The Short Answer

The main reason foreclosed homes are cheaper is because lenders want to recoup the loan balance of the property as quickly as possible. Pricing foreclosure homes below market value increases the likelihood of making a quick sale. Once the property is sold, the lender can recoup the outstanding loan balance and get the property off their books entirely.

Owning real estate is a great way to build long-term wealth. Whether you are purchasing a home to live in as your primary residence or to buy as an investment property, real estate ownership comes with various financial advantages. When you are looking to purchase a home, buying a foreclosed home is a great option to consider. Foreclosed properties are those in which a prior owner defaulted on their mortgage payment and the bank took back possession. Once they have taken legal title, the bank then tries to sell back the home to the public. The process of buying a foreclosed home can be different from purchasing other homes and there is a lot to understand about this process.

What Is The Benefit of Buying Foreclosed Homes?

The main benefit of buying a foreclosed home is that you can potentially purchase the property for less than the true market value of the home. In other words, it presents the opportunity of purchasing a property for a discount.

Because lenders are under pressure to sell quickly, they effectively become motivated sellers. If they are presented with an offer that affords them the opportunity to cut their losses, it makes perfect sense for them to take it.

Remember, the end goal of the lender is not to make a profit. Instead, the objective is to recoup the loan value by executing a quick sale.

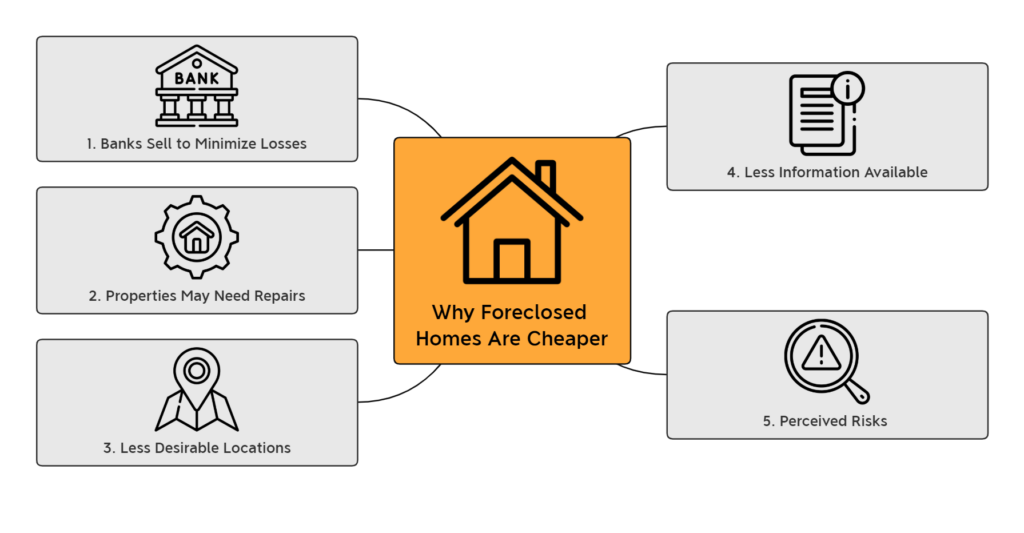

1. Banks Sell to Minimize Losses

When wondering why are foreclosed homes cheaper, one of the main reasons to understand is that banks are looking to sell foreclosed properties to minimize their losses. A foreclosed home is one in which the bank had to take the title back from a borrower that defaulted on their home loan. As opposed to trying to maximize the sales price of the property, the main focus of the bank is to get the home off their books and cover their costs as much as possible. Due to this, a bank will often list a home for a lower price than the standard market value. This is one of the main reasons why property investors search for foreclosed homes with potential.

2. Properties May Have Repair Problems

Foreclosed properties can also be more affordable because the homes may have significant repair problems. Homes that have gone through the foreclosure process often will have had an unpaid mortgage for six months or more. In many cases, the property owners are aware that they will be losing the home and therefore do not have a financial incentive to keep up with maintenance. There are also situations in which a foreclosed homeowner will strip out appliances, cabinets, copper wires, and other parts of the value of the home. In the end, this can leave the new owner with significant repair needs, which can lead to a reduced purchase price.

3. Less Desirable Locations

There are also situations in which a foreclosed home will be located in a less desirable location. Before going through the full foreclosure process, a formal owner will likely want to try and sell the home to recoup any equity that they still have. If they went through this process and were unable to sell, it could be an indication of challenges in the location. This can result in a lower purchase price when compared to other properties available for sale.

4. Less Information Available

As a real estate investor, you may also find that a foreclosure sale comes with less information to review than standard homes. With a normal sale, it is common for you to receive a home disclosure report in which the seller will acknowledge any issues they have had with the property. When buying a foreclosure, you will likely not receive any disclosures as the bank is selling the home and will not have the same knowledge as the prior owner. Also, many foreclosure properties will not come with a survey, which will require you to pay for it on your own. The lack of information increases the risks and costs of buying the home, which will reduce the market value.

5. Perceived Risks

Overall, foreclosed homes are often cheaper because there are many perceived risks that come with buying a foreclosed property . A lot of property investors will avoid homes in the foreclosure process as they are concerned about the property condition and other factors that can be challenging to deal with in the future. Due to these risks, there is a smaller pool of potential buyers, which decreases total demand and will lead to a reduction in the final sales price.

Key Steps To Follow When Buying A Foreclosed Home?

If you are going to purchase a home, getting a foreclosure property can be a great idea. These properties tend to come with lower purchase prices and can provide great value. While there are advantages of buying a foreclosure, there are some risks as well. There are several things you should do to ensure you make a good purchasing option.

A) Complete A Thorough Inspection

Having a property inspection completed is a normal part of buying a property, and it is something you have to do when buying a foreclosure. You should hire a home inspector that you trust and complete the tour with them. This will give you better insight into what the total repair costs will be. It may also be a good idea to have additional inspections completed to assess the structure, roof, plumbing, and other valuable parts of your home.

B) Get Your Financing In Order

If you want to buy a foreclosed house, you need to ensure you have your financing in order. If the foreclosed property is in a good location and will have multiple offers, knowing you have financing lined up is important. In many cases, purchasing in all-cash is the best way to guarantee your bid will win. However, you can also finance the purchase with a mortgage. There are both conventional and FHA mortgage products that can be used to buy a foreclosure. The process for buying a foreclosure is not too much different, but the banks may complete additional diligence to ensure you are making a good purchase decision.

Final Thoughts

As you are looking to purchase a new home, investing in a foreclosed house can be a great idea. Foreclosed properties tend to be more affordable for several reasons and can offer great value. There are several things you should do leading up to the purchase to ensure you make a great purchase decision.

Lastly, if you want to find foreclosed homes online, check out our resource which lists the best foreclosure website. It is a great resource for finding foreclosure listings.