One of the most important aspects of real estate investing is financing. But traditional lending may not work in every situation and you may choose to go with a private lender instead. Here is a closer look at private money lending and how to find private investors for real estate.

Table of Contents

What is a Private Investor For Real Estate?

A private money lender is an individual or company that uses personal funds to finance an investment – in this case, a property. While many real estate investors choose to secure financing from a traditional lender such as a bank, there are certain circumstances where this may not be feasible. For instance, if you are looking to flip a house, a conventional mortgage loan with an early repayment fee probably isn’t the best solution.

Private money lenders often offer more flexible terms or other benefits that may be attractive to investors. It’s up to the discretion of the lender to set the terms of the loan, as they aren’t under the same kinds of regulatory pressures as a traditional lender. As a result, private money lenders typically charge higher interest rates than banks, but they can also offer more flexibility and other key benefits that can be beneficial to certain investors.

Private Investing Companies vs. Private Investing Individuals

There are two types of private lenders: companies and individuals. Anyone with the funds available can become a private lender as long as both parties agree to the terms of the loan. So, an individual private lender could be a friend, relative, neighbor, business partner, or colleague.

There are also companies that specialize in private lending. These are not banks, but private businesses that offer alternative financial products that have key benefits for real estate investors. They will also typically have some underwriting standards, but they won’t usually be quite as strict as a bank or other institutional lender.

How the Process of Working with Private Investors Works

The process of working with a private lender will vary depending on the circumstances of the loan and the relationship between the two parties. The nature of private lending is that it’s up to the lender and borrower to agree on the terms of the loan. So, the process may be different depending on the scenario.

If you choose to get a loan from a private lending company, it will likely be similar to working with a traditional lender, but with different loan terms. Whereas if you are borrowing from a close friend or relative, the process may be even more informal.

As a real estate investor, the first step is to decide who you are going to borrow from and where they are getting the funds. Perhaps the lender already has the cash on hand or perhaps they are pulling the money from a retirement account or tapping into the equity on their own home. It’s important to establish where the funds are coming from before you agree to anything, so there are no surprises.

Other than that, it works just like a traditional mortgage. Both parties will sign a contract agreeing to the terms of the loan and repayment schedule. No matter how familiar you are with the lender, you should always sign a contract before you take any money – otherwise, things could get messy later on.

How to Find Private Investors for Real Estate

There are several ways that you can find a private real estate lender for your next investment opportunity.

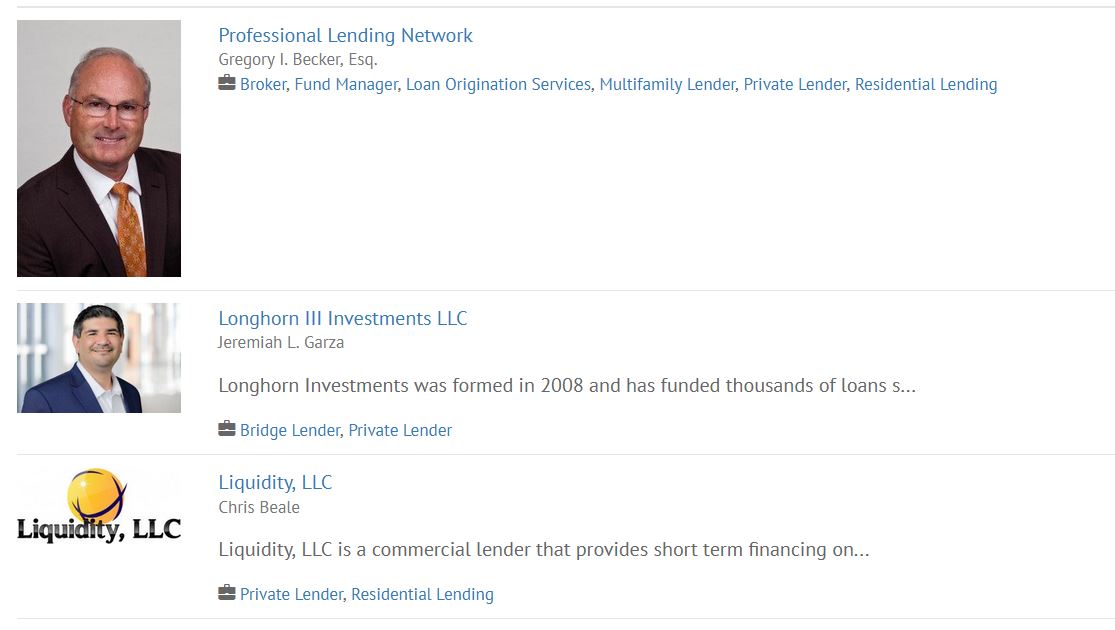

1. Use The American Association of Private Lenders: If you are based in the United States, you will be glad to know that there is an online database of private money lenders that you can tap into with ease.

As you can see from the screenshot above, it’s fairly easy to find private money lenders on this platform.

On this point, it’s worth mentioning that New Silver Lending LLC is an official member of the American Association of Private Lenders, and we offer extremely fast closing private money loans.

2. Do a Google Search: Just like any other business, many private lenders advertise online. This will only help to find private lending companies that may not be quite as flexible as an individual lender. But this is a good place to start, so you get a sense of what is available and what kinds of interest rates are standard.

3. Networking: Networking is key to real estate investing, no matter what kind of funding source you’re after. You can start with your personal network and see if there is anyone you know who may be interested in funding your real estate project. Attending local real estate events, conferences, workshops, and other business functions is also a good way to get your name out there and meet potential investors.

4. Cold Calling: If networking isn’t working out, you should try a more direct approach and reach out to investors in your area through cold calling. You can find a list of local investors through a local real estate brokerage or by searching public records. You’ll probably have to make a few phone calls to find someone who is interested, but you’d be surprised at how effective this method can be.

5. Use LinkedIn: There are a large number of reputable private real estate investors that have a LinkedIn profile. For instance, here is the profile of Kirill Bensenoff, whose company is dedicated to helping investors source capital for real estate.

There is nothing preventing you from reaching out to people like this. Also, if you have a professional LinkedIn account, it can greatly enhance the speed and efficacy of your outreach efforts.

Private Investor vs Hard Money Lender

Hard money lending is another type of alternative financing that many investors use to finance investment property. A hard money lender will usually offer most of the same benefits as a private money lender. However, there are a few key differences.

Hard money lending refers to a loan that is secured by an underlying asset – in most cases a property. So, the value of the property is what determines the loan amount. There are typically no credit or income requirements. If the borrower fails to repay their debt, the asset can be repossessed and sold. Hard money lending will typically carry higher interest rates because there is more risk for the lender, but this can be another way to finance a real estate deal if you’re in a pinch.

Private money lending, on the other hand, is more based on your relationship with the lender, whether it’s someone you know personally or a company you’ve contacted. The main difference is that hard money lenders will work with anyone who meets their criteria, whereas a private lender may be more exclusive and only work with you once you’ve proven yourself.

Benefits of Using a Private Investor for Real Estate

There are numerous benefits to using a private investor to finance a real estate investment. The biggest benefit is the flexibility of the loan terms when compared to a conventional loan.

When you obtain financing from a traditional lender, there is very little flexibility with the terms of the loan because the institution has to meet certain underwriting standards and regulatory requirements. A private money lender is not held to those same standards, so there is much more room to negotiate and customize the loan terms to meet your needs.

Another major benefit of a private money loan is that you likely won’t be required to meet certain credit or income requirements, especially if you know the lender personally. This can be useful to those with bad credit or self-employed individuals who may be deemed more of a risk to traditional institutions.

- Flexible loan terms

- Ability to negotiate terms

- Less stringent credit requirements

- Willing to fund properties if there is obvious potential

Risks of Using a Private Investor for Real Estate

There are also a variety of risks when it comes to using a private investor to finance a real estate project.

A private lender may charge a higher interest rate because they are assuming more risk. Or they may want a larger cut of the profits. While they may believe in your hustle and work ethic, private lenders are assuming a bigger risk than a bank. They likely don’t have a huge balance sheet or other deals they are working on, which could offset the loss if you don’t repay. So, they may try to neutralize that risk in other ways to ensure they make their money back.

Plus, if you borrow money from someone you know personally, it may damage your relationship if things don’t work out. Sometimes business and friendship don’t mix and if the deal goes south, you may lose a close friendship in addition to your time and money.

- Higher interest rates

- Will repossess the property the repayments aren't met

- You can put your personal relationship at risk

- Might take longer than expected to source funds, depending on which investor you use

Final Thoughts

No matter where you obtain financing, you should always do your due diligence and have a solid business plan before you agree to anything. But private lending can be a smart option for real estate investors, especially if traditional lending doesn’t make sense for the project you’re working on.

Lastly, if you struggle to find a private real estate lender, a hard money lender is usually the best alternative. In addition to being quite easy to find, hard money lenders offer very quick access to finance, together with legal protection for both parties involved in the investment opportunity.

FAQ

Entering the real estate market can be a rewarding venture, but there are times when joining forces with another investor is the smart move. Here’s when partnering up might be the right choice for you:

Lack of Funds: Suppose you discover a promising property but find yourself short of the necessary capital. In such cases, teaming up with an investor can boost your financial leverage, enabling you to finalize the purchase you have your eye on.

Diversifying Experience: If you’re eyeing commercial properties but your current expertise lies solely in residential real estate, collaborating with an experienced commercial investor can bridge this knowledge gap. This partnership can provide the expertise needed to navigate new territory.

Time Constraints: Have the finances but not the time or ability to manage properties? Consider a partnership where you supply the capital, while your partner handles day-to-day operations. Such arrangements allow you to stay involved in real estate without the management burden.

Real estate agents are not just valuable for finding homes; they’re also instrumental in connecting you with potential investors. Here’s how they can assist:

Extensive Industry Networks

Real estate agents maintain vast networks filled with industry professionals. Their contacts often include real estate investors, making agents a perfect intermediary when you’re on the hunt for investment partners.

Insider Knowledge

Agents possess in-depth knowledge of the market. This expertise allows them to identify investment opportunities that align with your goals, and they can introduce you to investors who might be interested in partnering on promising ventures.

Access to Exclusive Listings

By working closely with agents, you gain access to exclusive listings and off-market deals. These opportunities often attract investors looking for unique investment prospects.

Professional Relationships

Agents build strong relationships with developers, property managers, and other key players in the real estate sector. This network can be pivotal in finding investors who have a keen interest in specific property types or areas.

Strategic Advice

Finally, real estate agents can offer strategic advice tailored to your investment pursuits. They can guide you through the complexities of investment deals, helping to attract investors by highlighting the potential returns and benefits of your proposal.

Whether you’re an individual looking to expand your investment portfolio or a developer seeking project funding, leveraging the connections and expertise of a real estate agent can be a game-changer in finding the right investors.

Creating comprehensive property profiles can significantly draw in potential investors by making projects more transparent and enticing. Here’s how:

Enhanced Clarity: Investors want to know all the details before making commitments. Offering expansive profiles with precise information ensures they understand the project’s scope, reducing ambiguity and making them more comfortable in proceeding.

High-Quality Visual Appeal: Integrating stunning, high-resolution photographs presents properties in their best light, sparking interest and providing visual context that written descriptions alone can’t convey.

Comprehensive Information: Including detailed data such as location specifics, market analysis, and potential growth forecasts can showcase the value and opportunities a property holds.

Trust Building: A well-structured profile demonstrates professionalism and earnestness, helping to build trust and credibility with potential investors who are keen on seeing a project’s transparency upfront.

By utilizing detailed profiles, you offer investors a clear, attractive, and honest look into your property opportunities, increasing the likelihood of engagement and investment.

Institutional investors are powerful players in the financial world, commanding vast resources and capital. These entities include pension funds, insurance companies, endowments, and mutual funds. Their influence extends across various sectors, with real estate being a key focus area.

How Institutional Investors Engage in Real Estate

Capital Powerhouses: With substantial financial reserves, institutional investors have the ability to undertake large investments. This often means they target sizeable real estate projects such as commercial buildings, hotels, and large residential complexes.

Portfolio Diversification: Real estate serves as a crucial component in their investment portfolios, providing diversification from stocks and bonds. This helps in not only spreading risk but also stabilizing returns.

Seeking Long-Term Gains: Unlike individual investors looking for quick returns, institutional investors are driven by long-term strategies. They typically focus on assets that promise steady income over time, like rental properties or lease agreements.

Market Influence: Due to their significant investments, these investors play a pivotal role in shaping real estate trends. Their decisions can dictate market directions, impacting property values and development.

Professional Management: Institutional investors often employ expert teams to manage their real estate assets. These professionals ensure that the properties are well-maintained, maximizing value and returns over time.

By leveraging their substantial financial power and expertise, institutional investors are central figures in the real estate market, driving development and innovation in the sector.