Hard Money Loans

Data driven hard money lending. Get your loan in under 10 minutes

Hard Money Loans

Data driven hard money lending. Get your loan in under 10 minutes

Hard Money Loans

Data driven hard money lending. Get your loan in under 10 minutes

Hard Money Loans

Data driven hard money lending. Get your loan in under 10 minutes

Hard Money Loans

Data driven hard money lending. Get your loan in under 10 minutes

Hard Money Loans

Data driven hard money lending. Get your loan in under 10 minutes

Hard Money Loans

Renovate, rehab and resell your property with a hard money loan

Interest Rate

9.25 - 11.25%

Origination fee

1.25 - 1.75%

Loan To Cost (LTC)

up to 90%

Construction Financing

up to 100%

Loan To ARV

up to 75%

Term

up to 18 months

Minimum Loan Amount

$100,000

Maximum Loan Amount

$5,000,000

Minimum FICO

650

Type of Property

Residential 1-4 units, condos, townhomes

Benefits For Borrowers

Instant Proof of Funds Letter

Interest Only Payments

Discounts for Repeat Borrowers

Instant Term Sheet

No Hard Credit Pull

No Junk Fees

All Hard Money Loans

Fix & Flip

Funds for purchase + rehab or refinance + rehab

Get up to $5,000,000

Interest rate 9.25 - 11.25%

Origination 1.25 - 1.75%

Up to 100% construction

Rent

30 year fixed product for stabilized properties

Get up to $3,000,000

Interest rate from 6.375%

Origination 0 - 2%

30-year fixed rate

Ground Up

Construction loans for residential builders

Get up to $5,000,000

Interest rate 10.5 - 11.5%

Origination 1.5 - 2%

Up to 18 months

Key Questions About Hard Money Loans

How do hard money loans work?

Hard money loans are short-term, asset-backed loans in which the property acts as collateral for the funds that are borrowed. These collateralized loans are originated by hard money lenders, which commonly fund fix and flip investors, landlords, and even commercial project developers.

What are hard money loans used for?

Hard money loans are most commonly used to finance fix-and-flip real estate projects. However, hard money loans can also be used to complete fix-to-rent projects, invest in rental property and build residential homes from the ground up. Hard money loans can also be used to refinance an existing property or to purchase a property as a business rather than as an individual.

What are the credit requirements for a hard money loan?

The minimum FICO score is 650.

Despite what some might say, institutional hard money lenders, such as New Silver, require borrower’s credit review when underwriting files. Importantly, when applying for a loan, the borrower’s credit score isn’t impacted, as only a soft pull credit is performed during underwriting. In certain scenarios, borrowers with an excellent credit history and credit score may qualify for a lower rate than borrower’s with a poor credit score. The hard money lender determines the final rate that is offered, based on the underlying collateral, borrower’s experience, census data and borrowers’ credit.

What are the minimum property value requirements for a fix-&-flip loan?

The minimum loan amount of $100,000, property as-is value of $100,000 or higher

Is financing for rural properties available?

No, we do not finance rural property.

Is an appraisal required?

Yes, an appraisal with interior access is required. For projects with 5+ units, a full commercial appraisal will be required.

Hard Money Loan Pros and Cons

Pros of Hard Money Loans

Hard money loans can be approved in just minutes and close in just a few days. The lending process is much smoother than it is with traditional lenders, because the lending criteria is not as stringent. Instead of putting hard money borrowers through difficult underwriting, hard money lenders are primarily concerned with the final value of the property that an investor intends to purchase.

A hard money lender will still evaluate each borrower’s credit score during the loan application process, but there is no strict approval process and very little paper work in comparison to a traditional loan:

- Hard money lenders can offer extremely fast closing

- Hard Money Loans have flexible loan terms

- Easy loan approval

- Hard money lenders provide streamlined loan applications

- The property is used as collateral when setting the loan terms

- Extremely efficient way for real estate investors to source capital

- Hard money lenders can be used to fund a variety of different projects

- Some hard money lenders provide an Instant proof of funds letter

Cons of Hard Money Loans

The biggest disadvantage of using a hard money lender is that hard money loans typically have higher interest rates than traditional loans. While this is one of the most signficant hard money loan negatives, it’s worth keeping in mind that some hard money lenders (like New Silver Lending) offer interest only monthly repayments, and loans are meant to stay open 12-24 months. This helps to offset the higher interest rate involved with a short term real estate loan. In addition, New Silver also offers 30 Year Hard Money Loans for Rental Properties specifically.

Another big risk when working with a hard money lender is that if the borrower defaults on the loan for an extended period of time, a hard money lender can potentially force the property into foreclosure. While this is a risk, it is worth noting that many traditional mortgage lenders can actually do exactly the same thing if a borrower consistently defaults on a traditional loan.

Another drawback is that hard money lenders tend to require a larger down payment than a traditional loan. Most hard money lenders expect a down payment of 20%, although this does vary from lender to lender.

- Hard money loans have higher interest rates than traditional loans

- Hard money loans have extra costs and fees compared to traditional lenders

- A hard money loan requires a larger down payment than a normal loan

- A hard money loan may require previous real estate investing experience

- If the borrower defaults, the hard money lender can force the property into foreclosure

Hard Money Loans Near You

New Silver Lending offers fast closing hard money loans in the following US States.

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington DC

- West Virginia

- Wisconsin

- Wyoming

Hard Money Lending Resources

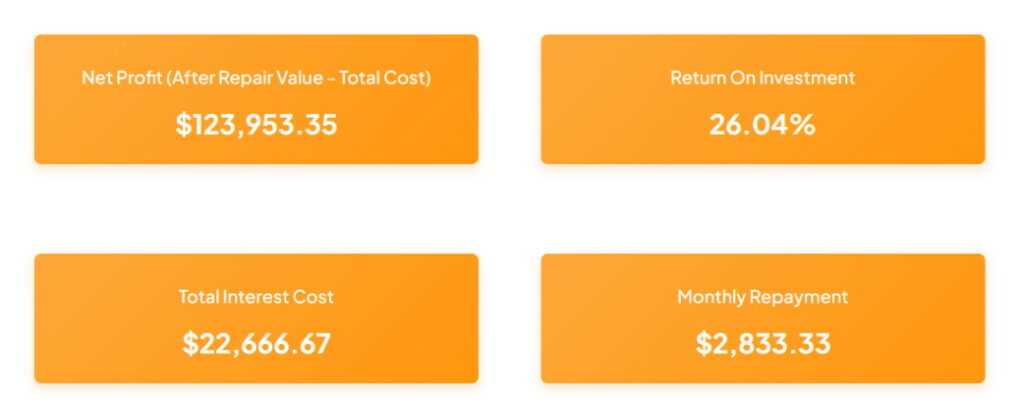

New Silver’s extremely easy to use hard money loan calculator can help you analyze the ROI of a secured loan for a fix-and-flip project. It provides a quick summary of the down payment, interest rates, monthly repayment and closing costs associated with a hard money loan.

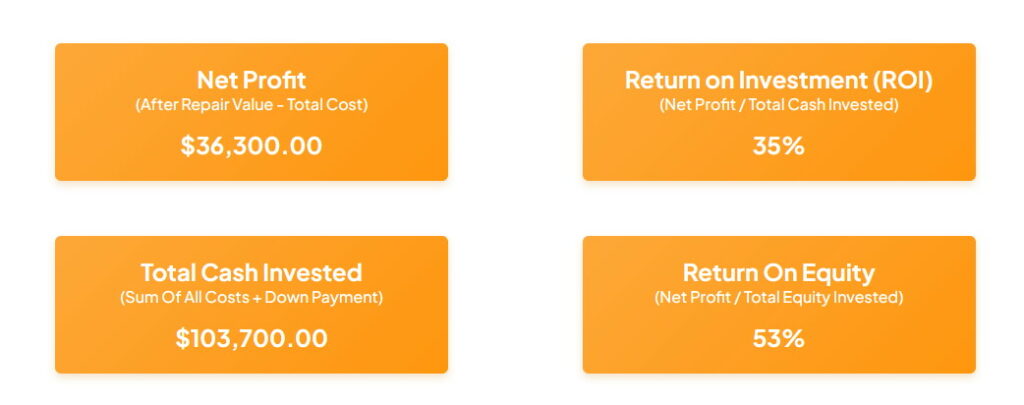

This house flip profit calculator is designed to show you how much profit you can make when executing a fix and flip property deal. It includes a detailed breakdown of Net Profit, ROI, Total Cash Invested, Return on Equity, Loan Amount, Down Payment & Monthly Loan Repayment.

Why Is It Called A Hard Money Loan?

Reading Time: 4 minutes You hear the term ‘hard money loan’ and assume it’s a bad thing, right? These loans have a bad reputation, but they’re one of the best ways to finance investment real estate transactions. If you’re

What Is The Average Interest Rate On A Hard Money Loan?

Reading Time: 3 minutes Hard money loans are a great way to get the necessary financing for real estate investments. If you don’t have a large amount of cash available or you don’t want to tie up 100% of

What Happens if you Default on a Hard Money Loan?

Reading Time: 6 minutes The Short Summary Sometimes investors have a hard time securing traditional financing. Banks don’t like taking chances on risky loans and when you don’t live in the property, they sometimes consider it to be a

What Are The Risks of Hard Money Lending?

Reading Time: 7 minutes A quick summary Hard money loans can be a quick solution for investors who need cash quickly, however there are still some concerns from investors around using hard money lenders instead of traditional financial institutions.

What are the Hard Money Loan Credit Requirements?

Reading Time: 3 minutes Hard money loans are a great way to secure financing to buy a home fast. They don’t rely on your personal qualifying requirements as much as they rely on the property itself. This makes it

What are Points on a Hard Money Loan?

Reading Time: 3 minutes If you have ever shopped around for quotes for a loan for a personal or investment property, you have more than likely heard the term “points”. So, what exactly are points? Paying points is a

The Ultimate Guide To Hard Money Lending

Reading Time: 8 minutes Hard money loans can be a highly successful way to invest in real estate and build financial independence. The key is understanding how they differ from traditional mortgage loans, what type of projects they are

Short Term Real Estate Loans

For Property Investors Buy, renovate and resell your property with a short term real estate loan Current as of Interest Rate – Origination fee Loan To Cost (LTC) up to Construction Financing up to Loan

RTL Loans: How They Work + Real-Life Examples

Residential Transition Loans For Property Investors Current as of Interest Rate – Origination fee Loan To Cost (LTC) up to Construction Financing up to Loan To ARV up to Term months Minimum Loan Amount Maximum

Pros and Cons of Hard Money Loans

Reading Time: 8 minutes A brief outline Hard money loans can be a great option for real estate investors who are looking to fix and flip houses or purchase a rental property, or developers who are building a house

How To Refinance A Hard Money Loan

Reading Time: 4 minutes If you used a hard money loan to buy a property, thinking you would fix it and flip it, but changed your mind, you’ll want to refinance it instead. Sometimes a property that starts off

How To Become A Hard Money Lender

Reading Time: 7 minutes Short Summary A hard money lender provides short-term loans to real estate investors, typically using the property as collateral and providing flexible loan terms. A hard money lender is usually a private lender who is

How Does Hard Money Lending Work?

Reading Time: 7 minutes If you’re new to real estate investing, the chances are good that you will have come across the term “hard money loan” somewhere online. Hard money is an alternative approach to borrowing that doesn’t involve

How Do Hard Money Loan Monthly Repayments Work?

Reading Time: 5 minutes Hard money loans have become increasingly popular with real estate investors because they can facilitate highly profitable property flips without the usual waiting time, administrative hassle and possible rejection that one could face when approaching

How Do Hard Money Lenders Make Money?

Reading Time: 4 minutes A brief summary Key Points When we use the term “hard money loan”, we are referring to loans that use a hard asset as collateral, like property. Hard money lenders provide these loans which are

Hard Money vs Soft Money Loans

Reading Time: 6 minutes Real estate investors typically use loans to make their property purchases, whether that be for a fix and flip property, rental property or buy and hold strategy. In this article, we compare hard money vs

Hard Money Loan vs Mortgage – Key Differences Explained

Reading Time: 6 minutes A brief outline Whether you’re looking to buy your first home or your next investment property, there are many financing options available. The trick to deciding which is best for you and your specific purpose,

Hard Money Loan Example

Reading Time: 7 minutes A brief outline Hard money loans can be useful financial solutions for real estate investors, particularly those doing fix and flip projects. Let’s take a look at a hard money loan example so that you

Hard Money Lending Regulations

Reading Time: 8 minutes The Short Answer When it comes to mortgage lenders, hard money lending is the ideal financial solution for many real estate investors who need an alternative to traditional loans. Whether their choice is made for

Hard Money Lenders vs Private Lenders

Reading Time: 7 minutes A brief outline Hard money loans and private loans can sound quite similar, however there are some fundamental differences. If you’re trying to decide which creative financing solution is right for you, we’ll the outline

Hard Money Lenders For First-Time Investors

Reading Time: 3 minutes Hard money loans are typically the preferred method of real estate funding for house flipping investors. However, not all hard money lenders are suitable for beginners just getting started in the business. For less experienced

Hard Money Lenders and Banks: 4 Key Differences To Know

Reading Time: 3 minutes Lending 101 For decades, loans have been helping real estate entrepreneurs overcome a multitude of challenges. Loans are a natural step for many in the real estate business, but finding the right loan for a

Hard Money 2nd Mortgage Lenders

Reading Time: 7 minutes What You Need To Know A hard money 2nd mortgage is provided by a private lender and is taken out as second loan, which means that borrowers need to have a first mortgage already in

Full List of White Label Hard Money Lenders

Reading Time: 6 minutes The Short Answer White label hard money lenders allow businesses to partner with them, to offer the lender’s financial products branded under the business. Which means that the lender doesn’t feature prominently in the process,

Do Hard Money Lenders Require Down Payment?

Reading Time: 4 minutes How To Calculate Hard Money Loan Down Payment For most borrowers, a down payment of 20% will be required in order to initiate a hard money loan. If you are an experienced house flipper, you

Complete List of Hard Money Lenders In 2025

Reading Time: 14 minutes A Short Summary Hard money lenders provide real estate investors with a great alternative to traditional loans. Hard money lenders are geared towards lending to real estate investors, which means that the loans terms are

Beginner’s Guide to Using Hard Money to Buy Rentals

Reading Time: 5 minutes A short summary Hard money loans are an alternative financing solution for many real estate investors, often used for fix and flip projects. However, you can also use hard money loans to finance other types

Sign Up for The Investment Insider

And Get A Free Copy Of

Real Estate Investing In The Digital Era