through ABL can be used for single family, multi-family, and mixed-use properties. There is no pre-payment penalty on these loans which are 12 months, and loan amounts begin at $100,000 and go up to $3.5 million.

3. Cash Out Refinance

The cash out refinance loans offered by ABL are for those who would like to use the equity they have already built up in a property. ABL offers cash out or refinance loans of 1-4 family residential or mixed-use properties. There is no experience level required for these loans, and the minimum credit score requirement is 680. The interest rates on the cash out refinance loans range between 10% and 15% at the time of writing. The minimum amount that can be borrowed on these loans is $100,000 and the maximum is $3.5 million. ABL’s cash out refinance loans are short term loans of 12 month.

4. Rental Property Loans

ABL’s rental property loans are geared towards investors of any experience level that are looking to purchase rental properties by using a cash out or permanent refinance on a property they currently own. The minimum credit score requirement is 620, and the interest rates at the time of writing start at 6.5% and go up to 9%. These loans do not require a high level of experience and they offer up to 80% advance rate on the current value. These are long term loans of 30 years with amortization, and the minimum loan amount is $100,000.

How Does The Appraisal Process Work?

The appraisal process begins with a loan application being submitted and approved. After this, a purchase contract for the property needs to be submitted and a detailed written explanation of the scope of the project. A property appraisal is then scheduled with an appraiser or appraisal company.

There are three methods appraisers or an appraisal company will use to estimate value: the cost approach, the sales comparison approach, and the income capitalization approach. The appraiser will visit the property and take into account things like location, age of the home, square footage, and any recent improvements that have been made. They will look at comparable homes in the area that have sold recently in order to come up with a fair market value for the property in question.

Best Features of ABL Lending

- Zero Point program: This is a loan option that includes no pre-payment penalties or exit fees, which means that it is truly zero points. No experience is required for the zero-point loan program options, and they offer up to 90% LTC for fix and flips and new construction, and up to 75% LTV for cash out and refinance loans.

- Deal Calculator: ABL offers a free fix and flip calculator where investors can put in the purchase price, rehab budget, After-Repair Value (ARV) and other details about their deal, to work out the numbers that determine the success of the project. These include the estimated total project cost, net profit, return on project cost percentage, and so on.

- Financial coaching and support: Asset Based Lending offers videos, a useful blog, tips, case studies, and advice for borrowers along their journey. The ABL team offer their support to investors during the entire loan process.

- Various loan options: ABL Lending has a variety of loan options to suit each real estate investor’s unique strategy or business goals. Fix and flip loans, cash out and refinance loans, construction loans and rental property loans are all on offer with this lender.

- Reasonable lending criteria: For many of the loans, no experience is required and a minimum credit score of 660 is typically required.

- Fast loan processing: ABL offers loan pre-approval in just 24 hours, and loan closing in as little as 3 days. When it comes to real estate investing, closing loans in a timely manner is one of the best ways to beat the competition and secure good deals.

Worst Features of ABL Lending

- Interest rates: ABL’s loan interest rates start at 9% and go up to 15% which is not a viable option for many investors as 15% interest on the loan may eat into their profits too much.

- Communication: Some customers have complained in the ABL reviews that they didn’t receive timely communications, and they had to follow up many times with the company.

- Higher risk: The risk with asset based lending is that putting a property up as collateral means that investors could lose it, if they cannot make their loan repayments. This is a big risk for investors who ultimately need this property to generate a profit.

- Lack of data and insights: In comparison to other lenders, Asset Based Lending lacks certain data and insights, and has no option to find and purchase properties on their website. Being able to see detailed data about the real estate market and the property that an investor is considering purchasing could be more beneficial to an investor.

ABL Lending Alternatives

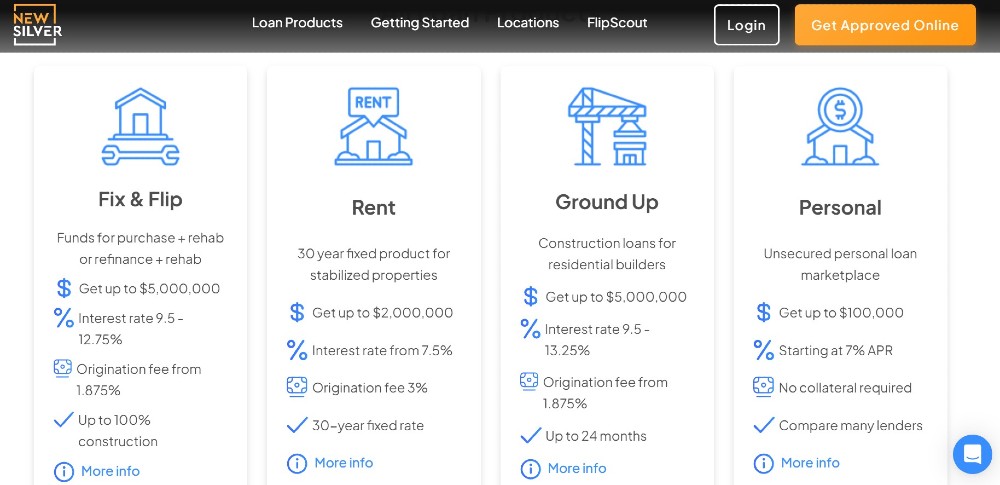

New Silver

New Silver are a hard money lender with a specific focus on real estate investors. New Silver offer fix and flip loans, rental loans and ground up construction loans. They also have a marketplace for personal loans. The lender pride themselves on being able to offer hard money loan closing in as little as 5 business days and loan approval in just 5 minutes.

New Silver operates entirely online and provides instant online term-sheets and proof of funds. There are loan consultants to help, every step of the way. A minimum credit score of 650 is generally needed, depending on the loan type. Some loans don’t require any previous experience, and investors can qualify based on the property deal itself, along with the less stringent lending criteria. New Silver offers short term loans for fix and flip projects and long term loans for rental properties.

Kiavi

Kiavi is a lender that provides capital to real estate investors. The lender provides bridge loans (fix and flip) and rental loans. The bridge loan rates start at 6.95%, and a borrower can get funding from $100,000 to $1.5 million. Kiavi has flexible loan terms on their long-term rental financing which is 30 years. The interest rates on these loans begin at 6.875%. There two loan options, either a 5/1 ARM or a 7/1 ARM, and both are fully amortized.

Kiavi doesn’t require an application fee or appraisal for bridge loans. Kiavi also doesn’t do income or employment verification, and there is no asset verification which saves time and money. Loan terms are flexible and based on each the needs of each borrower.

LendingOne

LendingOne provides loans for rental properties, fix and flips, new construction, multi-family properties and portfolio rentals (which are multiple rentals at one time). Using their own capital, LendingOne provides loans solely to real estate investors, with up to 90% of the purchase and repairs covered for fix and flip loans.

LendingOne will provide more information on the interest rates that investors can qualify for, within 2 minutes or less, once investors have applied. Loans range from 12 months upwards.