The Short Answer

RealBricks is a fractional real estate investing platform that aims to make real estate accessible by allowing individuals to invest in properties with as little as $100. Through RealBricks, investors can buy shares in curated properties, ranging from single-family homes to commercial buildings, and earn passive income from rental yields and potential property appreciation. The platform stands out for its debt-free ownership model, which protects investors from interest rate fluctuations and focuses solely on property performance.

Additionally, RealBricks offers a secondary marketplace for trading shares, providing liquidity and flexibility for investors who may need quicker access to their capital. With mobile access, a user-friendly interface, and no property management required, RealBricks is well-suited for beginners, hands-off investors, and those looking for a diversified real estate portfolio without high capital requirements or management responsibilities.

Jump To

What Is Realbricks And How Does It Work?

Realbricks is shaking up the real estate industry, by providing a more accessible and flexible option for real estate investors. Realbricks is a fractional real estate investing platform which aims to democratize real estate investing by giving investors the chance to purchase portions of a property, instead of the entire property. Their mission is to democratize real estate investing so that you can “buy and sell real estate, on your own terms, whenever you want”.

With RealBricks, you don’t need to buy an entire property or have lots of capital saved up. Instead, you can invest in a variety of properties—ranging from single-family homes to large commercial buildings—by simply purchasing shares.

Here’s how it works:

- Investors can start investing with as little as $10, and choose from one of the platform’s curated properties. Realbricks identifies and screens properties that have a high potential, and select the best ones for the platform.

- Investors will then earn passive income in the form of quarterly dividend payments based on the rental income, for any property that they own shares in.

- Investors can sell their shares on the Realbricks secondary marketplace if they need to, which gives real estate investors more cash out options.

Our goal is to open up investment opportunities to a broader audience, breaking down traditional barriers, and empowering individuals with the tools they need to succeed in the real estate market.

What Are The Key Selling Points Of This Platform?

Easy Setup

Getting started with Realbricks is as simple as signing up online. You can browse properties, check out the investment options, and quickly set up your account. RealBricks takes care of the tough stuff—property sourcing, due diligence, and management—so you can focus on choosing the investments that appeal to you. With just a few clicks, you’re on your way to becoming a real estate investor, no mountains of paperwork or endless negotiations required.

Low Minimum Investment

One of Realbricks’ biggest draws is its low minimum investment threshold. Traditional real estate typically requires a big upfront payment, but with RealBricks, you can buy a share of a property without needing a huge sum. This fractional ownership model lowers the barrier to entry, making real estate more accessible to a wider audience, whether you’re a first-timer testing the waters or a seasoned investor diversifying your portfolio.

Mobile Access

Realbricks is available on iOS and Android, allowing investors to manage their portfolios anytime, anywhere. The mobile app offers the full functionality of the desktop platform in a convenient, user-friendly format designed for on-the-go access.

More Cash-Out Options

Realbricks knows flexibility is essential, so they provide various options for cashing out. The platform offers a secondary market where investors can sell their shares to others before the property itself is sold, meaning you’re not locked in if your financial needs change. And when the property does sell, investors also get their share of any appreciation, giving you an added potential boost in returns. This flexibility allows investors more control over their investment timeline.

No Property Management Headaches

One of the toughest parts of real estate investing is the constant upkeep, tenant relations, and property management duties that come with it. Realbricks handles all of that for you, managing each property on the platform. They ensure each property is well-maintained, so your investment remains as hands-off as possible, freeing you up to enjoy the income and growth potential without the added stress.

Diversification Made Easy

With Realbricks, investors are not limited to a single property type or location in their investment portfolio. They can spread your investment across multiple properties and real estate assets, from residential homes to commercial real estate. This diversification of investment portfolio helps reduce risk and provides investors with exposure to different real estate markets.

Strictly Vetted Properties

Every property listed on Realbricks goes through a thorough vetting process to ensure it meets strict investment standards. Key factors, including vacancy rates, rental demand, and local economic stability, are carefully evaluated to help maximize returns and provide a strong foundation for investor success.

What Is Minimum Investment Amount?

Realbricks opens the doors to real estate investment, allowing anyone to invest in cash-flowing rental properties with shares starting at just $100. All of their properties will first be accessible to investors via initial offerings, the majority of which will have $100 investment minimums. The low entry point that Realbricks offers, provides investors with the opportunity to invest in real estate without needing a fortune, and earn passive rental income from a variety of rental properties.

How Much Money Can You Make In A Year?

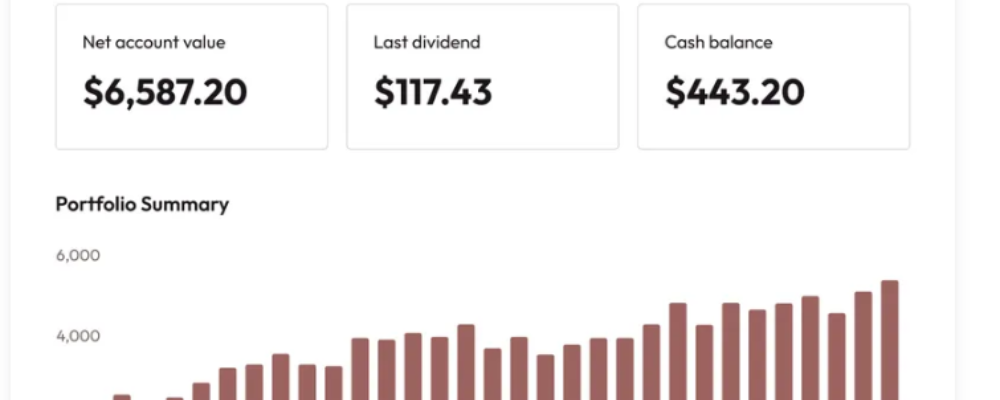

The amount of money you can make each year, using the Realbricks platform, depends on various factors including how much money you invested, the type of property you invested in, the rental income that is generated and any property appreciation that occurs within the year.

Here’s a closer look at how you will make money from your fractional real estate investment with Realbricks:

Rental Income

Realbricks offers investors the chance to earn annual yields from rental income. These yields can range between 5% and 10% based on the property type, location, and market conditions. Rental income is typically distributed quarterly, which gives investors more regular payouts for a steady cash flow.

Property Value Appreciation

Beyond rental income, investors can earn property appreciation which is an increase in the value of the property over time. Real estate typically appreciates in value by around 3% to 5% each year, but this varies depending on the local market conditions, the type of property and the condition of the property. When Realbricks sells a property, the appreciation is paid out to investors based on their share of investment in the property.

What Separates Realbricks From Other Fractional Real Estate Investing Platforms?

Debt-Free Ownership Model

Other fractional real estate investing platforms like Arrived use debt and mortgages to finance their property acquisitions. Realbricks differentiates themselves from platforms like this by purchasing properties outright with no loans or mortgages involved.

This debt-free strategy shields investors from the impacts of rising interest rates and market volatility, ensuring returns are generated purely from the property’s performance. By eliminating reliance on borrowed capital, RealBricks removes the burden of loan repayments and interest rate fluctuations, giving investors a clear advantage in today’s economic climate. This approach provides stability and helps maximize returns, as investors are unaffected by the potential financial strain of debt.

Secondary Market Liquidity

Another differentiating factor for Realbricks is the liquidity provided by their secondary market. Once a property is fully funded on the primary market, it becomes available for trading in RealBricks’ peer-to-peer marketplace (secondary market) after 30 days. This marketplace offers investors the flexibility to buy and sell shares freely, with options for placing both limit buy and limit sell orders.

Investors can choose partial or full fills on their orders, providing a significant boost in liquidity. This setup is ideal for those seeking quicker access to their capital, rather than being locked into a long-term commitment. RealBricks has essentially created a stock market-like system for real estate, making it easy for investors to trade property shares with the flexibility and freedom of traditional stock trading.

Investing On-The-Go

RealBricks is built on simplicity and transparency, making it easy for investors to purchase shares in fully-owned, debt-free properties and seamlessly manage their investments. With a user-friendly design, the platform provides a straightforward experience for buying, selling, and trading property shares. Available on both iOS and Android, RealBricks lets users manage their portfolios anytime, anywhere. The secondary market adds even greater flexibility, allowing investors to adjust their holdings with ease and enjoy higher liquidity than traditional real estate platforms offer.

Are There Better Ways To Invest In Real Estate?

The best real estate investing strategy for each investor is dependent on their goals, financial situation and the current market climate. Fractional real estate investments are best suited to investors who are:

- Just beginning their real estate investing journey and don’t have experience yet

- Don’t have a lot of capital to invest

- Would like to be hands-off and not responsible for management of the property

- Want the flexibility to diversify across multiple properties

- Investors who require liquidity options

Investors looking to gain real estate assets without the responsibilities of property ownership have several appealing alternatives, including Real Estate Investment Trusts (REITs), real estate crowdfunding platforms, and mortgage funds. Each of these options allows investors to participate in the real estate market with varying degrees of risk, liquidity, and potential returns, providing access to rental income, property appreciation, and, in some cases, debt interest, all without the need for direct ownership or management of real estate investments.

Lastly, if you are an accredited investor aiming for higher returns than most REITs can offer, you should also consider a real estate debt fund. Funds like these can pay up to 20% per year, which is a very respectable return, even for aggressive investors. Also, because debt funds are tied to underlying mortgages, they aren’t as risky as stocks. In essence, they offer a good balance between risk and reward for investors that have large lump sums to play with.