The Short Answer

Hard money loans can be a very attractive option for real estate investors. With fast closing, flexible loan terms and less stringent lending criteria, hard money loans can be a good idea for investors who are looking for short-term loans that provide funding quickly. However, the drawbacks are that these loans have higher interest rates and may require larger down payments. So, hard money loans aren’t suited to everyone, but they can be a great solution for some investors.

Jump To

Why do investors use hard money loans?

Hard money loans are becoming increasingly popular with real estate investors looking for quick and reliable capital. A hard money loan is a short-term, asset-backed loan typically used for real estate investment deals ranging from short-term flips to larger development projects. Hard money lenders provide investors with the necessary capital to fund their projects in a more agile fashion than more traditional financial sources such as banks or private debt partners.

The lending criteria required by hard money lenders is often heavily geared toward the tangible asset being purchased, meaning that even if an investor has bad credit, they may still be eligible. A hard money loan will usually require no pre-payment penalty and have a higher rate, compared to long-term bank loans, but is attractive due to the speed and lack of stringent lending criteria.

Here are 5 of the key benefits to hard money loans that attract real estate investors:

1. Fast closing

Hard money loans can close in as little as 5 days in some cases, which is much faster than the traditional loan closing time of 47 days, on average. This closing speed means real estate investors can get access to funds shortly after they find a good investment deal. Competition is stiff when it comes to good real estate deals, so investors are particularly attracted to the short loan closing times because this allows them to beat the competition and secure the deal.

Add to this, the fact that some hard money lenders provide proof of funds the minute a loan has been approved. Investors can use this to secure a real estate deal by proving that they will have the funds to purchase it. Hard money loans aren’t bound by the same regulations as conventional loans and therefore the entire process can move much faster and result in funding in just a week or two.

2. Flexible loan terms

Hard money loans aren’t bound by the same regulations as traditional loans, so lenders can offer flexible loan terms. This means that investors can often get loan terms tailored to their specific real estate deal and unique needs, which is a big plus for investors who need loan terms that are different from the conventional terms. Dealing directly with individuals instead of going through a bank or other financial institution can be beneficial for investors who may have special financial needs.

Hard money loans are also flexible in that they can be used for various investing strategies, from rental properties to fix and flip projects. There are various loan terms to suit each strategy, and different rates based on each loan type. This suits investors well as each strategy would ideally require its own loan terms.

3. Less stringent qualification criteria

Hard money loans have less stringent qualification criteria than traditional loans, which makes them easier to get approved for. For real estate investors with bad credit, or those who are looking to get access to funding quickly, this makes the loan qualification process faster and easier.

Traditional loans require a good credit score, LTV ratios and debt-to-income numbers, whereas hard money loans can have much lower credit score requirements and are centered around the property deal itself. Hard money loans place less importance on good credit and LTV ratios and focus on the real estate itself because they aren’t at the mercy of traditional financial regulations.

4. Property is collateral

The underwriting process for a hard money loan is less strict than many other loan types which means that these loans are more convenient and accessible. Instead of placing high importance on the borrower’s personal finances, hard money lenders use the property as collateral. This means that the property itself secures the loan.

Some lenders may accept other assets to securitize a hard money loan, however the property is the most commonly used one. It’s important to note that borrowers who cannot pay the loan anymore will risk losing the property to the lender. However, it won’t impact their personal finances. Real estate investors who have bad credit, or don’t have the funds personally, but have found a good deal can benefit from using hard money loans in this case.

5. Higher volume

Hard money loans often provide larger amounts than traditional loans and investors are attracted to this because they can buy bigger homes and even buy more properties using these loans. Funding more than one deal at a time is a great way for investors to build their real estate portfolios quickly and a hard money loan can make this a reality. Traditional loans typically don’t allow for the funding of more than one deal at a time.

What are the main risks involved in a hard money loan?

While hard money loans are an attractive option for real estate investors, it’s worth noting the risks that are associated with these, as a result of their nature. Let’s take a look at 3 of the biggest risks involved with using a hard money loan.

- Higher cost

Hard money loans cost more than traditional loans because they come with higher interest rates. These increased interest rates are to mitigate the risk for investors, and allow them to recoup their losses, should the deal go awry. This means that over time, borrowers will be paying more for the loan than they would on a traditional loan. Hard money loans can have interest rates anywhere from 8% to 15%, it depends largely on the lender and the type of loan.

- Short-term loans

The short-term nature of hard money loans makes them less suitable for certain investors. For some strategies, such as buy and hold, longer term loans make more sense. Investors can’t always pay back these loans within the shorter time frame. Typically, hard money loans need to be repaid in 1 to 3 years, which doesn’t suit every investor.

- Large down payments

A hard money loan will often require a larger down payment than a traditional loan. These down payments can be anywhere from 20% to 25%. This is also to help mitigate the risk that lenders are taking by providing these loans. However, for investors this may not always be viable if they haven’t got the cash on hand to cover this large amount.

Why can't you just use traditional loans to buy investment property?

Getting a loan for an investment property is more difficult than getting a loan for a primary residence. When it comes to traditional loans, conventional lenders don’t offer many loans to that suit real estate investing purposes, and the ones they do offer usually require much higher down payments and interest rates, and come with more stringent loan terms. These loans cannot be used for fix and flip projects, for example, and certain other investing strategies.

Recommended hard money lenders

Choosing a hard money lender is an important decision, therefore it’s vital to pick a reputable and reliable lender. A quick search online will show a variety of hard money lenders, and it’s challenging to know which ones are reliable. Here are 3 hard money lenders that real estate investors should consider:

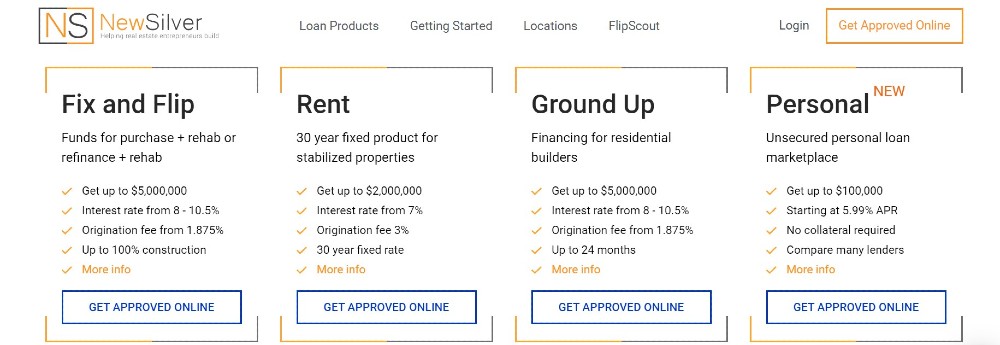

New Silver

New Silver is a reliable hard money lender providing funding in 41+ states across the US. New Silver offers hard money loan products in the form of fix and flip loans, rent loans and ground up construction loans to suit various real estate investing strategies. New Silver’s loan terms range from 12 months on fix and flip loans, to 30 years on rental loans. The lender offers instant online pre-approval, proof of funds letters and closing within as little as 5 days.

Investors can find profitable investment properties using FlipScout, which is New Silver’s own platform where properties are listed. Other resources include a hard money loan calculator, ARV calculator, BRRR calculator, informative blog and much more.

Kiavi

Kiavi is a hard money lender that provides capital to real estate investors. The lender provides bridge loans (fix and flip) and rental loans. The bridge loans offer funding from $100,000 to $1.5 million. Kiavi has flexible loan terms on their long-term rental financing which is 30 years. There two loan options, either a 5/1 ARM or a 7/1 ARM, and both are fully amortized.

Lima One Capital

Lima One Capital is another hard money lender providing loans to real estate investors. Lima One’s loan terms are flexible. There is a maximum LTV of 70% and loan terms range from 13 months to 2 years. While various loan requests are considered, the lender focuses primarily on single family homes and multi-family residences. Loan amounts begin around $250,000 and go up to about $5million.

Final Thoughts - Should You Use A Hard Money Loan?

A hard money loan can be a great option for real estate investors looking to make quick acquisitions. They are typically easier and faster to get approved for than traditional mortgage loans, requiring only an appraisal of the property that you’re looking to buy and usually no hard credit checks.

The interest rates on hard money loans are much higher than those offered through a bank, so it’s important to consider these additional costs in your investment forecast, but the rewards may outweigh any extra expenses. Bear in mind that interest rates vary across hard money lenders.

Being able to close on a property quickly with minimal paperwork can be incredibly advantageous when trying to capitalize on potential real estate opportunities. Ultimately, each investor should evaluate their current situation and determine if a hard money loan is the right solution for them.