The Short Answer

For people who are entering the real estate investing world, debt can either be a major help or a hindrance. More often than not, real estate investors will need to use debt to purchase an investment property and sometimes renovate it (in the case of house flipping). In many cases, debt creates opportunities for investors that wouldn’t have been available otherwise.

The benefits of using good debt for a real estate investment include leverage to amplify buying power, greater return on equity, a stable cash flow, tax benefits and diversification. Debt can be used for buying your own house, fix and flip properties, rental properties and ground up construction projects.

Jump To

Why It Makes Sense To Use Debt To Buy Real Estate

Using your own money isn’t always the best option for purchasing an investment property, sometimes it makes sense to consider using debt or borrowing money. Here’s why…

Leverage In Real Estate

Debt allows you to amplify your purchasing power and acquire properties that you might not be able to afford solely with your own money. By using other people’s money through borrowing money, you can control a larger asset with a smaller upfront investment.

A down payment can act as a form of leverage when buying an investment property. For instance, if you contribute a 10% down payment on a property, you can take ownership of an asset that is worth 10 times more than the equity that you have invested. If the property then appreciates in value, your return on equity (the down payment) is multiplied by 10.

However, bear in mind that this is also a two-way street. If the property depreciates in value, you can experience a significant loss. Thankfully, the real estate market tends to be fairly stable over the long term. This helps reduce the risk of using your own equity to buy real estate.

Using leverage allows real estate investors to build a portfolio of properties, by purchasing real estate quicker than they would’ve been able to otherwise. For example, being able to put down $100,000 and purchase 5 properties using debt, instead of 1 property which you’d own more of initially.

Return On Equity

The leverage that we mentioned above can potentially increase your returns if the property appreciates in value. Historically, real estate has the potential to appreciate in value over time, so for real estate investors this provides the opportunity to earn higher returns on any equity that has been invested in the property. By using debt, you can maximize your returns by investing very little of the total property value as equity initially, and getting a higher return on this over time.

A common misperception is that funding investment properties with your own money is the most lucrative way to execute fix and flip projects. However, you can actually achieve a better return on equity, and reduce the financial risks of the transaction, by utilizing a real estate lender like New Silver.

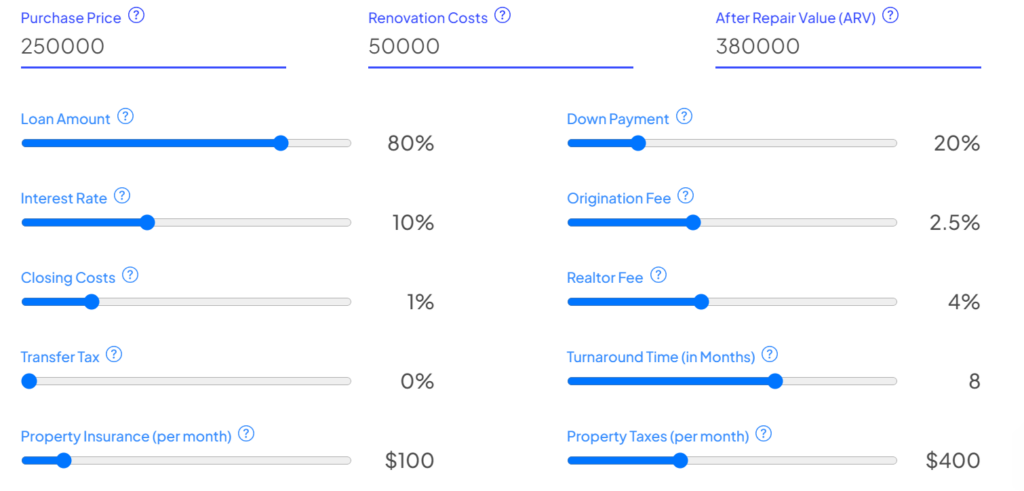

To illustrate this point, let’s take a look at an example, using the New Silver house flipping calculator for a property with a purchase price of $250,000…

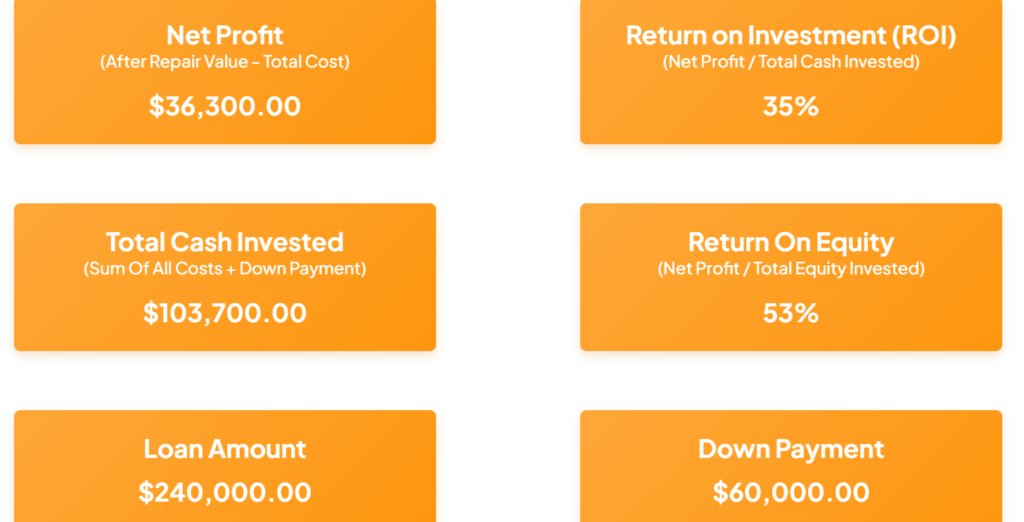

The house flipping calculator shows the total loan amount that will be required, return on equity and down payment that will be needed.

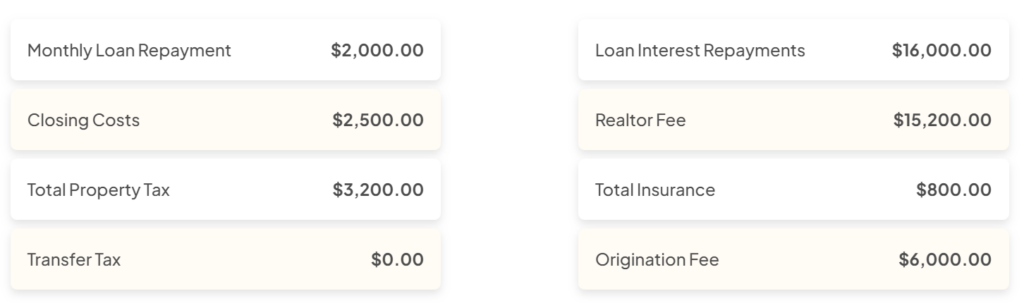

The statistics shown by the house flipping calculator below indicate the total costs that the investor will incur.

Cash Flow

A positive cash flow is one of the key aspects to a successful real estate investment and having income producing assets. One way to achieve this is to use debt, or other people’s money (OPM), to create a favorable cash flow. A positive cash flow is one where the income generated exceeds the money being spent on the property each month.

In real estate, this means that the rental income will exceed the property expenses (which include the mortgage payment). Being able to invest in rental real estate, without having to fork out a huge amount of capital, allows real estate investors to create a good cash flow and often cover their mortgage payment and more, with the rental income.

Tax Benefits

Real estate investors who use debt to purchase properties can reduce their taxable income through the debt payments which are tax-deductible. Along with this, depreciation expenses can be claimed, which leads to less tax overall. This improves cash flow and enhances the overall investment returns, thanks to the tax benefits associated with using debt to purchase properties.

Diversification

Using debt to purchase properties allows a real estate investor to diversify their portfolio by purchasing properties in other areas, market segments, or different types of properties with the funds available.

By investing in different properties across various locations, property types, or market segments, you can spread the risk and reduce the impact of any individual property’s performance on your overall portfolio. A larger portfolio, when managed correctly, can be significantly better for real estate investing.

Using Debt To Buy Your Own House

Many people want to own their own home, for the security and flexibility that it provides. Owning a home allows people to make any modifications they desire, and truly make the space their own. It also creates a feeling of permanence and security as it’s a stable place that isn’t going anywhere. Using debt to buy a primary residence is a common and practical approach used by most people. The advantages of this are:

- The ability to buy a property, without having the entire purchase amount available upfront. Spreading the cost of homeownership over a longer period, to make the purchase more affordable.

- Remain liquid without having your capital tied up in a single asset that cannot be sold quickly, if you need money.

- Reduce your tax by deductions from the monthly mortgage payment and interest. This can make homeownership more beneficial overall.

- The potential for appreciation on a property is high, so this means that using debt to purchase an asset such as real estate can lead to higher returns, making it worthwhile.

However, using debt to purchase a primary residence is dependent on people’s income, expenses and long-term goals. Homeowners also need to consider the additional monthly costs such as maintenance, insurance, utility bills and more. Luckily, mortgages allow people to purchase homes that they wouldn’t otherwise have been able to afford.

Using Debt To Buy Rental Properties

When it comes to rental properties, debt can be used to finance the purchase of the investment property, after which the rental income can be used to cover the monthly mortgage payments. In this case, investors would usually put down a 20% deposit on the property, so that there is some equity invested and to mitigate the risk for lenders.

The benefits of using debt to purchase rental properties are:

- Increased purchasing power: Debt allows investors to purchase multiple rental properties, with a smaller upfront investment. Which means that the investment portfolio can be expanded, more rental income generated, and higher overall returns earned.

- Good cash flow: Rental properties generate rental income, which can be used to cover the debt payments each month. In other words, purchasing a rental property with a loan, allows investors to generate a positive cash flow by covering the loan repayment with the rental income.

- Higher return on investment: Real estate typically appreciates in value over time, and rental income usually increases over time too. This means that overall, rental properties can provide a higher return on investment over time and using debt to purchase these properties can be worthwhile.

- Hedge against inflation: Another benefit to using debt to purchase a rental property is to use the property as a hedge against inflation. With rental rates and property values typically rising with inflation, investors can use a rental property to maintain purchasing power and increase rental rates over time.

It’s important to bear in mind that the profitability and cash flow of your investments are at the mercy of market fluctuations, property vacancies, unexpected expenses, and interest rate changes. As such, rental properties can end up being cash flow negative, so conducting due diligence and adequate research is imperative.

Using Debt To Flip Houses

Investors who are looking to buy properties, renovate or improve them, and sell them quickly for a profit can use debt to fund these flips. This is a beneficial strategy for many, as a loan can be taken out to finance both the purchase of the property and the renovation. The real estate investor will need to put down a 20% to 30% down payment, cover the closing costs and the carrying costs of owning the property for a few months.

Typically, the loan is then paid off once the property is sold again, and this amount often covers both the principal loan amount and allows for a profit. This offers the benefits of increased purchasing power, portfolio diversification, a higher return on investment and preservation of your own cash resources.

Flipping houses involves risks, such as unexpected repairs, market fluctuations, or difficulty in selling the property. This is a key element for a real estate investor to keep in mind for house flipping when debt is being used.

Using Debt To Build Houses From The Ground Up

In the real estate industry, new construction projects are often done by using good debt. This allows investors the ability to increase the project scope and take on larger projects which ultimately leads to larger profits. Debt also allows investors to use leverage to amplify the impact of the equity investment, which means that the ROI is higher than using personal capital if the home sells at a higher price.

Debt financing enables investors to expedite the construction process. With sufficient financing in place, investors can start and complete the project more quickly, reducing the time required to bring the houses to market. This can be advantageous in a competitive real estate market or when there is high demand for new housing.

Using debt to finance a ground up construction process, a construction business can be scaled easily by reinvesting the profits generated from each sale into further projects and increase the overall returns.

When Is It Best To Avoid Using Debt To Buy Properties?

While debt can be a useful tool for real estate investing, there are also certain instances where it may be best to avoid using debt. These include:

- Those who experience an unstable financial situation or already have significant debt. Taking on more debt can be too much strain for those who are in a precarious financial situation and end up doing more harm than good.

- When the real estate market is particularly volatile or unpredictable it may not be a good idea to use debt. These conditions can impact property values, rental income and the selling time for homes on the market, which can be detrimental for real estate investments.

- If the property that you’d like to purchase isn’t going to generate a good cash flow through rental income or isn’t expected to appreciate in value enough after being renovated, you may want to avoid using debt. It’s vital to perform a detailed financial analysis of a real estate deal, before taking out a loan or committing to the deal.

- Those who are new to real estate investing, or who lack the necessary knowledge and expertise, may want to hold off on using debt to finance their investment property purchases. Gaining more expertise before taking out a loan and committing to investing in real estate is advisable in some cases.

- Investors with a high Debt-To-Income (DTI) ratio may want to avoid trying to take out a loan for financing their real estate purchase. Lenders will use the DTI ratio as a gauge on whether borrowers can pay back the loan or not, and a high DTI ratio isn’t a good sign for them.

Final Thoughts

Ultimately, the decision to use good debt in real estate investing instead of your own money, should be based on careful consideration of a few factors. These include your financial situation, market conditions, property cash flow, investment horizon, expertise, and risk tolerance.

It’s important to conduct thorough research, consult with professionals, and perform comprehensive financial analysis before making any investment decisions such as purchasing investment properties that are income producing assets.