The Short Answer

Rent to Retirement offers those who are doing rental real estate investing a hands-off approach to building a rental property portfolio, providing investors with fully renovated properties that are ready to generate passive income right away. This turnkey model simplifies the process of rental real estate investing, making it easier for investors to diversify their portfolios and achieve long-term financial freedom and tax benefits through the real estate market.

While it can be an excellent way to begin real estate investing with less effort and work towards financial freedom, when it comes to Rent to Retirement reviews, it’s important to be aware of potential drawbacks like limited property selection, no price negotiation, and the lack of a fully online purchase process. Turnkey properties can be a great option for those looking for an easy way to invest in rental properties without having to deal with extensive renovations or property management.

Jump To

What You Need To Know About Rent To Retirement

Rent to Retirement is a real estate company that focuses on helping those who are doing real estate investing build a rental property portfolio that brings long-term financial freedom. Known as a “turnkey real estate company,” their goal is pretty clear from the name—providing investors with the tools to grow their wealth through turnkey rental properties. They take a hands-off approach, making it easier for you to get started and navigate the entire investment process.

Here’s a breakdown of what Rent to Retirement has to offer:

- Carefully Chosen Turnkey Properties

Rent to Retirement puts a lot of work into selecting the right properties for investors. They focus on properties with solid cash flow potential, good equity growth, and appreciation prospects. The properties are located in high-growth U.S. markets, so you’re not just investing in any property—you’re investing in one with long-term potential.

- Help with Closing Deals

Once you’ve chosen your property, Rent to Retirement steps in to help you with the closing process. They make sure everything goes smoothly, handling the nitty-gritty details so you can focus on the bigger picture of growing your portfolio.

- Educational Resources for Smart Decisions

Rent to Retirement doesn’t just offer properties; they also provide helpful educational resources. Whether you’re new to rental real estate or just looking to refine your strategy, their materials guide you in making smart choices about locations, property types, and investment strategies.

What Are Turnkey Rental Properties?

A turnkey property is an investment that’s ready for immediate rental, having already undergone the necessary renovations. These properties, which can range from single-family homes to apartment complexes or duplexes, are fully functional and won’t require any major updates. For investors, this means less stress and more opportunity to start earning rental income right away without having to deal with extensive repairs or renovations. Simply put, turnkey properties offer a straightforward path to building a rental portfolio.

How Does The Turnkey Rental Process Work?

The beauty of turnkey rental properties is that they are ready to be rented out immediately. This allows investors to skip the major renovations and start earning rental income as soon as they make the purchase. The process is designed to be straightforward and hands-off, making it easier to build a rental portfolio without the stress of renovation projects. Here’s how it typically works:

- Research the Best Investment Areas

Start by identifying a real estate market with high potential for cash flow and appreciation. Use online platforms, real estate agents, or other resources to find areas that align with your investment goals.

- Secure Financing

Shop around for mortgages to find the best financing options. Make sure your financing is in place before making an offer, so you’re ready to move quickly when you find the right property.

- Select Your Property and Make an Offer

Once you’ve identified a suitable property, make an offer. If your offer is accepted, proceed with closing on the property.

- Consider Property Management

If you’d rather not handle the day-to-day operations, consider hiring a property management company. They can find tenants, manage maintenance, and take care of the property’s needs, allowing you to sit back and let the rental income come in.

- Start Renting and Building Equity

Once tenants are in place, begin collecting rent and building equity in the property. With a turnkey investment, you can start reaping the rewards of passive income without worrying about major renovations.

Do You Buy The Whole Property Or Is It A Fractional Ownership Model?

Turnkey properties are typically purchased as a whole, meaning you own 100% of the property, often with the help of a mortgage loan. Unlike fractional ownership, where multiple investors share ownership of a property, the turnkey model allows you to fully own the property and reap all the benefits—such as rental income and property appreciation—as well as take on the associated risks, like maintenance costs and vacancies.

While some turnkey companies offer property management services to handle tenant placement and property upkeep, the investor still retains full ownership and control of the property. This makes turnkey rentals an appealing option for those looking for a more hands-on investment that can generate passive income.

Benefits of Rent to Retirement

Benefit 1: Simplified Property Search

As shown in Rent to Retirement reviews, the platform makes it easier to find the right turnkey properties by doing much of the legwork for you. Their team handles the research, identifying rental properties with strong cash flow potential, so you can save time and money and get closer to building your investment portfolio.

Benefit 2: Tenant Placement May Be Included

One of the key advantages of turnkey properties is that many are either already rented or move-in ready, eliminating the need for tenant placement. This helps you start generating rental income right away without having to go through the process of finding and screening tenants. Bear in mind, there are also other advantages to this strategy such as tax benefits, cash flow and steady passive income.

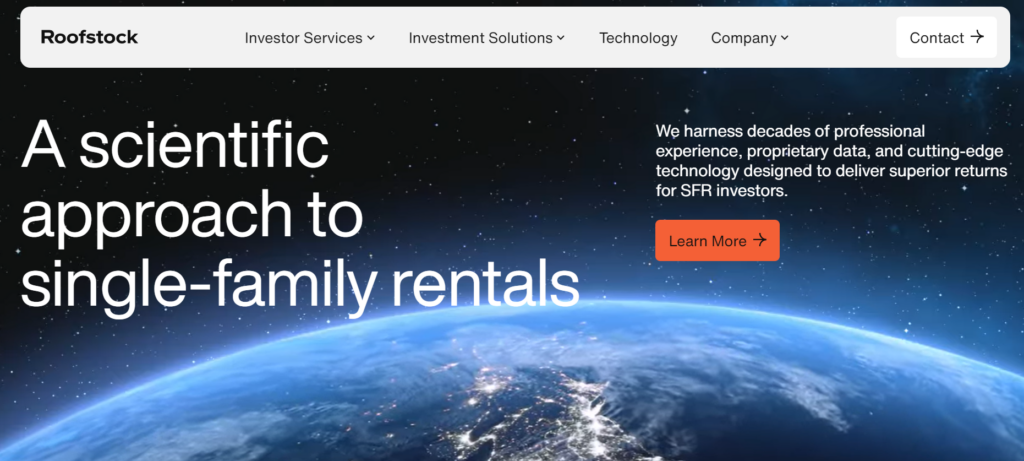

Benefit 3: A Range of Property Options

Rent to Retirement offers a variety of property types to suit different investment strategies. Whether you’re looking for renovated homes, new construction, or even short-term vacation rentals, there’s a property type to meet your goals. This variety allows you to diversify your portfolio and choose investments that align with your financial objectives, such as your end goals and ideal cash flow. Rent to Retirement reviews show that this is a valuable tool for investors.

Drawbacks of Rent To Retirement

Drawback 1: No Price Negotiation

Rent to Retirement typically does not negotiate on property prices. The company believes that their properties are priced fairly based on market conditions and usually sell quickly at the listed price. This means investors don’t have the opportunity to haggle or try to secure a lower price, which might not appeal to those who would prefer to negotiate deals, as soon amongst Rent to Retirement reviews.

Drawback 2: Limited Property Selection

While Rent to Retirement reviews show that they offer carefully selected rental properties, the number of available options can be limited, and so can the markets where these properties are located. This could be a downside for investors looking to diversify across different regions or looking for a wider selection of properties.

Drawback 3: No Fully Online Purchase Process

While the platform simplifies much of the rental real estate investing process, you can’t complete the entire transaction online. Due diligence and property purchases still require more direct involvement, meaning you may need to invest time and effort in researching the property and finalizing the deal offline.

Rent To Retirement Alternatives

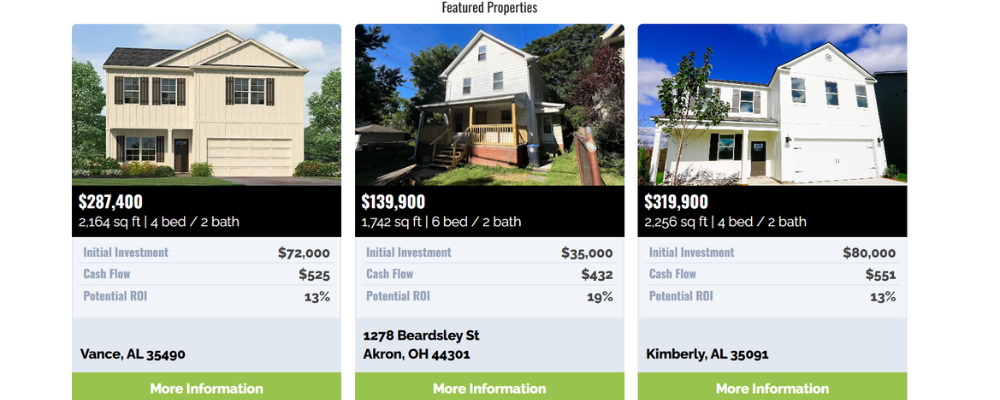

Alternative 1: Roofstock

Roofstock is one of the most well-known turnkey rental real estate platforms in the real estate investing space. It allows investors to buy single-family rental properties across various U.S. markets, with thousands of properties to choose from. Roofstock provides detailed property information, including financial performance, and offers property management services for investors looking for a hands-off experience. Roofstock also allows investors to complete the entire transaction online, including property inspections and closing.

Alternative 2: REInation

REInation is a turnkey rental real estate platform that connects those who are doing real estate investing with fully renovated rental properties. The company focuses on high-demand real estate market options and offers a range of services, including property management, property sourcing, and property sales. REInation streamlines the process of finding, purchasing, and managing income-producing properties, making it a great option for anyone looking for a seamless, hands-off experience.

Final Thoughts - Should You Invest In Turnkey Properties?

Real estate investing in turnkey properties can be a smart move for those looking to build a rental portfolio with minimal hands-on effort. The main appeal of turnkey investments is the ability to start earning passive income immediately (cash flow), without the headaches of major renovations or property management. With platforms like Rent to Retirement, Roofstock, and REInation, investors have access to a range of properties in high-growth markets, all fully renovated and ready for tenants, to build towards their financial freedom.

However, like any investment, turnkey rental properties come with their own set of risks and drawbacks. Limited property selection, no price negotiation, and the inability to complete the entire purchase process online are all factors to consider when deciding whether a turnkey investment is right for you. It’s also important to carefully research the markets and rental properties you’re interested in, as well as the tax benefits, ensuring they align with your investment goals.