The below is for informational purposes only, it is not investment advice or recommendation. Please contact your licensed investment advisor if you have specific questions.

Jump To:

There are a number of ways to invest $100k in real estate. In this article, we will outline three of the most tried and trusted methods for getting started, namely:

- Fixing and flipping properties

- Buying a rental property

- Investing $100k into Real Estate Investment Trusts (REITs)

Each avenue has its own set of risks and rewards. We will now analyze the pros and cons of each strategy, while offering a few basic tips on how to take your first steps down each particular path.

Option 1 - Fixing & Flipping A Property

Of all the ways to invest $100k in real estate, flipping a property presents both the highest risk and the highest reward.

Despite the various tv shows that make it seem as simple as flipping a pancake, there are significant financial and administrative challenges involved in flipping a property successfully that the investor will need to take on. That being said, if you know how to stick to a budget and have strong project and time management skills, this could be the right avenue for you to pursue.

Pros of flipping a property

It is common to generate an ROI of 40% or more

If you have a look at the stats released by Attom Data Solutions, the average ROI for property flips in the US ranged from 38-42% during each quarter of 2019. Of course, this doesn’t mean there are any guarantees of achieving a similar ROI and performance will vary. However, if the average ROI is 40%, there’s a good chance that you can achieve a positive and respectable ROI by sticking to your budget and managing the project diligently.

You can make money very quickly

Unlike more traditional investment vehicles like bonds, ETFs and mutual funds, you don’t have to rely on 5-20 year investment horizons in order to make money flipping a property. With property flipping, you can effectively reduce the investment timeline to 24 months or less, provided you are able to complete the renovation work on time and resell the property quickly.

Importantly, if you have very little experience with renovations, it is best to partner with a reputable contractor that can guide you through the process. In doing so, you can greatly increase your chances of meeting the renovation deadlines and selling the property before your loan expires.

You Can Start A Chain of Profitable Flips

Flipping properties can become very addictive if your initial project is a success. Seeing some of the potential ROI’s that can be earned in hot real estate markets, it’s easy to understand why.

The average profit from a successful property flip in 2019 was approximately $65,500. This is higher than the average annual salary of a US citizen, which is approximately $48,600.

More importantly, property flipping is a skill that you can develop and improve over time. After flipping your first property, you can use the confidence and experience gained to help you flip the next one. This potential domino effect could help you build immense wealth over a number of years.

Cons of flipping a property

You could spend more than you make

If you approach a fix and flip project without a clear understanding of all the costs involved, you could spend more than you make during the project.

Naturally this is the biggest risk when flipping a property, but it’s a risk which can be minimized if you research the property market diligently and don’t rush into any decisions. Unlike stocks and bonds, you have a huge amount of control during a fix and flip. If you leverage this control wisely, you can greatly increase the odds of success.

A bad contractor could derail your flip

Even if all the numbers add up, a bad contractor could prevent you from achieving profitability.

Apart from poor quality workmanship, the biggest risk with an unprofessional contractor is that your fix and flip project could take longer than expected.

In the flipping game, the longer it takes to complete the project, the less money you will make. Furthermore, most hard money lenders provide 24 month loan terms. If contractor issues disrupt your timeline, loan extension costs may need to be paid, and you also introduce the possibility of foreclosure (more on this below).

If you can’t sell the property, foreclosure is a possibility

According to Zillow, an average property in the US is likely to spend 65-93 days on the market before it is sold. This might not seem like an extremely long time, but time is one of the most important variables when flipping a property.

Simply put, the longer it takes to sell the house, the less money you will make, and the greater the likelihood of foreclosure. Fortunately, it is possible to extend the length of the loan if you do run into this particular issue, provided you make use of a reasonable Hard Money lender like New Silver LLC.

Is $100k enough to flip a property?

The short answer is “it depends on where”. However, you will more than likely need to make use of a hard money loan in order to fully fund the deal.

Most property flippers make use of a loan in order to fund the shortfall between what they have saved for the project, and the total amount needed to purchase the property and pay for the renovations.

This is a perfectly safe and reasonable thing to do. It isn’t realistic for most investors to save the full amount needed to purchase the property outright. However, with $100k, you could potentially fund all the renovations in your own capacity, and use the loan to cover the cost of purchasing the property.

Ultimately, $100k is more than enough to successfully fund a fix and flip project, provided you are open to taking out a loan. To gain a more complete understanding of all the costs involved and to calculate the potential ROI, have a look at our fix and flip deal analyzer.

Option 2 - Buying A Rental Property

Owning rental properties is one of the oldest and most reliable ways to generate a steady stream of cash flow. The basic goal of this strategy is to purchase a desirable property that can generate rental income which comfortably covers the bond repayments and monthly property expenses on an ongoing basis.

Pros of Buying Rental Property

Long Term Passive Income

Of all the benefits associated with owning a rental property, long term passive income is probably number one on the list.

From the moment the property becomes cash flow positive (when monthly rent exceeds the monthly expenses), it can be classified as a passive income stream. Perhaps more importantly, rental income is a relatively stable source of passive income, that can last indefinitely, provided the area remains desirable to live in.

It Is Standard Practice To Increase Rent Annually

Most landlords will build rental increases into the contract signed with the tenant. This will typically range from 5-12%, depending on the area, the landlord and the length of the tenant’s contract.

In other words, your returns from rental property can increase with each passing year, meaning better ROI over the long term and more money in your pocket.

Properties Tend To Appreciate In Value Over Time

In addition to receiving rental income every month, most rental properties will increase in value over time. Of course there may be tumultuous periods, with the housing crash of 2008 and the impact of coronavirus being two recent examples. However, over an extended period of time, these downturns tend to be temporary, and the overall upward trajectory of property prices continues to rise.

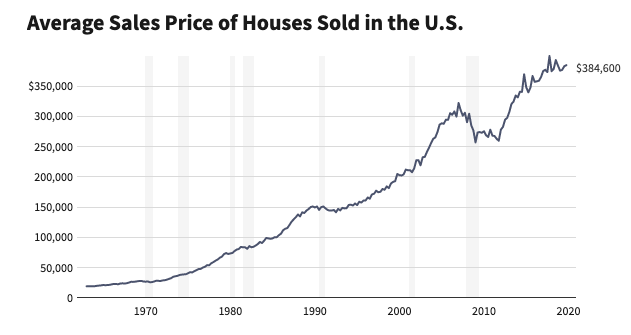

As you can see in the graph above, the average sales price of houses sold in the US has been steadily increasing since the 1970’s. Ultimately, there is ample evidence to suggest that properties will continue to rise in value over time, provided you take a long term view.

Cons of Buying A Rental Property

You could overpay for the property initially

If you pay too much for the property, it has a knock on effect on the profitability of the deal which could take years to correct. One way to quickly analyze the profitability of a rental property is using cap rate.

You could experience periods without tenants

This is commonly called the vacancy rate, and it should be factored into your rental property calculations. Research suggests that the average vacancy rate in the US is currently hovering around 7%. This means that your rental property is likely to be without a tenant for at least 7% of the year.

During these times without a tenant, you will need to bear the full cost of the loan and all the other property costs associated, without any rental income to cushion the blow. Also, you may need to take on the services of a property management company if you experience difficulty finding new tenants, own multiple properties or simply don’t want the hassle of finding tenants in your personal capacity.

Maintenance costs could be higher than you expect

Here is a list of common expenses that you should consider when buying and holding a rental property:

- Property tax

- Property Insurance

- Homeowners Association (HOA) fees

- Property Maintenance

- Property management costs

Even if you decide to take on the management of the property yourself, taxes, insurance and maintenance costs will always form part of the property’s balance sheet.

The property might not be cash flow positive from the get go

In certain instances, the rental income from the property may not be enough to cover the monthly expenses. This is more likely to happen with expensive properties, where the investor intends to hold the property for an extended period of time, and generate a profit when it is eventually sold.

Is $100k enough for this strategy?

With \$100k to work with, you should definitely be able to secure a rental property that has the potential to generate positive cash flow from the outset, but you will probably need to make use of a loan to fund the shortfall between your savings and the property price.

The good news is that the terms offered for rental property loans tend to be more favorable than standard hard money loans. Specifically, the interest rate is often much lower than a fix and flip loan, mainly because the length of the loan is longer and the risk involved in the transaction is lower.

For instance, at New Silver, our fix and flip loans start at 9.375%, whereas our rental property loans start at 5.375%. The lower interest rate will decrease your monthly repayment, meaning more monthly cash flow and a better ROI over the long term.

Option 3 - Investing In Real Estate Investment Trusts (REITS)

Real Estate Investment Trusts (REITs) offer another viable way to invest \$100k in real estate. Of all the methods outlined in this article, REITs are by far the easiest to buy and the easiest to sell. This makes them very attractive to investors who want to experience the benefits of investment properties, without the hassles involved in managing rental properties.

How Do REITs work?

This definition from Investopedia sums it up quite nicely: “A real estate investment trust (REIT) is a company that owns, operates, or finances income-generating real estate. Modeled after mutual funds, REITs pool the capital of numerous investors. This makes it possible for individual investors to earn dividends from real estate investments—without having to buy, manage, or finance any properties themselves.”

While the majority of the rental income generated by REITs will ultimately funnel back to the investor, a significant percentage will also be set aside to acquire additional properties. This allows REITs to appreciate in value over time, as the portfolio of properties expands.

The 3 Main Types of REITs

There are three primary types of REIT:

- Public Listed REITs – These are the easiest to buy.

- Public Non-Listed REITs – These are similar to listed REITs, but are slightly more difficult to access.

- Private REITs – These are basically reserved for accredited and institutional investors. They aren’t recommended for beginners.

(1) Public Listed REITs – These are traded on a stock exchange in the same way that stocks and ETFs are. In order to purchase public REITs, you simply need to open a brokerage account, which should give you access to over 200 REITs if you are based in the United States.

If you aren’t sure how to open a brokerage account, this list of beginner friendly options could help you get started. Also, if you are still a novice real estate investor, it is recommended that you stick to public listed REITs before considering public non-listed or private REITs.

(2) Public Non-Listed REITs – Unlike listed REITs, non-listed public REITs are not available through popular stock exchanges like Nasdaq and the NYSE. In order to purchase public non-listed REITs, investors need to purchase the shares directly from the REIT company, using a crowdfunding platform, or via a third party broker.

(3) Private REITs – Unlike Public REITs, Private REITs are not available through a normal stock exchange. Private REITs are not traded on a national stock exchange or registered with the SEC. As a result, private REITs are not subject to the same disclosure requirements as stock exchange-listed or public non-listed REITs .

Long story short, private REITs aren’t really accessible for entry-level investors with $100k to invest. To play in this space, you either need to be an accredited investor (meaning a net worth of over 1 million dollars, excluding your home) or you need to be an institutional investor. Given these considerable barriers to entry, it makes sense to focus on public listed REITs, especially if you are inexperienced.

Pros of Public Listed REITs

Diversified Risk

Unlike purchasing an individual stock or residential property, REITs consist of multiple different properties, most of which are commercial. This automatically diversifies the risk involved. Of course there may be economic downfalls that affect the entire industry, but this applies to property flipping and rental properties as well.

Large and Consistent Dividend Payouts

According to NerdWallet, for a REIT to be compliant with the IRS, it needs to “return a minimum of 90% of taxable income in the form of shareholder dividends each year”. Naturally this is a huge draw card for real estate investors, and the dividend yield can be comparable to the rental yield of an investment property.

On this point it is worth noting that dividend payouts can either be monthly or quarterly, depending on which REIT you choose.

Exposure To Commercial Real Estate

The skills and experience required to tackle commercial real estate deals can take years to acquire, and that’s if you ever make the plunge. With REITs, you gain exposure to multiple commercial properties, without having to do anything except purchase the shares.

Cons of Public Listed REITs

They are not immune to risk

Although REITs have been relatively stable over the long term, they are still susceptible to risk. For instance, the impact of coronavirus has led to a 30-40% drop in value for this particular asset class in 2020. In addition, the 2008 Global Financial crisis was also particularly damaging to REITs. So while the real estate industry and REITS in general are pretty resilient, they still incur a medium level of risk that investors must be aware of.

Less tax efficient than rental properties

With an investment property, the property owner can deduct the vast majority of expenses from their taxes. This includes mortgage costs, property taxes and property insurance.

REITs are not quite as efficient as rental properties from a tax perspective. The main tax benefit of REITs is that most of the rental income received is distributed to the investor in the form of dividends.

In other words, instead of the rental income being taxed at a corporate level when it is received by the REIT, it is effectively only taxed at an individual level, in the form of income tax. Moreover, shareholders can deduct 20% of taxable dividend income they receive, in accordance with the 2017 Tax Cuts and Jobs Act in the United States.

Is $100k enough for this strategy?

Most definitely. Of all the investment choices presented in this article, public listed REITs require the least amount of starting capital. To put this in perspective, you could start your REIT investment journey with 500 dollars to your name, rather than $100,000. This makes REITs particularly attractive to novice investors hoping to make their first foray into real estate investing.

Final Thoughts

We have provided a fairly detailed overview of three tried and trusted ways to invest $100k in real estate. If you’re still uncertain of the best option to pursue, it might be worth downloading a free copy of ‘Achieving Wealth Through Real Estate’. It is authored by Kirill Bensenoff, a highly experienced real estate investor and the co-founder of New Silver Lending LLC.