Many budding landlords find themselves believing that a rental property is less risky than owning other types of real estate. As a more long-term option, with consistent income, surely there is very little in the way of risk that can come from investment property. This is a mistake that many new landlords make; while the rental market is typically less volatile than something like house flipping, there are still many risks landlords can come across in the course of their property ownership.

As a real estate investor of any kind, it’s key to understand how to protect your assets over the long-term. Choosing a legal structure is one of the most important decisions you will make for your real estate investments and overall business – which applies to rental properties too. Without some layer of protection, your journey as a landlord will quickly be marred. For many investors, there is some question about using an LLC for rental properties. If it’s suitable for other types of real estate, surely it should be a good fit for landlords too. Then there is also the question of what benefits there are to gain by choosing an LLC, and the equally important disadvantages of LLC for rental property. All investors want to go into rental property ownership in the safest way possible, not just for themselves but also for any partner landlords and tenants.

Keep reading to find out more about whether an LLC is suitable for your investment property and why it may not be:

Table of Contents

LLC Basics

The goal of forming a real estate LLC is to limit your personal liability and separate your personal assets from the assets of your business. Asset protection should provide you with peace of mindif you come across legal or financial issues, such as a lawsuit or debt, your personal assets cannot be seized. At its roots, an LLC is a blend of limited partnership and corporation, allowing people to work individually or with other investors in a seamless manner. LLCs are regulated by the states they are registered in, which also means that the registration process differs from state to state. Generally, LLCs are the preferred choice when structuring a company for a rental property owner, as they are more flexible in tax options and applications.

There are several standard practices that come with creating an LLC around your rental real estate investments. First, the LLC will need a separate bank account from which all rental income and expenses are handled – none of your personal finances should be intermingled with those of the business. Next, financial records and bookkeeping will need to be done to ensure that everything is in accordance with the laws of the state of incorporation, just another reason why your business finances need to be separate. There are repeated costs associated with owning an LLC which will need to be paid yearly.

Structuring an LLC can come with significant tax advantages and several other benefits, which can apply to rental properties. For tax purposes, an LLC allows you to treat a large number of rental property expenses as tas deductible entities. This can have a dramatic impact on the profitability of a real estate investment.

Although the ability to deduct expenses is a very obvious tax benefit, there are also caveats that should be considered before jumping into the registration of a new LLC. We cover both the pros and cons of an LLC for rental properties below:

Advantages of LLC for Rental Property

So how would an LLC be beneficial to landlords and are they better than some of the other options available out there? Is it worth the time and effort to register one, and is it really necessary?

To start, there is the issue of liability on the side of the landlord. The biggest risk would be if a tenant would be injured while inside the rental property and decide to sue. As much as you like to believe that your property is safe, there is always the possibility of an unintentional home injury occurring. Should anything befall your tenant or tenants, an LLC would cover your financial liabilities. Paired with a good insurance plan an LLC can create an umbrella of cover for your business in case any unforeseen situations would arise.

LLCs offer several tax benefits for rental property, with set expenses that can be deducted and ways to minimize total payable tax costs. LLCs are able to utilize pass-through taxation and a single member LLC can deduct mortgage interests similar to a sole proprietorship under the IRS. The income and capital gains made by the LLC will be taxed at an individual level. In addition to tax savings, LLC’s are easily registerable by the business owner or can be set up with the assistance of a real estate attorney. They can be registered online for just a few hundred dollars or less depending on the state of incorporation.

An LLC provides an ability to build up credit for your business without affecting your personal credit. It’s also a great way for landlords to stay organized, particularly if they own multiple rental properties – as long as they keep all the accounts, records, and details separated between their owned LLCs.

Disadvantages of LLC for Rental Property

As much as there are benefits to owning a rental property under the LLC structure, there are also drawbacks that potential landlords should know about. These are the characteristics that could mean an LLC is not a good fit for your rental property:

LLCs can run up costs that not all other business structures do, such as accountants charging more for the filing of LLC returns. The IRS considers LLCs similar to partnerships when it comes to taxation unless the members involved choose to be taxed as a corporation. When taxed as a partnership, members of the LLC are considered to be technically self-employed and responsible for paying their own self-employment taxes based on the business’ net earnings.

If you own multiple properties or have a partner, owning an LLC can quickly become complex – each LLC will need separate bookkeeping for example. Some lenders will not provide financing directly to an LLC, or if they do, the funds are backed by your personal name regardless. There is also the trouble of member turnover – if you have partners in the LLC that leave, in many states the company needs to be dissolved leaving remaining members responsible for the legal and financial termination obligations. You are allowed to continue the business but will have to register a new LLC and start from scratch.

In some cases, your LLC may not protect you from potential lawsuits. Even limited liability has its limits, and should it be found that the LLC was not run 100% in accordance with the rules and regulations you can be at risk of legal liability. It’s best to consult with a lawyer for more detail on the legal vulnerabilities your LLC may have. The action taken against LLCs in these situations is often referred to as “piercing the veil”.

The biggest risk with an LLC is that with certain loan agreements, you may trigger the “due-on-sale” clause causing the remainder of your loan amount to be due immediately. This often happens when the landlord transfers ownership of their rental property to the LLC while there is a loan outstanding on it and they have not discussed their intentions with the lender. If this clause is triggered in a time at which interest rates are higher, causing the property owner to be liable for a much higher amount.

Additional Factors And Considerations

Not every rental property you own will need its own LLC, but it’s good to think about how much equity there is at stake in case a lawsuit were to happen. Having multiple properties under a single LLC can put all of your investment portfolio in danger, while spreading them out under multiple LLCs ensures that all your eggs are not in one basket. Under the LLC umbrella, you’ll also need to keep any rental real estate separate from your house flipping projects.

You’ll need to consider whether to file the LLC in the state the rental property is located in, versus your home state. When you move a registered LLC to another state it is considered to be a “foreign LLC” which is allowed to conduct business but will need to register as such. Additionally, foreign LLCs have to maintain a registered agent in each state they are active in and maintain that state’s filing and reporting requirements.

One of the biggest benefits of registering an LLC is the tax benefits and deductions that can be made on LLC business activities. However, you do not necessarily need to register an LLC to be able to write off expenses – if that’s your major motivation for registering one. The chances are good that many of the actions you take with your property can be deductible without needing to register a legal structure. It’s best practice to do more research about creating an LLC in your state and to pay careful attention to the entity fees, maintenance costs, and other expenses that will apply from formation all the way through to dissolution.

Final Thoughts

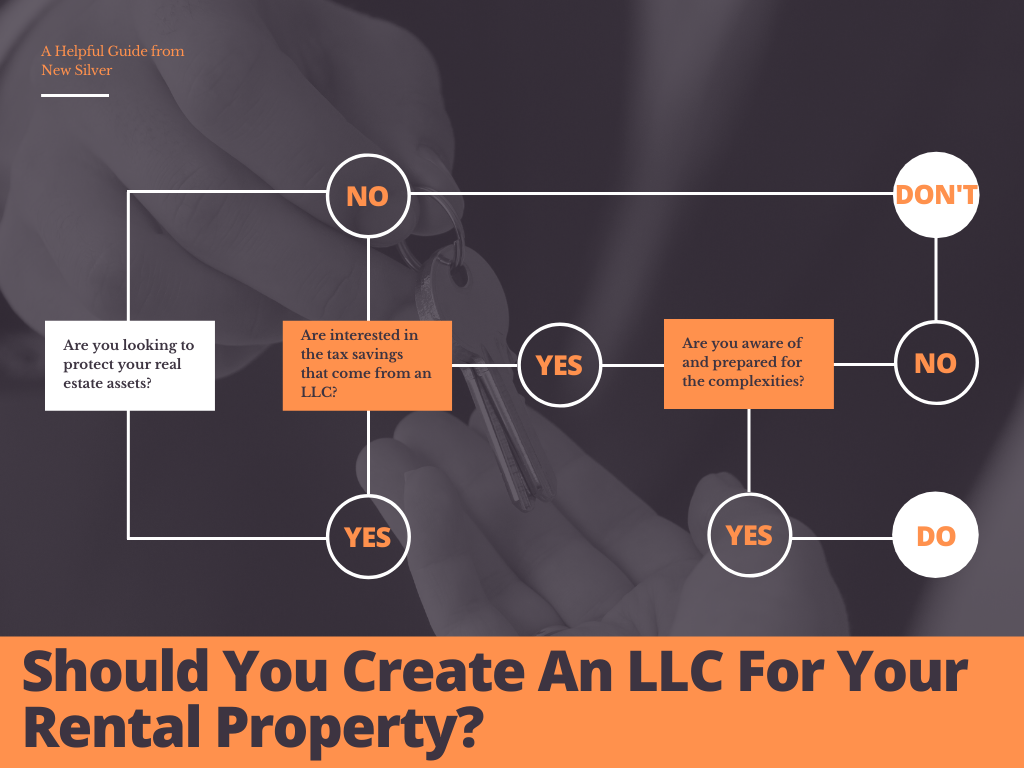

With all the above laid out, it’s time to answer the ultimate question: should you create an LLC for your rental property? The answer is that it will largely depend on your situation, your location, and your investment goals. There are many benefits to investing in real estate under an LLC structure, which is why it has become such a popular option with investors.

However, this doesn’t mean you will be protected from all liabilities and challenges. As many advantages as there are, LLCs can also quickly become complex to manage even for “safer” real estate investments such as rental properties. In addition to that, LLCs are not the only business structure available that is suitable for use in rental homeownership, and it’s up to the landlord to do their homework and find the option best suited to their circumstances.

An LLC can be beneficial for landlords and other rental real estate investors if approached from an informed perspective. These benefits cannot be overlooked, particularly in a situation where there are multiple partners. Just be sure to keep any lenders and tenants in the equation informed if you do decide to transition a property to LLC ownership.