A brief outline

Private lenders can offer real estate investors a convenient way to get access to capital quickly, with an easier qualification process. For those considering the private lender route, we’ve created a list of 10 private lenders for real estate, to get you started on your search.

Table of Contents

Private money lenders are a critical part of the real estate investing industry. They provide the necessary liquidity for private investors to buy and sell properties quickly, and they offer recourse loans to help protect investors in case of default.

Private money lenders can help you grow your real estate business, if you’re looking for a way to speed up your investment transactions, or if you’re looking for more security in your investments. We’ve put together a list of 10 private lenders for real estate investors who are looking to explore this financing avenue.

What Is A Private Money Lender?

Private money lenders are entities or individuals that provide funds to borrowers who are in need of money but cannot qualify for a bank loan or have chosen a different financing route. Real estate loans and personal loans are two of the most common loan products when it comes to private money lending.

Private money lenders are not affiliated with any banks or credit unions. As such, they can process loans quicker and their loan qualification criteria are typically less stringent. This makes private money loans easier to get approved for, and borrowers won’t need a high credit score to qualify.

Private lending works the same as any other kind of financing, where a lender provides a loan and the borrower pays this loan back over an agreed upon period of time, with interest. The interest charged by private lenders is usually higher than conventional loans because private loans are often short-term and come with a larger risk for lenders.

List of 10 Highly Rated Private Money Lenders

Real estate investors who are considering use a private money lender should begin by learning the ins and outs of private money loans for real estate. Investors should familiarize themselves with the application criteria that private lenders will usually require and keep this in mind. Private lenders can be found via referrals from a real estate network or an online search, however to save you time we’ve put together a list of 10 highly rated private money lenders.

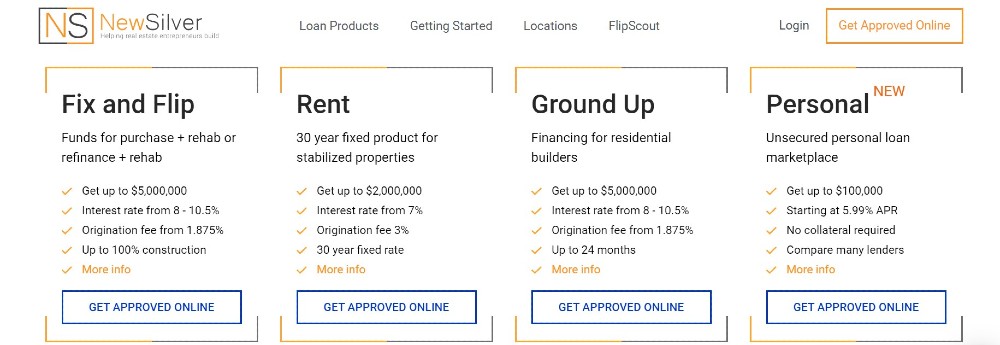

1. New Silver

New Silver is a reputable hard money lender providing funding to real estate investors. While New Silver has a particular focus on fix and flip loans, the lender also offers rental loans, ground-up construction loans and personal loans. New Silver provides ultra-fast funding, with loan closing in just 5 days and online approval in as little as 5 minutes.

New Silver offers up to $5million on their fix and flip loans, with up to 100% of construction costs covered. The rental loans are 30-year amortized for stabilized properties with the option of buying or refinancing. The ground-up construction loans are geared towards residential builders and borrowers can get access to a maximum of $5million. New Silver also has an unsecured personal loan marketplace where investors can find a personal loan that suits their needs, by comparing lenders.

From finding an investment property, to funding it, the entire process can be done on New Silver’s website. The platform offers a free platform called FlipScout, where investors can find profitable investment properties. From there, investors can contact the real estate agent or broker, then apply for funding with New Silver and purchase the home.

2. Best Egg

Best Egg is a private lender offering a variety of personal loans for home improvement, moving, vacations, credit card refinancing, major purchases and more. The private lender offers loan of up to $50,000 and a variety of loan terms ranging from 12 months to 60 months. Funding is provided in as little as 5 business days.

Best Egg provides funding in 44 states across the country, and the APR is anywhere between 18% and 35.99%. The minimum credit score for borrowers who are looking to lend with Best Egg is 640 and there is no prepayment penalty.

3. Kiavi

Formerly known as Lending Home, Kiavi provides capital to real estate investors in the form of fix and flip (bridge) loans and rental loans. Kiavi’s bridge loans begin at $100,000 and have a maximum of $1.5million, with loan terms ranging from 12 to 24 months. The rental loans are 30-year fixed loans that can be 5/1 or 7/1 fully amortized. There are interest-only options available on rental loans and borrowers can get up to 80% LTV (loan-to-value).

Some of the biggest advantages to using Kiavi is that no application fee or appraisal is required for bridge loans. Kiavi does not do any income or employment verification. The lender also doesn’t do hard credit pulls and loans can be tailored to investors.

4. Lightstream

Lightstream offers private money loans up to $100,00 with an APR range of 5.99% to 22.49%. Lightstream has loan terms of 24 to 48 months, and different rates are offered according to the loan’s purpose. The lender doesn’t charge a prepayment penalty, and neither do they charge origination fees to process loans. There is also no late fee for missing a due date, which is a big plus for borrowers.

5. CoreVest

CoreVest offers real estate investors direct access to capital. The lender has customized loan products for various investing purposes. These include, rental loans, bridge loans, build for rent loans and multi-family loans. CoreVest’s loan terms begin at 18 months and go up to 10 years for rental loans. The minimum loan amount that CoreVest offers borrowers is $1million and the maximum is over $50million.

6. Visio Lending

Visio Lending offers loans to real estate investors who are purchasing investment properties to buy and hold. The lender has flexible loan terms and provides long-term loans for single-family rental properties and vacation rentals. Visio Lending offers LTVs up to 80% on purchases and refinances and operates in 38+ states around the US. With 15+ years of experience, Visio Lending has closed over 13,000 loans and originated over $2.1billion across the US.

7. Lima One Capital

Lima One Capital is a private lender offering loans for investment properties ranging from fix and flip to construction projects and rental loans. The lender gives borrowers the opportunity to work with in-house experts, instead of middlemen. A minimum FICO score of 600 is required for loans with Lima One, and down payments of 20% are usually necessary. Loans through this lender are based on the quality of the deal itself, rather than the borrower’s personal financial situation.

8. Lending One

Lending One offers real estate loans to part-time investors, large landlords, developers and real estate funds. Lending One has fix and flip loans, rental loans, new construction loans, fix to rent loans and multi-family bridge loans. The lender’s interest rates start at 5.99% on their bridge loans and go up to 12%+. A credit score of 680 is generally required for loan applications with Lending One, however this varies based on the loan.

9. RCN Capital

RCN Capital is a private lender operating nationwide. The lender provides both short-term and long-term loans which can be used for a variety of real estate investing strategies, from fix and flip properties to rental properties and more. The lender has a quick and easy application process to provide funding as fast as possible for real estate investors. Loan amounts begin at $50,000 and top $10million. RCN’s rates begin at 10.24% and vary depending on the loan.

10. Lending Point

Lending Point is a private lender offering loans from $2,000 to $36,500 with flexible financing options. Lending Point’s rates range from 7.99% to 35.99% APR, according to each private money loan, with terms from 24 to 72 months. The lender provides unsecured personal loans for consumers across the credit spectrum.

Are Private Money Lenders The Best Option For Funding Real Estate Deals?

Different real estate deals require different funding options, there is no one-size-fits all when it comes to real estate investing. A private money lender would be the preferred option in the following scenarios:

- You need cash for a deal: Real estate investors who particularly need cash for a deal can get this from a private lender. Cash offers are very attractive for sellers and can help secure a real estate deal. So, investors who are buying distressed properties may want to consider a private money loan so that they can get cash and secure the deal easier.

- Your credit isn’t good: For real estate investors with credit that isn’t good enough to get a conventional loan, a private money loan can be a good solution. People who have below-average credit scores can still get loans with private lenders as they are more focused on the real estate deal itself than the borrower’s personal financial history.

- You need fast financing: Private money loans are known for being an effective solution to get funding fast. This means that real estate investors who need to beat stiff competition can use a private money loan to get access to funding quicker and make offers on deals in a timely manner.

FAQ

A private lender is a person or entity that is providing funding for investment purposes. This can be to the likes of real estate investors who are wanting to purchase investment properties. Private lenders are regulated by state and federal lending laws however they are not subject to the same regulations as banks and other financial institutions. Private lenders can therefore be extremely flexible with their lending terms, as these are based on whatever they choose.

Hard money lenders provide asset-based loans which are secured by using the property itself as collateral. While hard money lenders can offer flexible loan terms, these aren’t as malleable as private money lenders because they need to fit within the structure created by the lender. Hard money lenders are licensed to lend money, whereas anyone can be a private lender. Along with this, hard money lenders are widely advertised, whereas private lenders may not be.

Anyone can act as a private lender, provided that they are supplying capital to fund an investment. To be classified as a private lender, the individual or entity cannot be affiliated with any financial institution, and they are therefore not regulated by the same governing bodies. So, friends and family members can be private lenders if they are supplying capital to you, for your real estate investing needs.

There are risks associated with private money loans, and these risks apply to both the lender and the borrower. Private money lenders are taking on a higher risk by providing these loans because they have less stringent lending criteria, so the risk of borrowers defaulting on the loan is higher. To mitigate this, private lenders usually charge higher interest rates.

The risk for borrowers is that, with the higher interest rates, they might find it harder to make a profit on real estate deals. Overall, private money loans are more expensive than traditional loans which is a big risk for real estate investors. Another risk for borrowers is the short-term nature of private money loans, which can leave real estate investors having to refinance or sell a property if they cannot pay the loan off in time.

Lastly, borrowers need to make sure that the private lender is legitimate, and that the private money loan will not fall apart at any point. Private lenders aren’t held to the same standards as banks and other financial institutions, so borrowers need to do their homework before choosing a lender.