Real estate investors are always looking for a way to one-up the competition, and that includes finding the hottest real estate markets of the year and capitalizing on them. There are a variety of ways real estate investors characterize ‘fast-growing’ property markets, and everyone has their own opinion as to what the signs of a top-performing market are.

Generally, the characteristics that investors look out for are markets that have increasing populations, strong job growth potential, and attractive amenities that draw in buyers. Scoring these markets is an arduous process of comparing month-to-month performance while also considering year-on-year improvements or deterioration. The real estate market moves in cycles and when markets are up investors will find themselves struggling to identify exclusive deals. For investors that are able to buy into these markets, there is a pretty set guarantee that their property will appreciate in value.

Having a strong understanding of the local real estate market before making an offer to purchase a property will help the investor to set realistic goals and expectations for their venture. We’ve put together some of the top places to invest right now, and while some of these areas are no surprise there are a few new names on the list compared to 2019.

Keep reading for our breakdown of the hottest real estate markets of 2020, the local property values, and reasons why investors should consider buying into them.

Table of Contents

Boise City, Idaho

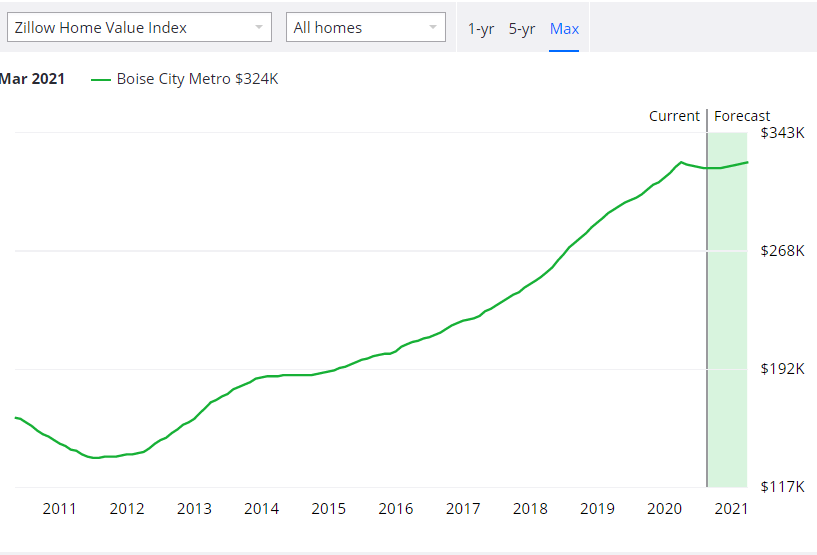

The first location on the list is Boise City, Idaho, known for its large science and technology sector. Nicknamed the City of Trees, Boise is the populous capital of the state with an extensive greenbelt and property market that is rapidly heating up. In fact, looking at the performance of the housing sector in Boise, it’s possible to see that there has been a consistent year-on-year improvement since 2012, with only a slight dip predicted to take place between the end of this year and the start of 2021.

In terms of what investors can expect when buying into this area, properties in Boise City currently spend around 58 days on the market prior to selling. Median home prices in this location come in at $324,254, with home values increasing 10% over the past year.

Another key indicator of the heat of this market is the growth in the local population since 2010 which has been steadily increasing. This year, Boise alone reached a population total of 236,310, an increase of more than a hundred thousand people in the last twenty years alone. There are many reasons for this growth, but the biggest is living close to nature. Hot, dry summers make for plenty of opportunities to spend time in the great outdoors and the area is known for biking, hiking and horseback riding trails to name a few activities.

Apart from a love for nature, people are also flocking to Boise due to the comparatively lower housing costs. Properties in Boise are priced relatively closely to the national average of $320,000, and with lower starting costs the affordability and slower way of living is a big draw to many around the country looking for starter properties.

Notably, Boise boasts a strong job market with an unemployment rate over a percentage lower than the national average. One of the bolstering factors for widespread employment stability is the presence of the tech industry with companies like Micron and HP headquartered there.

Predictions are that the volume of home sales will increase slightly while housing prices will go up significantly. This is a market to watch this year.

Tucson, Arizona

Located in the valley of the Sonoran Desert, Tucson Arizona has seen good real estate performance in recent months. This location has become renowned for its mixture of the authentic Southwestern experience and a modern, cultural metropolis. Tucson may be more famous for its desert, but the scenic locations in this area also include incredible mountain ranges and the city has in recent years become somewhat of a foodie-haven.

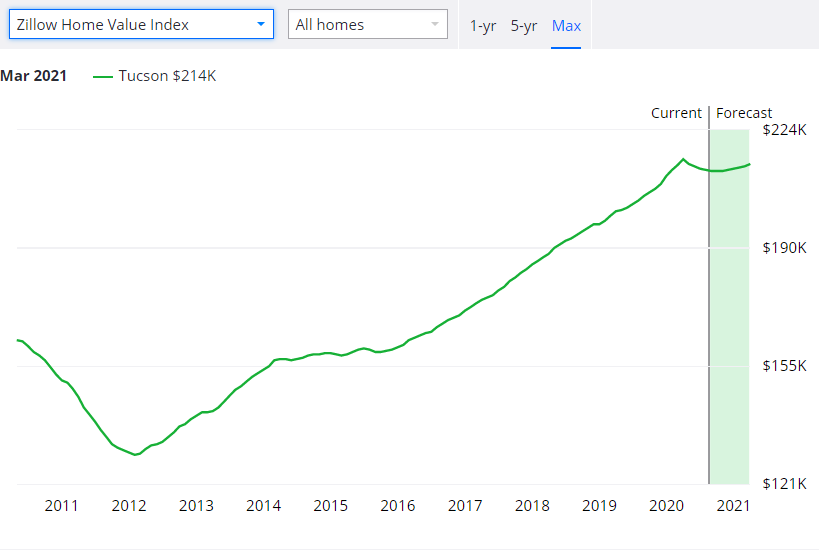

In recent years, the property market in Tucson has been growing significantly. Homes for sale in this city spend around 57 days on the market before selling, with a median listing price of $215,965. This is far lower than the national average property price, making this market more friendly to beginner investors with less funds and experience to invest in.

Home values in Tucson are expected to drop slightly this year as a result of the economy softening, but if the population growth continues this drop should be only temporary.

Experts predict that Tucson will see an increase of over 3% on both home sales and home prices in the coming months. But what is causing these increases? The answer is limited housing inventory. Fewer single-family homes have been built in Tucson in recent years, meaning that there is significant competition for properties located in this area.

The local Tucson population amounts to around a million people, but home building activity has dragged behind in comparison, with only an estimated 2,350 homes built per year between 2012 and 2017.

Other benefits of buying into Tucson real estate include steady real estate appreciation which has been high in this area in recent months.

Rochester, New York

Next on the list is The Flower City, also known as Rochester New York. Boasting big city culture with a small town feeling, this location is popular with individuals pursuing a family-friendly lifestyle. Rich in museums, scenery and having a strong history in industry, Rochester is also being highlighted as a great place to invest in property this year.

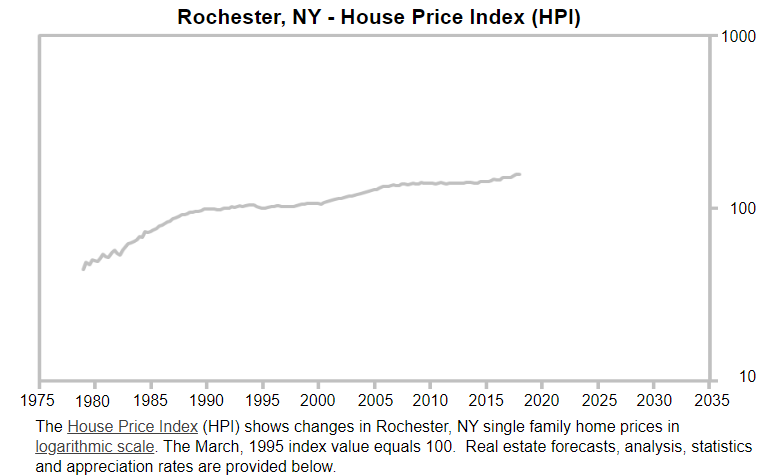

The housing market in this city has been rapidly heating up with properties for sale spending under 63 days on the market on average. Properties in this popular area had an average price of $200,000, with declining population growth. Despite this decline, this Upstate New York location is predicted to see home sale increases of nearly 5% while prices are set to stay consistent.

Despite being tucked into the northeast corner of the state, Rochester has managed to keep the momentum going in the real estate sector. A boom in recent home investments has come at the expense of limited housing supply. In 2013, over 5000 new homes were put up for sale. By the end of 2019 that number had shrunk to just over 3000.

Even as a highly competitive market, Rochester has remained more affordable than some of the other metropolitan areas in the state and is expected to see more growth in this year.

Colorado Springs, Colorado

At the base of the Rocky Mountains lies Colorado Springs, the next market investors should be keeping their eyes on during 2020 and beyond. One of the most populous cities in Colorado, Colorado Springs is a popular tourist destination featuring many great trails, parks and unique geological monuments.

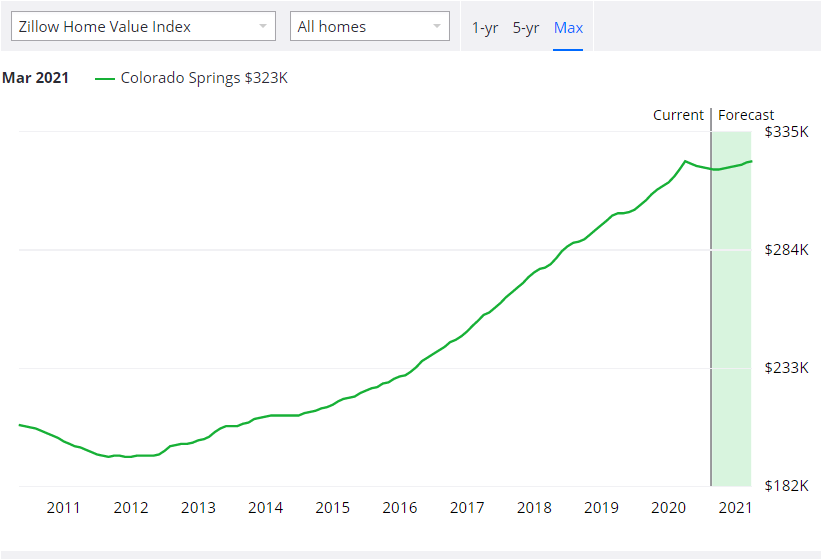

Here, properties for sale spend just two months on the market before being sold. Average home values in Colorado Springs have reached $323,194 – an increase of over 7%. The real estate sector has been performing well here in recent years, but has not been completely immune to the economic fallout caused by COVID-19. Property sales in the area may slow down over the next few months, but prices are expected to rise by over 6% by 2021.

Colorado Springs may not be the biggest city on this list, but it still holds several advantages for real estate investors. The city has always ranked highly for job growth and employment opportunities, even during times when the economy has softened. The local military base amongst other industries has been a main driving factor in the steady employment rates, and the city’s proximity to the popular location of Denver has made it an attractive location for buyers.

With few entry-level friendly properties, this market may not be beginner-friendly but the number of listings and sales have increased notably for more experienced investors. Home prices here are notably higher than the national average, but home appreciation has been particularly high especially in downtown neighborhoods. Other incentives to buy here include great colleges and is considered to be a top place for elite athletes to train due to how close it is to The Olympic Training Center.

Winston-Salem, North Carolina

Last, but not least on the list is Winston-Salem, North Carolina, also known as the ‘Twin City’. Famous for a dual heritage and age-old tobacco industry, today the city is the home of bigger universities such as Wake Forest University and Winston-Salem State University. The presence of these institutions make this a good location for students and younger investors. On the other hand, Winston-Salem has also been ranked as one of the best places to retire.

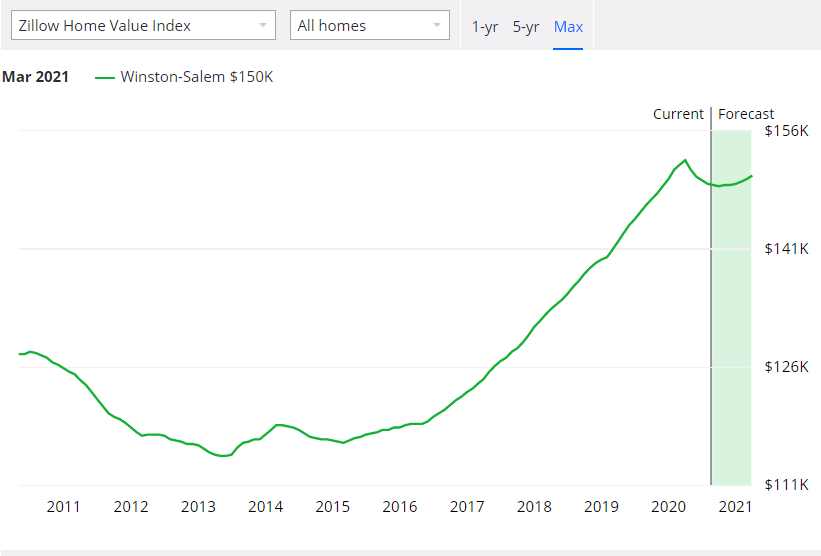

The local real estate market has been heating up in recent weeks while maintaining more affordable property prices that are suitable for investors with less seed funds of their own. Homes in Winston-Salem are valued at $152,337, spending about 77 days on the market on average. Not only is this much more affordable than the national average property price, but the population is actively growing and demand for homes is growing.

Home values here are expected to drop by a percentage but home sales are expected to increase by nearly 4%. With low unemployment rates, strong employment sectors like education, health services, retail, constructions and more, Winston-Salem is a high potential area for housing growth in the next year. Similar to Tucson, Winston-Salem has an issue with low inventory levels which is a concern but has not had an impact on the market as of yet.

Final Thoughts

Even though this year has presented severe challenges to the economy, there are many real estate markets that have remained steadfast and are ripe for investment right now. When buying into ‘hot’ markets, the investor will need to compete with other buyers and won’t have the benefit of making an exclusive offer – meaning it’s essential to prepare your offer accordingly. For example, in a competitive market having an instant proof of funds letter ready to accompany your offer could be the differentiating factor between closing or losing the deal altogether.

Some of the biggest markets this year listed in this article have managed to keep the momentum in the real estate sector going, albeit with minor, temporary decreases. Boise, Tucson, Rochester, Colorado Springs and Winston-Salem all have the characteristics that investors use to single out profitable markets and these characteristics also guarantee that real estate in these locations will continue to grow in value.

While exact performance is never guaranteed and 2020 not quite over yet, results remain to be seen. That being said, some of the best deals can be found in unusual markets and investors can confidently put their money into real estate during 2020.

FlipScout by New Silver is a free tool that can help investors to find house flipping opportunities in both hot and not-so-hot markets.