The Short Answer

Finding off-market properties can be a lucrative strategy for real estate investors looking to secure deals before they hit the open market. These properties are not listed on the MLS and are often sold discreetly, which creates opportunities for flexible negotiations and reduced competition. If you’re wondering how to find off market properties, here are some of the most effective methods to choose from:

Networking: Connect with real estate professionals like agents, brokers, and investors to gain access to properties not publicly listed.

Online Tools: Utilize platforms such as Zillow’s off-market programs, real estate auction sites, and pocket listing services to find hidden opportunities.

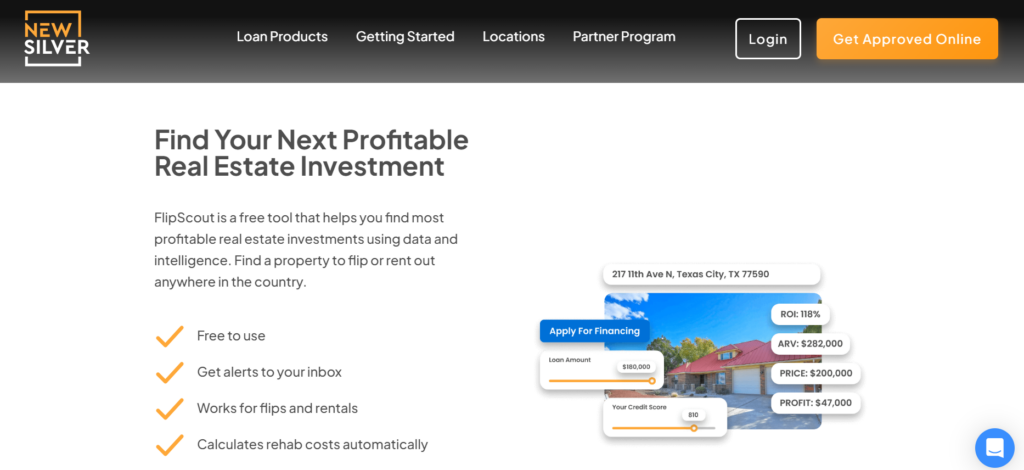

FlipScout: Use New Silver’s tool to discover profitable deals with detailed property insights and automated calculations for ROI and rehab costs.

Direct Marketing: Approach homeowners directly through door-to-door visits or personalized mailers to make offers on properties that may not be listed for sale.

Public Records: Research public records to identify homes that failed to sell, offering a chance to contact motivated sellers directly.

Real Estate Agents: Consult local agents for insider knowledge on properties not yet listed publicly or available off-market.

Driving for Dollars: Scout neighborhoods for distressed properties and contact owners to inquire about potential sales.

Property Management Companies: Leverage relationships with property managers to access rental properties that may be for sale off-market.

Choosing the right method depends on your investment strategy, your time and available resources, as well as the network you have within the real estate market and how this can help you.

8 Ways To Find Off Market Properties

Off Market Property Definition

An “off-market” house is essentially a property not listed on the MLS (Multiple Listing Service) and not available for public sale. However, the term can also refer to properties sold without being listed publicly, often called pocket listings. If you’ve explored real estate websites or heard investors discuss off-market purchases, then you have encountered this concept.

In these cases, sellers directly approach potential buyers through private ads, without ever making the property publicly available. Surprisingly, off market deals are quite common. According to the National Association of Realtors (NAR) 2019 Home Buyer and Seller Generational Trends Report, 10% of all home sellers find buyers without listing their properties on the MLS. This discreet method of selling can offer advantages such as privacy and potentially quicker transactions.

Off-market deals can be particularly attractive to real estate investors. These transactions often allow for more flexible negotiations and can present opportunities to find undervalued properties before they hit the open market. Additionally, off-market sales can reduce competition, as fewer buyers are aware of the property.

However, navigating off-market transactions requires a solid network and strong negotiation skills. Investors often rely on relationships with real estate agents, wholesalers, and other industry contacts to uncover these hidden gems.

Method 1: Networking

When you’re looking at how to find off market properties, one of the most powerful methods involves networking with real estate professionals such as agents, brokers, and other investors. These individuals often have insider knowledge of properties not listed publicly and can connect you with owners who are contemplating a sale. By cultivating relationships within the real estate community, you enhance your chances of learning about exclusive opportunities before they become widely known.

Having connections with investors can immediately give you access to a vast array of potential properties. These investors frequently encounter properties that are not advertised to the public. When you come across someone with a property that piques your interest, don’t hesitate to make an offer on the spot. A direct and timely proposal can sometimes lead to a fast and mutually beneficial agreement.

Building a network with real estate professionals and investors also helps establish your reputation as a serious buyer, which can lead to more referrals and introductions to sellers seeking private transactions.

Method 2: Online tools

There are a variety of online resources where you can find off market listings, making it easier for investors to discover hidden opportunities. Websites like Zillow’s off-market programs, real estate auction sites, and specialized pocket listing services showcase properties that aren’t listed on the MLS or, in some cases, anywhere else. These platforms often feature foreclosure homes, short sales, and bank-owned properties, all of which are considered off-market. Keeping these categories in mind can help you expand your search and increase your chances of finding a great deal.

Social media is another powerful tool for uncovering off market listings. Platforms like Facebook allow for targeted advertising to specific audiences who might be interested in off-market properties. For instance, you could use Facebook Ads to reach individuals interested in moving companies or credit repair services. Additionally, targeting real estate-related groups and online communities can connect you with motivated sellers and potential buyers who prefer the privacy and efficiency of off-market transactions.

To further enhance your search, consider engaging with niche online communities and forums dedicated to real estate investment. These platforms often have members who share tips, leads, and insights about off-market properties. By actively participating in these discussions, you can build valuable connections and gain access to exclusive listings.

Method 3: FlipScout from New Silver

New Silver’s FlipScout is an invaluable tool for real estate investors looking to uncover profitable deals on investment properties. This tool offers free access to a wide range of listings, both on and off the market, and provides detailed insights into each property.

FlipScout aggregates results from various sources, allowing you to see the most profitable properties first. This streamlined approach allows you to sort and filter properties according to your preferences, ensuring you find the best investment opportunities with ease.

FlipScout helps investors make informed decisions about potential investments, with a data-driven approach that simplifies the process. FlipScout stands out for its user-friendly features, it also allows you to receive alerts directly to your inbox, so that you can stay updated on the latest opportunities. FlipScout automatically calculates rehabilitation costs, displays ROI, and provides instant rental income projections.

Method 4: Direct marketing to homeowners

Buyers can target specific areas with higher chances of off market properties or particularly hot housing markets, directly approaching homeowners can be an effective strategy. By going door-to-door or sending personalized mailers, serious buyers can contact homeowners who may not yet be considering selling. Presenting a compelling pitch or direct offer might persuade some homeowners to consider a sale, which gives investors exclusive access to potential deals before they hit the market.

Direct mail marketing is a powerful tactic for reaching potential sellers. By sending postcards or letters to property owners in a targeted area, you can attract interest from those who might be open to selling their homes discreetly. This approach is particularly effective when focusing on specific types of properties, such as fixer-uppers, probate properties, or homes in need of significant repairs. You can tailor your message to focus on the unique benefits of selling off-market.

Using these strategies, combined with a solid follow-up plan can be a good way to enhance your chances of securing off-market deals. Following up regularly with homeowners who are on the fence about selling, can be persuaded over time to sell their property.

Method 5: Public records

Public records are another useful tool for finding off market properties. While this method is more tedious, it can be more fruitful for finding homes that have failed to sell and subsequently gone off the market. These listing can present a great opportunity for buyers who can contact motivated sellers who want to get their properties sold as soon as possible. While this route requires a significant amount of research and due diligence, it can lead to discovering valuable deals that others might overlook.

Identifying the owners of these off-market properties is just the beginning. Once you have this information, the next step is to persuade them that selling their property to you is a good move. Creating a compelling offer that addresses their needs and pain points can make your proposition more attractive.

In addition to contacting owners of unsold properties, leveraging public records can also help you identify other potential opportunities, such as properties in foreclosure, probate, or those with tax liens. These records can point you toward motivated sellers who may prefer a discreet sale.

Method 6: Real estate agents

One of the most accessible and convenient methods of finding off market listings is to consult local real estate agents. Real estate agents with strong local networks can direct real estate investors to specific neighborhoods and houses that might soon be available. These professionals often have insider knowledge about properties that are not yet listed publicly or are available off-market. They often have relationships with homeowners who are considering selling but haven’t made their intentions public.

Essentially, local real estate agents can provide investors with valuable information about upcoming listings and properties that haven’t been advertised, giving them a head start on potential deals. This early information can be crucial in competitive markets, which helps you to approach potential sellers before others even know the property is for sale.

By leveraging these agents’ expertise and connections, you can gain access to exclusive opportunities that are not accessible through traditional channels. Real estate agents can also assist you in evaluating the potential of off-market properties, provide insights into market trends, property values, and the overall investment landscape, helping you make informed decisions.

Method 7: Driving for dollars

“Driving for dollars” is a hands-on strategy that involves physically driving through neighborhoods to scout for properties that appear neglected, in need of repair, or outright abandoned. This method is particularly useful for identifying off-market opportunities that may not be visible through traditional listing services.

By checking the condition of homes, overgrown lawns, boarded-up windows, and other signs of distress, investors can pinpoint properties that might be available at a bargain price. Once a potential property is identified, the next step is to reach out to the owner. Investors can attempt direct contact by knocking on doors or leaving a note expressing interest in purchasing the property.

If the owner is not present or the property is abandoned, investors may need do more research to find the owner’s details. Public records, such as property tax records, deed records, and local government databases, can provide the necessary details to locate and contact the property owner. By creating an attractive and respectful inquiry, investors can open the door to negotiations and potential deals.

Method 8: Property management companies

Leveraging property management companies is another useful way to find off market properties. These companies manage a number of rental properties and have established relationships with property owners, which makes them valuable sources of information about potential off market deals.

Property managers often know which landlords are considering selling their rental properties, especially those that are underperforming or in need of significant repairs, providing a pipeline of potential investment opportunities. Working with property management companies, you can also find properties that fit your investment profile, whether you’re looking for fixer-uppers, multi-family units, or single-family homes. Property managers can also provide insights into the property’s rental history, current market conditions, and any upcoming vacancies.

Along with all of this, property managers can facilitate introductions to property owners, which can speed up the negotiation process and increase an your chances of securing a deal. This information can help you make informed decisions and identify properties with the highest potential returns.

Which Method Is Best For You?

Choosing the best method for finding off market property depends on each real estate investors’ particular investment goals, resources and personal preferences. There are 3 key questions to consider to help you decide:

- How much time do you have available for this?

Some methods require a significant time investment, which means that investors will need to have a lot of time available, while others don’t but instead may require other forms of energy. For example, for investors while more time, searching public records and driving for dollars can be viable methods. However, for investors who have very little time, forming relationships with property management companies, and real estate agents may be more suited to them because they can use professional services to do the time-consuming legwork.

- Do you have a good network in the market?

For those who have great real estate contacts and relationships in the real estate game, such as real estate agents, other investors or property managers, this is a good place to start trying to find off market deals. These professionals may be able to give inside information into the market and present investors with deals before they hit the market. If you don’t have a good network yet, you can start with other methods like direct marketing to homeowners, driving for dollars and using online tools.

- What is your investment strategy?

Your investment strategy is a large factor in your choice of method for finding off market property. For example, investors who are looking for distressed properties to fix and flip may choose to drive for dollars and approach homeowners directly. This is an important consideration for deciding which method will work best for you when looking for off market deals.