A brief overview

Fund That Flip is a platform that offers accredited investors a low-risk way to add real estate to their portfolio without the usual loan requirements for an investment property purchase. The platform services both borrowers and lenders, so for those looking for their next real estate financial solution, we’ve done a review of Fund That Flip to help.

Jump To

There are a variety of platforms available for borrowers who are looking to fund residential real estate projects, such as fix and flip deals, for real estate investing purposes. A quick online search for such lenders can be overwhelming thanks to the large list that you may be greeted with. In light of this, we’ll take a look at a popular lender called Fund That Flip.

This lender not only offers funding to borrowers, but accredited investors can also get access to a low-risk way to add real estate to their portfolio without the usual loan requirements for an investment property purchase. Find out how it works, and what loans are on offer for investors in our Fund That Flip review below.

How does Fund That Flip work?

Fund That Flip falls into both the hard money lender and private lender categories. While they have formalized underwriting processes and procedures much like hard money lenders, the capital they deploy comes from crowdfunding which is more in-line with private lenders.

Fund That Flip has various offerings for different real estate investing requirements. From investors looking to do a fix and flip project, to those looking to invest in pre-vetted real estate projects to earn annual yields.

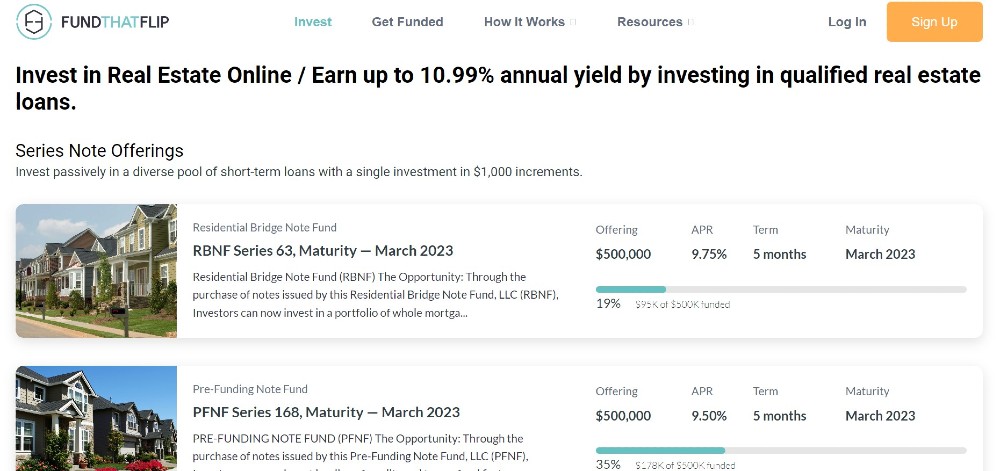

For accredited investors

Accredited investors can earn a passive income by investing in real estate projects that have already been vetted. Investments can be done in $5,000 increments and due diligence is conducted by the Fund That Flip team. The lender themselves will invest alongside investors to make sure that there is incentive for both parties. Investors can earn up to 10.99% annual yield. There is currently $999,931,453 invested.

The platform has also released a Residential Bridge Note Fund. The Residential Bridge Note Fund (RBNF) is an opportunity for accredited investors to passively invest in a diverse pool of short-term, real estate-backed loans within the larger Fund That Flip portfolio with a single investment.

For borrowers

There are 4 types of loans available for those who are investing in 1-4 family residential real estate projects. Investors will need to share their previous experience, talk to an Account Executive and once they’ve confirmed some basic information, they can get a pre-approval letter. Fund That Flip offers the following loans: fix and flip, fix and rent, new construction and cash-out refinance.

What kind of loans does Fund That Flip offer?

1. Fix and Flip Loan

The fix and flip loan is geared towards investors who are going to buy a fixer-upper property under market value, repair and renovate it, and then re-sell it for a profit. This is generally a short-term process, so this loan is a short-term loan which can be paid back quickly.

2. Fix and Rent Loan

This short-term loan is geared at investors who are buying rental investment properties. Particularly properties that they are going to fix up and then rent out. This loan is aimed at being a solution for the renovation process and the purchase of the property, with the intent of paying it back in the short-term.

3. New Construction Loan

This loan is aimed at tear down or ground up construction projects. Fund That Flip has the capability to fund 100% of the construction costs, however they’ may hold a percentage of these construction funds in escrow and release them as project milestones are met, subject to inspection.

4. Cash-out Refinance

For those who have already built up equity in their home, this loan is a good solution because it allows these borrowers to leverage the equity in their property to make home improvements.

5. Bridge Loans

Whether you have a project under contract or are still working on the details, Fund That Flip’s bridge loans are available to borrowers who need funding for their next real estate investing project. Loans start at $100,000 and loan rates start at 9.99%. The down payment required for this loan is 10% of the purchase price, and interest-only payment options are available.

These loans are anywhere between 3 and 24 months, which makes them short-term loans. The property needs to be non-owner occupied for borrowers to qualify for a bridge loan. Up to 100% of the renovations can be covered within this loan.

Best features of Fund That Flip

- There are a variety of individual deals and note funds available to choose from.

- The platform offers low Loan-To-Value ratio, most if not all loans fall at or below 65% LTV/ARV. Which lowers the risk on these loans drastically.

- Loans can get pre-approval and even pre-funding, which helps investors beat the competition to secure good real estate deals quickly.

- The lender offers fast loan closing for borrowers in just 7-10 days and acting fast is one of the most important aspects of securing real estate deals.

- All past investment performance is published so that investors receive the ultimate transparency.

- There are useful documents and resources available to help investors make better informed decisions after learning more about real estate investing.

- Investors only need to have $5,000 available to make an initial investment, so there isn’t a huge amount needed to start investing.

Worst features of Fund That Flip

- The platform has a low investment volume.

- Previous investing experience and accreditation is required for those who are wanting to get funding or invest in the funds.

- While borrowers can pay off loans before the terms end, there is a minimum number of months of interest that borrowers must agree to initially.

- Investors are at risk if a borrower defaults, as the entire note could decline.

- Investing with Fund That Flip means that the investment is an illiquid asset and there is no secondary market or redemption program. So, it is a long-term investment that investors will need to be committed to.

- The platform’s interest rates on loans aren’t particularly low.

- Investors who are new to real estate may not have enough money on-hand to begin investing in the fund.

- Rigorous application process which many borrowers do not pass. In fact, only about 6-8% of applicants will end up qualifying.

Fund That Flip alternatives

Fundrise

Fundrise gives people the opportunity to invest in a low-cost, diversified portfolio of institutional-quality real estate. It is a private investing platform that is aimed at long term (5+ year) investments. The platform uses crowdfunding, which means that investors can pool funds with other investors in order to purchase properties. Fundrise pays quarterly dividends and only charges 1% in annual management fees.

Fundrise follow a “value investing” strategy of acquiring assets for less than what they believe their intrinsic value is, and typically less than their replacement cost. The team then works to increase the value of each asset over time through hands-on management and in partnership with local operators.

YieldStreet

YieldStreet is an alternative, private investing platform offering curated investment opportunities at accessible minimums. The alternative investments on offer are commercial real estate, marine projects, art, cryptocurrency and more. Investors typically need about $10,000 for their initial minimum investment. Investors usually need to be accredited to gain access to these investments.

The platform has debt investments that are backed by assets which were traditionally only accessible to hedge funds and other professionals. YieldStreet has now made these available to individual investors. The annual management fees are reasonable and there is a large selection of investments to choose from, however there are a limited number of open offers at any given time.

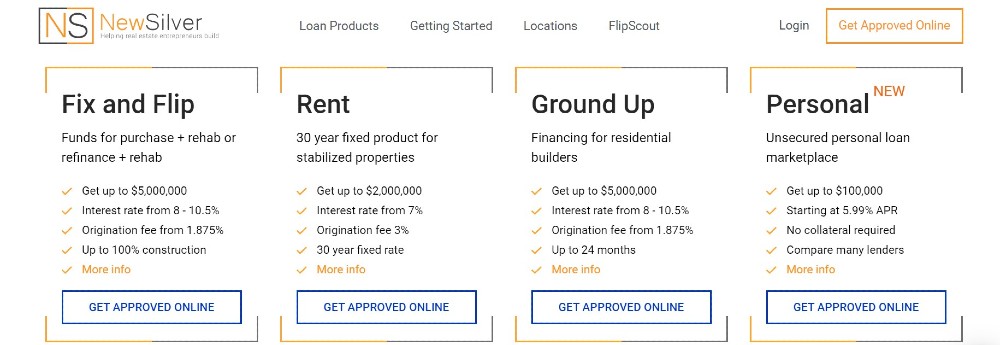

New Silver

New Silver is a hard money lender, providing loans in 41+ states in the US. The lender offers fix and flip loans, rent loans, ground up construction loans and personal loans. New Silver has the fastest loan closing times and offers investors competitive rates starting at 6%, as well as flexible loan terms.

New Silver also has a free platform called FlipScout, where people can find their next investment property by browsing many listings and using the data and insights provided. New Silver offers loan closing in as little as 5 days, with instant pre-approval and proof of funds letters. Borrowers can do the entire loan process online and get loan approval in just 10 minutes.

Kiavi

Kiavi is an equal housing lender that provides capital to real estate investors. The lender provides bridge loans (fix and flip) and rental loans. The bridge loan rates start at 6.95%, and borrowers can get funding from $100,000 to $1.5 million. Kiavi has flexible loan terms on their long-term rental financing which is 30 years. The interest rates on these loans begin at 6.875%. There two loan options, either a 5/1 ARM or a 7/1 ARM, and both are fully amortized.

Some benefits of Kiavi are that no application fee or appraisal is required for bridge loans. Kiavi also doesn’t do income or employment verification, and there is no asset verification which saves time and money. Loan terms are flexible and based on each borrower’s needs.

Is it safe to invest your money with Fund That Flip?

Fund That Flip is a legitimate company where real estate debt can be accessed by investors and added to their portfolio. Real estate debt investing is risky, however Fund That Flip does its best to mitigate this risk by using principal preservation wherever possible. Some loans are pre-funded by the company itself, which means that they also have some skin in the game. LTV rates are also kept as low as possible, to reduce the risk as much as possible.

Should you borrow money from Fund That Flip?

Fund That Flip provides funding for various projects like renovations and flips, upscaling rental properties, demolition jobs, and refinancing existing equity. The platform provides fast funding for real estate investors, so for investors who need to take advantage of a good deal quickly, this is a good option.

Loan terms range from 3 months to 24 months, and loan rates start at 8.49%. It’s important to note that there is an extensive application process with specific criteria that need to be met. The website claims to have a high number of repeat borrowers, which bodes well for any investors wanting to get funding from this lender.

Fund That Flip FAQ

The Residential Bridge Note Fund is a new offering from Fund That Flip where people can invest in a pool of short-term, real estate backed loans. It’s a passive real estate investing strategy, and it occurs within Fund That Flip’s portfolio, so investors only need to make a single investment.

Once investors have made their financial contribution, this is spread across multiple whole and fractional mortgages via borrower-dependent notes. Each note has a fixed maturity date, and investors will receive a fixed return with monthly interest payments.

Yes, investors will need to be accredited in order to invest in Residential Bridge Note Fund. Due to the fact that the private placements within this fund are made in accordance with SEC rule 506(c) of Regulation D, the SEC will only accept accredited investors to qualify for certain filing exceptions.