The Short Answer

Real estate prospecting is a key element of any successful real estate business. It involves finding and evaluating potential investment opportunities in the real estate market. There are various real estate prospecting tips to keep in mind, and it’s important to make use of a few methods, as well as the right tools. Some of the best prospecting methods are:

- Online platforms

- Social media

- Direct mail

- Networking

- Email marketing

- Driving for dollars

- Real estate auctions

- Partnerships

Some of the most popular real estate prospecting tools include DealMachine, DealChecker, HouseCanary and Roofstock. Using the tools available online for real estate investors is a good way to tap into quality real estate leads and convert them into great deals. These platforms can help investors find motivated sellers and deals that haven’t reached the market yet, without having to use a real estate agent.

Skip To

What Is Real Estate Prospecting?

Real estate prospecting is the process of identifying and evaluating potential investment opportunities in the real estate market. Unlike traditional real estate prospecting, which focuses on finding clients to buy, sell, or rent properties, prospecting for investors revolves around locating properties that offer profitable investment potential.

For real estate investors, prospecting is a strategic process that requires a knowledge of the real estate market, financial analysis and risk determination. By using several methods, investors can focus on identifying properties that have the potential to generate returns through rental income, appreciation, or other investment strategies.

8 Ways To Start Real Estate Prospecting

While there are a variety of real estate prospecting ideas that investors can consider, it’s a good idea to use a combination of methods to spread your reach and find more potential deals. Here are 8 ways to start real estate prospecting that should lead you to useful opportunities.

Method 1: Online Platforms

There are a variety of online platforms that you can use to expand your reach when doing real estate prospecting, many of which real estate agents have tapped into for decades. Online platforms often provide market insights, detailed listings and data with analytics that can help investors make informed decisions on each deal that is presented. Platforms like LoopNet, CoStar, and Real Capital Analytics are often used to search for investment properties.

Method 2: Social Media

In the age of social media, why not leverage these platforms to do your prospecting? You can join real estate investing Facebook groups, do targeted searches on LinkedIn to connect with other real estate professionals who may be able to point you in the right direction or collaborate with you, and much more. Social media gives investors the platform to easily find and connect with others who could be instrumental in locating investment properties.

Method 3: Direct Mail

One of the oldest, tried and tested methods for finding real estate deals is using direct mail. Investors can formulate direct mail campaigns and send these to a targeted audience, who may not even be selling their property yet, and propose a deal that they would struggle to refuse. This outreach may be successful, even with homeowners who hadn’t planned on selling yet, provided that you offer a deal they can’t turn down. Actively reaching out to your target audience is a good way to stay ahead of the competition.

Method 4: Networking

Real Estate Investment (REI) clubs and networking events for real estate professionals are a good way to meet real estate agents, brokers, property managers, and other investors who can be a useful resource. Joining investment groups and participating in online forums are also good ways to expand your network. You can leverage the contacts you’ve gained to find real estate deals which could turn into profitable investment opportunities. Other real estate professionals may have leads or access to real estate deals before they even hit the market.

Method 5: Email Marketing

Another way to reach your target audience is to pop into their inboxes with a targeted email campaign. Email marketing is an easy way to reach a wide and tailored audience. Investors can use email marketing to nurture leads that they already have and remain top-of-mind for sellers. Make sure to include content that is valuable and applicable for each audience. Once these go out, you can track their performance and optimize your emails accordingly, so that you’re making sure to stay relevant and engaging.

Method 6: Driving For Dollars

For those who are willing to take to the streets, you can drive around neighborhoods in the area that you’re going to invest in, to identify properties with signs of distress or neglect. These properties may present opportunities for investors to negotiate directly with motivated sellers or pursue distressed property acquisitions. Driving for dollars may also lead to securing a deal before it hits the market, with a motivated seller willing to part ways with a property under market value.

Method 7: Real Estate Auctions

Distressed properties, foreclosures, or bank-owned properties are often auctioned off, and these can be a goldmine for real estate investors. They’re usually sold for a discounted price as the lender typically doesn’t want to hang onto them any longer than they need to. Attending real estate auctions in person or online, can be a good way to scout for investment opportunities that may come at a steal. Before heading to an auction however, make sure that you know how much you’re willing to spend, so that you don’t overspend on a deal that may not be worth it.

Method 8: Partnerships

Partnering with real estate wholesalers or bird dogs is an important method to consider for investors who are trying to find potential opportunities to invest in. Wholesalers specialize in finding distressed properties, negotiating deals, and assigning contracts to investors for a fee. Which means that they can be a valuable resource for investors who can find deals through wholesalers, before anyone else. This can even trump using a real estate agent.

Alternatively, investors can work with bird dogs who scout for potential investment opportunities in exchange for a finder’s fee or commission, to identify off-market deals and motivated sellers. Either way, wholesalers and bird dogs both offer investors an opportunity for prospecting, to find potentially profitable real estate deals.

Tools That Can Help With Real Estate Prospecting

Using the following tools, you can bolster your real estate prospecting efforts by analyzing data and finding property deals that are more likely to be profitable. Here are 5 tools often used by investors and even real estate agents to do real estate prospecting.

Tool 1: DealMachine

DealMachine is a comprehensive platform tailored for real estate prospecting and lead generation, aimed at assisting investors in uncovering off-market opportunities and establishing connections with property owners. By integrating mobile technology, data analytics, and direct mail marketing, it simplifies the steps involved in identifying, researching, and reaching out to potential sellers, offering a seamless and efficient approach.

DealMachine’s features include:

- DealMachine automatically logs your location every time you hit the road, so you can easily view your past routes on a map and avoid driving the same route twice.

- The platform allows you highlight properties on the map that match your criteria so that you can plan your route before you begin.

- Discover off-market properties from the comfort of your own home using the virtual driving feature.

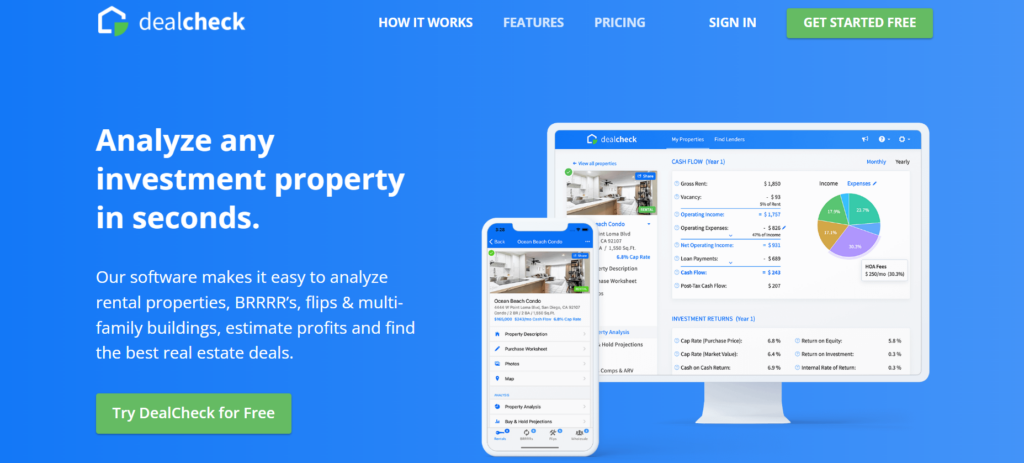

Tool 2: DealCheck

DealCheck is a versatile real estate investment analysis software designed to assist investors in evaluating and analyzing potential real estate deals. It provides a range of tools and features to help investors calculate financial metrics, perform property analysis, and make informed investment decisions.

DealCheck’s features include:

- Searching for properties can be done quickly and effectively, and the property details on display include a detailed description, list price, value and rent estimates, property taxes, photos and more.

- Detailed financial analysis and projections for each property, that include cash flow, ROI, acquisition costs and more. Investors can use this to work out the long-term cash flow of a property and estimate their profit.

- Configure a host of deal parameters so that you can structure your unique deal.

- Browse recent sales comps, comparable rental listings and market statistics.

Tool 3: Roofstock

Roofstock is a cutting-edge digital marketplace aimed at streamlining the experience of acquiring, managing, and selling single-family rental properties. Providing an all-encompassing platform, it empowers investors to explore, assess, and acquire investment properties. Typically, the investment properties on the Roofstock platform are occupied by tenants already.

Roofstock’s features include:

- Roofstock curates the investment properties on the platform, which means that investors are looking at properties that have undergone a thorough inspection and appraisal process. Detailed property reports, including inspection reports, financial projections, and historical performance data, are provided to investors for due diligence.

- Many of the properties have tenants already occupying them, which means that investors are looking at properties that will be profitable off the bat.

- Roofstock offers investors tools like investment calculators, property management software integrations, educational articles, webinars, and expert insights, to help with prospecting and making informed decisions.

Tool 4: HouseCanary

HouseCanary is a leading real estate analytics firm specializing in precise property valuations and predictive forecasts. Their mission revolves around harnessing the power of data and technology to equip real estate professionals with the insights and tools they need to excel in their endeavors.

HouseCanary’s features include:

- HouseCanary makes use of proprietary algorithms and machine learning models to generate property valuations, based on the property’s characteristics, local market trends and more. These valuations can be instrumental in prospecting, allowing investors to stay informed, along with the platform’s comprehensive market analytics and insights.

- The platform also has tools to assess the risk involved with real estate investments. These tools use the property condition, neighborhood stability, economic indicators and other factors to determine the risk involved with each investment property.

- HouseCanary provides flexible tools and services that can be customized to meet each investor’s requirements.

Tool 5: Carrot

Carrot is a platform that offers various tools and functionalities aimed at assisting users in lead generation, website creation, and business expansion. Investors can use Carrot to create websites for their business and find quality real estate leads through the platform. The platform provides investors and other real estate professionals with the SEO tools to attract traffic and convert visitors into quality leads. For prospecting, a tool like Carrot is extremely valuable for finding motivated sellers and good real estate deals.

Carrot’s features include:

- Website templates and assistance with design, SEO, and more. These templates are customizable to suit various purposes and needs.

- Content marketing tools such as blog publishing and email integration, to help users reach their target audience.

- Powerful lead generation tools including lead capture forms, landing pages, and Call To Action (CTA) widgets that are designed to generate conversions.

- Lead nurturing tools, so that users can track their real estate leads and convert these into deals.

Final Tips For Real Estate Prospecting Success

To be successful in your real estate business, knowing how to do real estate prospecting is key. Finding the right deals is paramount to making a profit in real estate, with or without a real estate agent. Here are some important real estate prospecting tips:

- Clearly define your target market and investment criteria: Before you begin real estate prospecting, it’s crucial to define your target market, so that you can tailor your efforts to these people. It’s also important to have a clear idea of your investment criteria, so that you can know where to start looking for the types of properties that you plan on investing in.

- Build a strong network: One of the most successful real estate prospecting ideas is to leverage your network. Start by building a network of real estate agents, brokers, wholesalers, property managers, lenders, and other industry professionals who can provide valuable insights, referrals, and access to off-market deals. You can also attend real estate events and join investment groups, to further your real estate prospecting efforts.

- Use a variety of methods: There are many real estate prospecting ideas that you and your peers may have, so it’s best to pick a few to use, instead of relying on one. Cast your net wider, to allow yourself the chance to uncover different types of opportunities. You can use networking, online platforms, direct mail campaigns, real estate auctions, social media marketing, and more.

- Be adaptable and informed: Remain open to different types of properties, investment strategies, and market conditions. Be willing to adapt your criteria and strategies based on changing market dynamics, emerging opportunities, and feedback from your network. Stay informed on the current market trends, so that you can adapt to these, in order to find the best deals.