The Short Answer

Fractional real estate investing is a dynamic and transformative strategy that has opened the door for many investors in the real estate market. Fractional real estate investment allows investors to purchase shares of real estate, instead of having to fork out large amounts of capital upfront to outright purchase properties.

For investors who would like to take a closer look at this strategy, 2 of the best fractional real estate investing platforms in 2024 are:

- Fundrise: As one of the most popular fractional real estate investment platforms, Fundrise offers fractional investors a large selection of properties across both the residential and commercial sectors. Fundrise is best suited to smaller, non-accredited investors who don’t have a lot of capital to invest

- Upright: Previously known as Fund That Flip, Upright allows accredited investors to acquire fractional shares of loans for residential renovations and new construction projects. REI software is used to find and manage each project, and maximize the profitability for investors.

Jump To

What Is Fractional Real Estate Investing?

Fractional real estate investing is a revolutionary strategy for investors who can now own a portion or share of a property, instead of the entire property. In other words, investors own a small slice or fraction of a property, instead of taking complete ownership of the property themselves.

How does it work? Investors combine their resources to collectively purchase real estate, and each investor will own a portion of the property that relates to the amount that they have contributed. This all takes place on platforms that specialize in fractional real estate investment, which allows investors to browse, select and invest in specific properties. Once the property is acquired, responsibilities like maintenance, leasing, and management are typically handled by professional property management services.

Fractional real estate investing has opened the door to a larger number of investors who may not want to own a property, or simply don’t have the funds. It’s also a great way for investors to diversify their portfolios and expand into new areas of investing.

Best Fractional Real Estate Investing Platforms In 2024

For investors who are considering using the fractional real estate investing strategy, it’s worth considering a few of the best fractional real estate investment platforms, to determine which is best suited to their specific financial and investing goals. Let’s take a look at some of the best fractional real estate investing platforms in 2024.

Platform 1: Fundrise

Fundrise is one of the most popular real estate crowdfunding platforms that is known for being easy to use, with a wide range of real estate investments. Fundrise has a diverse portfolio of both residential and commercial properties, which allows investors to access real estate markets that may be easier to enter. The platform uses cutting-edge technology to streamline the investment process and provide a more seamless experience for investors.

Fundrise is aimed at creating a place where smaller, non-accredited investors can invest for a low initial investment. Fundrise offers quick access to real estate fund options that are tailored to different investing goals and investors can choose one that works best for their investing goals. The platform advises a five-year timeline, before investors should expect to see major returns on their investments.

Minimum investment: $10 taxable account

Platform 2: Upright

Upright (formerly known as Fund That Flip) is an end-to-end real estate investment platform that specializes in providing loans for residential renovations and new construction projects across the United States. Along with this, they offer accredited investors the chance to acquire fractional shares of these loans, presenting a unique opportunity to generate passive income.

REI software is used to find, analyze, and manage every project to exit — and maximize profitability. Upright is offering investments with returns up to 13%. The investment products on offer include borrower dependent notes, residential bridge note fund, pre-funding note fund and horizon residential income fund.

Platform 3: Arrived

Arrived offers non-accredited investors the opportunity to invest in single family residences and vacation rental property options. The platform aims to provide a passive income stream through long-term investments in the single-family and vacation rental market.

Investing in Arrived rental property can deliver returns to investors in two different ways, these are rental income and property appreciation. The dividends from the rental income on each rental property, which is currently paid out to investors quarterly. Alternatively, the appreciation from the change in property value that will be realized at the end of the investment hold period.

Platform 4: Lofty

Lofty is a fractional real estate investing platform that offers investors the chance to participate in large-scale commercial projects, including office buildings, retail centers, and more. The platform aims to diversify real estate portfolios by offering exposure to different types of commercial properties using tradable, blockchain based tokens. No experience is required, and no down payments need to be made.

Lofty offers instant access to property deals with in-depth analysis and a community of investors. They also offer daily rental payouts derived from rental income, and a property appreciation payout when investors cash out. Investors can also reinvest their income over the long term, which enables them to further their real estate investing opportunities.

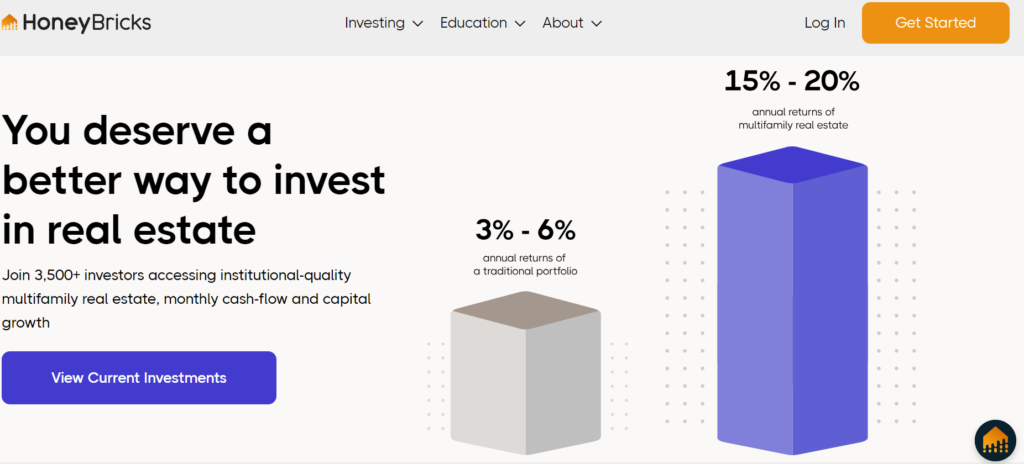

Platform 5: HoneyBricks

HoneyBricks is a new platform, providing accredited investors with a curated marketplace of institutional-quality multifamily real estate to fractionally invest in. The platform provides 15% minimum annual returns and investments are backed by reputable sponsors with strong track records.

The minimum investment is set by the investment sponsor, so this can vary from deal to deal. HoneyBricks leverages the blockchain to provide more flexibility for investors. Investors can invest in an individual or business capacity. The platform provides detailed educational material for investors and is easy to use.

Platform 6: CRE Income Fund

CRE Income Fund provides investors with the chance to invest in private commercial real estate in the form of fractional ownership. The platform offers a 10% annual yield, with a focus on the industrial and technology sectors. The CRE team is an experienced group of real estate professionals.

The CRE Income Fund is available to accredited investors who are looking for a passive income source and asset appreciation. The platform has a diverse range of commercial real estate, from various sectors, and they are leased with NNN leases, which means that tenants pay a prorated share of the property taxes, maintenance and insurance on the real estate assets.

Platform 7: RealtyMogul

RealtyMogul is a successful platform that provides fractional real estate investing for accredited and non-accredited investors. The platform offers public, non-traded REIT (Real Estate Investment Trust) products to its non-accredited investors, with a buyback program which adds liquidity and high targeted rates of return. These REITs are RealtyMogul Income REIT and RealtyMogul Apartment Growth REIT.

Accredited investors can invest in any of RealtyMogul’s offerings. Private placements are only available for accredited investors and these are usually single property commercial properties or a small real estate portfolio across various property types within the US. These typically have a 2-10 year investment timeline.

Advantages of Fractional Real Estate Investing

Fractional real estate investing has revolutionized the industry, as investors can now reap the benefits of this inclusive and streamlined investing strategy. Here’s why more investors are choosing to use fractional real estate investing:

- Diversification: Investors can diversify their portfolios by spreading their investments across multiple properties. Fractional investing allows investors to explore different property types, areas and more. This provides a greater opportunity for investors to expand their real estate portfolio to include properties that they wouldn’t have been able to otherwise.

- Less Capital Required: The initial capital investment required to purchase fractional amounts of real estate is significantly lower than the cost of purchasing a home outright. Which means that there is a greater number of investors who can use this strategy and can invest in real estate when this wouldn’t have been possible for them previously.

- Liquidity: Fractional real estate ownership can offer investors liquidity, which is something traditional real estate investing hasn’t offered before. Investors can sell their shares on secondary markets, providing an avenue for exit or portfolio adjustments.

- Lower Risk: The risk associated with investing in real estate can be significantly lowered by investing in fractional real estate, because the risk is spread across various properties, without full investment in any.

- Property Management: When it comes to fractional real estate investing, investors won’t need to manage the property as this is usually done by a property management company. This saves investors extra hassle and extra costs and allows them to play a more passive role in the investment.

Disadvantages of Fractional Real Estate Investing

While fractional real estate investing can be an attractive strategy for those who want to invest in real estate without the hassles of property ownership, there are also some downsides to be aware of.

- Limited Control: Investors who purchase shares of real estate usually don’t have a lot of control over the management of the property, and other decision-making within the process, such as strategic direction. This is determined by the platform or the management company which means that investors are left without much control over their investment.

- Diluted Returns: As more investors join a particular project or property, the ownership shares of existing investors may be diluted. This dilution could impact the overall return on investment, which means that it’s vital for investors to monitor the dynamics of their ownership percentage.

- Market Volatility: The real estate market can be volatile, which means that during periods where the market is experiencing a downturn, fractional investors may experience a negative impact on their returns. This is due to the fact that property values can go down during these periods, which in turn influences the profit being generated by those properties.

- Unreliable Platforms: The success of fractional real estate investing hinges largely on the platform itself. Which means that if a platform faces financial issues, makes bad decisions or has operational challenges, your investment could be impacted. This leaves you at the mercy of the platform, and an unreliable platform can be detrimental to the success of your investments.

Alternatives To Fractional Real Estate Investing

Those who aren’t quite ready to dip their toes into the world of fractional real estate investing have many other options to consider. Here are a few:

- Real Estate Crowdfunding: Similar to fractional investing, real estate crowdfunding platforms allow investors to pool funds for specific real estate projects. However, crowdfunding often involves more direct participation and decision-making compared to fractional ownership. Crowdfunding platforms are easy to find, and the profits investors can make depend on the projects that they choose to invest in.

- Mutual Funds: These mutual funds are real estate fund options that allocate funds across a diversified portfolio of real estate assets, granting investors exposure to the real estate market without requiring direct ownership of properties. This alternative allows for professional management of real estate assets but remains susceptible to market risks.

- Partnerships: This strategy involves collaborating with other real estate investors to collectively own and manage real estate projects. This offers investors a higher level of control than fractional ownership, but it also requires a more engaged investor in terms of involvement and commitment to each project.

- Traditional Investing: Choosing traditional real estate investment over fractional ownership involves acquiring complete properties. This grants you complete control over the property, decision-making processes, and the potential for increased returns. However, it necessitates a larger initial investment and demands more hands-on management.

- Real Estate Investment Trusts (REITs): REITs are publicly traded entities engaged in owning, operating, or financing income-generating real estate. Opting for REIT investments allows for diversification across multiple properties and demands less capital than direct ownership. Nonetheless, it remains susceptible to market fluctuations and doesn’t offer the same level of control associated with owning tangible real properties.