The real estate market has very distinct ebbs and flows, but what do you do when the ebbs become the norm? Sometimes despite the best efforts of the fix and flip investor, improving the local deal flow and investing in their own state is not always possible. Some investors that are interested in flipping houses are located in places like San Francisco or New York, where a real estate project of that nature is just not financially feasible.

Other investors live in areas where markets may have become depressed and buying locally presents the risk of properties spending months on the market, leading to huge losses. The average property price in April of this year amounted to $320,000, but in some of the bigger, more expensive metros in the country this price can be twice as high – that prices many fix and flip investors out of the game completely.

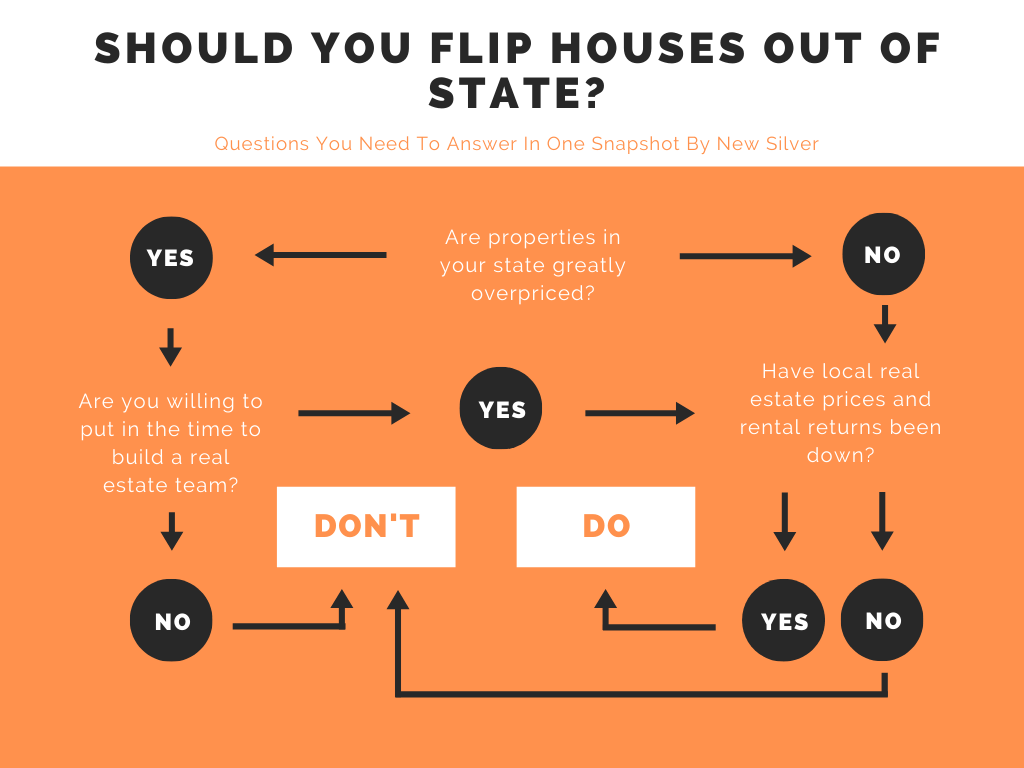

The truth is that expensive local real estate or poor rental return rates often drive investors to look for greener pastures elsewhere, such as by investing in real estate in a different state. Some states bring in rental returns of less than 10% on average and offer poor population growth and employment opportunities, which leaves the investor standing in the dust with a vacant property for months on end.

Previously, real estate investors were advised not to break the 30-minute rule, which states that you should buy a property no more than 30 minutes from where you are personally located. Despite this rule investing out of state, although challenging, could be a lucrative investment approach for the right investor. Keep reading for our ultimate guide to flipping houses out of state:

Why Invest Out of State?

There are several benefits to be had by investing in flipping houses out of state when approached with a strategy and a good real estate team.

We’ve already established that the investors most commonly pursuing this strategy cannot invest in their own locations due to the high cost of entry, causing them to look more seriously at more-affordable cities and states, but the benefits to this investing strategy go even further.

For these investors, investing further out of their own state betters their chances of earning a good ROI on their fix and flip project, at a much more affordable price point. In this case, an affordable market is one where the average property price does not exceed three or four times the median income for the area. This is because these are the markets where you can find the best cash flow potential.

Investing out of state also allows investors to diversify their investments, helping them to reach overall financial goals with minimized risk, especially if they are working with a partner. A partner can not only inject more money into the fix and flip project, but also take on half of the risk.

When it comes to rental properties if the investor can understand the nuances of buying and holding in those out-of-state markets, they can determine the profitability thereof prior to closing.

The motivation for investing out of state can be driven by investor-friendliness; not all states have good terms and policies for fix and flips, and for investors located in these states there may be no choice but to pursue an opportunity elsewhere.

Risks of Investing Out of State

With all the distinct benefits to be had by investing out of state, there are also significant challenges that the investor will need to face. The most obvious risk of investing out of state is that it can be difficult to establish the value of a property personally, especially if you are unable to visit the property personally. In this case, the investor will need to rely on a realtor or other real estate professional to assess the property for them. Basically, unless you are buying in an area you travel to regularly, buying a fix and flip property in another state will leave you dependent on the assessment and decision-making of others which is an additional risk for your project.

Along that line, determining renovation costs in another state is challenging and takes a lot of research and comparison work. You’ll need to vet the work of potential service providers by checking previous references and not necessarily by seeing their work in person. Finding the right fit with vendors can take a lot of valuable time, especially for a project like a fix and flip that has to work on a very tight schedule.

In terms of renovating rental properties, trusting property or rental managers to oversee everything can be just as much of a challenge as trusting them to profile potential properties. Finding the right property manager will again be a lengthy process that can eat into your project timeline. Remember that your project’s property manager will have a direct impact on your ability to get tenants and keep them long-term.

It’s not always possible to minimize the times spent finding the right real estate team if you want to invest out of state either. Unless you take the time to select service providers that are highly-trustworthy, it can put you at risk of being taken advantage of, costing you more in the long run.

How To Invest Out of State

If you’re determined to invest out of state, the best place to start when buying a fix and flip is to select cities or locations that you are familiar with and have visited before. This will give you the advantage of knowing at least some potential neighborhoods you could look into further for investment potential.

Once you have a shortlist of locations to buy in, you’ll want to start collecting data about the local housing markets for each option. This will involve finding out what type of properties sold recently, their prices and how long they were on the market prior to being sold. From there you’ll want to pay attention to how home prices have risen or decreased in that area over the past few months.

A flipper needs to know if the area they are buying in is headed for a downturn or if their investment will appreciate instead, so it will be helpful to determine if there are any major developments taking place in the neighborhood or metro area.

Fix and flip investors can use the Zillow home value index to determine pricing trends easily and track them over time in order to identify the best time to buy. Once you’ve narrowed down a location, you’ll need to start building a local real estate team that can help you acquire a property in that area, rehab it successfully, and sell it for you.

Other Investment Options

Investing directly in flipping a property that is out of state is not the only way to invest long distance. Some investors choose to invest in REITs as an alternative option to flipping: in essence, REITs are made up of a group of investors that own or finance properties collectively. The biggest benefit of this investing method is that investors can enjoy all the advantages of real estate paired with the structure of publicly-traded stocks. REITs work by providing investors with income based on dividends, increased liquidity, portfolio diversification, and several other benefits.

Another option that has similar potential for the investor is joining a real estate syndication – basically, a partnership between multiple investors. Investing through a real estate syndication leads to specific benefits like working under the guidance of several experienced investors, access to larger properties, and minimal risk.

These are not the only choices available to you though – if you are familiar with another investor in the area you want to invest in, you could invest in a fix and flip property together by way of a private note. In a private note transaction, you would effectively take on the role of the lender while the other investor undertakes the actual flipping process. This method provides you with the advantage of having someone you trust to be hands-on with the renovation of the property. Partnering, in this case, would also have minimized risk because you can foreclose on the property to recoup your finances if the project doesn’t go according to plan.

Potential Investment Spaces

Buying a property right now may be more challenging than normal due to the outbreak of COVID-19, but volatile markets can lead to great investment opportunities. The best time to buy could be now, with the hottest real estate markets around the country experiencing pricing declines – this could be your chance to buy a property in a sought-after market for less. Recent data has shown that housing demand has grown for the past five consecutive years, and while the sector will still face challenges, the signs are positive that it will recover.

Prior to the outbreak of the coronavirus, some of the best states to fix and flip in included Florida, North Carolina, Texas, Oklahoma, and Arizona. These states were listed due to their consistently low unemployment rates and high levels of job growth, two factors that are key to the success of real estate investments.

These states were also found to have the most affordable labor and available materials, however, with many countries around the world in lockdown, many building materials have been affected and it could take some time before supply lines are stable and re-established. While many of the factors that highlight the top investment spaces may be affected by the virus over the short-term, they will also be the factors that will re-establish the market and make it successful again in the future.

Final Thoughts

The thing to bear in mind when flipping houses out of state is that the fundamentals of investing away from home are very similar to the fundamentals of investing locally – all the characteristics of good real estate remain the same, no matter the location of the investment property. The biggest difference between these two strategies is having to delegate and trust others to handle your investment. With a good real estate team in your corner, the benefits of investing out of state could far outweigh the risks.