Can You Actually Buy A House With Bitcoins?

The short answer is yes.

- You can use cryptocurrency payment processors to make your monthly mortgage repayments with cryptocurrencies like bitcoin

- You can also apply for a crypto-backed mortgage, where your crypto assets are used as collateral for the loan.

- Then you can also simply convert bitcoins into FIAT currency like the US Dollar, and then just purchase a house normally.

In addition, there are platforms which list properties that can be purchased using bitcoin directly. The only issue with these platforms is that they tend to have very limited inventory.

We will now dig deeper into the methods you can use to buy a house with bitcoins.

Table of Contents

Ways To Buy A House With Bitcoins

Method 1: Convert Your Bitcoin Into Fiat Currency

This is the easiest way to purchase a property with crypto.

Let’s imagine that you have 10 bitcoins to invest in real estate. That translates to about $700,000 which far exceeds the average property price in the US.

You could simply convert 6 of your available bitcoins into approximately $420,000, and then purchase a property that falls within this price range.

It really is that simple. Convert the Bitcoins into US Dollars, and then purchase the home.

The biggest challenge is timing the market. You obviously want to execute the exchange when the price of Bitcoin is trending upwards rather than downwards.

Method 2: Pay Your Mortgage With Bitcoin

This is another great way to leverage cryptocurrency to cover the cost of your mortgage.

All you need to do is sign up to a service like Bitpay Bill Pay.

Once you are up and running, you can connect your Bitpay account with your mortgage provider, and then choose which of your crypto assets you would like to use to make the monthly repayments.

Importantly, almost all the major loan providers in the US are already connected to the platform including:

- Rocket Mortgage

- Bank of America

- loanDepot

- Chase

- New American Funding

- Wells Fargo

Method 3: Use A Crypto Mortgage

A crypto mortgage is a type of mortgage where your cryptocurrency holdings are used as collateral. This innovative financial product leverages the value of digital assets to secure a loan for purchasing property. Here’s a breakdown of how a Crypto mortgage works:

Collateral: In a crypto mortgage, your cryptocurrency (e.g., Bitcoin, Ethereum) acts as the collateral for the loan.

Seizure in Default: If you default on the mortgage, the lender has the right to seize your crypto assets.

The key to leveraging this strategy is to find a lender that actually provides Crypto-backed mortgages. At the time of writing, there only about 3 companies that specialize in this particular product, namely:

Milo Mortgage:

Milo was founded in 2019 to provide mortgages to global crypto consumers. The company provides mortgages backed by crypto assets– a minimum of $200,000 and a maximum of $5,000,000.

Figure

Figure is a well-known company that provides home equity lines of credit (HELOCs) based on blockchain technology. In March, it opened a waiting list for crypto-backed mortgages, promising up to $3 million of loans per customer collateralized by Bitcoin or Ethereum.

It’s important to note that of the 2 crypto-mortgage providers mentioned above, Milo Mortgage is the only company actually doing it properly. Figure hasn’t officially launched their crypto mortgages just yet.

In time, the number of Crypto-backed mortgages will almost certainly increase, but for now, Milo Mortgage is your best bet.

Method 4: Use A Property Listing Platform That Accepts Bitcoin

Real Open

Technically speaking, RealOpen is a service provider that allows you purchase homes listed on any major property site, including Zillow, Redfin and Trulia.

RealOpen is a buyer-side service, so it doesn’t matter if the seller is willing to accept crypto. RealOpen specializes in converting digital assets to fiat cash en route to escrow. There are two primary benefits to their approach:

- You can purchase a property listed on any of the major real estate websites in the US

- Their process is designed to minimize slippage (when the final price of your crypto transaction differs from the expected price at the time of the order)

Ultimately, their service makes it relatively simple to purchase whatever property you desire using Bitcoins to fund the purchase.

Crypto Real Estate

Crypto Real Estate is the largest crypto-friendly real estate marketplace globally, boasting 1,700 property listings across 50+ countries. Since its establishment in 2021, it has aimed to revolutionize property transactions by embracing cryptocurrency, offering buyers a wide range of global properties and allowing sellers to list properties for sale with crypto. The platform ensures seamless and secure transactions for a smooth experience.

Crypto Real Estate welcomes private sellers, agents, and developers who don’t directly accept cryptocurrency, providing all necessary crypto-related services, including exchanges. Their expert team bridges the gap between real estate and cryptocurrency, offering tailored solutions to address the unique needs and challenges of crypto transactions in the real estate market.

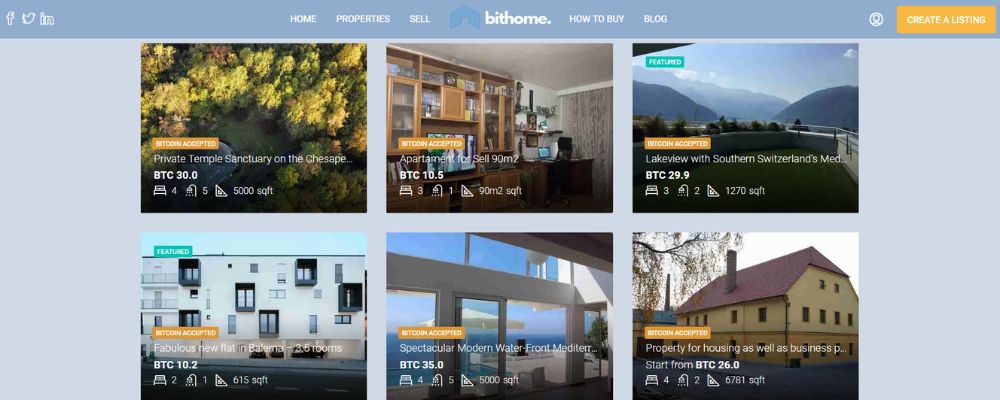

Bithome

Bithome is another property listing website that makes it possible to purchase properties with Bitcoin directly. While the value offering is fairly straightforward, the biggest issue with this platform is inventory.

At the time of writing, there are only 14 homes available for sale through Bithome, and the vast majority of those homes are located outside the US.

All-in-all, Bithome has the potential to grow into a popular website for purchasing properties directly with cryptocurrency. For that to happen however, they will need to address the inventory problem that is preventing them from establishing a unique position within the genre of property listing websites.

Pacaso

Pacaso offers a modern approach to co-owning luxury vacation homes, allowing individuals to purchase a share (typically 1/8 or 1/4) of a high-end property. This model lets co-owners enjoy exclusive access to their home throughout the year while sharing costs and responsibilities with other owners.

Unlike traditional timeshares, Pacaso provides fractional real estate ownership through a fully managed LLC, simplifying the process of co-ownership. This enables buyers to afford and enjoy premium vacation homes without the complexities and high costs of managing the property themselves.

Importantly, Pacaso has partnered with BitPay, which allows users to pay for a Pacaso property using:

- Bitcoin (BTC)

- Ethereum (ETH)

- Litecoin (LTC)

- Bitcoin Cash (BCH)

- Dogecoin (DOGE)

- Wrapped Bitcoin (WBTC)

- USD-pegged stablecoins

- +Several other cryptocurrencies

Admittedly this is an alternative form of home ownership and it’s most suitable for people that want to buy vacation homes in an affordable manner. Nevertheless, their platform allows you purchase a percentage of a luxury vacation home, using Bitcoin, so it deserves a mention in this round-up.

How Common Is It To Buy A House With Bitcoin?

There are two sides to this answer.

People who use Bitcoin to purchase properties directly (Very Uncommon)

While some people might complete the full purchase of a home using Bitcoin, they represent the vast minority of homebuyers in the US. This circumstance is still very rare, to the point that it makes a negligible impact on the overarching homebuying activity stats in the US.

People who convert Bitcoin into Dollars to buy a property (Fairly Common)

There are plenty of cryptocurrency investors that have made an absolute fortune, and real estate remains one of the safest channels for securing their profits.

For many crypto investors, their story basically boils down to:

- Investor strikes it big with Crypto

- Reinvests a percentage of their profits into stable assets like real estate and debt funds

- Continues investing in crypto currencies like Bitcoin

Final Thoughts

In the end, it’s safe to say that buying a home with Bitcoin is becoming increasingly more common, especially amongst Crypto investors that are hoping to diversify their profits and balance their financial portfolios.

However, most of these transactions ultimately rely on converting Bitcoin into dollars, and then making the purchase using traditional methods.

When purchasing properties in this manner, platforms like RealOpen can still serve a very valuable purpose, by reducing the administrative difficulties involved and minimizing slippage (the difference between the expected price of the cryptocurrency at the time the transaction is initiated and the actual price at which the transaction is completed).

However, if you are looking to purchase a home with Bitcoin directly, you will almost certainly run into challenges with inventory. All the platforms out there that cater to this highly specific need have very low property inventory levels.

Until such time that major players like Zillow and Redfin make it possibly to buy a home with Bitcoin, your best bet is to simply stick to the Bitcoin to USD conversion method, so you can find the perfect property for your needs.