Rental Property Depreciation Calculator

Rental Property Depreciation Calculator Results

First Year Depreciation

11.5 months

$12,272.27Last Year Depreciation

6.5 months

$12,272.27Full Year Depreciation

12 Months

$12,272.27Final Month Of Useful Life

July 2039| Year | Initial Cost | Depreciation Expense | Accumulated Depreciation | Final Cost |

|---|

Download a PDF with your results

Enter your email below

How Does Rental Property Depreciation Work?

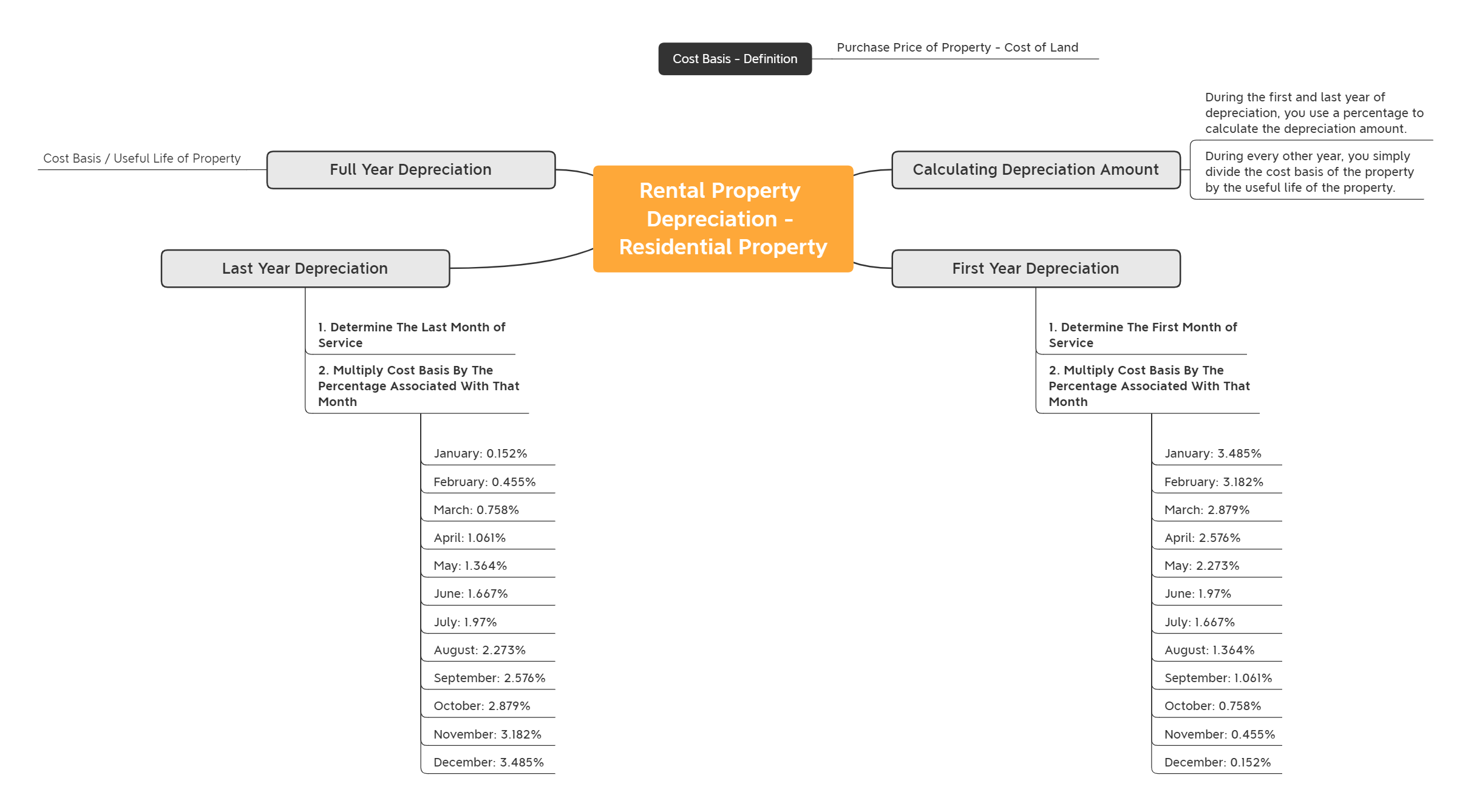

Property depreciation is much easier to understand when you know how to work out how much a property depreciates in a single year.

To do this, you simply take the Cost Basis of the property (aka the purchase price of the property, minus the cost of the land) and divide it by the useful life of the property, which is 27.5 years in the case of residential property.

For example, if the cost basis is $200,000 and the useful life is 27.5 years, to calculate the property depreciation for a single year:

- Rental Property Depreciation = Cost Basis / Useful Life

- Rental Property Depreciation = $200,000 / 27.5 = $7,272.73

This isn’t a very complex calculation. You are simply dividing the property value by the depreciation time (in years) to work out the depreciation over a full year.

That’s the easy part. The tricky part is working out how much a residential rental property depreciates in the first year and the last year of its useful life. To work this out, you can either use the rental depreciation calculator at the top of this page, or you can view the FAQ section which fully explains how to calculate property depreciation in the first and last year.

Understanding Depreciation in Real Estate Investments

Depreciation is an annual tax deduction for the “wear and tear” of property over time, which is vital for real estate investors. It reflects the gradual reduction in value of an asset, as recognized by tax authorities. The IRS, for instance, mandates that investors depreciate real estate over specified periods: 27.5 years for residential real estate and 39 years for commercial real estate.

This regulatory requirement allows investors to deduct the depreciation amount from their taxable income, effectively lowering their tax liabilities and enhancing cash flow. This makes depreciation a powerful tool in real estate investment strategy.

How To Minimize Depreciation Recapture Tax With A 1031 Exchange

A 1031 Exchange, named after Section 1031 of the Internal Revenue Code, is an advantageous tax deferral strategy for real estate investors. This mechanism allows you to defer paying capital gains taxes when you sell a property, provided you reinvest the proceeds into a similar type of property. Here’s a breakdown of how it impacts your taxes:

Capital Gains Tax Deferral

When you sell an investment property, normally you would pay a capital gains tax on its appreciation. A 1031 Exchange allows you to defer this tax by reinvesting in a “like-kind” property. This deferral can significantly improve cash flow, allowing you to reinvest more of your equity into new properties.

Accumulated Depreciation Recapture Tax

Accumulated depreciation refers to the tax deductions you’ve claimed over the years on the property’s depreciation. Normally, when you sell, this accumulated depreciation is “recaptured” and taxed. However, with a 1031 Exchange, the tax on depreciation recapture is also deferred, allowing you to avoid the immediate cash outlay associated with this tax.

Benefits of a 1031 Exchange

- Preserve Investment Capital: By deferring taxes, you retain more capital to invest in a new property.

- Increase Buying Power: With more funds available due to deferred taxes, you have increased leverage to acquire higher-value properties.

- Strategic Upgrading: Allows seamless upgrading from one property to another, maximizing investment potential without a heavy tax burden.

By deferring these taxes, you retain more capital to grow your real estate portfolio efficiently.

Understanding IRS Depreciation Requirements

The IRS allows an annual tax deduction for the “wear and tear” of property over time, known as depreciation. This is a gradual reduction in the value of an asset, and it’s mandatory for investors to depreciate real estate over a specified period.

- Residential Properties: Depreciated over 27.5 years.

- Commercial Properties: Depreciated over 39 years.

The IRS sets these specific schedules to standardize how depreciation is applied across different types of real estate. It’s essential to adhere to these timelines to ensure compliance and maximize tax benefits.

The cost basis of a rental property is the purchase price of the property minus the cost of the land. This value is used to calculate depreciation over time. It is important to accurately determine this value, as it will directly affect how much you can deduct from taxes when filing your annual return.

Once you know the cost basis of the rental property, you can then use this information to calculate depreciation over time. The IRS allows landlords to depreciate the cost basis of residential properties over a period of 27.5 years and the cost basis of commercial properties over 39 years.

Please Note – You can use the toggle button of the rental depreciation calculator at the top of this page to switch from ‘residential’ to ‘commercial’. This will automatically update the useful life of the property when making the calculations.

Rental Property Depreciation Calculator FAQ

With this rental property depreciation calculator, you can quickly estimate the amount of depreciation related to your investment in a rental property, allowing you to better manage your finances and plan for future investments. Read on for more information about how this calculator works and how it can help you plan for a successful future with real estate investments.

To calculate rental property depreciation in the first year, determine which month it went into service, and then multiply the cost basis by the percentages in this table:

| January | 3.485% |

| February | 3.182% |

| March | 2.879% |

| April | 2.576% |

| May | 2.273% |

| June | 1.970% |

| July | 1.667% |

| August | 1.364% |

| September | 1.061% |

| October | 0.758% |

| November | 0.455% |

| December | 0.152% |

Please note – these percentages are based on a residential rental property, which has a useful life of 27.5 years.

To calculate rental property depreciation in the last year, determine the last month of the property’s useful life, then multiply the cost basis by the percentages in this table

January | 0.152% |

February | 0.455% |

March | 0.758% |

April | 1.061% |

May | 1.364% |

June | 1.667% |

July | 1.970% |

August | 2.273% |

September | 2.576% |

October | 2.879% |

November | 3.182% |

December | 3.485% |

Please note – these percentages are based on a residential rental property, which has a useful life of 27.5 years. The percentages are different for a commercial property, which depreciates over a longer period (36 years).

| If First Month In Service Is January | Last Month In Service Is July | |||

| If First Month In Service Is February | Last Month In Service Is August | |||

| If First Month In Service Is March | Last Month In Service Is September | |||

| If First Month In Service Is April | Last Month In Service Is October | |||

| If First Month In Service Is May | Last Month In Service Is November | |||

| If First Month In Service Is June | Last Month In Service Is December | |||

| If First Month In Service Is July | Last Month In Service Is January | |||

| If First Month In Service Is August | Last Month In Service Is February | |||

| If First Month In Service Is September | Last Month In Service Is March | |||

| If First Month In Service Is October | Last Month In Service Is April | |||

| If First Month In Service Is November | Last Month In Service Is May | |||

| If First Month In Service Is December | Last Month In Service Is June | |||

Please note – these guidelines are for a residential rental property, which has a useful life of 27.5 years. When working with a commercial property, the last month in service is the same as the first month in service, albeit 39 years in the future.

The cost basis of a rental property is the purchase price of the property minus the cost of the land. This value is crucial for calculating depreciation over time, as it directly affects how much you can deduct from taxes when filing your annual return.

To further clarify:

Cost Basis: The original purchase price of the property, excluding the cost of the land. This is also called the depreciable cost. It is essential for determining depreciation amounts.

Recovery Period: This is the span over which the cost basis of a property is recovered. The IRS specifies different recovery periods based on property type.

Once you know the cost basis of the rental property, you can then use this information to calculate depreciation over time. The IRS allows landlords to depreciate the cost basis of residential properties over a period of 27.5 years and the cost basis of commercial properties over 39 years.

Please Note – You can use the calculator’s toggle button to switch from ‘residential’ to ‘commercial’. It automatically updates the useful life of the property when making the calculations.

The useful life of a residential property is 27.5 Years

The useful life of a commercial property is 39 Years

Straight-line depreciation is a method of calculating the decline in value of an asset over a certain period of time. This depreciation calculation assumes that the asset, such as a rental property, declines in value by the same amount each year. With this calculator, you can easily determine how much depreciation has occurred on your rental property over the course of a given year and plan ahead for future investments accordingly.

To use the rental property depreciation calculator, simply enter in some basic information about your rental property. You just need to know:

- The cost basis (purchase price excluding the land)

- When the property went into service

- The type of rental property (ie residential or commercial)

Armed with these 3 pieces of information, the depreciation calculator for rental property will then tell you:

- The depreciation amount during the first year

- The depreciation amount during the last year

- The depreciation amount during every other year

- The final month of the property’s useful life

- A year-by-year breakdown of the depreciation expense

When a rental property goes into service, it means that the property is now available for rent and can be used as an income-generating asset. According to eisneramper.com:

The IRS considers the property placed in service when the following three elements are all provided:

- Readiness

- Availability

- Capability to perform its intended function

When using this depreciation calculator for rental property, you can simply use the first month that the property was eligible to receive rent. If you are filing your taxes, you may need to consult with a tax advisor to be 100% certain of the first month in service, from a legal perspective.

Unlike many other depreciable assets that might retain a final salvage value, real estate properties are distinctive because they have no salvage value at the end of this period.

Why No Salvage Value?

Full Depreciation Deduction: The absence of a salvage value means that the entire initial cost of the property can be written off over time. This allows property owners to maximize their depreciation deductions, thereby reducing taxable income more significantly during the useful life of the property.

Tax Efficiency: By fully depreciating the property’s cost, owners can achieve better cash flow management. The reduced taxable income can result in substantial tax savings, freeing up cash for reinvestment or other financial opportunities.

Strategic Planning: The lack of a salvage value simplifies financial planning and budgeting. Investors and accountants can more easily predict the expenses associated with property holdings, making long-term financial strategies more straightforward.

In summary, the lack of a salvage value in real estate depreciation effectively enhances the financial benefits to property owners by allowing full cost recovery, promoting efficient tax strategies, and simplifying financial planning.

When calculating property depreciation, the mid-month convention is an essential method that impacts the first and last years of an asset’s depreciable life.

Key Aspects of the Mid-Month Convention:

Partial Month Depreciation: Instead of counting full months, this convention assumes that properties are in service for half a month at both the start and end of their service period. This adjustment means only half a month’s depreciation is calculated for those months, regardless of the actual date within the month that the property was placed in or removed from service.

Application to First and Last Year: By using the mid-month convention, the depreciation in the initial and final year of a property’s life is adjusted, preventing the overstatement or understatement of depreciation expenses.

This approach provides a more accurate reflection of the property’s use during its lifetime, adhering to tax guidelines and ensuring financial statements reflect true costs.

Additional Resources & Calculators

Workout the potential profitability of an investment property with our Rental Property Calculator.

To figure out the ROI of a fix and flip, you need a comprehensive Hard Money Calculator. It allows you to workout the monthly repayments, analyze net operating income, calculate the return on investment when you sell the property.

Each step in the Buy, Rehab, Rent, Refinance, Repeat (BRRRR) requires detailed analysis before you proceed with the deal. Fortunately our BRRRR Calculator breaks the process down into simple phases that are pretty easy to understand.

Quickly assess the After-Repair Value of a property with our user friendly ARV Calculator.

Cap Rate is a simple formula that helps investors work out how profitable an investment property is likely to be. Our Capitalization Rate Calculator makes this easy to do, in very little time.

FlipScout is a free search engine for property flippers. It lets you find properties that you can earn the highest return on when completing a fix and flip or fix-to-rent project. You can learn more about FlipScout here.

Quickly estimate the ROI of each home renovation project that you execute when flipping or renting investment properties.

Workout the net profit, ROI, maximum loan amount and monthly payment when building properties from the ground up. Ideal for estimating the profitability of a project.

If you're planning for retirement, this passive income calculator can help you understand how much you need to save each month to generate long term passive income.

To flip houses successfully, you need to fully understand the returns involved. This calculator provides ROI, gross profit, required down payment and more.

This calculator can help you decide if you should rent a property, or sell it and reinvest the profits. It provides a detailed analysis of each scenario, and it is very easy to use.