Wholesaling real estate is a good way to get exposure to the property market with lower risk than buying a home outright. This method of investing describes a process of finding a real estate investment opportunity and selling the right to buy that opportunity to another real estate investor.

Table of Contents

By acting as the middleman, you don’t have to take on any significant risks because you don’t have to pour tons of investment capital into renovations. With a lower barrier to entry than buying a starter home, becoming a successful wholesaler is a great way for new investors to jump into real estate.

That being said, this method is not always risk-free or successful, and it’s important to have a clear idea of what the process of wholesaling property requires. You don’t want to end up taking on bad deals or wasting valuable time that could have been invested elsewhere. If you can be consistent and know the steps to take, however, the chances are good this can be an additional stream of income for you.

Keep reading to find out how to start wholesaling , how much money you need to get started and whether it’s the right investment strategy for you:

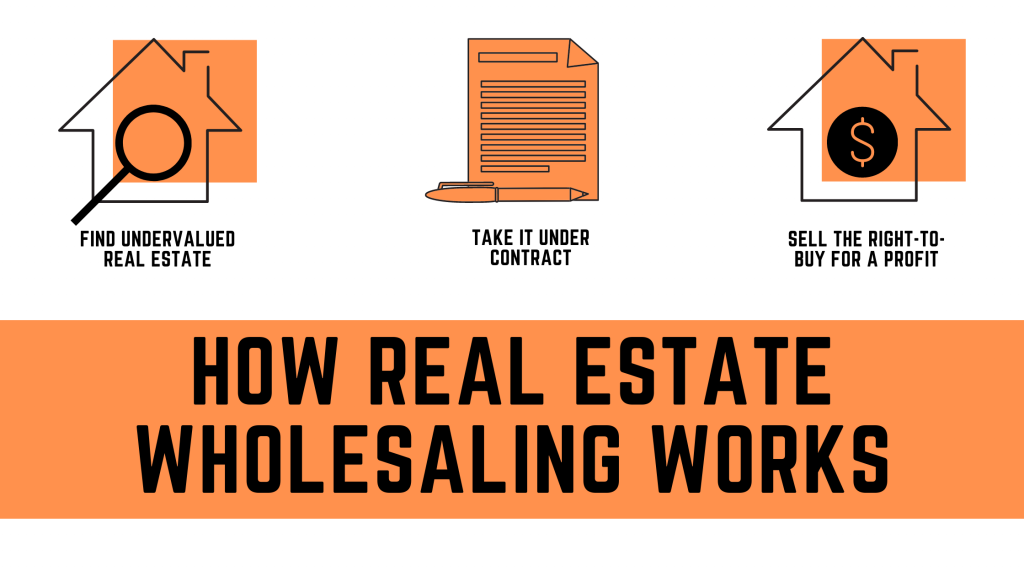

How Real Estate Wholesaling Works

When wholesaling real estate, you will typically look for a property that is below market value and take it under contract. You then sell that contract-to-buy to someone interested in buying the home and make a profit from the sale. In other words, you aren’t actually purchasing the property outright. You are simply purchasing the real estate contract that gives you the right to sell the property to a potential buyer at a price that the property owner has agreed to.

On this point, it is worth noting that FlipScout can potentially be a good resource for finding properties to wholesale. You can learn more about FlipScout here.

How does wholesale real estate work?

The wholesaler makes a profit by finding a buyer willing to buy the property at a slightly higher amount than the seller is looking for, taking home the difference when all is said and done.

This short-term investing strategy allows you to make money from the sale of the property without having to take ownership of it and pour capital into the property rehab. In fact, some wholesaling deals are closed within just hours, making it one of the fastest real estate transaction options out there. What makes this strategy even more attractive is that there is no required license or course you need to take to get started – it’s good people skills that will take you far here.

The agreement used in a wholesaling deal is usually referred to as a “purchase and sale agreement”. When the wholesaler takes on this contract, they are obligated to locate a buyer to take the property sale off their hands. The goal for wholesalers is to complete this process before the contract to sell the property expires. No funds are transferred between the wholesaler and the seller until a buyer has been located.

On this point, it is also worth noting that some investors are able to achieve success remotely, through virtual wholesaling.

This article also goes into more depth about how real estate wholesaling works.

How Much Money Do You Need To Start Wholesaling?

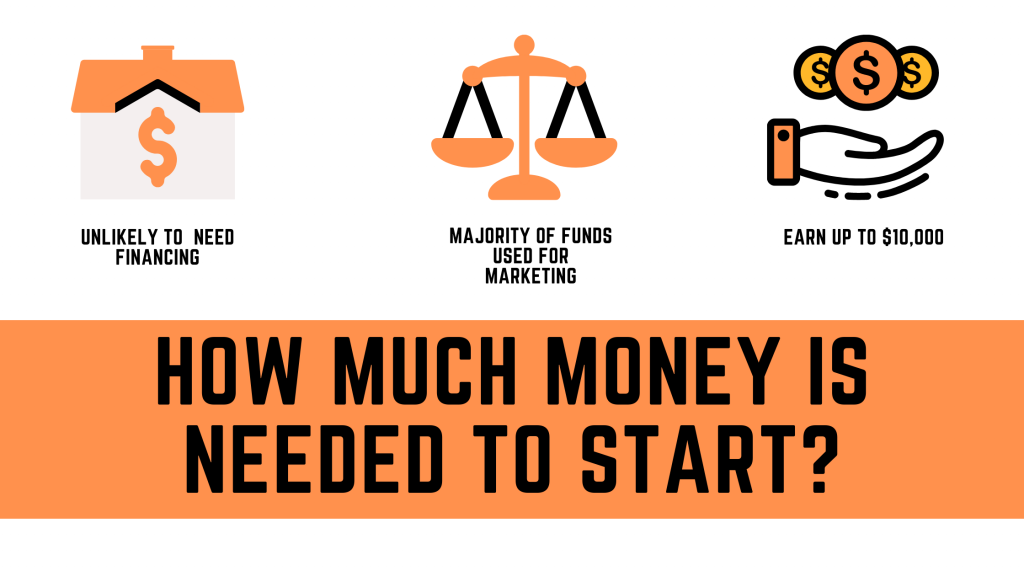

Since the profits made from wholesaling deals can be made so quickly, it’s natural to wonder how much start-up capital you need to become a real estate wholesaler. The good news is that unlike the process of buying a home outright, you probably won’t need external funding or even a good credit score to launch a property wholesaling business.

The majority of the funds you will need will be for the purpose of marketing your wholesaling services to motivated sellers, and marketing properties to potential buyers. For beginner wholesalers, it’s recommended to start with as many free marketing platforms as possible and build up your strategy from there.

Some wholesalers prefer to work with a partner that is able to inject additional funds into marketing campaigns. This is beneficial in terms of reaching more interested buyers but has the disadvantage of not being able to retain all the incoming capital yourself and splitting profits instead. The trade-off could be worth it however if your partner can contribute real estate expertise and introduce you to their existing network.

The amount you will make from each contract will be highly dependent on the deal. Your end goal is to buy a property undervalue and someone willing to buy it. The gap between those two is the amount of money you can expect to make from the deal. As you improve in the wholesaling game, you’ll be able to find better deals that have higher potential for profit.

With the above in mind, it’s not uncommon for private wholesalers and wholesale real estate companies to earn between $5,000 and $10,000 for each contract, with some deals going higher with a bit of luck. This also means that you need spend less than $5,000-10,000 during each deal, in order to make a profit.

Considering that this type of real estate investing doesn’t require any money down from the wholesaler, no credit or loans are needed and the wholesaler can focus solely on finding a cash buyer. Should the deal not go their way, they will only be out of pocket on their marketing expenses.

How To Start Wholesaling

While you won’t need a huge amount of capital to start whole saling real estate, you will need to prepare some capital that can help you find opportunities and buyers. There are several steps that will need to be followed if you want to launch a career as a wholesaler. Your success will be directly dependent on your ability to talk to investors, generate interest in selling properties and setting up purchase offers. Having a certificate from a real estate school can be an advantage when chatting to buyers, as it can help verify your wholesaling expertise.

It will be essential to establish a presence in the area you plan to wholesale in. You want to make sure your details are out there and familiar to people because the majority of deals will be found through word of mouth in your network. Building up that a solid and reliable network of property investors, real estate agents and house flippers is what will take up most of your time and require the most dedication. Wholesalers can make use of a variety of marketing platforms to build leads, including direct mail, phone calls, social media, and much more.

Once you’ve gotten the word out to your network, you’ll need to find a property to take under contract in order to complete your first real estate deal. Looking for a distressed property is a good place to start, as these homes often have owners who fall into the motivated seller category. The additional bonus of targeting distressed homes is that they are likely to be sought after by house flippers , especially if it’s in the right location. The important thing with these places is to get an idea of what renovation costs are estimated to be before approaching potential buyers.

When looking for a wholesale property, it’s important to know what type of offer to make. You don’t want to go too low and lose out on the deal, and you don’t want to go too high, or else you won’t be able to find a potential buyer for the home at the end of the process.

The biggest reason why people decide to sell their home through wholesalers is that the wholesaler can take on the burden of selling the home, for a very reasonable fee. By taking on the responsibility of selling the property, you alleviate a lot of the stress that the individual selling their home would usually have to take on themselves. If you are able to convince them that working with you is advantageous, you’ll soon find yourself repeating the process and becoming an experienced wholesaler.

Knowing The Wholesaling Risks

Wholesaling houses may be an easier entry into the real estate market than buying homes, but that doesn’t mean that these transactions are without risk or that things always work out the right way.

Many new wholesalers make the crucial error of going into these transactions without taking the time to get the financial basics down or do their research about the neighborhood. You need to know what properties go for on average, and look into the median cost of renovation. You have to crunch all the numbers before getting out there and approaching homeowners with the suggestion to sell. Having your financial data prepared and on-hand will help you to stick to your budget and ensure you can find a buyer later.

Real estate wholesalers will sometimes include a special clause in their purchase contract that allows them to cancel the agreement should a buyer not be found before the cutoff date. This limits the wholesaler‘s risk to an extent, but still costs them a lot of time. The worst-case scenario is that a buyer backs out, as is their right. You might not lose funds on the deal but you will lose all the time spent on finding that buyer and marketing the deal only to have to start over from scratch. You might not be able to find a buyer before the date specified by the purchase agreement. These outcomes are especially key to be aware of as someone new to the business.

It’s also worth mentioning that while deals can play off quickly, the work that goes into them won’t. Setting up your network, building up leads, and finding deals will be a long and ongoing process without a guaranteed income. You may have to keep your primary job or do something part-time to support yourself while you establish your network and complete your first few successful deals.

Final Thoughts

Learning how to start wholesaling is a relatively low-risk way to get exposure to real estate investing without having to pay for home renovations, or fork out a huge amount of capital to pay for a home. What makes a successful property wholesaler is consistency, people skills, and a lot of patience. It takes some time to set up a network of buyers that you can go to with the deals you find, but it’s worth the effort in order to be able to close purchase agreements quickly.

As much as wholesaling property is considered to be about buying and selling, it’s really more about marketing. You’ll need to know your numbers, but more than that you need to get the message out about what you do and add interested individuals to your professional network for upcoming deals. This will see you explore advertising via direct mail, phone, social media platform, and email to get to your target market.

Like any business, wholesaling has pros and cons. The absence of required licenses makes getting started in wholesaling more straightforward, and the notable risks typically taken on during renovations fall away. Ultimately, wholesaling real estate is a great way to get familiar with the real estate industry and earn the funds you need to explore other property investment opportunities in the future.

If you can’t wholesale after this, it might just be fear that is holding you back. On this point, it’s worth mentioning that you can approach real estate wholesalsing with a very frugal mindset. If you choose to do it this way, the biggest risk is sinking your time into a business project that may or may not pan out. When viewed from this perspective, wholesaling might seem less daunting and less risky than you initially imagined.

FAQ

For instance, a business is able to write off all the marketing costs and administrative fees associated with a wholesaling deal. This can greatly reduce how much tax you are liable to pay during each successful deal.

In a word, NO. You don’t need a real estate license to wholesale real estate and you don’t need to become a real estate agent. However, it may be in your best interests to form good relationships with real estate agents in your area, as they may be able to help you sell properties if you are finding it difficult to connect with potential buyers.