A quick summary

The pandemic has brought about major changes to interest rates, and this has had a knock-on effect on the price of homes in an interesting way. We take a look at what happens to home prices when interest rates rise and what’s next for 2022.

Jump To:

Since the start of the pandemic, economies have been impacted in a big way and this has led to interest rates rising and falling. This rise and fall has had a domino effect on other areas of the economy and one of these is real estate. Let’s take a look at how real estate has been impacted by the recent interest rate changes, by looking at what happens to home prices when interest rates rise, and how mortgages change.

How does the interest rate affect mortgage?

How do mortgages work?

Let’s start at the beginning and go through exactly how a mortgage works. Many people who buy houses need a mortgage in order to do the transaction, which means that they’re borrowing money and paying it back over time. The monthly mortgage payments are determined by the size of the loan and the loan terms. In other words, on a loan of $300,000, a loan term of 30 years would equate to a smaller monthly repayment than a loan term of 20 years.

When you’re paying off a loan, you will be paying both the principal amount (which is the total amount that you owe), and the interest on the mortgage. Lenders need to charge interest so that they can mitigate the risk they are taking by lending people money. This interest can either be a fixed rate or an adjustable rate, depending on the type of mortgage.

Interest is determined by a few factors, one of which is the state of the economy. The interest rate is set by the central bank, so the economy plays a major part in determining whether interest rates are higher or lower, based on inflation and the cost of debt.

The impact the interest rate has on mortgages

So, with interest rates on mortgages being tied to the Federal Reserve Bank, this means that mortgage payments fluctuate according to the interest rate decisions directly. An increase in the interest rate leads to higher mortgage rates and therefore larger repayments for borrowers, and a decrease in the interest rate leads to lower mortgage rates and smaller repayments.

Interest rates vs home prices

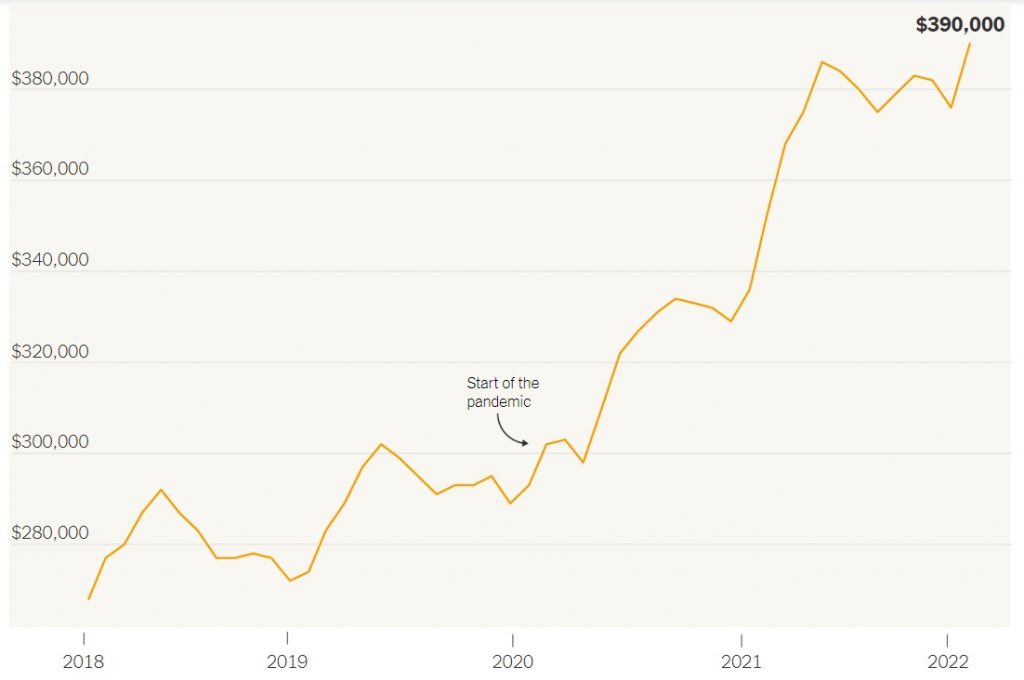

Mortgage interest rates in the US are rising quicker than they have in a very long time, and with this comes a change in home prices. Below we have two graphs to illustrate the changes in each, sourced from the New York Times.

At the beginning of the pandemic, interest rates were at a low, but as you can see above, the interest rates have since risen by more than one percentage point since the beginning of 2022 and continue to rise.

Similarly, home prices were lower at the start of the pandemic and the national median home sale price has since risen to $390,000. However, house prices have since slowed down in their upward trajectory.

As you can see, interest rates also have an impact on home prices, because they essentially determine how much people will have to pay for loans to buy homes. Which in turn impacts the price of homes as the demand for houses increases or decreases based on the interest rates. Naturally, a lower interest rate is more attractive for buyers and a higher one is less. However, this dynamic was quite different during the pandemic, thanks to the major dip in interest rates, followed by sudden increase. Now let’s see how what this means for the real estate market.

What happens when mortgage rates go up?

When the economy is growing, the interest rate tends to rise as the economy gets stronger. A rising interest rate means that mortgage rates will also go up. Under normal circumstances, rising mortgage interest rates would lead to a decline in home prices. This is because rising interest rates on a mortgage lead to higher mortgage payments and this is a deterrent for many buyers. Which means the demand for houses will slow down, and sellers will not be able to sell their houses as fast, and they will need to lower their home prices. Essentially, rising interest rates can cause a decline in house prices as demand slows down from buyers.

For example…

If a buyer is looking for a home loan of $400,000, their monthly repayment would be around $1,900 on a 30-year mortgage with an interest rate of 4%. However, if this interest rate increases by just 1%, it results in a $238 increase in a home buyer’s monthly mortgage repayment. This is a jump from $1,900 to $2,138.

For the market, this means that buyers are less able to afford houses, and therefore the market changes. As sellers struggle to get their homes sold, they lower their prices, which turns the market into a buyers’ market, as the housing supply outstrips the demand.

Will mortgage rates go up in 2022?

After the plunge at the beginning of the pandemic which saw mortgage rates hit record lows of under 3%, 2022 has seen these rates go on a major upward trajectory. Many real estate professionals believe that the days of a sub-3% mortgage are long gone and that the average interest rate on a 30-year loan is going to be between 3.5% and 4% by the end of 2022.

Is it better to buy a house when interest rates are high?

Since the pandemic began, the monthly mortgage repayment amount that most American home buyers have to fork out has increased more than the last 25 years. This is the effect of low interest rates which caused a peak in home prices and then as the interest rate continues to rise, house price increases have begun to slow down. With the end not yet in sight for these increases, many people are wondering if they should even buy a home in the current economic climate.

This decision depends entirely on each person’s specific situation. For some, buying a house is a necessity and simply cannot wait, for others, they can continue to rent until the interest rates come down and house prices decrease along with it.

For real estate investors, deciding whether to buy property when interest rates are high can be a tough decision. What happens to real estate during inflation? Real estate can serve as a hedge against rising inflation and also provide positive returns over time as property values continue to rise. Real estate investors and those who are selling properties may want to sell sooner rather than later as house prices may not continue to rise at quite the same pace. However, those who are buying properties may prefer to hold off until prices have come down a little, or face paying a premium for an investment property.

How do interest rates affect rental prices?

When interest rates rise, the price of houses typically goes down as the buying demand for houses slows thanks to higher mortgage rates. In other words, as interest rates go up, the market value of houses falls.

Now when it comes to renting, it can be a different scenario as rental prices are set by landlords or agencies and are not directly correlating to the interest rate necessarily. However, rental property prices will drop along with other house prices so this will impact landlords. Sometimes this can drive landlords to put rental prices up based on the fact that they are paying more for their monthly mortgage repayments.

Rent prices are high in 2022, largely due to the high interest rates driving house prices up and making affordable housing options hard to find, along with various other factors.

Rental prices can also increase or decrease based on inflation, because the price of living goes up or down. In times of high interest rates, it can be more affordable to continue renting than to buy a property, but this depends largely on each individual situation.

Will house prices fall as interest rates rise in 2022?

House prices have been on a major upward trend, and this is expected to continue through 2022, even with rising interest rates. No drop in house prices is forecast for this year, however the growth is not likely to continue at the same furious pace as the supply remains tight. House prices are estimated to increase by about 7.5% this year, as opposed to last year’s whopping 18% rise, according to Doug Duncan, senior vice president and chief economist at Fannie Mae.

The bottom line

For real estate investors and home buyers, this year will be a more stable year for house prices, with the major increase slowing down but house prices not dropping just yet. The future isn’t certain with the continuous economic changes, however knowing how the interest rates impact home prices is valuable for those who are looking to get into the real estate investing game, or simply buy their first home.