A brief outline

One of the most useful terms to get familiar with is absorption in real estate. This is a valuable tool that real estate investors can use to get to know local housing market trends. Not only does it indicate housing supply and demand, but it also signals the pace of sales.

Table of Contents

As a real estate investor, you’ll need to understand the terms that are used in real estate, some of which may sound unfamiliar. These terms are significant in a real estate investor’s journey towards understanding the market and making informed investing decisions. Let’s take a look at the term “absorption” and what the absorption rate refers to in real estate. It’s a key element that investors can use, so this term is essential to get to grips with.

What Is Absorption In Real Estate?

When it comes to real estate, absorption refers to the process of available homes being sold in a real estate market. The absorption rate, however, is a useful calculation for real estate professionals and here’s why.

Absorption Rate Explained

The absorption rate is the speed at which available homes are being sold within a particular market, in a specific time frame. In other words, the absorption rate is used to calculate the number of homes that have been sold in a specific real estate market within a certain time period. This indicates how long it will take to sell a home in this market, based on the speed at which homes are selling overall.

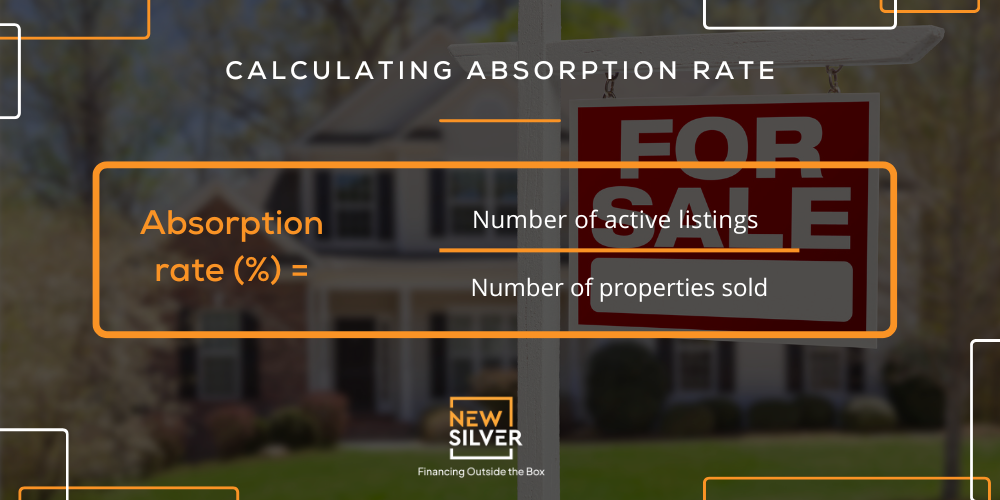

Real estate investors, real estate agents, developers, home appraisers and lenders all use this calculation as an indication of market trends in a certain area. The absorption rate is calculated by dividing the total overall number of properties that were listed on the market to be sold, by the number of homes actually sold within a given time frame.

A high absorption rate or positive net absorption rate is often deemed as anything over 20%. This would indicate that the demand for homes is high because they’re selling quickly, and it is therefore a seller’s market. The opposite rings true for a low absorption rate, which would be under 15%. A buyer’s market is indicated by a lower absorption rate as the demand is lower and houses are taking longer to sell.

What Influences the Absorption Rate of a Given Market?

The absorption rate is directly impacted by the same factors that influence the demand for housing. So, anything that would lead to an increase or decline in the demand for housing will likely lead to a rising or falling of the absorption rate as home sales are impacted.

Mortgage rates

Mortgage rates are one of the biggest influencing factors for housing demand. It stands to reason that the more expensive it is to get a loan, the less likely people will be to buy real estate. So, higher mortgage rates can lead to a decline in housing demand, which creates a buyer’s market, and will impact the absorption rate by making it decrease as homes take longer to sell. The opposite would be true if mortgage rates decreased, and it became a seller’s market.

Mortgage rates are impacted by the overall interest rates, which means that an increase in interest rates as determined by the Federal Reserve will have a knock-on effect on mortgage rates. Once these rates have increased, it’s only a matter of time before the change in the real estate market will take place.

Demographics

Demographic factors such as population size, income and age, have an effect on absorption rates because they impact the demand for homes. This is because demographics are a large factor in determining real estate pricing, the types of properties that are sought-after, whether renting or purchasing is more popular and so on.

The absorption rate can therefore go up or down in an area based on the demographics of the area. For example, an area with a large number of baby boomers may see a trend shift towards retirement, which would lead to homes being sold and people downsizing or moving into retirement locations. This would impact the absorption rate for this area in a big way.

Overall economy

The country’s economy plays a major role in real estate, often times a struggling economy leads to a slower real estate market. However, the economy can have various impacts on real estate and particularly the absorption rate as it leads to higher or lower buying power and demand. Knowing which part of an economic cycle the country is in can help investors plan for any potential impacts on their investments.

Government policies

Property prices and housing demand is also dependent on the legislations that have been put in place by the government. For example, if subsidies or tax deductions are in place, this can boost buying power and lead to a rise in demand for real estate. In turn, this results in a bustling real estate market and therefore a higher absorption rate.

How To Calculate Absorption Rate

Formula For Absorption Rate

In real estate, the absorption rate can be calculated by dividing the number of properties for sale in a particular market by the number of homes sold, in a specific timeframe. This number is converted into a percentage by multiplying by 100. For example, 0.3 x 100 would be 30%.

How to Calculate Absorption Rate

The parameters of the calculation can be determined by the market that you choose, and the time frame that you decide on. Here are the steps to follow…

Step 1: Select the market you’re interested in and the time frame you’d like to consider.

Step 2: Identify the total number of active listings in the market of your choice, during the time period you’d selected.

Step 3: Find the number of sold listings during the same time period.

Step 4: Divide the total number of listings by the number of sold listings, to find the percentage absorption rate.

Absorption Rate Example

Let’s use the steps mentioned above in an example.

If you decide to look at the properties sold in Alabama in December 2021, you’d start by sourcing the information you’ll need for this area. First, you’ll identify the total number of homes listed in Alabama in December 2021, let’s say it was 5,000. Next, you’ll find the number of listings that were sold in this time period, let’s say it was 1,000.

You’d take the formula above and plug in the numbers you’ve found:

Absorption Rate = 1,000 / 5,000

= 20%

In this example, the absorption rate was 20% for Alabama in December 2021.

Why Is Absorption Rate Used By Real Estate Investors?

Absorption rates can come in handy for a variety of real estate professionals, but for real estate investors it’s a key element used for decision making. The absorption rate gives investors vital information on:

- The level of demand in the real estate market of a particular area. A higher demand indicates a seller’s market and lower demand indicates a buyer’s market, which is important information for real estate investors as this impacts their investing decisions and their path to finding good deals.

- The types of properties that are selling quickly in an area. This means that investors can discover which types of properties are selling fast and take advantage of any opportunities presented in the market.

- Compare properties in one area to another. The absorption rate allows investors to compare the speed of home sales in one area to another, when they’re deciding which area to invest in.

- Demand fluctuations in different time periods: The absorption rate can also indicate which times of the year there is a higher demand in a certain area. This can be valuable for investors who are looking to buy or sell investment properties at different times and need to know when to attract buyers.

Is Absorption Rate Limited to Commercial Real Estate Investors?

Absorption rates are used in commercial real estate to indicate the speed at which space is taken, in a given market. In other words, investors can use the absorption rate to determine how much space has been vacated by tenants, and how much has been occupied by tenants in a specific area, at a certain time.

However, absorption rates aren’t only used by commercial real estate investors. The rate is a useful tool for lenders when they are evaluating their loan terms, appraisers who are working out the value of a property, residential real estate investors or home buyers who are making decisions on the timing of a purchase or sale, and real estate agents who are analyzing market trends.

Final Tips for Using Absorption Rate To Analyze Real Estate Markets

Absorption rates are an important metric to consider when analyzing real estate markets. By understanding how the absorption rate works and what factors can influence it, you will be able to make more informed decisions about your real estate investments. The main attraction is that the rate can be used to determine whether an area has a buyer’s or seller’s market.

Absorptions rates are useful for a variety of real estate professionals including real estate agents, developers, appraisers and more. The rate is a good indication of the housing market conditions within a specific area, at a certain time, and should form an integral part of your research as a real estate investor looking for places to purchase an investment property.