What does ARV stand for?

In real estate, ARV stands for After Repair Value. It is an estimate of what a home will be worth, after renovations have been completed. The underlying goal of a fix and flip real estate investor is to increase the ARV of the property, in order to maximize profit when it is sold.

Table of Contents

To calculate the after repair value of a property , you need to evaluate the comps. Comp stands for comparable property, and it refers to houses that are very similar in square footage and features to the investment property that you are assessing. For real estate comps to serve as a good property value benchmark, they need to be located as close as possible to the investment property that you intend to repair.

The primary objective when calculating ARV is to gain an accurate understanding of how much value the renovations will add to the property ‘s arv. Each comp that you identify effectively serves as a reliable reference point for estimating the market value of the home. Using comps makes it possible to determine if the repair cost will increase the value of the home, and help you estimate how much profit you can potentially make when house flipping. It is the most tried and trusted method for finding out how much your home is worth, after repairs have been completed.

How To Calculate ARV

- Step 1: Identify 3-6 comparable properties (comps)

- Step 2: Work out the average price per square foot of the comps

- Step 3: Multiply the average price per square foot of the comps by the square footage of the investment property

ARV = Average Cost Per Square Foot of Comparable Properties * Square Footage of Investment Property

Example Demonstrating How ARV Is Calculated

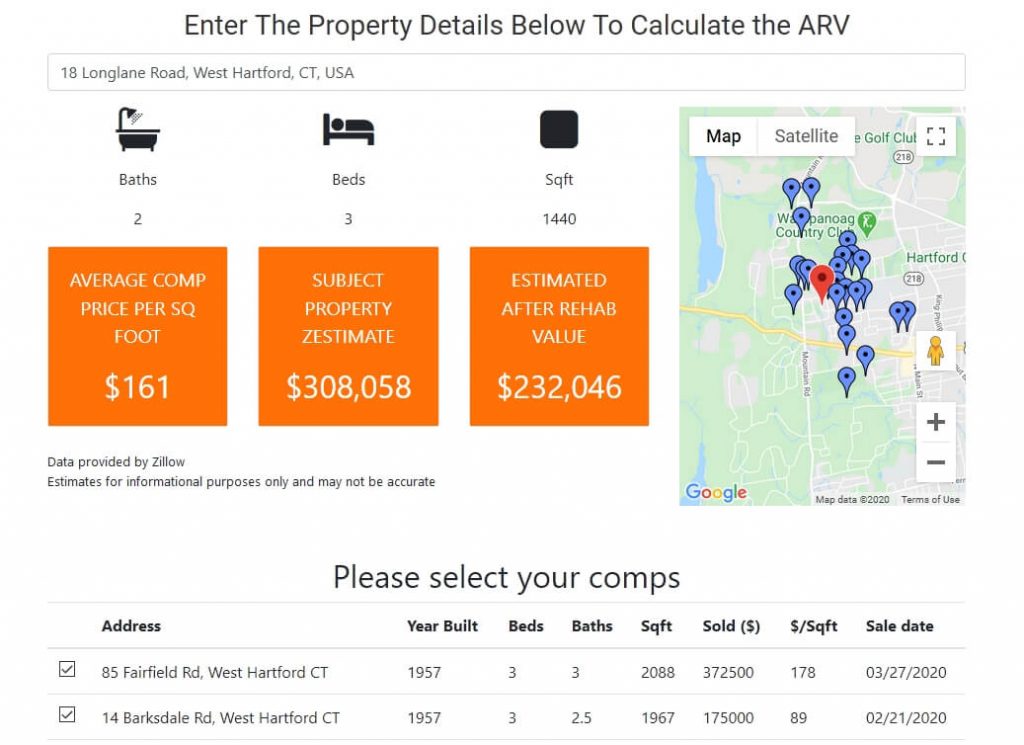

For this example, we will be using a property in West Hartford Connecticut, but the methods can be applied to any area or State in the US.

Step 1: Identify 3 or more comps

You can learn more about how to get comps on a house in this article. In this case, we have used New Silver’s ARV calculator, which has identified 4 comps. Zillow also has a recently sold filter which can be very useful when looking for comps.

Importantly, the properties you select need to be as similar as possible to the investment property that you are analyzing. This checklist from Mark Ferguson can help you pinpoint properties that will act as very good price reference points.

- Distance: Within one mile for any urban or suburban neighborhood.

- Age: Built within 10 years of your property-unless the home is more than 50 years old (feel free to widen the age brackets a bit then).

- Size/square footage: Only calculate above-ground square footage, which must be within 20 percent of the subject. Basement square footage is calculated separately.

- Property type: Single-family detached homes must be compared to single-family detached homes, duplexes to duplexes, town houses to town houses, etc.

- Bedroom/bathroom: Only count above-grade bedrooms and bathrooms-and the similar property can only be different by one bedroom or bathroom

- Style: Try to use the same style of home: a two-story to a two-story, split level to split level, ranch to ranch, etc.

- Sale date: Proper comps should have sold in the last six months, although many banks prefer three months.

You can formulate an arv estimate using comps from any of the following resources:

- New Silver ARV Calculator

- Popular websites like Zillow, Redfin, Realtor.com, Trulia & PropStream

- Search the area, noting all properties with ‘sold’ signs and then investigating further

- Chatting to a real estate agent

- Using the local Multiple Listing Service (MLS)

Step 2: Workout the average price per square foot of the comps

The ARV calculator has located 4 comps in the same area that also have 3 bedrooms and 2 bathrooms. The average $/SQ FOOT is $161 for the comps. Now you can simply multiply this amount by the revised SQ Foot amount of your investment property, to work out the estimated ARV.

Step 3: Multiply the average price per square foot by the square footage of investment property

- Average Price per sq foot of comparable properties: 161 $/SQ FOOT

- SQ FOOT of Investment Property: 1440

- Estimated Property Price: $161 * 1440

- Estimated Property Price: $232,046

As you can see in the calculation above, the home’s estimated ARV works out to $232,046 in this particular example.

What is the 70 rule in real estate?

The 70% Rule is a real estate investing rule of thumb that property flippers can use to determine the maximum purchase price of a fix and flip property, based on the ARV. It effectively builds a 30% profit margin into the deal. Here’s how the 70 percent rule works:

The 70% Rule Formula

Maximum Purchase Price = After Repair Value * 70% – Estimated Repair Costs

It is important to note that in order to use the 70 percent rule, you need to work out the after repair value first. Think of it as a two-step process.

- Step 1: Calculate the ARV of the property using comps (similar properties)

- Step 2: Calculate the maximum purchase price of the property using the 70% rule

70% Rule Example

The following example should help you understand how to calculate the maximum purchase of an investment property, using the 70% rule. Let’s revert back to the West Hartford house with an after repair value (ARV) of $232,046.

Property Details

- ARV = $232,046

- Expected Renovation Costs: $31,500

ARV Formula

- Maximum price = ARV * 70% – Repair Costs

- Maximum price = $232,046 * 0.7 – $31,500

- Maximum price = $130,932

In the example above, the maximum allowable offer would be $130,932 based on the expected ARV of $232,046 and expected renovation cost of $31,500.

It is important to note that the 70% rule uses the ARV Formula to workout the property’s current value , from a house flipping perspective. The current owner of the property may have a different valuation, which means you may need to negotiate in order for them to accept the maximum offer price that you have proposed.

Also, you need to have a firm grasp of the estimated repair cost, before you commit to a house flipping project. If you over-estimate the repair cost, the deal might not be profitable enough to proceed. At the same time, if you underestimate the renovation cost, you might form a false understanding of how much money can be made in the deal.

On this point, a hard money loan calculator can be a valuable resource when trying to get a firm grasp of all the costs involved in a house flipping project. Alternatively, chatting to an experienced investor can also be very helpful when estimating the repaired value of a home.

Are there any other important points worth mentioning?

Yes. You need to be aware of holding costs, loan costs, closing costs and administrative fees when analyzing a potential real estate deal. It is surprisingly common for people to ignore these costs when analyzing the potential profit, they can make in a fix and flip.

Fortunately, we have a very detailed Deal Analyzer which lists all the most common costs incurred during a typical fix and flip, together with the expected loan repayments. This can help you form a concrete understanding of a deal’s potential profitability.

Final Thoughts

At this point it should be pretty clear that working out the after repair value of a property is a fundamental skill for fix and flip investors to develop. Using comparable sales of similar properties in close proximity to your investment property represents the gold standard for calculating ARV.

Moreover, it should also be clear that in order to use the 70% rule to calculate a profitable bid price on the property, you need to work out the ARV first. That is why these two tools are so often used together to complete a comparative market analysis of an investment property.

Frequently Asked Questions:

What does 70 of ARV mean?

70 of ARV means that you shouldn’t pay more than 70% of the after repair value when purchasing a house to fix and flip. Importantly, you also need to deduct the repair costs before settling on the final offer price. The underlying concern of this question is how much you should pay for the property. Based on this, it makes sense to consult the 70 percent rule again:

Max Purchase Price = After Repair Value * 70% – Estimated Repair Costs

What is a good ARV?

A good ARV will give a property investor the best possible chance of maximizing profit when the property is eventually sold.

To this end, the 70% rule (outlined above) remains an excellent guideline for determining a good ARV. You need to ensure that the resale value not only covers all your costs, but also generates a healthy measure of profit. If you can find a property that is compliant with the 70% rule (or even cheaper), most real estate investors would agree that the after repair value can be classified as ‘good’. It effectively means that you have found a property that will almost certainly provide a positive return on investment.

What is loan to ARV?

Loan to ARV is the maximum loan amount that a hard money lender is willing to offer an investor, relative to the after repair value (ARV) of the property. For instance, if the loan to ARV is 75%, it means:

- If the ARV is $100,000, the lender is willing to offer a loan of $75,000

- If the ARV is 250,000, the lender is willing to offer a loan of $187,500

Most hard money lenders will offer loan to value terms ranging from 65% to 90% of the property ‘s post renovation selling price. To workout the loan to ARV, you simply need to multiply the percentage offered by the hard money lender by the anticipated arv of the property.

How To Find High ARV Properties?

To maximize profit in a fix and flip deal, you need to transform the current value of the property. In most cases, ugly, run-down houses actually have the most ‘transformation potential’. Ultimately, you should try to:

- Find distressed property or poorly maintained homes in good neighborhoods

- Find houses with a price per square foot that is lower than the market average

- Find houses with unique selling points like spectacular views or a large plot size

In addition, you can also use FlipScout by New Silver. FlipScout is basically a search engine for property flippers. It allows you to search for properties using any zip code, it provides a reason for the property being undervalued, and it provides an estimated ROI (return on investment).

Lastly, you can also read more about how to find undervalued properties in this guide.

How Accurate Is The ARV Calculation?

It is important to note that the ARV rule is ultimately used to calculate the estimated value of the property. In other words, it is not a perfectly accurate predictor of the future value of a house, but it is accurate enough for real estate flippers to estimate of how much profit they can make during the deal.