A short summary

Being a successful real estate investor involves finding the right properties. Purchasing foreclosed properties is one of the most popular real estate investing methods for those looking for the best deals. If you’re wondering how to find foreclosed homes for free, we’ve got 5 useful methods below.

Key Topics

Real estate investing boils down to finding the right deal for your strategy so that you can make the biggest profit. This usually entails finding properties that are selling for less than market value, in order to fix them up and then sell them or rent them out. The tricky part comes when you’re trying to find these properties. One of the most popular methods is to look for distressed homes, such as those that are in foreclosure. To help you find foreclosed homes for free, we’ve put together a list of useful websites and methods.

How to find foreclosed homes for free online

While real estate investors often want to find the best deal, it can be difficult to find foreclosed properties. So, here are 5 of the most popular websites to find foreclosed properties for free…

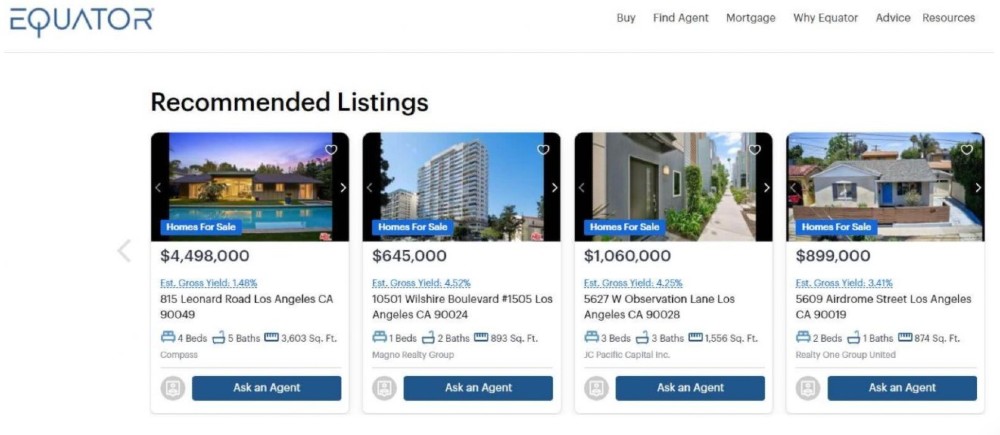

1. Equator.com

This free online software for real estate professionals, vendors, and investors features a database of foreclosures, short sales, and open market listings that are available through the Hubzu auction marketplace. Equator has a useful search feature which makes it easy for buyers to filter properties according to their investment strategy, making the entire process more streamlined and efficient. The database also shows detailed information on the property, such as the home price, taxes and contact information of the listing agent.

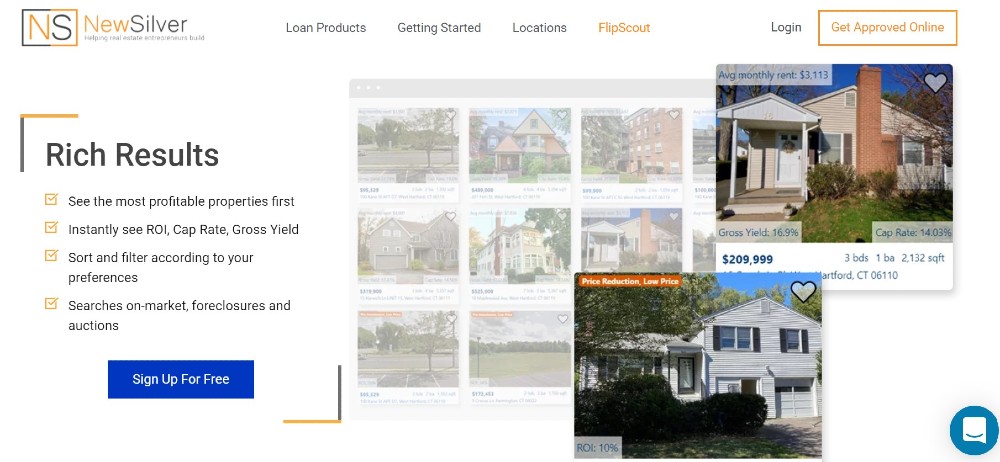

2. FlipScout on New Silver

New Silver offers a free and easy-to-use tool for real estate investors to find their next investment property using filters. FlipScout uses property technology to provide detailed insights on each property that is listed, including the ROI, cap rate, gross yield, and more. FlipScout aims to assist real estate investors to find the most profitable deals in the form of properties listed on the market, foreclosed properties and auctions. One of the biggest benefits to FlipScout is that you can filter by location and foreclosed properties. There is also an array of investment calculators available, such as the rehab cost calculator to help real estate investors make more informed decisions.

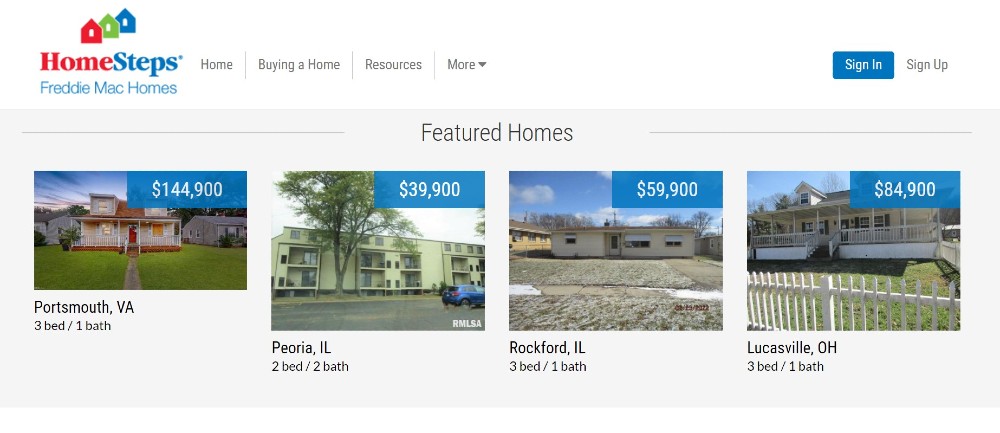

3. HomeSteps.com

The Federal National Mortgage Association, known as Fannie Mae, offers this free tool for real estate investors to browse through thousands of homes that are in foreclosure. HomeSteps is one of the largest websites in the US to use for finding homes in foreclosure and the platform lists single-family homes, condominiums, town homes and duplexes across the country. HomeSteps uses listing brokers and third-party vendors as part of the sales process.

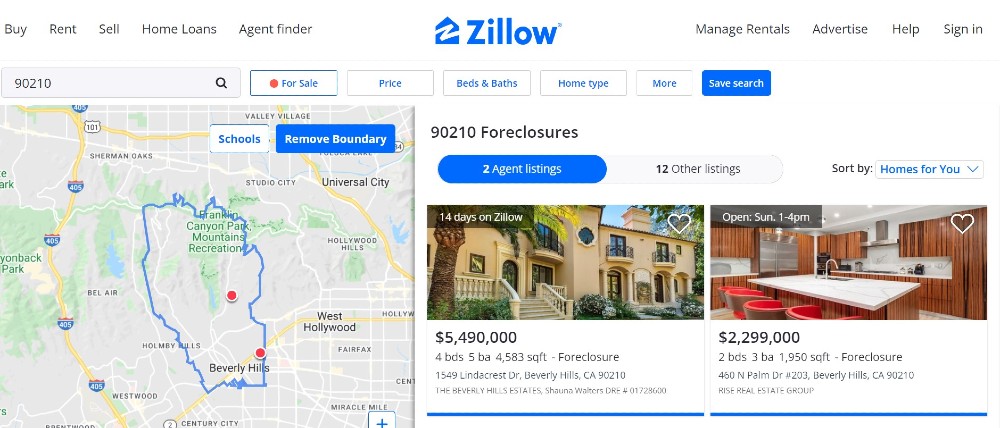

4. Zillow Foreclosure Centre

The well-known property listing portal has its own search for properties in foreclosure specifically. Real estate investors can tailor their searches exactly to their needs by using the location or cost of the property. On the results page, you can then filter according to the home type, number of bedrooms and bathrooms and more. Zillow also offers a map for easy location viewing, which you can remove the boundary from, to extend your search radius. It’s a completely free tool with thousands of listings available and you can save your searches.

5. Realtor.com

Not only does Realtor.com offer real estate for sale, but amongst these listings you can find properties that are in foreclosure. You can also find property records and take virtual tours of the properties once you’ve found a deal that you’re interested in. Realtor.com is run by the National Association of Realtors (NAR) and includes basic information on each property, including the number of bedrooms, size in square footage and the address. The site doesn’t offer you the ability to bid on any properties that are up for auction, however you can contact the agent involved.

How to find foreclosures in my area for free

- Browse bank websites

Foreclosed properties that are owned by banks are often listed by the applicable bank on their websites, so this is a good place to start looking for foreclosures by filtering the search according to your area. Listings can be limited on these websites, so bear that in mind. If this is the case, you could also check Fannie Mae and Freddy Mac websites, as these websites often purchase mortgages from the banks.

- Find government-owned listings

The Department of Housing and Urban Development has foreclosed homes listed on their website, and this is another way to look for foreclosed homes in your area at no cost. These foreclosed homes are owned by the HUD. Real estate investors can find properties in distress on this website and make an offer via the agent listed on the property. The catch here is that homes are sold as is, and there will be no repairs or fixes made to any homes on the website.

- Check the county records

Your county will have information on record for the houses that are foreclosed and some of this is also posted online. You can usually search for these using the applicable ZIP code, or provide the county office with the ZIP code and find further information there. There will usually be some sort of bidding procedure which you’ll need to follow for these properties.

- Browse foreclosure-specific platforms

The likes of Auction.com and RealtyTrac are good examples of the kind of specific foreclosure platform that real estate investors can use to find foreclosed homes. Some areas have foreclosure sites specific to their location, so you can check your area for these. For example, ForecloseHouston.com is specific to the Houston area.

- Find sheriff’s sales

Foreclosed properties are often put on auction at the local sheriff’s sales or at auction houses. You can find sheriff sales on the sheriff’s department websites or in the local newspaper, or you can look up private auction houses that are located in your area. You can also look at auction websites like Hubzu or Auction.com to find sheriff sales.

What is the best way to find foreclosures?

The best strategy for finding foreclosure properties is to look in various places. A variety of search methods will open up more avenues to find good deals. Each investor has a different plan in mind for their journey, and it’s important to take this into account.

If you’re looking for free foreclosures, the methods above are a good place to start. You’re likely to have more success by starting on websites that have more foreclosed properties available and moving onto less popular platforms thereafter.

For investors who’d prefer not to have serious competition, their strategy could be to use the less common avenues to find foreclosed homes first. It all comes down to each investor’s strategy and budget, which determines the best way to find foreclosures.

Additional ways to find foreclosed homes

- The MLS (Multiple Listing Service) is a go-to for many real estate investors and home buyers and sellers to find listed homes. Finding foreclosed homes is no different, and you can easily do this through the MLS or other real estate websites.

- Asset management companies are another resource for finding foreclosed homes. Some banks and lenders sell their foreclosed properties via asset management companies instead of doing it themselves. Companies like Keystone Asset Management, TREO and Bankers Asset Management.

- Trusty real estate agents are another way to find foreclosed properties. They may have some homes in mind already, and they’re likely to point you in the right direction.

Final thoughts

Once you’ve weighed up the pros and cons of buying a foreclosed home and decided to go ahead, there are a variety of ways to find foreclosed homes, and many of them are free which makes it easier for real estate investors to get their foot on the property ladder.

However, bear in mind that if you’re finding a good deal on these platforms, others may be as well. Which means that you’ll need to make sure that your offer beats the competition. One way to do this is to secure your financing ahead of time and get a proof of funds letter so that you can ensure that you’ll be able to finance the property and prove that you’re a serious buyer.