A quick summary

Finding the right lender for your real estate investing journey can be a difficult task. So, we’ve put together a review of Rehab Financial Group, a private lender, to help you figure out whether they’re a good fit for your needs.

Table of Contents

One of the most important steps for successful real estate investors is to obtain financing for their property purchase. Whether this is for a fix and flip project, a rental property or ground up construction, financing can make or break an investor’s journey in real estate. As such, this decision is of major importance to real estate investors.

For those looking at lending options outside of conventional bank loans, there are a variety of options. We’ll take a look at Rehab Financial Group reviews, to help you decide whether this lender is a good fit for your rehab project or alternative real estate investing needs.

Overview of Rehab Financial Group loan products & services

Rehab Financial Group are a private, leading rehab lender offering different loans to qualified real estate investors, with a focus on rehab investment opportunities. The lender offers income-based loans, experience-based loans and DSCR loans. Each loan product has different features, rates and loan terms.

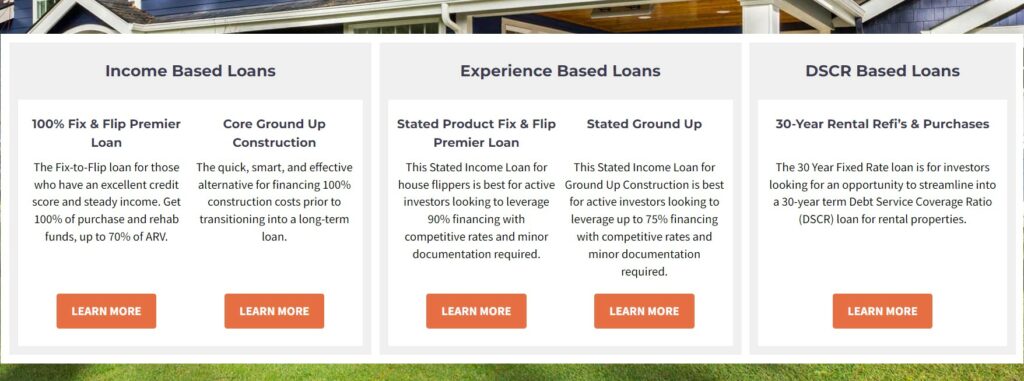

Income-based loans:

Within this group there are 2 loans, the 100% Fix and Flip Premier loan and the Core Ground Up Construction loan.

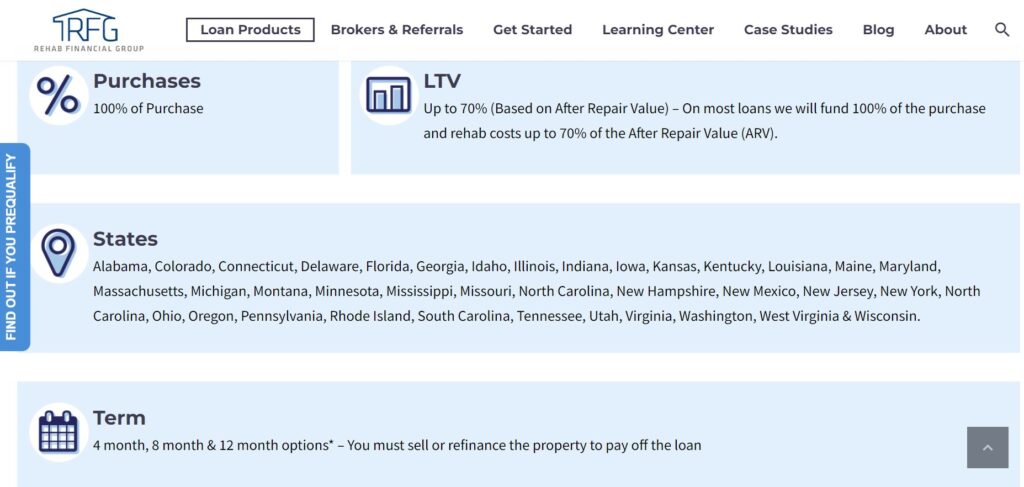

The 100% Premier Fix and Flip loan is a short-term loan aimed at investors who have good credit and a regular income. A credit score of at least 620 is required, as well as income verification. This is a 100% home rehab loan, which means that the entire purchase price and all the rehab costs are covered. Up to 70% of the ARV (After-Repair Value) is also covered by this loan. Investors have a choice of loan terms between 4, 8 and 12 months. The loan amounts available are $50,000 to $1million.

The Core Ground Up Construction loan is aimed at investors who are looking to do a ground up building project of 1-4 units that are non-owner occupied. Up to 100% of construction can be financed, with the view to transitioning into a longer-term loan. To qualify for this loan, investors will need to have a FICO score of between 660 and 700, or over 700 to qualify for more. Investors will need to have purchased the land already, laid the foundations and obtained all the necessary building permits. The loan terms offered are 8, 12 or 18 months.

Experience-based loans:

Under this category there are 2 loans, the Stated Product Fix and Flip Premier Loan, and the Stated Ground Up loan.

The Stated Product Fix and Flip Premier Loan is geared towards active investors who are flipping houses and are looking to leverage 90% financing. This loan is typically 12 months, and loan amounts begin at $50,000 and go up to $3million. Investors will need a FICO score higher than 620 to qualify for this loan. The property types that are covered include single family, 1-4 units, townhomes, and condos.

The Stated Ground Up Loan falls under the same product as the Core Ground Up Construction loan, with small differences between the two. These differences are to do with the FICO score, as investors who have a score between 660 and 700 can qualify for 65% of the ARV, whereas investors with a score over 700 can qualify for 70% ARV. 100% rehab financing is offered on this loan. Loans begin at $50,000 and go up to $1million.

DSCR-based loans:

There is 1 loan that falls under the Debt Service Coverage Ratio (DSCR) category, which is the 30-year Rental Loan Refinance and Purchases. The loan has 5/1 ARM with 10-year interest only options. The minimum loan amount offered on this loan is $75,000 and the maximum is $2million. The aim is to allow investors to take out of their existing loan and purchase a rental property. These are for non-owner occupied properties which can be condos or mixed use properties of up to 20 units. The minimum FICO score required is 640.

Minimum loan value

The minimum loan value the Rehab Financial Group has is $50,000. While this varies from loan to loan, the overall minimum on most loans is $50,000. None of the loan products offer a minimum amount that is lower.

Maximum loan value

The maximum loan value that the Rehab Financial Group has is $3million and this is offered on the Stated Product Fix and Flip Premier Loan. Other loans have maximum loan values of $2million and $1million, so this amount varies depending on the loan.

Rehab Financial Group Interest Rates

The interest rates offered by the Rehab Financial Group range from 9.99% upwards, with origination fees starting at 2 points. However, interest rates and points vary across each loan. The lender offers interest-only payments in some cases, such as the 100% premier fix and flip loan and the stated income loan for house flipping. In these cases, only the interest will need to be paid for a certain period of time before the principal amount needs to be settled.

Do you need real estate investing experience to qualify for their loan products?

Some of the Rehab Financial Group’s loans require previous experience. Such as the Ground Up Construction loans, which require at least 1 previous successful project to be completed within the last 12 months. This is a requirement that will need to be verified, as part of the loan qualification requirements.

How do rehab loans work?

Rehab financing is provided in the form of a rehab loan to investors who are purchasing a property to renovate and then resell. Rehab loans are intended to finance the rehab of the property, however sometimes they can provide finance for the purchase as well. Rehab loans with Rehab Financial Group typically cover up to 70% of the ARV value and up to 100% of the home’s purchase price and rehab.

Rehab Financial Group Reviews

Generally, Rehab Financial Group has 4 to 5 stars on the main review pages, which indicates a positive sentiment around the lender. The lender has scored 4.4 on Yelp (with 4 out of 5 reviews being positive), 4.9 on Facebook (although many of these reviews aren’t legitimate), and 4.4 on Google reviews (with 40 reviews).

From REI journeys to fix and flip projects, there are a variety of different loan use cases that have been mentioned in the reviews. The positive reviews include benefits like the fast turnaround time, the sentiment that the lender cares about their clients, and a smooth process. Some reviews boast approval times in under a week, others talk about the lender going over and above to close unconventional deals, and some are positive about the fees being lower than other lenders.

Key Advantages for Real Estate Investors:

Flexible Financing Options: Rehab Financial Group specializes in real estate investing, offering hard money loans that are particularly suited for BRRRR deals. This makes them an ideal choice for investors looking to leverage this strategy effectively.

Quick Funding: Known for their quick access to funds, Rehab Financial can often provide faster financing than traditional banks. This is a crucial factor for BRRRR investors who need to act swiftly on new property opportunities.

Client-Centric Service: Many reviews highlight the lender’s dedication to client satisfaction, noting their willingness to go above and beyond to secure deals that might be unconventional, ensuring a smooth, client-focused process.

For those seeking a reliable lender with a proven track record and a focus on real estate investment, Rehab Financial Group offers a compelling combination of speed, flexibility, and customer care.

Rehab Financial Group Complaints

Some of the complaints about the Rehab Financial Group are that they charge $250 for the initial application process. However, applicants may not be approved after that, in which case, they’ve wasted those funds.

Understanding the fee structure is crucial when navigating hard money loans. Typical fees you might encounter include origination fees, appraisal fees, and possible prepayment penalties. Origination fees often start at 2 points, but they can vary depending on the specific loan terms and lender policies.

The interest rates offered by the Rehab Financial Group range from 9.99% upwards. Interest rates and points can differ across each loan. The lender offers interest-only payments in some cases, such as the 100% premier fix and flip loan and the stated income loan for house flipping. In these cases, only the interest will need to be paid for a certain period before the principal amount needs to be settled.

By being aware of these potential costs, borrowers can better prepare for the financial requirements involved in securing a hard money loan, ensuring they make informed decisions that align with their investment strategies.

Rehab Financial Group Alternatives

Investors who are looking for loans similar to the ones Rehab Financial Group offers can consider one of the following alternative lenders:

New Silver Lending

New Silver is a hard money lender offering fix and flips loans, rent loans, ground up construction loans and facilitating personal loans. The interest rates on these loans start at 7%, and loan terms range from 12 months on fix and flip loans, to 30 years on rent loans. New Silver offers fast funding, with closing in as little as 5 days, and instant online proof of funds letters.

New Silver also provides a variety of tools and resources to help investors find profitable properties and make more informed investing decisions. FlipScout is New Silver’s innovative tool that investors can use to find profitable investment properties, using insights on each property such as the after-repair value, potential profit and estimated ROI. Investors can then use any of the useful calculators to work out their ARV, rental information, cap rate and more.

Lima One Capital

Lima One is a private lender for qualified real estate investors, providing fix and flip loans, new construction loans, rental loans and multi-family financing. The lender offers in-house underwriting and construction management. Lima One provides loans in about 40 states across the US, with loans starting at $250,000 and going up to $5million.

Lima One’s rates range between 8.99% and 10%, and their loan terms are flexible. There is a maximum LTV of 70% and loan terms range from 13 months to 2 years. While various loan requests are considered, the lender focuses primarily on single family residences and multi-family residences.

Abl1.net

Asset based lending LLC is a hard money lender to local real estate investors for fix and flip projects, new construction, cash out refinance projects for non-owner occupied properties and rental properties. ABL lend in 24 states across the country and offer loan pre-approval in 24 hours and closing in as little as 3 days.

ABL rates range between 6.5% and 12.5%, and loan amounts begin at $75,000 and go up to $5million, depending on the loan type. All loans have a 12-month loan term, except the rental property loans which have a 30-year amortized loan term.

Kiavi

Kiavi offers bridge (fix and flip) loans and rental loans to qualified real estate investors. The lender’s short-term fix and flip loans can be used for both the purchase and rehab of properties. Rates start at 6.95%, and the lender provides loans in 32 states across the country.

Kiavi offers closing in a minimum of 10 business days, and 90% LTC is also a benefit that some investors can experience. Loans start at $100,000 and go up past the $1 million mark.

Final Thoughts – Should You Use This Private Money Lender?

If you’re looking at the Rehab Financial Group as a lender for your next real estate investment project, it’s important to make sure that you’ve considered a few alternatives first. Make a list of your needs, and rank them in order of priority, then compare each lender according to this list, to see where they stand. This will help you decide which lender is the best for your personal circumstances.

For investors who have previous experience and good credit, getting rehab loans through Rehab Financial Group can be a good option. However, this depends on your personal financial situation, project timeline and property deal.

FAQ

Main Drawbacks of Hard Money Lenders:

Higher Interest Rates: One of the most significant concerns with hard money lenders is their tendency to charge higher interest rates than traditional financing sources. This can significantly impact your overall return on investment (ROI), so it’s crucial to factor these costs into your financial planning.

Additional Fees: Borrowers should be prepared for several additional fees. These can include origination fees, appraisal fees, and even possible prepayment penalties. These costs can add up quickly, further influencing your financial decisions.

By understanding these potential pitfalls, you can make a more informed decision about whether hard money lending is the right choice for your investment strategy.

When evaluating loan terms from a hard money lender, there are several critical factors to consider to ensure you’re making a sound financial decision.

Interest Rates and Loan Duration

One of the first things to scrutinize is the interest rate offered. Hard money loan rates are typically higher than traditional loans, so compare multiple lenders to find the most competitive terms. Also, consider the length of the loan. A shorter term might mean paying higher monthly sums, while a longer term could increase the total interest paid over time.

Repayment Penalties

Look closely at any penalties associated with repaying the loan early. Some lenders impose hefty fees for early repayment, which can significantly impact your return on investment if you plan to refinance or pay off the loan quickly.

Lender Reputation

Investigating the lender’s reputation is key. Seek out online reviews, but don’t stop there. Engage with other investors or individuals who have worked with the lender. Their experiences can offer invaluable insights. If possible, arrange a face-to-face meeting or a comprehensive phone interview to get a feel for their professionalism and reliability.

Experience with BRRRR Projects

If your project involves the “Buy, Rehab, Rent, Refinance, Repeat” (BRRRR method), it’s beneficial to choose a lender experienced in this area. Some specialize in funding such projects, offering insights and expertise that can streamline the process. Ensure the lender understands the nuances of BRRRR to better support your investment strategy.

By paying attention to these elements—interest rates, repayment terms, lender credibility, and specific project experience—you are better positioned to secure a loan that aligns with your financial goals and project requirements.

When navigating the world of real estate investment strategies, particularly the BRRRR method (Buy, Rehab, Rent, Refinance), partnering with a lender experienced in BRRRR projects is crucial for several reasons.

Understanding of Project Nuances: Lenders familiar with the BRRRR method can better assess your project’s potential. They understand the complexities involved in transitioning a property from rehab to rental, ensuring that the project flows smoothly from one phase to the next.

Tailored Financing Options: Experienced BRRRR lenders can offer financing options that align more closely with your strategy’s unique requirements. They might provide flexible repayment schedules or customized loan structures that a traditional fix-and-flip lender may not offer.

Speed and Efficiency: Time is of the essence in real estate, and working with a seasoned lender can speed up the funding process. Their familiarity with BRRRR projects can lead to quicker approvals and fewer hurdles, moving your project from purchase to rental phase swiftly.

Risk Mitigation: An experienced lender can better assess risks associated with BRRRR investments. Their insight into the market and potential pitfalls can guide you in making more informed decisions, ultimately protecting your investment.

Guidance and Support: Lenders who have funded BRRRR projects before can offer valuable advice and support throughout your investment journey. From suggesting reliable contractors to providing market trend insights, their expertise can be an asset beyond just financial resources.

Choosing a lender with a deep understanding of BRRRR projects can significantly enhance the success of your investment, ensuring you have the support needed to navigate this complex yet rewarding strategy.