Construction Loans Washington

Up To 100% Construction Financing

Can You Get A Construction Loan In Washington?

In a word, yes. You can apply for a Construction Loan in Washington.

However, for your application to be successful, you need to have detailed knowledge of the land that you are hoping to purchase and build on.

More specifically, you need an exact location, together with plans for development.

Get Approved Online

What You Need To Know About Building In Washington

There are plenty of reputable construction loan lenders in Washington, but for your application to get approved, you need to have building plans.

- Most Construction Loans in Washington offer interest only payments.

- Importantly, you are required to pay back 100% of the loan amount, when the loan terms end.

To pay back the loan in full, you need to have a clearly defined exit strategy. Either you need to sell the development for a healthy profit, or you need to refinance the property based on the revised value of the building once it is completed.

In addition, there other important factors that a lender will consider when assessing a loan application, including:

FICO Score: Typically, there will be a minimum FICO score that the borrower needs to meet in order for the loan to be granted. At the current moment in time, the minimum FICO is 650.

Cost of Project: A reputable lender should be willing to cover a substantial portion of the project cost. This ratio is called Loan To Cost, and it is a quick way to assess how much capital you can access to complete the building project. At this moment in time, New Silver offers up to 90% Loan To Cost (LTC).

Best Construction Loan Lenders In Washington

1. New Silver

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

- Interest rates 10 – 12.75%

- Instant proof of funds letter

- Credit score 650+

- Interest only payments

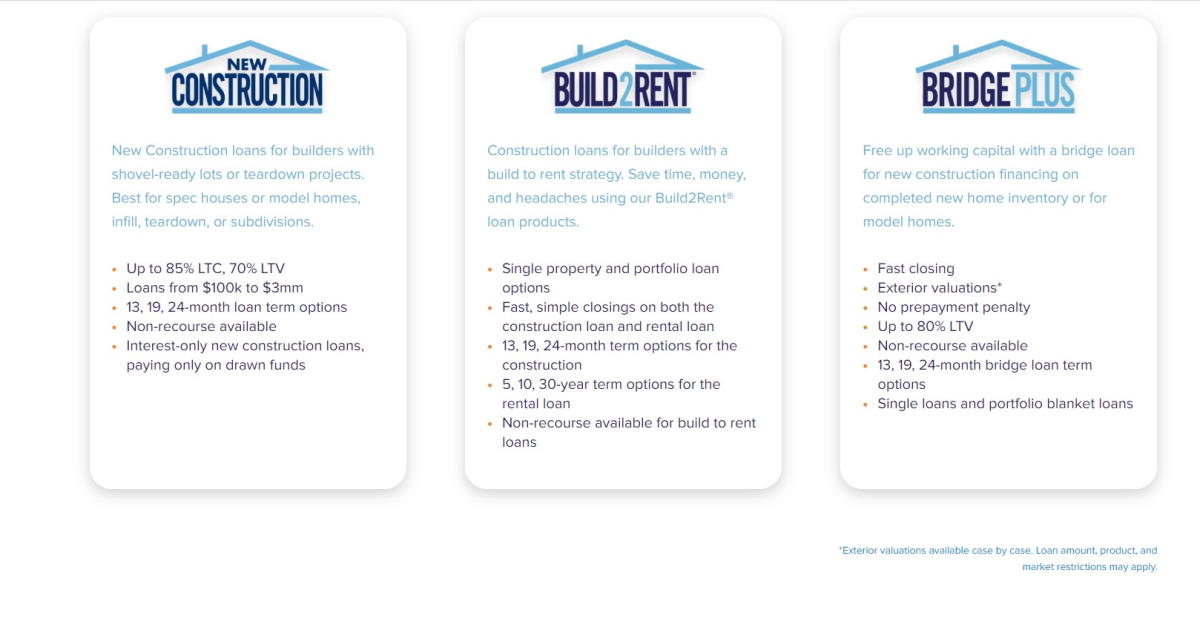

2. Lima One

Lima One Capital is a private lender offering investment property loans for various investing strategies. Borrowers can work together on their deals with the in-house team of experts at Lima One, which speeds up the hard money lending process and cuts out any middlemen.

Learn MoreRequirements For A Construction Loan In Washington

- Interest Rate: The interest rate for this financing option falls in the range of 10 to 13.25%.

- Origination Fee: An origination fee is applicable, starting from 1.375% of the loan amount.

- Loan To Cost (LTC): You can secure a loan for up to 90% of the total project cost.

- Construction Financing: This option offers financing of up to 100% of your construction expenses.

- Loan To ARV: You can borrow up to 75% of the property’s estimated value after repairs (ARV).

- Term: The loan term for this option is set at 24 months.

- Minimum Loan Amount: The minimum loan amount you can request is $100,000.

- Maximum Loan Amount: The maximum loan amount available is $5,000,000.

- Minimum FICO: To qualify, you must have a minimum FICO credit score of 650.

- Type of Property: This financing is suitable for various property types, including residential properties with 1-4 units, condos, and townhomes.

How To Complete A Building Project In Washington

Step 1 – Identify A Piece Of Land That Can Deliver A Positive ROI

First and foremost, you need to identify a piece of land in Washington that is suitable for ground up construction.

To ensure that the building project will be profitable, you need to be able to accurately estimate how much the building will be worth once the project is completed.

Step 2 – Complete Building Plans & Apply For Building Permit

For your construction loan to be approved, most lenders will require building plans to be submitted during the application. In addition to building plans, you will also need to submit a building permit. Without an official permit, the loan application cannot proceed to closing. This is a key item to attend to.

Step 3 – Select A Construction Loan Lender

After finding the land and sorting out the plans and the permits, the next task is to select a Construction loan lender that can meet your needs as a developer.

If you are a residential developer looking for a simple online approval process together with lightning-fast closing, New Silver Lending could be the right fit.

With that being said, there are numerous lenders to choose from. This article highlights the best Construction loan lenders.

Step 4 – Apply For Your Washington Construction Loan

The final step is to apply for the loan. If you have followed all the steps outlined above and you meet the minimum credit score requirements, there is a strong likelihood your loan will be approved.

Washington Real Estate Market Analysis

Over the last 12 months, home prices in Washington have decreased by 2.2%, with an average home value of $571,248. This is 220,000 more than the average home value in the US, which is currently $349,770.

- The Median sale to list ratio is 1.000.

- The percent of sales over list price is 42.3%.

- The percent of sales under list price is 33.9%

High Profit Potential: With some of the highest average property values in the US, there is money to be made developing properties in Washington. Provided you can find land that is suitable for construction in a desirable area, the post construction value will be much higher than most other states.

It all comes down to average market value and comparable properties (comps). If the value of the comps is high, it should be relatively easy to sell each completed unit for a good price. The challenge really boils down to finding the right piece of land. If you can do this, there are many compelling reasons to proceed with the development, with high profit potential being top of the list.

Washington Has A Strong Job Market: Washington State is home to major technology companies, including Microsoft and Amazon. The presence of these industry giants contributes to a robust job market, attracting professionals and supporting a strong demand for housing.

Limited State Income Tax: Washington does not have a state income tax, which can be an attractive feature for residents. This financial benefit may contribute to the state’s appeal for individuals and families considering a move.

Residential Sales Have Slowed Down: In 2022, there were 121,764 residential sales in WA. As of November 2023, there have only been 70,721 residential sales. This represents a steep drop in the number of homes sold in the last year. A challenging economic environment combined with historically high interest rates have ultimately led to decreased home buying activity in the Evergreen State.

Data Sourced From – Zillow.com | Attom Data

Construction Loans Near You

New Silver Offers Construction Loans Across The US

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington DC

- West Virginia

- Wisconsin

- Wyoming

Additional Resources

Construction Loan Calculator

Use our Construction Loan Calculator to estimate your monthly payments. Enter the loan amount, interest rate, and the term of the loan to calculate your monthly payment.

Construction Loan Rates

Find out the latest Construction Loan Rates here. This guide explores what rate you are likely to qualify for.

Construction Loan Requirements

First and foremost, you need to know the location of the development and you also need to have building plans and permits.

Construction Loan Down Payment

The typical down payment on a construction loan is between 10% and 20% of the total project cost.

Best Construction Loan Lenders

Some lenders are better than others. This guide reveals the Best Construction Lenders at this moment in time.

How To Get Into Construction

This guide explains out how you can get started in the Construction Industry.

How Much Does Construction Pay

On average construction workers make over $50,000 annualy.This resource explores how much construction pays, on average.

How To Start A Construction Business

This is a step-by-step guide which explains how to start a Construction Business.

Types Of Construction Loans

There are 3 main types of Construction Loan. This guide highlights the differences between them.

Banks That Offer Construction Loans

There are various US banks providing different Construction Loan options for real estate investors.

Construction Loan vs Mortgage

There are a number of differences between a Construction Loan and Mortgage. Each difference is fully explored in this guide.