A brief summary

Rehab properties are one of the popular ways for investors to take an affordable property and increase its value by rehabbing it, so that they can make a profit from it. These are either rented out for monthly income or sold for a higher price and a good profit. Read on to discover how to find rehab properties for sale.

Table of Contents

One of the cornerstones to real estate investing is finding properties that are in need of some TLC, rehabbing them to increase their value and then selling them at a higher price or renting them out. The trick to making a profit from this is finding the right property and particularly one that is under market value. The way to do this is by finding rehab properties specifically, which means that they’ll need some repairs and upgrades, and then sell these or rent them out. Let’s delve deeper into how investors can find the right properties.

Why do property investors choose to buy rehab properties?

In a nutshell, the biggest benefits of buying rehab properties is that they can be picked up at a cheaper price, and they can grow very quickly as an investment. Here’s why property investors choose to buy rehab properties:

- There is less competition for a property that needs a lot of work.

- The rehab property market is less expensive and investors can pick up good deals easily.

- Rehab properties offer a great return on investment if you can get the repairs done within budget.

- There are different financing options for rehab properties, such as loans that fund both the property purchase and the rehab.

- These houses can be used as a rental property for regular income, or they can be sold again to generate profit.

Distressed property vs rehab property - What's the difference?

A distressed property means that the owner cannot keep up with the mortgage payments, so the home is at risk of falling into foreclosure. These properties can be at varying stages of degradation, some may need a major overhaul if they have been abandoned, some might only need a fresh coat of paint and a yard clean-up.

A rehab property is similar, however, they are often in need of more repairs and upgrades than a distressed property. A distressed property isn’t necessarily abandoned or neglected, the owner may still be people living in the home but they simply cannot pay the mortgage. A full-scale rehab often requires a whole lot more work done than a fixer-upper, for example. A rehab property has usually been neglected for a while and it now going to be lived in for longer than a fixer-upper, so the project may be a lot bigger.

How to find neglected properties near you

1. Search online

Finding abandoned properties can be done from the comfort of your home, by visiting real estate websites like the MLS. Some of these properties are listed as For Sale By Owner and may not advertise that they are in distress or neglected, but they can still be found online. Some platforms like New Silver offer an investment property listing tool like FlipScout, which allows real estate investors to find their next deal for free. There are also websites like foreclosure.com and realtytrac.com that advertise properties in foreclosure which may be neglected.

2. Drive around the neighborhood

Driving around neighborhoods, also called driving for dollars, where you’d like to purchase property and looking for neglected or distressed properties can be a handy way to find them. Here are 5 signs that a home has been neglected:

- Peeling paint on the walls

- Notices in the windows or under the door

- An overgrown yard

- Broken windows

- Mail that isn’t being collected

Once you’ve found a property that may be of interest, you can contact the owner and even if the home isn’t for sale, you may be able to entice them into selling the property to you at a discount.

3. Leverage Real estate wholesalers

Another way to find neglected properties is through real estate wholesalers who can find the type of property you’re looking for a fee. They have their nose to the ground for good deals and finding a neglected or distressed property to rehab will be easier through a wholesaler because they can do the legwork.

4. Use Public records

Homeowners who can no longer pay their mortgage are often not able to maintain their homes as well, and these homes are neglected. They are usually at risk of foreclosure and therefore very motivated to sell the house, which is a good opportunity for investors. Finding houses with delinquent mortgages isn’t as complicated as it may sound, and you can do this by heading down to your local courthouse and searching the public records. The best time to catch a property like this is before it hits foreclosure, so that you can bail the owners out of a tight spot and create a win-win scenario.

Another type of property to check the public records for is a property with delinquent taxes. These could suggest that the homeowner is in financial trouble and therefore it’s likely that they aren’t able to pay their mortgage as well. This would mean that the homeowner is highly motivated to sell, to avoid foreclosure and more than likely isn’t keeping the home maintained very well. So, bear this in mind in your public records search as well.

How to find rehab properties online

1 – RealtyTrac

RealtyTrac is an online platform where you can get access to foreclosures, pre-foreclosures, auction properties, bank-owned homes and homes for sale. RealtyTrac provides an up-to-date and trusted database of foreclosure properties across the US. The platform requires a subscription in order to use the features, and it also includes daily alerts, off-market deals and filters to find the right investment property for you.

2 – Hubzu

Hubzu is an online solution for investors to find foreclosure properties, bank-owned properties, properties on auction and more. This is particularly useful for investors who are looking for a property to rehab. Investors can find properties for sale on Hubzu and contact the associated agent easily through the platform.

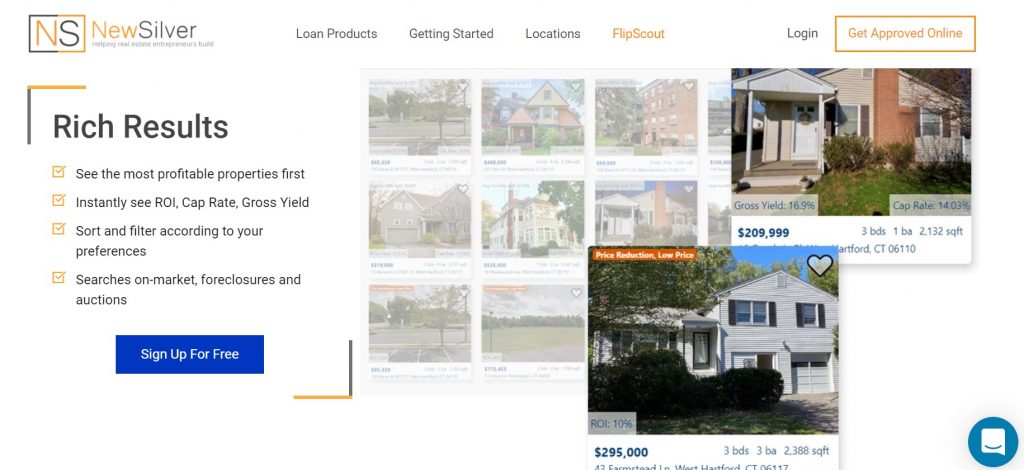

3 – New Silver’s FlipScout

New Silver’s FlipScout tool is an easy way to find investment properties online, including rehab properties. It’s completely free and provides data and insights for each property so that investors can make more informed decisions. The After Repair Value, potential ROI and repair costs are all listed on each property for investors, to make their property search quicker and more efficient.

4 – Foreclosure.com

As the name suggests, this website is used to find homes in foreclosure, because these can often be good deals to rehab for real estate investors. You can search at the state, county and city levels, or by using the exact address and/or zip code. The site provides up-to-date listings from all over the country, for all property types.

The importance of After Repair Value when identifying rehab properties for sale

The After Repair Value (ARV) is crucial for investors who are deciding whether a property is a worthwhile investment or not. The ARV calculation shows investors what the value of a property will be once all the repairs, renovations or improvements have been done. It’s essentially the estimated value of the property once it has been upgraded. As such, this value is important for investors to know, so that they can work out what their return on investment will be for a property.

The ARV of a property is determined by looking at similar homes in the same neighborhood. These are properties that are roughly the same in square feet, have the same number of bedrooms and bathrooms, similar features and age, and the houses must be in the same kind of condition. In other words, comparable properties.

The ARV formula is as follows below, however there are also free ARV calculators that you can use online, like New Silver’s ARV calculator which helps investors assess the comparable properties in the area to figure out the most accurate ARV estimate for a property.

Final Thoughts - Should you invest in a rehab property?

Some rehab properties are lower risk, with easy fixes and a good return on investment, while other rehab properties can be higher risk if a full rehab is needed, and a lot of money needs to be spent on getting the home up to scratch. It’s vital to your homework on each rehab property, to get an idea of which kind of rehab is worth the time and money, and which isn’t.

Rehab properties aren’t for everyone, but they can be a good opportunity for getting a cheaper property and making a good profit on it, either by selling it or renting it out for monthly income. Turning a rehab property into a good investment takes time and knowledge, so remember to hire the right people to help you.