The Short Answer

Real estate debt funds offer an investment avenue for financing real estate projects, often specializing in specific niches like residential construction loans for multifamily apartment buildings. These funds gather capital from multiple investors to provide short-term loans ranging from 90 days to 18 months, using the property itself as collateral.

For investors who are looking for an opportunity with steady returns that allows for diversification and passive investing, real estate debt funds are a good solution.

Some of the top real estate debt funds for 2025 are:

- New Silver’s Income Fund

- Blackstone’s Real Estate Debt Strategies

- Alliance Bernstein’s Commercial Real Estate Debt Fund

Jump To

How Do Real Estate Debt Funds Work?

Real estate debt funds provide an investment vehicle through which financing for real estate projects is provided. Typically, real estate debt funds are focused on a particular niche, such as residential construction loans which are aimed at multifamily apartment builders. In a nutshell, debt funds collect and pool money from various investors and use this to fund loans for prospective real estate buyers.

The debt provided by these funds is usually used as a short-term solution for anything from 90 days to 18 months. The property itself serves as collateral on the loans, which means that if the borrowers can no longer pay back their debt, the lender can take ownership of the property to recoup their losses.

Real estate debt funds are a useful investment vehicle for borrowers who are looking to make returns from real estate investing, without having to be hands-on or actively involved. They’re a good way to diversify a real estate portfolio and generate a secure form of income as investors receive recurring payments for the interest that is paid by borrowers on their loans.

Top Real Estate Debt Funds In 2025

If real estate debt funds are an area that has piqued your interest for investment in 2025 , we’ve created a list of some of the top debt funds to invest in this year.

Debt Fund 1 - New Silver

New Silver’s Income Fund is hot on the list of real estate debt funds to invest in, in 2025 . The innovative lender provides fix and flip, ground up construction and rental loans to real estate investors. The income fund provides a great opportunity for accredited investors to earn over 14% annually. With quarterly payouts, New Silver’s Income Fund generates a high income return from a diversified portfolio of loans that are underwritten and originated by New Silver Lending LLC.

All loans are short-duration and secured with a first priority, perfected lien on residential investment properties in the United States. Notes are held in an indentured trust for the benefit of investors, Ankura Trust Company serving as trustee. Fund returns are enhanced by committed senior leverage at a competitive cost of capital. New Silver Lending has $3mm+ of equity invested pari passu with the Fund.

Debt Fund 2 – Blackstone

Renowned as a leader in the real estate investing space, Blackstone Real Estate Debt Strategies (“BREDS”) is the firm’s successful debt fund. BREDS focuses on providing senior and mezzanine debt financing for commercial real estate projects globally. With a strong team of experts and extensive market knowledge, BREDS has a reputation for delivering attractive risk-adjusted returns to investors.

Blackstone’s debt fund is centered around the loans that are underpinned by high-quality real estate. Blackstone’s real estate debt enterprise offers innovative and holistic financing options spanning the entire capital structure and risk range.

Debt Fund 3 – Alliance Bernstein

AB CRED ranks among the top 10 global debt platforms, boasting dedicated investment teams in both US and European markets. It manages a total of $11.6 billion in combined assets. Real estate debt investing is a major part of AB’s alternative investments. The AB Commercial Real Estate Debt Fund has been around since 2012 and has successfully raised billions of dollars.

AB US CRED is the financing solution through which investors can tap into the commercial debt fund. The fund offers investors a comprehensive investment process, with risk-reductions techniques and returns that are optimized for each investor. Over $10 billion of investable capital is available in this fund.

Debt Fund 4 – Berkshire Residential Investments

Berkshire offers a real estate debt fund focused on senior bridge loan positions, mezzanine debt and Freddie Mac Capital Markets Execution (CME) securities. Berkshire has been an active buyer of Freddie Mac CME since 2009. The firm offers closed-end investments and separately managed accounts.

Berkshire invests in well-located residential assets with experienced sponsors, and this includes apartments, senior housing, student housing, manufactured housing and military housing. The firm utilizes their unique skills to source and underwrite debt investment opportunities on their vertically-integrated platform.

Debt Fund 5 – Goldman Sachs

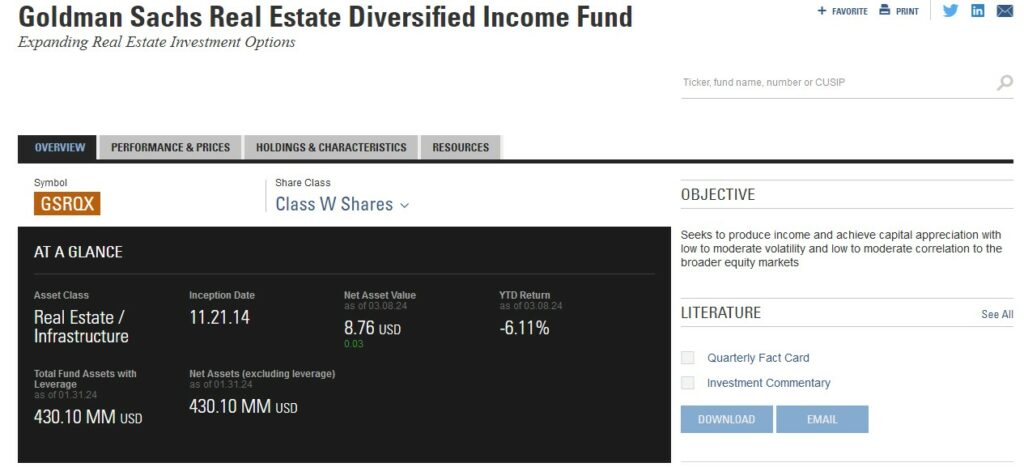

Investment banking giant Goldman Sachs offer investors a Real Estate Diversified Income Fund. The objective of the fund is to produce income and achieve capital appreciation with low to moderate volatility in relation to equity and public real estate markets. As such, the fund primarily invests in income-producing real estate, both equity and debt securities.

The fund’s portfolio managers have significant industry experience spanning over 20 years on average. Using this deep real estate knowledge, and global resources, they are able to a variety of investment opportunities. These include both private and public real estate in various areas, which are managed by a closed-end interval fund. The fund assets are around $430 million.

Debt Fund 6 - Oaktree Capital Management

Oaktree Capital Management offers multiple real estate debt funds, as part of their Real Estate Debt Strategy. Oaktree’s Real Estate Debt strategy aims to attain appealing risk-adjusted returns and ongoing income by investing in a diverse range of commercial and residential real estate debt opportunities.

The strategy incorporates commercial and residential first mortgages, commercial property mezzanine loans, real estate structured credit and real estate-related corporate debt. Oaktree specializes in alternative investments, and launched their Real Estate Debt Strategy in 2010 as an expansion of their Real Estate Opportunities Strategy.

Are Debt Fund Returns Comparable To The Stock Market?

Buying shares of a company in the stock market is significantly different to investing in real estate debt funds. Real estate debt funds offer investors stable returns in the form of steady interest payments from loans that are secured by tangible assets such as senior real estate assets, with private equity backed capital. While they may not offer returns as high as the stock market, debt funds aim to give investors consistent returns and preserve their capital.

On the other hand, stock markets are notoriously volatile, but they can offer investors higher returns. The catch here is that during market downturns, the volatility presented by the stock market can heavily impact the returns that investors will see. While the stock market offers investors liquidity and growth opportunities, this hinges on their appetite for risk.

What Are The Main Risks When Investing In Debt Funds?

Investing in real estate debt funds provides many opportunities for investors, however it also has some downsides. These include:

- Capped Returns: While the returns are steady and stable on real estate debt funds, they are based on a set interest rate. This means that the returns will be limited to a certain amount.

- Loan Prepayment: Early repayment of the loan can disrupt your interest income stream and is a risk to consider when investing in debt funds. However, liquidity is generally advantageous for most investments, so this could be a positive aspect in some scenarios.

- Inflation Cutting Into Returns: It’s possible that over time inflation can cut into the returns that investors earn from debt funds, depending on the inflation rate at the time when you invested.

- Market Risk: Real estate markets are subject to fluctuations influenced by factors such as economic conditions, supply and demand dynamics, and regulatory changes. These market uncertainties can affect property values, rental income, and the performance of real estate debt funds.

Final Thoughts - Should You Invest In A Debt Fund?

The answer to whether you should invest in a real estate debt fund or not depends largely on a few factors: your appetite for risk, your investment goals and your overall financial strategy. Consider each of these, and then make an informed decision based on your personal investment needs.

Investment goals

Real estate debt funds provide a stable income stream, along with capital appreciation. This income is by the interest payments on the underlying loans. They aren’t as volatile as the stock markets, and their returns may be lower, but they’re likely to be more stable. For investors who are looking to diversify their portfolio and receive a steady income, a real estate debt fund is a good solution.

Risk tolerance

Real estate debt funds typically have lower volatility compared to other funds however the risks include market fluctuations, capped returns, and loan prepayments which can disrupt the interest received. Real estate debt funds are typically suited to those who have a lower risk for appetite and prefer an investment vehicle that isn’t high risk.

Financial strategy

Depending on your financial strategy, real estate debt investments can offer various effective solutions. Investors can diversify their portfolios into multiple areas of real estate investment by using real estate debt investments, such as commercial real estate. Alternatively, private lenders can offer investors opportunities in real estate debt investing that they may not have with more traditional lenders.