The Short Answer

White label hard money lenders allow businesses to partner with them, to offer the lender’s financial products branded under the business. Which means that the lender doesn’t feature prominently in the process, and instead the brand itself can take advantage of the loan services provided by the lender. A few of the best hard money lenders providing white label platforms are:

- New Silver

- RCN Capital

- Cityscape Finance

- Roc Capital

List of White Label Hard Money Lenders

What Is A White Label Hard Money Lender?

A white label hard money lender essentially creates an opportunity for businesses to align with that lender and provide the funding solutions of that lender, under their own branding. In other words, a white label hard money lender enables partners to market their suite of financial products as their own.

White labeling enables businesses to build and strengthen their brand without having to develop the financial infrastructure from scratch. It’s a strategic collaboration that leverages the expertise of the lending company while allowing the partner business to focus on its core competencies.

Full List of White Label Hard Money Lenders

There are a few private lenders who provides businesses with the option to use a white label service. This means that they can market the lender’s financial products as their own and take advantage of the services that the lender provides.

Lender 1: New Silver

New Silver’s partner program offers a white label option for correspondent lenders. Within this program, lenders can sign up and market New Silver’s loan products as their own. These lenders or businesses can use their own logo, as well as other branding opportunities. New Silver offers secure funding in as little as a few days, so that investors can beat the competition.

While New Silver still underwrite the loans, the face of the origination process and post loan closing falls under the correspondent. Correspondents will also be able to control certain features within the loan process, such as pricing.

New Silver’s correspondent program is geared to fix and flip originators, with instant proof of funds and term sheets. Both fix and flip and ground up construction loans are offered on the correspondent program through secure funding. Borrowers can get up to $5,000,000 capital with each of these loans, and loans are up to 18 months with up to 100% construction financing.

Lender 2: RCN Capital

RCN Capital offers a white label solution for correspondent lenders to help them build their businesses, by supporting them in the background. RCN Capital runs a simple credit and background check on all applicants, and previous loans are examined as part of this process. The minimum requirement is that the lender has been in business for at least a year.

RCN’s proprietary software allows the broker or correspondent to use their own branding, which allows them to be seen as the lender closing the loan. RCN Capital offers pre-approval of less than 24 hours on loan applications, and as a direct lender, RCN Capital underwrites all loans.

RCN provides client financing and loan servicing, a dedicated loan officer for all deals and due diligence double checks. RCN also offers a range of financing options for real estate investors, along with their added features like loan servicing.

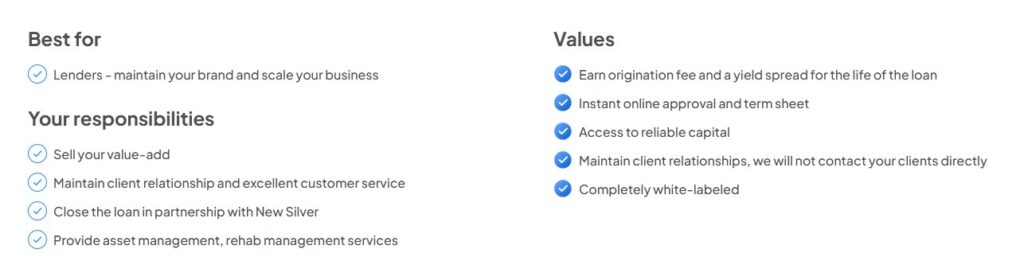

Lender 3: Cityscape Finance

Cityscape Finance, LLC are private lenders offering table funding to loan originators for residential and multifamily deals. Cityscape offers financing options to real estate investors in 17 states and no personal lines of credit are required. Cityscape doesn’t originate directly to borrowers, instead only works with brokers.

Cityscape’s real-time pricing engine is designed to generate instant pre-qualification letters, and the lender provides faster loan closing. Cityscape provides the following loan programs: Purchase Bridge, Refinance Bridge, Equity Cash Out, Rehab Fix & Flip, Rehab Fix & Rent and Ground-up construction (vertical only).

Cityscape also offers lead referrals to those who use their white label program, which is an added bonus to help them develop their business. Cityscape has a well-defined process and technology that speeds up their lending process and offers quicker document collection.

Lender 4: Roc Capital

Roc Capital is a capital provider for private lenders, focused on residential real estate. Roc Capital works with over 4000 lenders in 44 states. Roc Capital will fund their client’s borrower’s loans at the closing table under the client’s name and using their branding in the white label program. The program is called white label table funding.

Within this program, the loan is assigned to Roc at closing, however the client still appears as the lender and Roc simply works in the background. One of the biggest perks that Roc offers their clients is that no loans are ever required to be bought back. They also fund a range of loan types including fix and flip, ground up, multifamily bridge, single property rentals, rental portfolios, multifamily term and stabilized bridge.

The idea behind Roc’s white label table funding program is that clients can focus more on the origination of loans, and less on raising capital. Their web portal allows clients to securely submit and price deals, check a borrower’s credit and background, and follow each loan throughout its lifecycle.

Who Should Use A White Label Program?

There are a variety of businesses that can benefit from using a white label program to provide financial products under your own branding. Here are a few examples of companies that can benefit from a white label program:

- Companies with limited lending expertise: Partnering with a more experienced lender in a white label program gives small businesses with limited lending expertise a way to enhance their services. Using a white label program allows small businesses to offer comprehensive financial solutions and provide more value.

- E-commerce platforms: Online platforms and marketplaces, particularly those serving real estate investors or property buyers, can benefit from using a white label program. Integrating financial services in their e-commerce offerings, can improve their overall offerings significantly and provide a well-rounded alternative for homebuyers and investors.

- Businesses diversifying their offerings: Established businesses in related industries, such as real estate agencies or financial services, can use white labeling to diversify their services and enhance their value proposition without extensive investment in new resources. Ultimately, using a white label platform can lead to business growth.

Tips For Choosing The Right White Label Lender

Selecting the right white label lender is a crucial decision that can significantly impact your business’s success. Here are some tips to guide you in choosing the ideal white label lending partner:

- Reliability: Choosing a lender that has a solid reputation in the industry is a good place to start. You can find one by looking at the client reviews available online, and any testimonials which most lenders will have. Looking at a lender’s track record of loans provided on time with secure funding is one of the best indicators of a lender’s overall reliability.

- Technology: These days, technology plays a key role in making sure that loans are streamlined and that users have the best experience. Pay attention to the technology that the lender is using in their white label platform, and make sure that they are enhancing the borrower’s experience as much as possible.

- Speed: Loan speed is a crucial element to choosing the right white label lender. Lenders that offer speed and efficiency in processing applications and disbursing funds are front-runners in your choice. Real estate deals are time-sensitive so this is a vital element in the real estate space for most lenders to fulfill.

- Clear Terms: Clear and transparent loan terms are a key element to choosing the right white label lender. Lenders that provide their loan terms, including interest rates, fees, and any other associated costs upfront are a good option to consider.