Investing in residential real estate can be a profitable opportunity for investors who have the right house flipping business plans, partners and strategies in place. While many individuals find the passive investment income to be an absolute game-changer, achieving those results requires careful planning and preparation. Beyond that, timing and forethought will be critical to the success of your business plan and all the future real estate investments you make.

Therefore, before launching a real estate business of your own, it’s a good idea to set up a detailed business plan that covers all the eventualities you might face as a business owner and a house flipper. This is how to create a simple house flipping business plan that can help you achieve success:

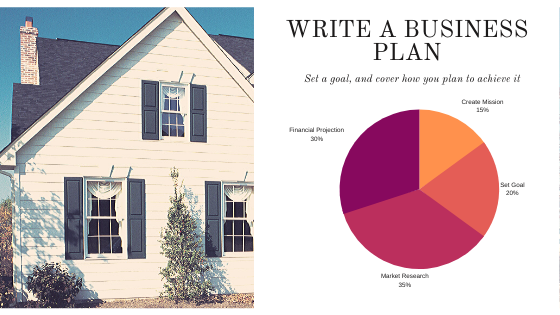

Writing a Real Estate Business Plan

Your house flipping business plan should ideally be a document that contains your mission statement for this venture, goals for the investments you take on and how you plan to achieve them. This document will give you, any involved partner(s), and any employees a clear idea of what your plans for the business are and the steps they will need to take to make it happen.

In order to create an effective house flipping business plan, you will need to do an in-depth analysis of the real estate market, create a description of the niche your business will address, identify potential avenues of earning revenue and make a general estimation of what the start-up expenses will be. Apart from these details, your market analysis should further be made up of two prongs; one should examine the overall real estate industry’s performance over the past few months, and the other the specific performance of the local property market you are interested in investing in.

You should also identify marketing strategies that will be good for raising awareness around your business and make financial projections of your expenses and income that will be earned. You and any partners involved should also consider the weaknesses in your plan that can be improved upon to minimize their impact.

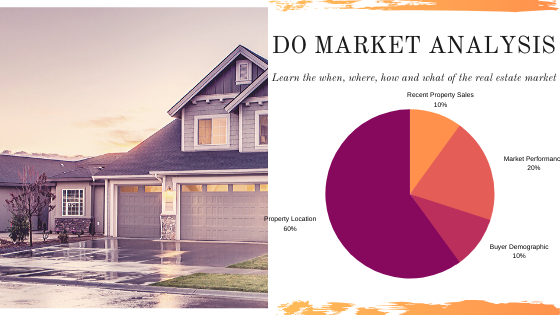

Real Estate Market Analysis

The market analysis section of a business plan is a summary of current data about the location you have chosen to invest in and will guide you through the steps you’ll need to take to achieve the goals you set in your plan. Your market analysis will involve selecting your target demographic of buyers, looking at recent property sales and deciding which type of investment property is of most value to those buyers.

The research you do surrounding recent real estate sales and trends in the area should have data on any home price increases or decreases over the past six months. Similarly, do an estimate that compares recent properties for sale in the area to the time they spend listed before being sold. This will give you a better idea of whether this is a profitable area of investment for you and if it will be conducive to long-term business growth to purchase a property there.

There are a variety of resources available online to help real estate investors find some of the data needed to create a well-rounded market analysis. The United States Census Bureau , the Department of Housing and Urban Development , and other websites like Realtor.com regularly publish details like the average sales prices of properties in specified areas and the number of properties taken off the market due to any reasons other than a successful sale. Use these resources to your advantage.

Furthermore, this analysis section should have information about your target demographic’s age and their average income. If the buyers you are targeting are older and more established, they won’t be interested in smaller properties or single-room apartments and instead prefer upgraded, secondary homes with enough room for their families to expand. Younger buyers will be more interested in affordable starter properties, apartments or rental properties as they build up their own financial resources and buyer power. The target demographic you are catering to will have a significant impact on the type of investment properties you choose, the prices you can list them at and the offers you will realistically receive in return.

Creating a Marketing Plan

There are many different marketing methods that you can choose from, depending on the goals you have set for your business. Setting up a real estate marketing strategy will entail finding the best way to acquire leads and put them through the sales funnel you create. A big part of getting started with the marketing portion of your business plan will be to choose a good CRM (customer relationship management) system that has the capability to track contacts and leads in various stages of the sales funnel. The system you select will likely also be able to create campaigns that will spread awareness about your business and the services you provide.

There are many different kinds of CRM’s aimed specifically at real estate businesses, both free and paid, which will help you create your sales funnel and manage it effectively. Free options are a good place to start, but they will not offer the same capabilities that premium options will be able to. You’ll ultimately want to select an option that offers a wide variety of features so that you can minimize the number of software or tools you have to use overall.

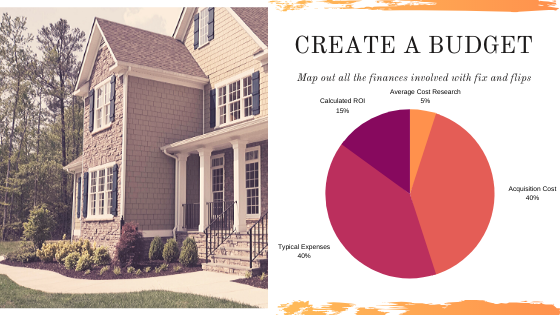

Create a Budget For Your Next Flip

There are many nuances to the financing side of a real estate business, and with so much information to go through, it can quickly become overwhelming. The best way to tackle such a big undertaking is to focus on one small step at a time, and break things down into achievable tasks that you can tick off the list as you go.

You can easily begin the budgeting process by researching average costs and finding the answers to several key questions about your real estate investment, like what percentage of your own funds you should use to acquire it, or the tax deductions you are eligible for as an investor.

Your initial cost will most likely be your acquisition cost or the price you pay for your investment property , but there will be other expenses that will need to be carefully monitored if you are to keep to your budget. Other typical expenses for real estate investors in this stage can include mortgage payments, taxes, interest fees, utilities, general maintenance or home insurance. Your budget, in this case, should be your guide to choosing the investment property with the greatest potential to deliver profit and cover the expenses listed above.

Determining the true value of a real estate asset is key to getting positive returns as an investor, which is why the return-on-investment (ROI) should be calculated for each property you evaluate. The last thing you want to do is saddle your new business with an investment that won’t pay off, so make sure to crunch your numbers carefully before making an offer.

Importantly, you need to be able to estimate the after repair value (ARV) of the property you are hoping to flip. Understanding what the home will be worth after the renovations are complete is fundamental to each and every property flipping deal.

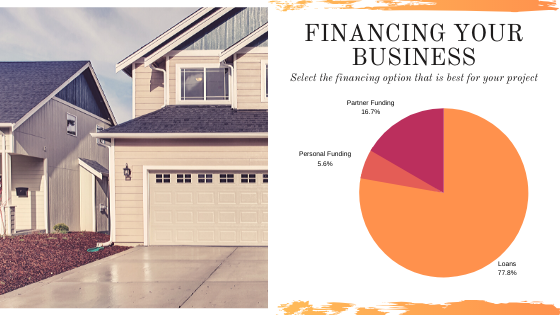

Financing Business Investments

Using external financing is common for real estate investors in the house flipping industry, but finding the right loan for a development project can be a big challenge in itself. There are so many different funding options available that entrepreneurs should carefully consider what is best for their project. There is no reason you cannot invest in real estate using funds mostly sourced elsewhere and still make the profit you want. Some investors choose to use their own funds or make use of private funding, but the majority of real estate buyers use a combination of their own funds and a loan.

If you’re an aspiring real estate investor with a lack of personal funds or an experienced investor looking for alternative funding sources for a house flip specifically, you will likely make use of a loan from a hard money lender or similar lending institution.

Hard money loans are typically available for shorter terms and are backed by the value of the borrower’s asset. In this case, it would be the property just purchased by the investor, which the lender takes possession of in case of loan default. Private money lenders are similar to hard money lenders, but they can be difficult to find and don’t necessarily offer as much legal protection for the borrower.

Another option is taking out a real estate loan from a bank or using private funding from a partner, family or friends. Banks will typically hold the property note until the borrower’s loan is repaid in full over longer terms, while personal loans from family or friends can have more forgiving terms.

The first fundamental difference between hard money lenders and banks is the source of the funds used. Hard money loans are funded by private investors, while banks fund loans using a pool of capital set aside for the purpose of granting high-risk loans. That pool is usually small and terms will vary depending on the bank’s overall deposit limitations. Banks can also be hesitant to take on flipping or renovation projects due to the risk involved. Hard money lenders , as private investors , are more flexible about the risk but compensate for this flexibility by asking a higher interest rate.

If you plan to work with a partner for funding, you should ensure that you structure your partnership legally and bear in mind that it is a partnership; you should also bring something valuable to the deal. The benefit of having a partner is typically related to scaling: more capital and hands-on-deck means there is a better chance of a successful outcome.

Creating a legal structure around your business is key to limiting your personal liability and protecting your assets. This framework should also be applied to funding granted in the form of personal loans from people in your own network – should things go awry you want to make sure not to burn any bridges!

With your research done, your budget planned, the legal details covered and your financing method chosen, you can finally move on to finding a suitable property to invest in. Having a thorough business plan in your pocket will be the deciding factor in the success of your house flipping business and will act as a blueprint of the steps you need to take for your investment to be profitable and your business to get the results you want going forward.

To get the best results, the business plan you put into action should be detailed, clearly outline your goals and how you plan to achieve them. As your business grows and you gain experience, you will likely create more than one iteration of your plan and refine your original strategies, targets, and budgets, in order to increase your levels of success when flipping homes.

Keen To Learn More?

Do you want to learn even more about flipping real estate and starting your own business? Whether you’re new to the real estate industry or an experienced house flipper wanting to take things to the next level, take a look at this all-in-one guide to starting a property flipping business of your own.