Welcome to the revealing results of our comprehensive House Flipping Survey for the year 2023. Flipping houses continues to be a lucrative strategy for real estate investors, with an impressive 9% of all real estate transactions in the US in the first quarter of 2023 consisting of 72,960 single-family homes and condominiums being flipped, according to ATTOM.

To provide invaluable insights into the world of flipping houses, we surveyed over 200 real estate investors, aiming to answer the most pertinent questions in the field. In the following sections, we will delve into the wealth of insights we’ve gathered, offering a firsthand look at the challenges, strategies, and market outlook as shared by experienced real estate investors.

How Much Are House Flippers Making In 2023?

According to ATTOM data, while fix-and-flip profits aren’t as high as last year, flippers can still make great returns from these projects in 2023. Here are the potential profits that house flippers can generate this year, according to ATTOM data from the first quarter of 2023:

- Average Net Profit – $25,000-$30,000

- Average Gross Profit – $56,000

- Average Gross Profit – 22.5%

ATTOM Data shows that the average gross profit from flipping houses reached $67,900 in the previous year but declined to $53,500 in the fourth quarter of 2022. However, there is a positive trend in 2023, with the average gross profit rebounding to $56,000 during the first quarter. In Q1 of 2023, the average return on investment (ROI) for house flips stood at an encouraging 22.5%, highlighting substantial potential for real estate investors looking to leverage this lucrative strategy.

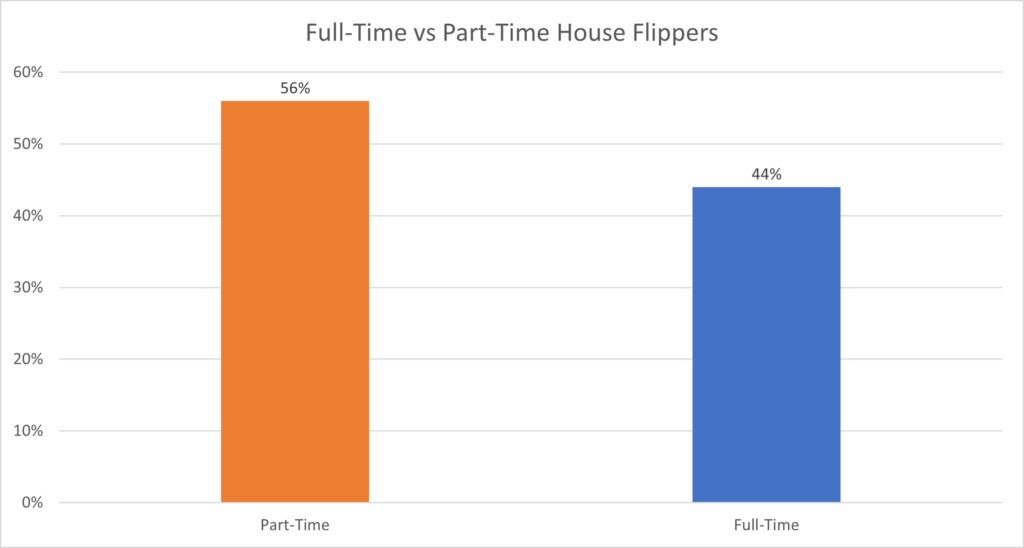

Full-Time vs Part-Time House Flippers

In the survey conducted by New Silver, we inquired about the professional status of the participating real estate investors. Among the 200+ respondents, 56% identified themselves as part-time investors, while the remaining 44% claimed to be full-time investors.

Traditionally, many house flippers begin their journey on a part-time basis, often juggling other commitments or jobs. As they gain experience and witness the potential profits, some transition into flipping houses full-time. This evolution underscores the dynamic nature of the real estate investment landscape.

Flipping houses part-time does come with a notable challenge: the renovation and sale process tends to take longer when investors aren’t available every day. However, it serves as an excellent starting point for investors, enabling them to accumulate knowledge and resources gradually.

Engaging in part-time fix-and-flip investing can be a successful means of supplementing income, offering busy individuals the flexibility to invest in real estate at their own pace, and providing newcomers with a gentle entry into the field.

Part-time house flippers typically undertake 1-2 projects annually, while their full-time counterparts manage between 2 and 7 properties per year. Nevertheless, these figures are highly contingent on individual factors such as availability, financial resources, and personal investment goals.

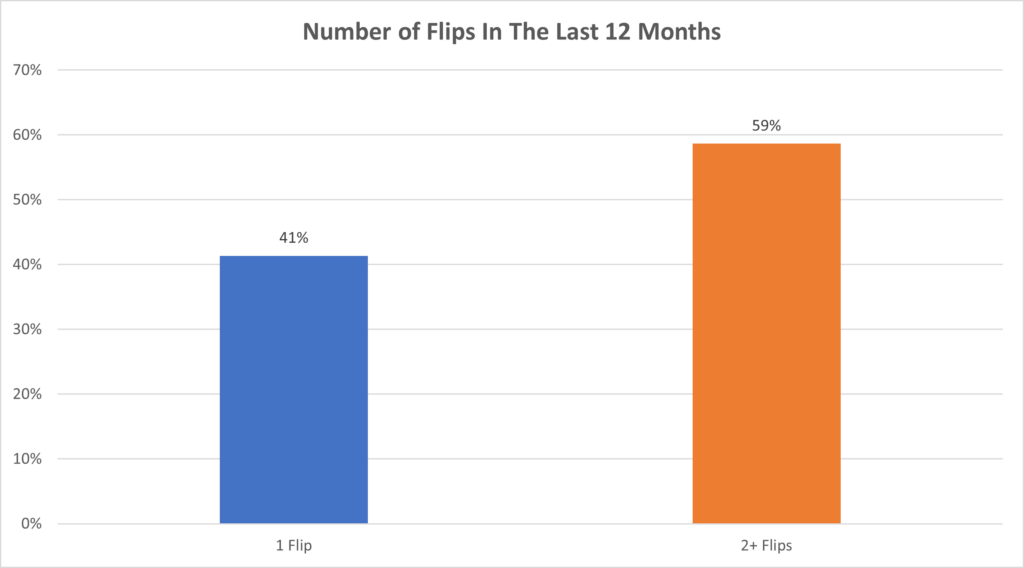

House Flips Per Year

In New Silver’s House Flipping Survey, respondents were asked how many house flips they had done in the last 12 months. The answers were as follows:

- One flip: 41%

- Two flips: 59%

Part-time house flippers often find themselves focusing on 1 or 2 flips per year. This limitation stems from the typical duration of house flips, which generally spans 4 to 6 months. Consequently, part-time flippers must carefully allocate their time and attention, restricting their capacity to take on more projects.

Remarkably, the survey conducted by New Silver revealed that a substantial portion of house flippers, including part-timers, manage to surpass this norm by flipping 2 or more houses annually. This trend underscores the potential for substantial earnings in the fix-and-flip arena while maintaining other professional commitments. It also suggests that exceeding the 4-house mark per year is attainable, especially for those skilled enough to handle multiple flips concurrently.

The number of properties one can successfully flip within a year hinges on various factors, such as available capital, market competitiveness, property availability, and the resources allocated for the renovation process. When these conditions align favorably, it opens the door to flipping more houses in a year, particularly if multiple projects are executed simultaneously.

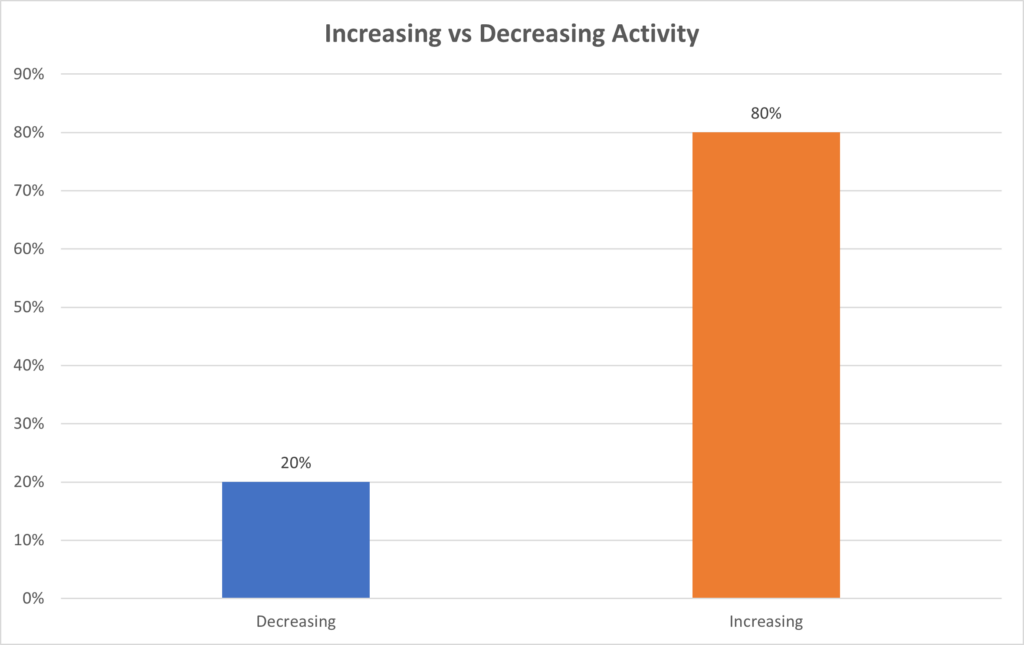

Is Flipping Houses Still Viable In 2023?

The vast majority of house flippers in New Silver’s survey indicated that they intend to flip more houses in the next 12 months than they have in the last 12 months. With a whopping 80% of flippers indicating that they anticipate their profits increasing over the next 12 months. While only 20% indicated that their profits are likely to decrease over the next year.

We can see that active house flippers have a particularly optimistic outlook on the fix-and-flip industry currently and going forward. While the US economy has been a rollercoaster ride for investors and fix-and-flip profits declined last year, this has begun to balance out this year. The overall sentiment amongst house flippers is extremely positive, with indications that they are going to continue investing in real estate and flipping houses, and that they predict their profits rising over the foreseeable future.

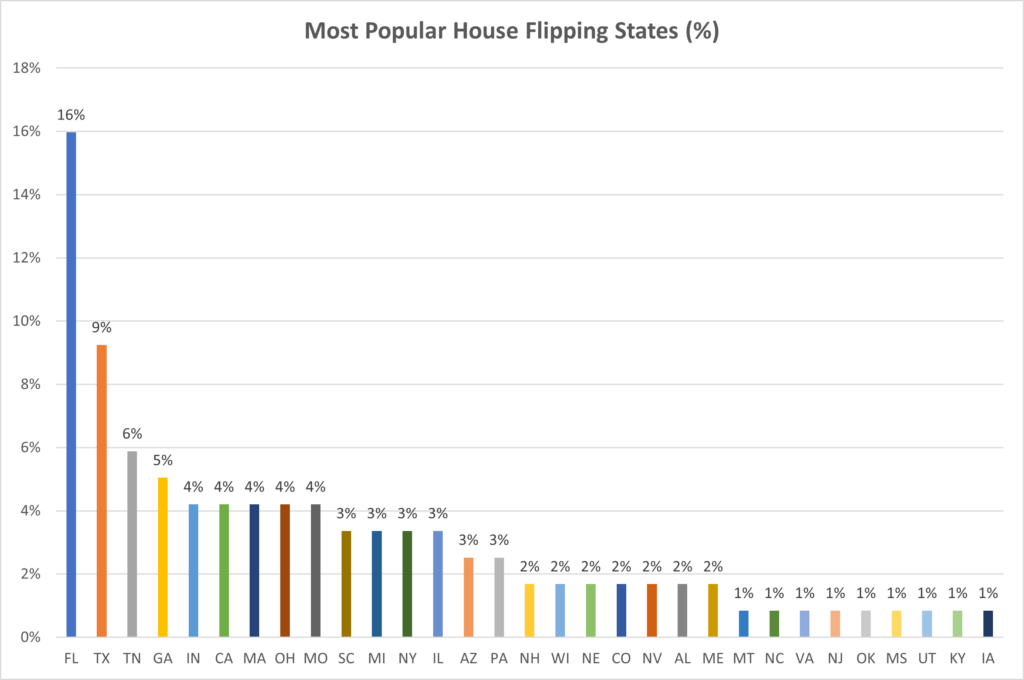

Most Popular States To Flip Houses

When it comes to flipping houses, some states offer investors a much higher return on their investment thanks to various factors in the local real estate market. Some of these important factors are the demand for homes and the price of homes, which impact both the profits that can be made and the likelihood of the home selling quickly. According to New Silver’s survey, the following states are the most popular amongst house flippers:

- FL 16%

- TX 9%

- TN 6%

- GA 5%

- IN 4%

- CA 4%

- MA 4%

- OH 4%

- MO 4%

- SC 3%

- MI 3%

- NY 3%

- IL 3%

- AZ 3%

- PA 3%

- NH 2%

- WI 2%

- NE 2%

- CO 2%

- NV 2%

- AL 2%

- ME 2%

- MT 1%

- NC 1%

- VA 1%

- NJ 1%

- OK 1%

- MS 1%

- UT 1%

- KY 1%

- IA 1%

According to the survey respondents, Texas and Florida are two major hotspots for flipping houses. Why is this the case? Let’s take a closer look at each market.

Florida

Florida is widely considered one of the top real estate markets in the US this year. With cities like Tampa, Jacksonville and Miami topping many lists of hot housing markets. According to Redfin, home prices in Florida were up 1.5% year-over-year in July 2023. The median home sale price in Florida is currently $404,100 and the median days on the market is 40. Redfin stats show that 16.5% of homes in Florida sell for above their listing price. The number of homes sold in the state is a staggering 31,889 which indicates the strong real estate market to be found in Florida.

Texas

Texas is also considered one of the best real estate markets in the country, by many experts and real estate professionals. Cities like Austin and Dallas propelling the state to the top of the real estate market lists for 2023. The median sale price of homes in Texas is $356,200 according to Redfin, while the median days on market is 34. Redfin indicates that 18.2% of homes in Texas are selling for above their listing price, which indicates a robust real estate market. Ideal for real estate investors.

Challenges With Flipping Houses In 2023

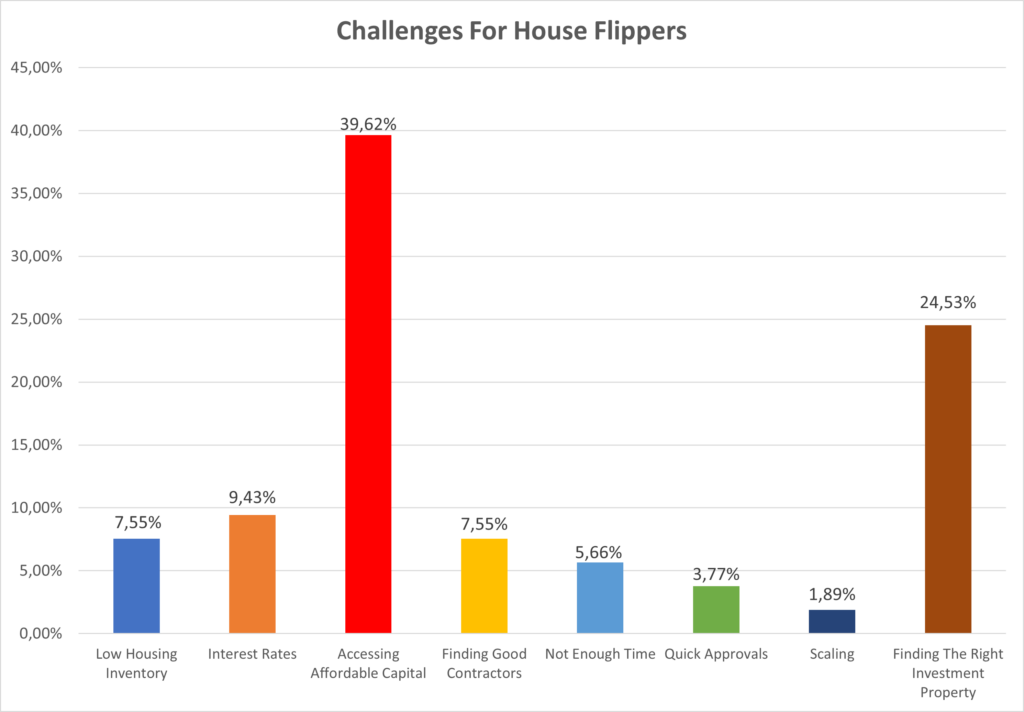

When it comes to flipping houses, there are various challenges that can arise. New Silver asked the respondents which challenges they found the most difficult to deal with and the resounding answer was the ability to access affordable capital. Let’s take a look at each challenge in more detail.

Low Housing Inventory – 7.55%: As we know, location is one of the most important aspects to real estate investing. Areas with low housing inventory can become a major concern for house flippers, as scarcity of available properties can lead to fierce competition and inflated prices.

Interest Rates – 9.43%: Interest rates play a pivotal role in determining the profitability of a house flip. As rates fluctuate, so do mortgage and loan rates, which impacts the amount that investors are paying towards the purchase and renovation of their house flip. As such, investors must carefully plan their financing strategies as interest rate fluctuations can have a major impact on the success of a house flip.

Accessing Affordable Capital – 39.62%: Of all the challenges facing house flippers currently, the ability to access capital is considered the number 1 challenge by house flippers. Flipping houses doesn’t generally lend itself well to traditional loans, which means that investors need to find other ways to borrow money. These alternative financing options can be difficult to assess to find a reliable alternative. In this case, New Silver can offer house flippers a reliable and faster alternative to traditional loans.

Finding Good Contractors – 7.55%: Renovations are at the heart of flipping, and finding reliable contractors can be a headache. Quality work that is within budget and happens on schedule is the gold standard, but not always easy to achieve. Good contractors are vital to the success of any fix-and-flip project, and as such this can be a challenge for some investors to find.

Not Enough Time 5.66%: Successful fix-and-flip investing demands careful planning and execution. Balancing a full-time job or other commitments with the demands of a flip project can be overwhelming. For house flippers, this isn’t the main challenge that they face, but it can be a tough one to manage.

Quick Approvals – 3.77%: Speed is of the essence when flipping houses. Being able to make quick decisions, get fast funding, and make swift changes is of utmost importance to beating the competition to secure a good deal and create a successful project. Unfortunately, not all financing partners are as quick with their funding as New Silver, which can slow down the process and cause investors many headaches.

Scaling – 1.89%: As house flippers grow their real estate investment portfolio, scaling can be a logistical challenge. Managing multiple projects simultaneously requires efficient systems and a well-organized team. However, this is the smallest challenge that house flippers are facing.

Finding the Right Investment Property – 24.53%: The second most daunting challenge for house flippers is finding the right investment property that will provide a good return on investment. Identifying properties with the right potential for profit, in neighborhoods with growth potential, can be a time-consuming process. So, for house flippers this can be a large challenge.

Final Thoughts

The landscape of fix-and-flip investing in 2023 is undoubtedly promising. The statistics speak for themselves, with an impressive 9% of all real estate transactions in the first quarter involving flips. This demonstrates the continued allure and profitability of this strategy for real estate investors.

What’s even more encouraging is the sentiment we’ve captured from the real estate investors we surveyed. The majority of them expressed a positive outlook, with high expectations of increased profits as the year unfolds. Their optimism stems from a combination of factors, including a keen eye for emerging market trends.

As we move forward in 2023, it’s clear that flipping houses remains a dynamic and viable avenue for real estate investors. With the right strategies, access to capital, and a data-driven approach, there are ample opportunities for success in this exciting sector of the real estate market. So, for those considering or already engaged in flipping houses, the outlook is indeed bright, and the potential for profitability remains robust.