The Short Answer

The real estate market cycle has been around for a long time, and it consists of 4 phases: the recovery phase, the expansion phase, the hyper supply phase and the recession phase. The market continues to cycle repeatedly due to a number of factors, including the general economy, interest rates, government policies and area demographics.

Real estate investors should learn about the cycle, so that they can adjust their investing strategy according to each phase within the cycle. This will help with generating profits in a longer-term way and making strategic decisions to avoid being impacted by market downturns.

Jump To

Real estate investors need to keep up to date with the housing market, and this means looking into the real estate market cycle. This cycle moves with the country’s economy and investors should keep tabs on where the real estate market is, in each cycle.

The market has been particularly volatile and difficult to predict over the last few years, which is where the real estate cycle comes in handy. Let’s take a closer look at real estate cycles, how they work and why they are so useful for investors.

What is the Real Estate Cycle?

Since the 1800’s, the real estate cycle was established by researchers as an 18-year cycle that the real estate market goes through. Economist Fred Harrison was one of the first people to identify the cycle and the distinct phases within the cycle.

This 18-year cycle ran regularly until 1925 when government regulations began to impact it, and it evolved into the real estate cycle we see today. The cycle indicates both commercial and residential real estate market performance and is used to predict the best time to buy, sell or hold.

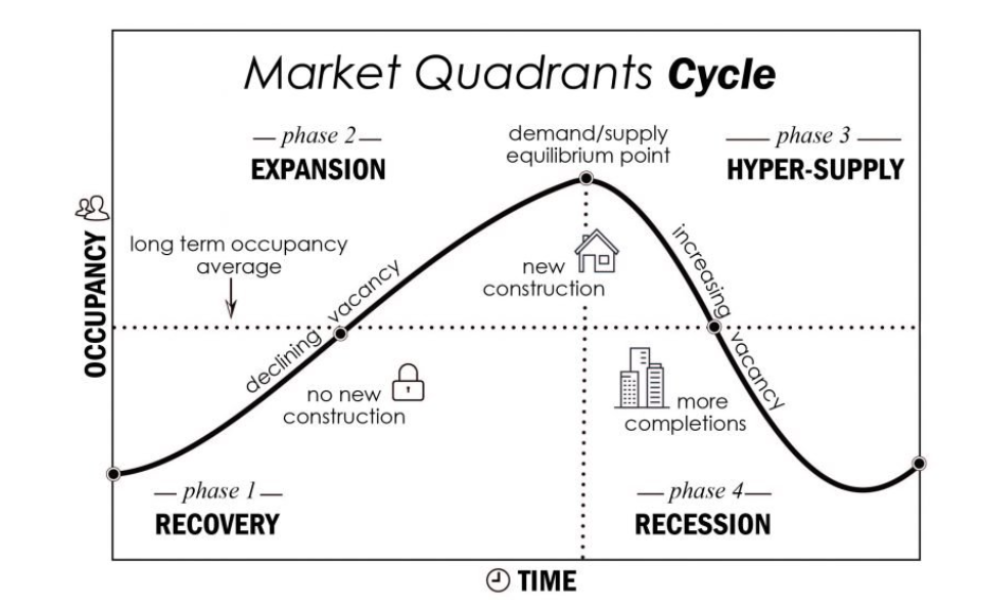

Essentially, the cycle has been repeating itself for a long time, with each phase leading into the next. The cycle is made up of 4 parts: recovery, expansion, hyper supply and recession. It follows the economic trends, which are also cyclical in nature.

Why do investors need to understand the Real Estate Cycle?

For real estate investors, understanding the real estate cycle is a vital part of the investing journey. Here’s why…

- Understanding why property prices go up and down helps investors gain confidence in the fact that prices will always come back up and helps them predict market changes better. This means that they’ll be able to make more informed investing decisions.

- Real estate market crashes are a part of the journey, which means that investors won’t get scared off by a market dip, and can learn how to navigate these along their journey to minimize any losses.

- Investors can learn about the market indicators to look out for, in order to predict what the market might do next and make the best investing decisions based on this.

The four phases of the Real Estate Cycle

Now we’ll take a closer look at each phase of the real estate cycle, and how they can be useful for investors.

Recovery Phase

During this phase, the economy has typically been in a recession, or has been showing signs of a recession and is on the path to recovery. This means that unemployment rates are high, there’s very little new construction, rental growth is low, and consumer confidence is shaky. Real estate prices have usually increased, which makes it harder for buyers to afford properties.

While the economic outlook is grey, during this phase real estate investors can look for properties that are priced below market value and begin doing upgrades. By the time the next phase of the real estate cycle hits, the economy will be shifting and selling or renting out this property can be a successful path.

Strategic Focus: Investors might consider targeting distressed properties. These often come with deferred maintenance issues or financial trouble, providing leverage to negotiate a below-market purchase price. Renovating these properties can set the stage for future profits as the market recovers.

Expansion Phase

During the expansion phase of the real estate cycle, the economy begins to bounce back from its decline. This means that the job market strengthens, consumer confidence grows, buying power increases and therefore the demand for houses begins to gain traction again. The real estate market will typically pick up again as demand increases and home prices begin to decline.

At this point, real estate investors should look at the housing market trends to figure out what home buyers are looking for and make renovations to investment properties based on this. These properties can then be sold above market value to make a profit or rented out as the rental demand increases.

Strategic Focus: Consider adding vacation rentals into the mix. As financial stability improves, more people are willing to travel, creating demand for rental properties in attractive locations. This can be a lucrative time to capitalize on short-term rental markets.

Hyper Supply Phase

The housing supply eventually begins to exceed the demand, as the Expansion Phase causes a flurry of activity around providing more housing, and sometimes the economy experiences another change. The result is that there is more housing inventory than demand, which leads to an increase in the price of homes.

For real estate investors, this is a good time to hold onto the property you already have or look for properties that could generate a good profit in the future and use the buy and hold strategy. The market is cyclical, and it will take another turn again, which will present a good time to sell and make a profit. Investors should also keep an eye out for rising vacancy rates and houses that aren’t being sold as this could indicate a recession.

Strategic Focus: During this phase, increasing the value of properties through additions like accessory dwelling units (ADUs) can be beneficial. This can enhance property value significantly and position it well for when the market cycle inevitably turns again.

Recession Phase

This phase of the real estate cycle is due to an economic recession, so there are high vacancy rates and supply is far more than demand. While new construction may have begun in the Expansion Phase, this takes time, so these homes would be finishing now. Unfortunately, the housing demand has already peaked and dropped, so this new batch of housing inventory is not sold quickly, resulting in higher vacancy rates.

Real estate investors can purchase properties that are in distress during a recession, which means properties that are well below market value. Properties that are being sold because the owners can no longer pay their mortgage provide a good opportunity for investors to buy and renovate. Investors can hold onto these properties until the real estate market hits an upswing again, as the economy bounces back, and then make a good profit.

Strategic Focus: Exploring affordable housing options can be a smart move. These options remain in demand even when the economy is down, providing steady rental income and stability during uncertain times.

Real Estate Cycle chart

Chart source: Mueller, Real Estate Finance

Why the real estate market has cycles

The real estate market is impacted by a variety of factors, each of which contribute to the cycles we can see taking place. The main factors that influence the housing market are:

General economy

One of the biggest influences on the real estate market cycle is the country’s overall economy. The real estate market is closely linked to the performance of the overall economy and will therefore go up as the economy strengthens, and down as the economy weakens. This is largely due to consumer confidence, and property values increasing as a result of a higher demand.

Interest rates

Interest rates are one of the most well-known factors that influence the real estate market. As interest rates rise or fall, so mortgage rates will rise and fall, and this impacts overall buying power. When the interest rate goes up, it leads to higher mortgage rates, which are typically a deterrent for potential buyers. The opposite is true for periods where the interest rate is low, as buying power goes up and buyers are motivated to get into the real estate market.

Government policies

When the economy is slow or there has been a recession, the government will often put policies in place to boost the economy or incentivize people to purchase real estate. These policies can impact the real estate market, as tax deductions, tax credits and subsidies form part of the government policies put in place. These can cause the real estate market to grow, as incentives promote real estate transactions.

Demographics

The demographics of a population can impact the real estate market because the people living in an area drives the supply and demand of housing. For example, if a population is made up of young families, this will impact the real estate market in terms of where people choose to live, the types of homes they are buying, when they buy and so on.

Additionally, it is important to consider:

- Population Shifts: Migration trends, whether towards urban centers or rural areas, can significantly alter demand in specific regions.

- New Construction: The rate at which new homes are built affects the supply side, potentially meeting or exceeding demand.

By understanding these factors, investors can better anticipate changes in the real estate cycle and make more informed decisions.

How long do Real Estate Cycles last?

Real estate cycles typically last around 18 years, according to researchers. However, it depends entirely on the influencing factors. Each phase can last different time periods within each cycle, so there is no general rule for this. It depends on the local, national and even global economic factors that are impacting the real estate market.

For example, the recent pandemic led to various phases of the cycle taking place, but each lasted a different amount based on the economic recovery time, government stimulus, consumer confidence and so on. This has changed the way the real estate market cycles are working and created more unpredictability.

What stage of the Real Estate Cycle are we in right now?

As we near the end of 2024, many real estate markets in the US are in the Expansion Phase of the real estate cycle. However, this can vary from area to area, so your local real estate market may be different.

The US economy is current bouncing back from the negative impact of the pandemic, the real estate market has been booming and home prices have been sky-rocketing. However, recently home price growth is slowing, as is inventory. Government stimulus has scaled back, interest rates are high, and the economy is stabilizing. Which leads to the Hyper Supply Phase next on the horizon.

Home sales fell by 20% year-over-year in July 2022, and the median price of a home was $403,800, which was an increase of 10.8% in comparison to last year. In June 2022, new housing reached the lowest point that has been seen since September 2021. Inflation is high (8.5% in July), and interest rates have continued to rise. However, the unemployment rate has dropped to 3.5% recently, taking it back to pre-pandemic levels.

The pandemic has led to an upset in the economic and real estate cycles, which means that we can never be quite sure what’s coming next. It’s important to keep tabs on what the economy is doing, in order to predict what could happen next in the real estate market.

Should you change your real estate investing decisions based on the current cycle?

Paying attention to the current real estate cycle is vital for real estate investors who wish to achieve long-term success. The cycle should have a big influence on real estate investor’s strategic decisions, because this will ultimately impact the profits they can make.

Certain phases of the cycle can result in higher profits, while other phases can result in more affordable investment property options. So, knowing when to buy, hold and sell is key to taking advantage of the opportunities presented by each phase of the cycle. This is good news for real estate investors who can make the most of each phase of the real estate cycle, to create long-term success.

How to predict a real estate market crash

A real estate investor can use certain signs that will indicate a potential housing market crash. This helps investors stay ahead of the crash, to anticipate the impact it could have on investment properties and prepare to minimize the effects. Here are some signals to be aware of:

- Interest rates: One of the biggest indicators of a potential real estate market crash is an increase in interest rates. Once short-term interest rates become higher than long-term interest rates, the economy is likely to become unstable.

- Overpriced properties: When home prices are so high that they are no longer affordable for most people, and the rise in prices overtakes inflation, this could indicate a future market crash.

- GDP changes: When economic activity slows down, and household economic activity becomes one of the larger contributors to the GDP.

- Higher mortgage rates: It stands to reason that the higher the mortgage rates, the less inclined people will be to buy homes. This invariably leads to a decline in demand, and eventually there will be a surplus of housing inventory.

- Rental and capital values change: During a crash, capital values will begin to rise, while rental values will decline. This would mean that investors are raising capital values as they anticipate capital gains.

The bottom line

The real estate market cycle consists of 4 phases, which are important for real estate investors to bear in mind on their journey to creating wealth. These phases are characterized by certain indicators that can be used to adjust a real estate investing strategy. This means that investors can capitalize on each phase by adjusting their strategy accordingly and making more informed decisions about their real estate investment.

Frequently Asked Questions (FAQ)

The real estate market is anything but one-size-fits-all. Cities and property types can experience different phases of the real estate cycle simultaneously due to varying local conditions and demand trends.

Geographical Variations

Each city has its own unique factors influencing its position in the real estate cycle. For instance, during the peak of the pandemic-driven housing surge, large urban areas advanced into a recession phase quicker than smaller cities. These smaller markets were often still caught up in the hyper supply phase, driven by slower changes in demand and development pace. Even now, as many places are cooling, cities like Los Angeles and San Diego remain in the limelight as some of the hottest markets. This highlights how local economic conditions and housing demands can create stark contrasts in cycle phases across different cities.

Divergence in Property Types

Within a single city, different types of properties can also find themselves in distinct phases of the cycle. For instance, while single-family homes may face varying demand pressures causing them to hit a recession phase, rental properties might experience a different trajectory. As individuals unable to afford homeownership increase, the rental market can swiftly move into a recovery phase. This divergence often results from shifts in consumer preferences or economic conditions affecting specific property types differently.

In summary, the real estate cycle is not uniform. Varying local factors across cities and differences in property demand contribute to disparate cycle phases, creating a complex yet fascinating real estate landscape.

Navigating the ups and downs of the real estate market can be daunting, but with the right strategy, you can build a portfolio that thrives in any phase. Here’s how:

1. Diversify Your Investments

A balanced portfolio is key. Invest in a mix of residential, commercial, and industrial properties to spread risk. This way, if one sector takes a hit, others might perform better, stabilizing your overall returns.

2. Invest with Experienced Partners

Consider partnering with firms or real estate experts who can guide you through complex market cycles. Experienced professionals can help you identify opportunities that might not be obvious at first glance, leveraging their insights to enhance your investment choices.

3. Leverage Industry Insights and Data

Stay informed about market trends by following industry reports from renowned sources like the National Association of Realtors or Zillow. This data helps you make informed decisions and anticipate changes in the market before they happen.

4. Prioritize Real Estate Projects with Strong Fundamentals

Invest in projects with robust fundamentals, like properties in prime locations or those with high rental demand. These investments tend to be more resilient during downturns, offering a buffer against market fluctuations.

By following these steps, you’ll be well on your way to building a real estate portfolio designed to withstand and succeed through various market phases, ensuring both stability and growth over time.