A brief outline

Hard money loans can be useful financial solutions for real estate investors, particularly those doing fix and flip projects. Let’s take a look at a hard money loan example so that you can see how hard money works and what the main costs associated with hard money loans are.

Table of Contents

Hard money loans can be a great alternative to traditional loans and mortgages because they offer fast funding, with less stringent lending criteria. If you’ve never used a hard money loan before, we’ll take you through the process step by step, by showing you two examples and explaining how hard money loans work and what you can expect.

What is a hard money loan?

A hard money loan is a short-term bridge loan provided by a private or non-traditional lender. The asset (usually a property) is used as collateral for a hard money loan. A hard money loan is usually used by house flippers to purchase and renovate properties. A hard money lender provides the capital the investor needs to purchase the property, complete high ROI renovations, and thereby increase the after-repair value (ARV) of the home.

Hard money loans are usually offered for anywhere between 12 and 24 months. Borrowers are typically required to pay back the full loan amount at the end of the loan term. Often, the funds received from the sale of the house are used to pay back the full loan amount.

Hard money loans often cover 70% to 80% of the funds needed, and the borrower will need to cover the shortfall, so for the deal to work out, the ARV value of the house will need to be quite a bit more than the purchase price. There are various types of hard money loans available such as: fix and flip loans, refinance loans, construction loans and rental property loans.

Now let’s take a look at two practical examples of how hard money loans work.

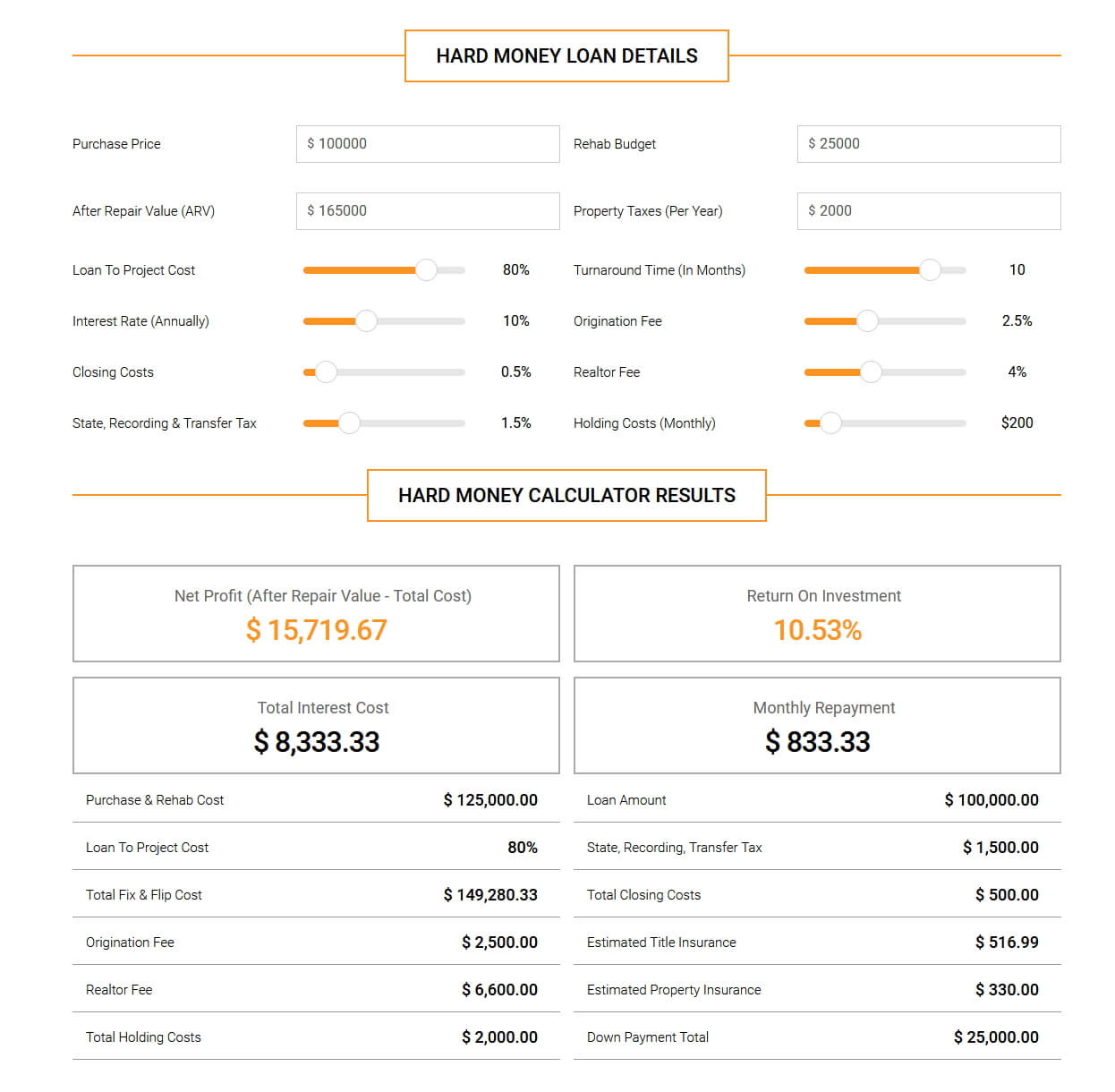

Hard Money Loan Example 1 - $100,000 Loan

For our first example, we’ll look at a $100,000 hard money loan with a 10% interest rate, taken over 10 months. We’ve used the New Silver Hard Money Loans Calculator to give you an idea of the information you’ll need to input to work this out, and how this calculation looks. For this deal, the return on investment is estimated to be 10.53%, based on a Net Profit of $15,719.67.

Net Profit:

To Work Out the Net Profit, you simply take the After Repair Value (ARV), and deduct the total cost of completing the house flip.

At a higher level you are taking the total income and deducting the total expenses to workout how much money you are likely to make.

In this example:

- Net Profit = $165,000 (ARV) – $149,280.33 (Total Fix & Flip Cost)

- Net Profit = $15,719.67

Loan Amount:

In this example, the Loan Amount is $100,000.00. This number represents 80% of the Project Cost.

- Loan Amount = (Purchase Price + Rehab Budget) * 80%

- Loan Amount = ($100,000.00 + $25,000) * 0.8

- Loan Amount = $100,000.00

Monthly Repayment:

The monthly repayment of $833.33 is based on the loan amount of $100,000.00 and the interest rate of 10%. You work out the monthly interest rate by multiplying the loan amount by the interest rate, and then dividing by 12.

- Monthly Repayment = $100,000.00 * 10% / 12

- Monthly Repayment = $833.33

Total Interest Paid

To calculate the total interest paid, multiply the monthly interest payment by the number of months that the loan is active (turnaround time).

- Total Interest Paid = Monthly Interest Payment x Turnaround Time In Months

- Total Interest Paid = $8,33.33 * 10 Months

- Total Interest Paid = $8,333.33

Down Payment

With most hard money loans, a down payment is needed to secure the deal. The down payment is the shortfall between the project cost and the loan amount provided.

- Down Payment = Purchase Price + Rehab Budget – Loan Amount

- Down Payment = $100,000.00 + $25,000.00 – $100,000.00

- Down Payment = $25,000.00

Total Fix & Flip Cost:

The total fix and flip costs represents the sum of all expected costs associated with the fix and flip. In this example it is the sum of all the costs listed below:

- Loan Amount: $100,000.00

- Down Payment: $25,000.00

- Total Interest Paid: $8,333.33

- Property Taxes: $2,000.00

- State Recording & Transfer Tax: $1,500.00

- Origination Fee: $2,500.00

- Closing Costs: $500.00

- Title Insurance: $516.99

- Realtor Fee: $6,600.00

- Property Insurance: $330.00

- Total Holding Costs: $2,000.00

Total Fix & Flip Cost = $149,280.33

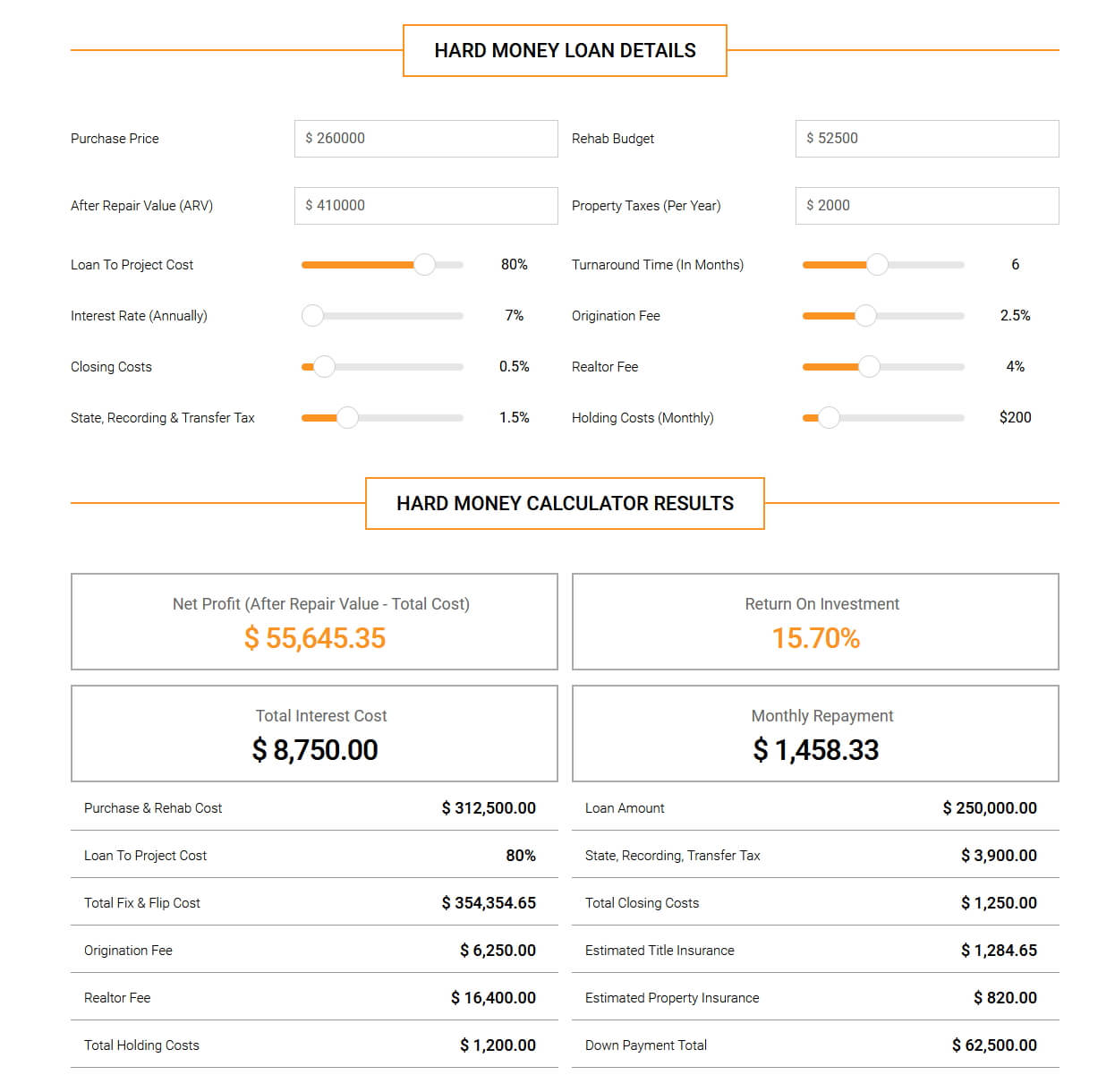

Hard Money Loan Example 2 - $250,000.00

For the next example we’ll use a $250,000 hard money loan with 7% interest rate and a project turnaround time of 6 months.

Net Profit:

- Net Profit = $410,000 (ARV) – $354,354.65 (Total Fix & Flip Cost)

- Net Profit = $55,645.35

Loan Amount:

- Loan Amount = ($260,000.00 + $52,500) * 0.8

- Loan Amount = $250,000.00

Monthly Repayment:

- Monthly Repayment = $250,000.00 * 0.07 / 12.

- Monthly Repayment = $1,458.33

Total Interest Paid

- Total Interest Paid = $1,458.33* 6 Months

- Total Interest Paid = $8,750.00

Down Payment

- Down Payment = Purchase Price + Rehab Budget – Loan Amount

- Down Payment = $260,000.00 + $52,500.00 – $250,000.00

- Down Payment = $62,500.00

Total Fix & Flip Cost:

The total fix and flip costs represents the sum of all expected costs associated with the fix and flip. In this example it is the sum of all the costs listed below:

- Loan Amount: $250,000.00

- Down Payment: $62,500.00

- Total Interest Paid: $8,750.00

- Property Taxes: $2,000.00

- State Recording & Transfer Tax: $3,900.00

- Origination Fee: $6,250.00

- Closing Costs: $1,250.00

- Title Insurance: $1,284.65

- Realtor Fee: $16,400.00

- Property Insurance: $820.00

- Total Holding Costs: $1,200.00

Total Fix & Flip Cost = $354,354.65

How do you work out the total interest paid on a hard money loan?

To work out the interest on a hard money loan you take the loan amount and multiply it by the interest rate offered.

In other words, if you are offered a $100,000 loan with an 9% interest rate, the total interest paid would be $9,000 ($100,000 * 9%).

Similarly, if you were offered a $300,000 loan with an 11% interest rate, the total interest paid would be $33,000.00 ($300,000.00 * 11%).

Are hard money loans 'interest only' and what exactly does that mean?

Reputable Hard Money Lenders like New Silver offer interest-only repayment terms. For example, if you were offered a $200,000 hard money loan, with a 10% interest rate, your monthly payment would work out to $1666.66. Here’s how it works:

- Amount Borrowed: $200,000

- Annual Interest Rate: 10%

- Monthly Repayment: Amount Borrowed * Annual Interest Rate / 12

- Monthly Repayment: $200,000 * 10% / 12

- Monthly Payments: $1666.66

At the end of the interest-only period, you’ll have covered only the interest on your loan and none of the capital will have been paid back. So, you’d need to pay back all the capital before the loan expires and this is done in a balloon payment. Many investors use the sale of the property to cover the loan amount, which means that it’s vital to make sure the property is sold in time.

With a traditional lender, the monthly payment is a mixture of the interest owed and the outstanding capital amount. However, this is one of the ways hard money loans are different. They offer borrowers the chance to structure loans differently so that it works for their investment purposes and is ideal for those who are flipping houses.

What are all the main costs involved in a hard money loan?

Origination Fee

The origination fee is an additional cost associated with hard money loans. It usually ranges from 1.25 – 1.75% of the loan, but this is ultimately up to the lender that you choose. It is the expense that the lender charges the borrower to cover all the costs associated with initializing the loan. So, if your loan amount is $200,000 and the origination fee is 1.5%, that would result in a cost of $3,000.

Holding Costs

Holding costs are the fees that need to be paid simply for owning an investment property. This needs to be paid during the period where you own the property. For example, if you purchase a property the rehab takes 8 months before you sell it, you’ll need to pay holding costs for those 8 months until it’s sold.

Closing Costs

The closing costs are fees paid to the lender to cover the home appraisal, title search and other activities your lender has had to do to get the loan approved. These are typically between 3% and 6% of the home’s price.

Realtor Fee

This covers any services which may be required from the realtor.

Loan-to-project cost

The loan to project cost is worked out by taking the loan amount and dividing it by the total project cost. It is worked out as a percentage and allows borrowers to calculate the amount that they need to contribute towards a renovation project.

Interest rates

One of the notable differences with traditional loans and hard money loans are the significantly higher interest rates associated with hard money loans. The reason these are higher is to mitigate the risk for hard money lenders, who approve loans with less red tape and in a short time frame, and also offer short loan terms, which is a bigger risk for them.

Insurance

Property insurance and title insurance are both necessary costs associated with hard money loans. Property insurance is necessary for theft and damages, and title insurance is necessary for both the lender and the homeowner, to protect them from any financial loss that could happen as a result of any defects in a title to a property.

Tax

There are property taxes that real estate owners need to pay the county or local tax authority based on the assessed value of the home. Then there are transfer taxes which are paid when a property is transferred from one owner to another. There is also a tax imposed for recording a mortgage or loan on real estate.

Final thoughts

Hard money loans can be a great solution for real estate investors who don’t qualify for traditional loans, or who need funds fast for a fix and flip project. While the interest rates are higher, hard money loans allow for more flexibility and are based on the deal at hand, as opposed to the borrower’s financial history. Bear in mind that you’ll need to pay off your loan in full before it ends, and these loans are shorter than traditional ones, so make sure that your deal works out so that you can settle what you need to, in the time frame you’ve got.