Purchasing a mortgage point allows you to reduce the interest rate of your home loan, from the very first monthly repayment until the very last. Because you are paying an upfront cost to reduce your interest rate, purchasing mortgage points is commonly called ‘buying down your rate’.

It is important to understand that there are two primary components of a mortgage point.

1 – The cost of the point:

The cost of one point is usually 1% of the total loan amount. However, you are also entitled to buy points in fractions, and you can buy multiple points if you are determined to lower your interest rate significantly

2- The interest rate reduction that the mortgage point unlocks

With most lenders, one mortgage point will reduce your mortgage interest rate by 0.25%.

However, this is not a universal standard. It’s entirely possible that some lenders may reduce your interest rate by less than 0.25%. Conversely, if you’re a good negotiator with an excellent credit score, your mortgage provider could reduce your interest rate by more than 0.25%.

Before you proceed with purchasing mortgage points, you need to have a crystal-clear understanding of the interest rate reduction that you can unlock, with each point purchased.

What is the breakeven point with mortgage points?

The break-even point is the length of time it takes you to recover the cost of the mortgage points that were purchased when the loan agreement was finalized.

In most cases, the break-even point is around 6 or 7 years, but it can be shorter or longer depending on your individual mortgage agreement. Crucially, you only truly start saving money on your mortgage after the break-even point has been reached.

How do you calculate the break-even point of mortgage points?

There is a relatively simple formula that you can use to work out the break-even point when dealing with mortgage points specifically.

Break-Even Point Formula = Cost of Points / Monthly Repayment Saving

Break Even Point Example

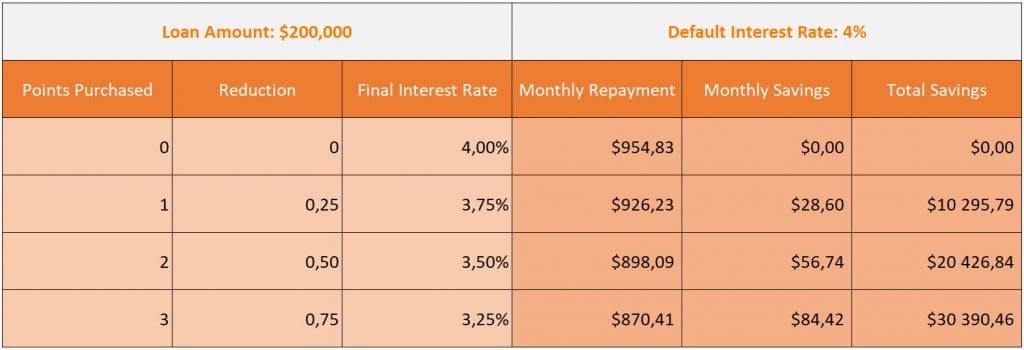

Let’s imagine that you spent $4000 paying for 2 mortgage points, bringing down your interest rate from 4,00% to 3,50% and reducing your monthly payment by $56.74. Now you have all the details you need to use the formula:

- Break Even Point = Cost of Points / Monthly Repayment Saving

- Break Even Point = $4000 / $56.74 = 70.5 Months

In this example, it would take 70.5 months to break even, which translates to 5 years and 10 months

Is it better to buy points or put more money down?

This is an important question. Buying points and putting more money down as a deposit on the house are both valid ways to reduce your monthly repayment. It makes sense to consider the advantages and disadvantages of each approach.

Buying Mortgage Points vs Putting Down A Big Deposit

Benefits of Mortgage Points

Permanently lowers the interest rate of your mortgage agreement

This means your monthly repayments are reduced for the full duration of the loan. Even if you have an adjustable-rate mortgage where the baseline interest rate of the loan changes over time, your points will still be deducted from that baseline interest rate.

Reduces the Total Amount of Interest That You Pay

The direct consequence of a lowered interest rate is that you will pay less total interest over the full life cycle of the loan.

For instance, if you take out a $200,000 loan with a 4% interest rate, your monthly repayment will be about $945.83 per month. However, if you purchase one loan point for $2,000 and thereby lower the interest rate to 3.75%, your monthly repayment will be about $926.23 per month. This works out to a saving of $10,295.79 over the full course of the loan.

As you can see from this example, purchasing a mortgage point can save you thousands of dollars, provided you keep the house for a long time (ie more than a decade).

Disadvantages of Mortgage Points

It takes several years before you actually start saving money

This is by far the biggest drawback of mortgage points. While your monthly repayment is reduced from the get go, it usually takes about 5-7 years before you recoup the costs of the points that were purchased.

This is problematic, because the average American is likely to move more than 11 times in their lifetime. Given an average life expectancy of 78 years, this equates to one move every 7 years.

In other words, the stats suggest that there is a strong possibility that you will move home before you reach the break-even point of the mortgage points that you purchased.

Lack of flexibility

Once mortgage points are purchased, there is no way for you to reverse the transaction.They are applied to the contract that you sign with your loan originator, and it isn’t possible to change your mind after the decision has been made.

Benefits of Bigger Deposit

Reduces Monthly Repayment

The most obvious benefit of a larger deposit is that it will reduce the total amount of money you need to borrow in order to purchase the house.This translates to a smaller mortgage, and a reduced monthly repayment.

Automatically Increases Your Home Equity

Home Equity is the difference between the value of the house, and the amount owed on the mortgage. When you make a lump sum payment (like a bigger deposit), it reduces the capital amount that you still owe on the mortgage and by extension the equity available to you as a homeowner.

It is also worth noting that as your property appreciates in value over time, your home equity will also increase, provided you don’t tap into it using a Home Equity Line of Credit (Heloc) or a refinance loan.

There Is No 'Waiting Period' For The Savings

As mentioned earlier, it usually takes around 5-7 years before you break even with mortgage points.

If you opt for a larger deposit however, there is no waiting period before you accumulate all the benefits. The capital owed, total interest, and monthly repayment are all lowered instantly, removing the need to wait several years before your investment decision actually pays off.

Disadvantages of A Bigger Deposit

A Bigger Deposit Doesn't Guarantee A Lower Your Interest Rate

Unlike mortgage points, there is no guarantee that your bank will lower the interest rate offered to you if you make a large deposit.

You will still reduce the total amount of interest paid during the course of the loan, but that is because the capital amount owed is smaller. This is particularly important if you have an adjustable-rate mortgage, which could see your monthly repayment balloon if the interest rate rises over time.

In other words, if you want to achieve a permanently lowered interest rate, buying points on a fixed rate mortgage is probably the way to go, unless you have a good relationship with your loan originator. If you do have an open line of communication with your bank, you could potentially lower the interest rate and the total mortgage amount by opting for a bigger deposit. It’s a conversation that could save you thousands of dollars if you are willing to negotiate with your loan provider.

Not Financially Viable for Some People

The simple reality is that sometimes it isn’t possible to put down a large deposit, especially if you are already financially constrained. After the Global Financial Crisis of 2008, the lending requirements for residential real estate became significantly stricter. The minimum deposit and minimum credit score needed to buy a house increased in the aftermath of the great recession, which effectively means that many adults (especially millennials) do not meet the requirements needed to secure a home. This is one of the main reasons that homeownership rates in America are declining.

Final Thoughts

It’s fair to say that purchasing mortgage points is an effective way to lower the interest rate of your mortgage. However, you need to have a long-term investment horizon in order for this particular decision to truly pay-off. To really save money, you need to move beyond the break even point (usually 5-7 years) and continue to hold the house for several years after that for the lowered interest to translate into tangible savings.

In many cases, it may be preferable to put down a larger deposit rather buying mortgage points. This decision pays off immediately by automatically reducing your repayments, and it gives you the flexibility to sell the house at any point in the future. In addition, you may be able negotiate a lowered interest rate with your mortgage provider, which would effectively unlock the benefits of each approach.

FAQ

What is the downside of buying points on a mortgage?

There are 2 major downsides to mortgage points.

Firstly, it is possible that you may move out of the house before you reach the break-even point. If you don’t reach the break-even point, buying mortgage points can actually cost you money rather than helping you save money.

Secondly, a lot of modern lenders prefer it when borrowers put down the biggest deposit they can afford, because this decreases the risks associated with the loan. Lowering the risks involved in the loan can often lead to a lower interest rate for the borrower.

The end result is that you can potentially reduce the capital amount borrowed and the interest rate offered to you by opting for a bigger deposit rather than mortgage points.

What’s the Difference Between Mortgage Points and Mortgage Origination Points?

It is important to note that there is a big difference between Mortgage Points and Mortgage Origination Points. Mortgage points are a valid way to reduce the interest rate of your home loan, whereas mortgage origination points are part of the closing costs that certain lenders charge when originating a loan. Mortgage origination points are particularly common with hard money lenders, but they are also often applied by traditional lenders as well.