With the rise of apps like AirBnB and VRBO, many real estate investors are turning to short-term rentals to earn high returns compared to renting to a typical tenant with an extended lease of a year or more. While short-term rentals do offer certain benefits for investors, they also carry risks compared to long-term rentals that you should consider before trying this strategy. To help you decide if this is the right tactic for you, here is a look at the pros and cons of short-term rentals.

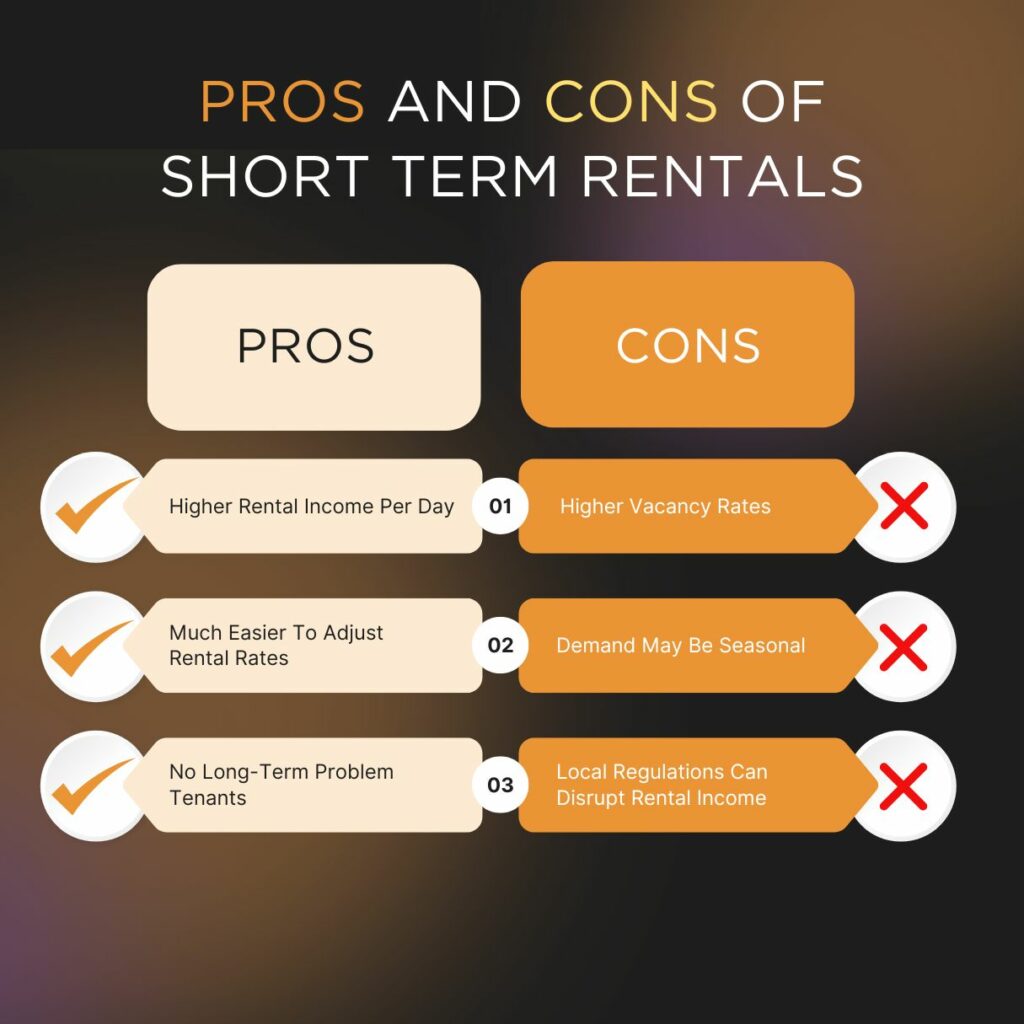

Pros of Short-Term Rentals

Higher Rental Income Per Day

Short-term vacation rentals often yield a higher return per day compared to long-term rentals where the tenant has an extended lease. People who are on vacation often expect to spend money and don’t mind paying a higher rate per day because they know it’s only temporary.

So, by posting your rental property on one of the short-term rental apps, you can cash in on this trend by filling the unit with a steady stream of high-paying vacationers.

Easier to Adjust Rates

Another major benefit of short-term rentals is the ability to adjust your rates whenever it suits you. Perhaps you own an investment property in a beach town where the demand is much higher in the summer than in the winter.

If you sign a lease with a tenant for a year or longer, you wouldn’t be able to raise the price of the rental unit in the summer to accommodate beach-goers, and then drop it back down in the winter when there isn’t as much interest. But if you market it as a short-term rental property for vacationers, you can easily adjust the rates as soon as the current guest checks out.

No Long-Term Problem Tenants

One of the major risks of long-term rentals is dealing with problem tenants. If you sign a lease with a difficult tenant who is constantly throwing parties or smoking inside the rental unit, it may be difficult to get them to leave or stop the behavior without going through an eviction process.

However, with short-term rentals, you will only have to deal with a problematic tenant temporarily. Plus, you have the power to leave guests a bad review on the app if they refuse to respect your rules.

Cons of Short-Term Rentals

Higher Vacancies

While short-term vacation rentals are often more profitable than renting to a long-term tenant, they also come with a higher risk of vacancy. With long-term rentals, you get the peace of mind of knowing that you will have predictable cash flow for the duration of the lease (as long as the tenant continues to pay on time). But with short-term rentals, there is no guarantee that one tenant will move in as soon as another moves out, which may pose challenges if you’re using the rental income to pay for the mortgage on your investment property.

Demand May Be Seasonal

Depending on where your short-term rental property is located, the demand may shift dramatically depending on the season. The short-term rental market is highly influenced by the time of the year. For instance, a ski lodge may be very popular in the winter but not so much in the summer, while a beachfront villa may experience the opposite.

Although some cities have consistent tourist traffic throughout the year, most areas that are popular with vacationers tend to see some seasonal fluctuations. So, you’ll want to make sure you have a strategy to deal with the changes in demand.

The Influence of Local Regulations

The short-term rental market is highly regulated in some areas, which may impact your ability to take advantage of some of the major benefits. For example, in New York City, short-term rentals for 30 days are more or less are banned unless you get permission from the mayor’s office. Hawaii is also beginning to crack down with similar legislation. This prevents landlords from solely renting to vacationers and pricing out regular working tenants. While you can still rent to tenants on a month-to-month basis, doing so doesn’t always offer the same profit potential as renting to vacationers for a few weeks or days at a time.

As a result, the rental income you could earn may not be worth the added risk or vacancy. So you’ll want to research the local laws on short-term rentals before investing in one of these markets.

.

Are Short-Term Rentals Right For You?

Short-term vacation rentals offer many benefits to investors who own a rental property in an area with a high amount of tourist traffic. In some places, you may be able to earn more money in a few months renting to vacationers than you could in an entire year renting to a long-term tenant.

However, short-term rentals also carry added risks and responsibilities that may not make sense in every market. So, weigh the pros and cons and crunch the numbers to make sure the strategy makes sense for you.