There are a number of benefits associated with being a good landlord, including massive a boost to your net worth, evergreen passive income, and the ability to fund your retirement. In this post, we outline some of the best benefits that you can look forward to, while also listing some of the biggest challenges you can expect to face by taking ownership of an income property.

Table of Contents

Best Benefits of Being A Landlord

1) A Passive Income Source That Can Last A Lifetime

Of all the benefits of being a landlord, a lifelong supply of passive income is probably the most enticing. Provided you invest in an area with decent demand for rental properties and a stable economy, it is perfectly reasonable to expect an investment property to generate rental income for decades.

Even it takes some time for the property investment to become cash flow positive, once it transitions to this status, a landlord effectively becomes the owner of an evergreen source of income.

2) The Option to Sell When Market Conditions Are Optimal

There’s one golden law that all successful property investors follow with religious dedication. Buy low and sell high. However, when market conditions take a turn for the worse, it can be difficult to follow this rule, especially if you are impatient, prone to emotional decision making or under immense financial strain.

Fortunately, having a good tenant can help ease the financial burden of servicing the mortgage during tough times. This can make it much easier for you to weather the storm, even if it takes years for the property market to start trending upwards again.

If the history of real estate market crashes is anything to go by, the housing market will bounce back in time, allowing you to sell in favorable conditions for maximum profit.

3) Property Appreciation Can Massively Increase Your Net Worth

In real estate investing, equity is the difference between the value of the property, and the outstanding debt on the mortgage. In other words, if a property is worth $250,000, and the remaining balance of the mortgage is $150,000, you have $100,000 of equity to play with. This counts toward your total net worth.

More importantly, the equity available to a rental property owner tends to increase over time for two reasons.

- The Property Appreciates over time: Using the same $250,000 property mentioned earlier, if it were to appreciate by 5% over the course of the year, it would be worth $262,500, with an equity increase of $12,500. As the years pass by, your equity in the property will start compounding.

- The tenants pay off the mortgage: Even if your property isn’t cash flow positive from the outset, the income from your tenants can make massive dents in the capital owed on your mortgage. As the mortgage debt decreases through the rental payments, the property equity increases. Over time, this can lead to a very small (even non-existent) mortgage, and a very valuable property which you can continue to rent or sell for massive boost to your net worth.

4) Rental Properties Can Help Fund Your Retirement

Some people may not realize that when using equities and shares to fund retirement, you need to sell a small percentage of your portfolio each year to fund your living costs. This arrangement works well if your portfolio continues to grow at a faster rate than it is shrinking (due to the portion you sell each year).

However, with rental property investment there is no need for you to sell any part of your portfolio, provided your property is cash flow positive and your total income exceeds your total expenses. Instead, you can watch the annual rent increase year on year, while your net worth continues to grow as the property value increases.

5) Inhabitable Land Is A Limited Commodity

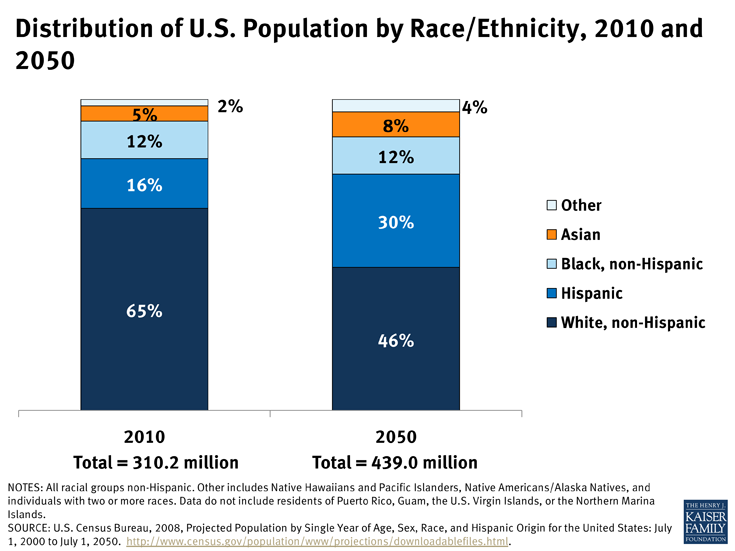

Simply put, there is a limited amount of inhabitable land on the planet, while the world population continues to expand. When combined, these two forces are effectively increasing the scarcity of residential property. The net result is that property prices should continue to rise for decades to come, while making it increasingly difficult for new buyers to enter the market, primarily due to the increasing cost of property.

To add some context to this argument, it’s worth considering that the US population was 308,758,105 in 2010, rising to 328,239,523 by 2019, and increase of approximately 20 million people. Moreover, the US population is predicted to exceed the 400-million mark by 2060, with additional 79 million people to form part of the US population.

As a landlord, you can benefit from the famous adage that it’s not about ‘timing the market’ so much as ‘time in the market’. The earlier you get into property investing, the sooner you can start reaping the benefits of appreciation. Conversely, if you leave it too late, property prices could rise beyond the point of affordability.

6) Numerous Tax Deductions & Benefits

Owning a rental property introduces a number of tax benefits that you can unlock without having to worry about tax evasion. More specifically, you can deduct the following rental property expenses:

- Property Taxes

- Certain Maintenance & Repairs

- Property Depreciation

- Mortgage interest

- Buildings and contents insurance

- Accounting expenses

- Cleaning and gardening services

- Other Professional services

- Utilities and property insurance

Just keep in mind that the rental income generated by the property is considered taxable income, and the capital portion of the mortgage repayment doesn’t qualify for tax deduction (ie the tax benefit is limited to the interest portion of the loan).

7) You Have A Fallback Property In Case Of An Emergency

If the covid-19 pandemic has taught us anything, it’s that the US and world economy is less predictable than we sometimes like to think. Black swan events will continue to happen, causing temporary turmoil until the market re-stabilizes.

As a landlord, it is comforting to know that if things take a turn for the worse with your business, job or retirement portfolio, you will always have a property that you can turn to in case of an emergency. Naturally you would still need to respect the rights of your tenants, but the point is, the option to move into the property will always exist while you are the owner.

8) Annual Rental Increases

In addition to property appreciation, it is also common to increase the monthly rent of your property once a year. Over time, this can have a huge impact on the cash flow status of the property, without any risks to the landlord.

In addition, the effect of inflation makes a fixed mortgage repayment more affordable as time passes. When combined, annual rent payment increases and a stabilized mortgage payment make the joys of being a landlord even sweeter. The total cash flow the property produces will increase, while the mortgage becomes increasingly more affordable. That’s an attractive proposition for any real estate investor.

9) You Can Use An Agency To Do Almost All The Work For You

The last benefit of being a landlord is that are not legally obliged to do any of the work. Instead, you can outsource the management of your property to a property management company. This is particularly useful if you have multiple properties, have limited time, or lack confidence in your landlord abilities.

Of course, a property management company will reduce the profitability of your rental property, but if you want the investment to be truly passive and you can afford the dent in your net profit, it’s definitely worth considering.

Cons of Being A Landlord

1) Vacancy Rate

There’s a good reason most rental property calculators include a field for vacancy rate. As a landlord, you will face periods without tenants. This is so common; investors have to build the expected vacancy rate into the long-term profit projections of the property.

It is something you need to be aware of, and you need to have the cash reserves required to manage the property’s expenses (including the mortgage) while you search for a more reliable tenant.

2) Bad Tenants

While having no tenants is one of the biggest problems a landlord can face, having a bad tenant can be worse in some cases. This is a list of some of the most common problems that you can run into when dealing with terrible tenants:

- Late payments and inconsistent payments

- Poor hygiene practices that leave your property absolutely filthy

- Damage to property

- Squatters that move in without any intention of ever paying you a cent

- Secret subletting

- Pets finding their way into non-pet friendly homes

- Excessive complaining to landlord (borderline hypochondriac tenants)

- Tenants that bother, annoy and aggravate other tenants

3) Cash Flow Can Be A Challenge

It is important to note that not all rental properties are cash flow positive from the very beginning. In fact, it is quite common for real estate investors to purchase rental properties that are cash flow negative, knowing that they will only turn a profit when the property is eventually resold.

If this scenario applies to your rental property, you need to be able cover the difference between the monthly rent and the mortgage repayment. Naturally this situation can present cash flow challenges for the property owner.

To avoid taking on a financially burdensome property, it can be helpful to follow the 1 % rule. According to this rule, you should only invest in rental properties that can generate rental income that equals or exceeds 1% of the property’s value. In other words:

- $100,000 property must generate $1,000 or more rental income

- $200,000 property must generate $2,000 or more rental income

The main benefit of following the 1% rule is that it greatly enhances the likelihood of the property being cash flow positive (although it is not an absolute guarantee)

Alternatively, you can focus on purchasing properties that are relatively inexpensive, and then make additional lump sum payments toward the bond in order to transform the property into a cash flow positive asset over time.

4) Legal Risks & Liabilities

There are three major legal risks that you face as a landlord, together with plenty of other smaller risks that you might not even be aware of. This is the number one risk that you face as a landlord:

What Happens If Your Tenant Gets Injured On Your Property?

According to the National Safety Council, 53.6 percent of all injury-involved accidents occur at home. In most cases, if the injury is minor and it wasn’t caused by a property fault, the landlord is unlikely to be contacted. However, if a property related issue is found to be the cause of a major personal injury to one of your tenants, you could find yourself in a very precarious legal position.

To prevent a legal nightmare from becoming tangible experience, the best thing you can do is ensure that all the required safety certificates and safety tests have been completed for your rental property. While it may cost some money initially, the onus is on you to be intimately familiar with landlord and tenant law. Building adequate legal protection into the lease agreement can save you a fortune in legal bills and obligations if anything untoward should happen to one of your tenants.

5) You Are Responsible for Property Maintenance, Repairs & Emergencies

There’s a good reason many landlords end up outsourcing their responsibilities to a property management company. Maintaining a rental property will rob you of time and mental energy.

When you enter a financially binding legal agreement with a tenant, you take on direct responsibility for all major upkeep and maintenance duties. While there may be quiet periods where you go undisturbed, there will also be times when a string of property issues crops up. You have to be ready, willing and able to fix these issues as quickly as possible, especially if you have a demanding tenant that has the power of the law on their side.

6) Rental Properties Aren't Very Liquid

You need only look at the impact of covid-19 on the real estate industry to understand how illiquid properties can be. Where stocks, mutual funds and real estate investment trusts (REITs) can be sold within days (if not hours), selling a property can take months.

According to Zillow, ‘ the average time it takes to sell a house is 55-70 days in the U.S’ Moreover, it could take even longer to sell if the market conditions are poor or the house still needs a bit of work.

In other words, it could take anywhere from 2-6 months to actually sell your house, and it’s not unheard of for certain properties to be on the market for longer than this. Ultimately, this is one of the unavoidable risks of being a landlord.

Final Thoughts

In the end, being a successful landlord holds a number of powerful rewards that can dramatically improve your net worth and provide extra income on a monthly basis for years and even decades to come.

However, you may also encounter a number of challenges along the way, including tenant turnover, late rent payment, legal issues that aren’t covered by the lease and other landlord responsibilities that can consume time, money and mental energy.

Regardless of these challenges, becoming a real estate investor can change the course of your financial life and greatly increase the likelihood of having enough money for retirement.