What Is Roc Capital?

Roc Capital is a nationwide lender that provides real estate investment loans across a range of property types, including single-family homes, multifamily buildings, apartments, office spaces, retail centers, and industrial properties. Their loan programs include fix and flip financing, ground-up construction, stabilized bridge loans, and both single-property and portfolio rental loans. Roc Capital also supports private lenders and brokers through a white-label, table funding platform available via portal and mobile app. The platform includes services such as underwriting, closing coordination, loan servicing, and funding. Additional features (like access to property insurance, appraisals, and discounts at national home improvement retailers) are designed to streamline the process for lenders and their clients.

Key Topics

Who Should Consider Using Roc Capital's Services?

Roc Capital’s offerings are primarily geared toward experienced residential real estate investors who regularly take on projects such as fix and flips, ground-up construction, and rental property acquisitions. These investors often work with single-family homes or small multifamily properties (typically 1–4 units) and require fast, reliable financing to keep their projects moving efficiently. The loan products are suited for those looking to scale their investment portfolios, pursue short-term renovation strategies, or build new residential inventory from the ground up.

In addition to individual and institutional investors, Roc Capital also serves private lenders and mortgage brokers through its white-label table funding program. This allows smaller lending businesses to originate loans under their own brand while leveraging Roc Capital’s infrastructure for underwriting, servicing, and funding. For brokers looking to expand their offerings without building a back-office team from scratch, this model can provide a turnkey solution with added tools like branded portals, app-based access, and borrower perks such as appraisal ordering and insurance integration.

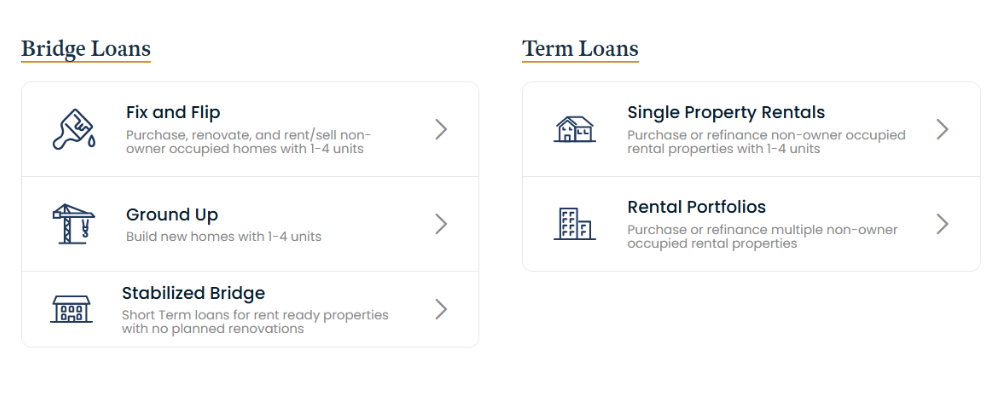

What Loan Products Does Roc Capital Offer?

Roc Capital offers a suite of real estate investment loan products designed to meet a range of financing needs for residential-focused investors. These products are generally suited to investors working with 1–4 unit properties and include both short-term and long-term financing options.

- Stabilized Bridge Loans: Short-term financing solutions for investors who need temporary capital while transitioning a property or preparing for permanent financing. Roc offers two variations—one with no DSCR (debt service coverage ratio) requirement, and another that includes a DSCR exit option requiring a minimum DSCR of 1.10. These loans typically have 12-month terms and apply to single-family homes, 2–4 unit properties, townhomes, PUDs, and warrantable condos.

- Fix and Flip Loans: Designed for investors who purchase, renovate, and resell residential properties. These loans can fund up to 100% of the renovation budget, with terms around 12 months. Loan amounts range from $50,000 to $3.5 million, and eligible properties include 1–4 unit residential buildings.

- Ground-Up Construction Loans: For investors looking to build new residential properties from scratch. Financing covers up to 75% of the land value or purchase price (or 60% if the property is unpermitted), plus 100% of construction costs. Loans can go up to 70% of the after-repair value (ARV) and require a minimum of one month’s interest reserve. Roc also offers a program specifically for experienced developers with at least three years of track record.

- Single Property Rental Loans: Long-term financing for purchasing or refinancing 1–4 unit rental properties. These are 30-year fixed mortgages with loan amounts between $75,000 and $2 million. No prior landlord or real estate investing experience is required, making this an accessible option for newer investors.

- Rental Portfolio Loans: Tailored for investors with multiple rental properties, these loans allow for a blanket mortgage covering several assets. Financing options include 30-year fixed, fully amortizing loans as well as hybrid ARMs (5/6, 7/6, 10/6) with interest-only or fully amortizing terms. Requirements include at least 90% occupancy and rental income verification, with flexibility for purchase, rate-term refinance, or cash-out scenarios.

These products cater primarily to active investors focused on residential real estate—whether they’re acquiring distressed properties, building from the ground up, or scaling a long-term rental portfolio. Roc’s structure allows for flexibility and speed, which can be beneficial in competitive or time-sensitive markets.

Pros and Cons of Roc Capital

Pros

Diverse Loan Options: Roc Capital offers a wide range of products, from fix and flip loans to ground-up construction and rental portfolio financing, making it appealing to various types of real estate investors.

Support for Brokers and Lenders: The white-label platform allows private lenders and brokers to originate loans under their own brand while leveraging Roc’s backend services.

Integrated Platform: Roc provides access to services like appraisals, property insurance, and national retailer discounts, streamlining the loan process for both originators and borrowers.

Nationwide Coverage: Investors in most parts of the U.S. can access Roc’s loan programs, offering flexibility in choosing markets.

Experienced Investor Programs: Roc offers specialized options for seasoned developers and investors, which can mean more favorable terms or higher leverage in some cases.

Cons

Primarily for Experienced Investors: While some products don’t require experience, the majority of Roc’s offerings are best suited for seasoned investors with a track record.

Limited Property Types: Most loans are designed for residential 1–4 unit properties; investors looking to finance larger multifamily or commercial properties may need to look elsewhere.

Short-Term Focus on Some Loans: Many of the loan options, such as fix and flip or bridge loans, are short-term—investors must have a clear exit strategy or plan for refinancing

Not Ideal for First-Time Investors: Despite having a no-experience rental loan, newer investors might find the platform and process more aligned with those who are familiar with real estate financing and the pace of investment lending.

Potentially Higher Rates: As with many private lenders offering short-term or asset-based loans, interest rates and fees may be higher than those found with traditional banks or credit unions.

User Reviews and Feedback

Roc Capital Holdings LLC holds an A+ rating from the Better Business Bureau (BBB) and maintains a 4.1-star rating on Google, based on approximately 40 reviews. Overall, customer feedback reflects positively on the professionalism, speed, and the reliability of the business and its loan services. Many reviewers—particularly brokers and correspondent lenders—highlight Roc’s role as a dependable business partner, noting that the team is responsive and easy to work with throughout the lending process.

Partners often mention the benefits of Roc’s white-label platform, citing how it helps them scale their lending operations without having to manage underwriting, servicing, or funding in-house. The streamlined technology and backend support are recurring points of praise.

On the other hand, some borrowers have expressed frustration with denied loan applications, often citing unclear qualification criteria or communication gaps. A few reviewers have mentioned extended timelines, stating that certain loans took longer than expected to close—sometimes several months—especially when documentation or deal complexity came into play.

As with many lenders in the private capital space, borrower experience can vary depending on project type, preparedness, and borrower profile. While Roc appears to have a solid reputation among intermediaries and repeat investors, new borrowers or those with unconventional deals may encounter more friction.

Roc Capital Alternatives

Alternative 1: New Silver Lending

New Silver is a direct, tech-enabled lender offering business-purpose loans to real estate investors across the U.S. Their loan products include fix and flip loans, ground-up construction loans, and DSCR-based rental loans. Known for fast closings—sometimes in as little as five days—New Silver provides instant online approvals, digital term sheets, and competitive rates. The company offers high leverage options and a fully built-out white-label lending program, allowing brokers and correspondent partners to originate loans under their own brand while using New Silver’s backend systems. Their combination of speed, flexibility, and technology makes them a strong option for experienced investors looking to scale efficiently.

Alternative 2: Kiavi (formerly LendingHome)

Kiavi is a private lender focused on residential investment properties. Their offerings include fix and flip loans, new construction financing, DSCR rental loans, and rental portfolio loans. Kiavi caters to a broad investor base, from first-time flippers to institutional-grade, high-volume operators. They also offer a partner program tailored to service providers in the real estate ecosystem—such as property managers, auction houses, and investor mentors—as well as a broker program. Kiavi places a strong emphasis on technology-driven underwriting and borrower experience, making it a good fit for those who value digital efficiency.

Alternative 3: Lima One Capital

Lima One Capital provides a full suite of real estate investment loans, including fix and flip, bridge, rental, and new construction loans. Their rental loan offerings span both single-property and portfolio products, with terms designed for long-term buy-and-hold strategies. Lima One is known for its institutional backing, competitive leverage, and focus on professional real estate investors. They also serve small balance multifamily and offer lending for short-term rental properties. While the approval process can be more traditional compared to purely digital lenders, their broad product range and reliability appeal to investors with more complex needs or those scaling to higher volume.

Final Thoughts - Should You Partner with Roc Capital?

Roc Capital is a comprehensive lending platform built for real estate investors and private lenders who need a wide range of financing options, backend operational support, and nationwide access. Their loan programs—spanning fix and flip, bridge, ground-up construction, and rental loans—are best suited for investors working with 1–4 unit residential properties, and particularly appealing to those with prior experience.

For brokers, correspondent lenders, and smaller lending shops, Roc’s white-label, table-funding platform provides a way to offer competitive loan products without managing underwriting or servicing in-house. The availability of integrated services like insurance, appraisals, and discounts on materials helps streamline the lending process further.

However, Roc Capital may not be the best fit for first-time investors or those working on unconventional deals. Some borrower feedback points to long closing times or unexpected denials, underscoring the importance of strong documentation and alignment with Roc’s underwriting criteria. Rates and fees may also be on the higher side compared to traditional lending sources—typical for private capital lenders offering speed and flexibility.

Ultimately, if you’re a seasoned investor looking for tailored real estate financing, or a broker aiming to scale lending operations without heavy infrastructure, Roc Capital could be a strong contender. Still, it’s wise to compare offerings from other lenders—such as New Silver Lending, Kiavi, or Lima One Capital—to determine which provider aligns best with your goals, project timeline, and borrower profile.