When it comes to real estate investing resources, there are a myriad of options available online and it can be difficult to choose between platforms. The best way to find out which platform is right for your unique investing needs is to do a deeper dive into what they offer. To help you with this, we’ll take a closer look at another top real estate software tool available to real estate investors today called BiggerPockets, and how this platform’s resources fare for investors.

Table of Contents

What is BiggerPockets?

Essentially, it’s an online community focused on real estate investing. With a variety of content available, various tools to use, and a community of over 2 million members, the platform has made quite a name for itself. BiggerPockets aims to bring both new and seasoned investors together with real estate experts, to foster a real estate learning environment.

There is free content available on the site, for those wanting to test it out or for new investors who are looking to start learning. If you’re more serious about investing, you can get paid account options which will give you access to different resources. Let’s take a closer look at the membership options and the features on the BiggerPockets platform that make this community stand out.

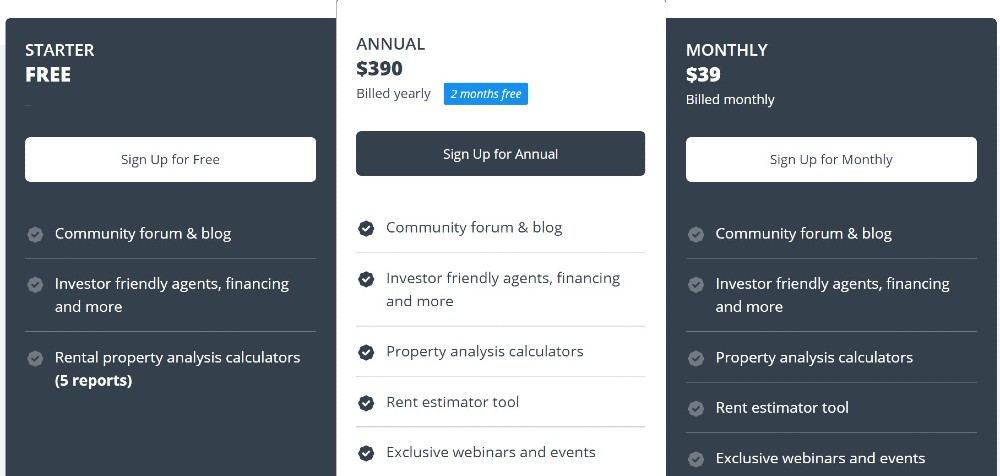

BiggerPockets Free vs Pro vs Premium - Membership Options Explained

- FREE: The BiggerPockets free membership will give you access to the community forum and blog, investor-friendly agents, financing options, along with rental property analysis calculators (which includes 5 reports). With materials centered around real estate investing at all stages of the journey, both new and experienced investors can gain free access to a plethora of materials on the website in the form of blog articles, webinars and podcasts as well as join topical discussions in the community forums to expand their knowledge further. The platform also features Ultimate Beginner’s Guides which are geared towards helping you understand the ins and outs of a variety of real estate topics.

- PRO: The BiggerPockets Pro membership comes in 2 forms, either a discounted annual fee of $390, or a monthly fee of $39, which works out to $468 annually. This option is for experienced investors who are looking to get access to pinpointed resources, a variety of investment calculators that can help you decide on your next deal, property management software which includes tenant screening capabilities, as well as access to the BiggerPockets marketplace where you can search and post listings.

- PREMIUM: The Premium membership is geared towards real estate agents, hard money lenders ad investment companies who are looking to grow their network and get more leads. Those with a Premium membership will have a company profile to showcase their business, be able to connect and network with qualified investors, message anyone you have connected with, run ads across the site and become a featured agent, get unlimited access to webinars on real estate investing and business management and list properties in the marketplace to find prospective buyers. A Premium membership will cost you $99 per month and require you to sign up for 12 months.

BiggerPockets Advantages

1. Huge selection of educational resources

The BiggerPockets podcast is a common place for real estate investors to get started, it features successful investors and will broaden your horizons into the world of creating financial freedom through real estate. Not only does the platform have this useful resource, but the other free resources on offer span through a variety of real estate topics, in the form of articles on the blog, webinars by real estate experts, and downloadable beginner’s guides. The platform covers a huge range of educational topics from setting real estate goals when you begin investing, to advanced tax strategies.

There are also a host of real estate books under the BiggerPockets label which cover topics like Flipping Houses, Managing Rentals and Funding Deals, to name a few. The Bigger Pockets bi-monthly Wealth magazine is on offer for investors to subscribe to, at $29.99 for a 1 year subscription. BiggerPockets also offers real estate investing courses like the BiggerPockets Introduction to Real Estate Investing, which is a four-hour course made up of 62 lessons to walk you through the basics.

2. Dynamic software

The BiggerPockets platform is a vast array of helpful tools using the latest tech to bring investors a host of different functions. Investors can use the Pro membership to essentially get access to a portfolio management platform where they can grow their investments. Annual members can get access to a lease agreement package which even includes lawyer-approved lease agreements, contracts and anything else a landlord may need.

Then there are the calculators, beautifully designed pieces of technology that give Pro members access to 8 different types of calculators (but more on these later). Vendors on the Premium package have access to in-depth analytics which they can use to connect with the right people.

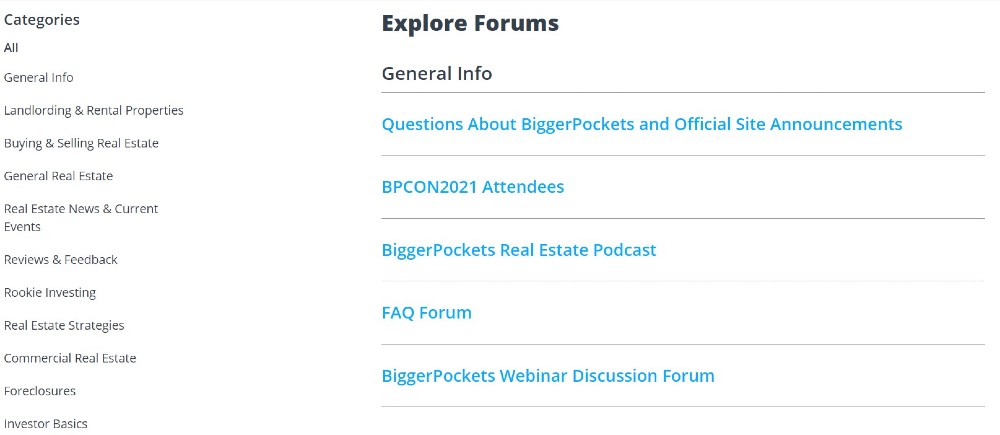

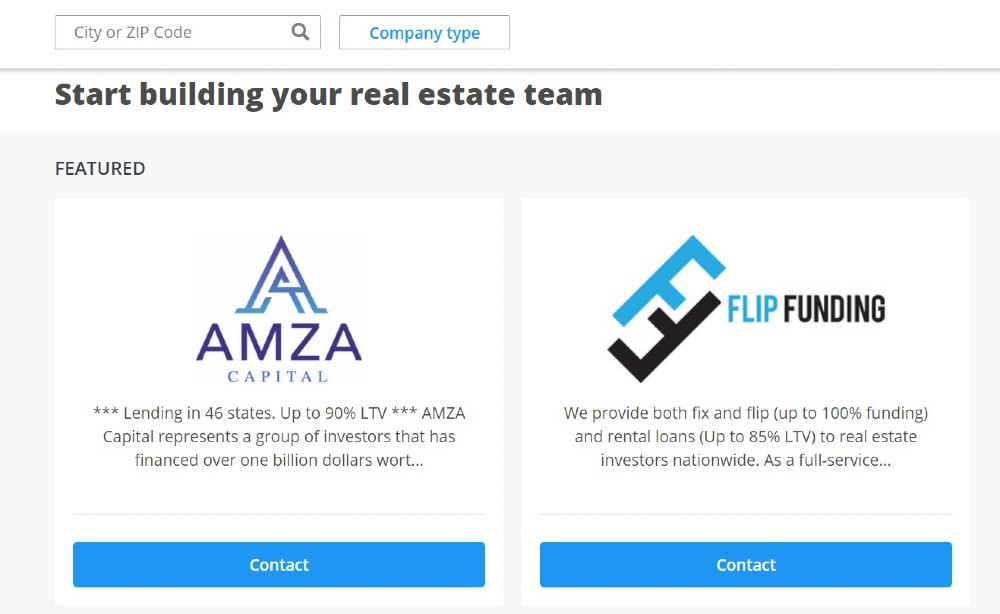

3. Easy to connect with other real estate investors

Whether it’s on the forums or through the Premium membership, the BiggerPockets platform is designed to help you connect with others in the real estate investing game, either to network or simply to learn more. They’ve done this well, by giving users the opportunity to have discussions in forums or connect via message on the Premium membership and network with other investors, agents and companies.

There are more exclusive and targeted forums available for those on the paid packages, which makes the platform ideal for both newcomers and experienced real estate investing professionals. A real estate investing community that is actively engaged and useful is hard to find but BiggerPockets has managed to achieve this successfully.

4. Variety of free features

Those who opt for the free option on BiggerPockets can still get access to variety of features. This is one of the biggest drawcards for the platform, as it encourages anyone to think about real estate investing and learn more from people who are already in the field.

The core of the website revolves around its access to free features like educational content, forums, The Real Estate Investing and Money Show podcasts and some property calculators. For those just starting out in the real estate investment arena, this is a great way to test the waters and get the low-down on how it all works.

BiggerPockets drawbacks

1. Forums aren’t fully reliable

As with many forums online these days, there are people who can be negative or are not on the forum with the same intentions as everyone else. The BiggerPockets forums are open to anyone who is a member, so there can be some pushy marketing attempts or people who may cause problems with others.

With the forums being open to all members, the information isn’t always 100% reliable as some people may not give accurate answers or responses. Members will need to fact check what they may see on the forums, particularly with regards to any legal questions.

2. Content can be biased

While BiggerPockets aims to educate on all things real estate investing related, their content can be a little biased. For example, their podcasts will often feature successful investors who will align to the message that BiggerPockets is aiming to portray. While this may all be true and accurate, it doesn’t show much of a balance in the content.

The platform aims to encourage people to begin investing in real estate, so their content is centered around driving this narrative and promoting inspirational stories. While newcomers also need a balanced idea about what real estate investing entails (the good, the bad and the ugly), this isn’t likely to come from a platform like BiggerPockets.

3. The cost factor

We’ve discussed that each membership comes with very specific features, and this may or may not be worth it. It largely depends on your real estate investing journey and what you’re in need of, however having to sign up to the Premium membership for 12 months can certainly be a drawback to the BiggerPockets experience.

Many people would prefer to trial a membership before committing to 12 payments of $99. While the Pro membership comes in much lower than that, it’s a yearly commitment with a once-off payment or a monthly commitment again, and these costs may not work for those who aren’t quite ready to jump into real estate investing.

Overview of BiggerPockets Calculators

Rental Property Calculators

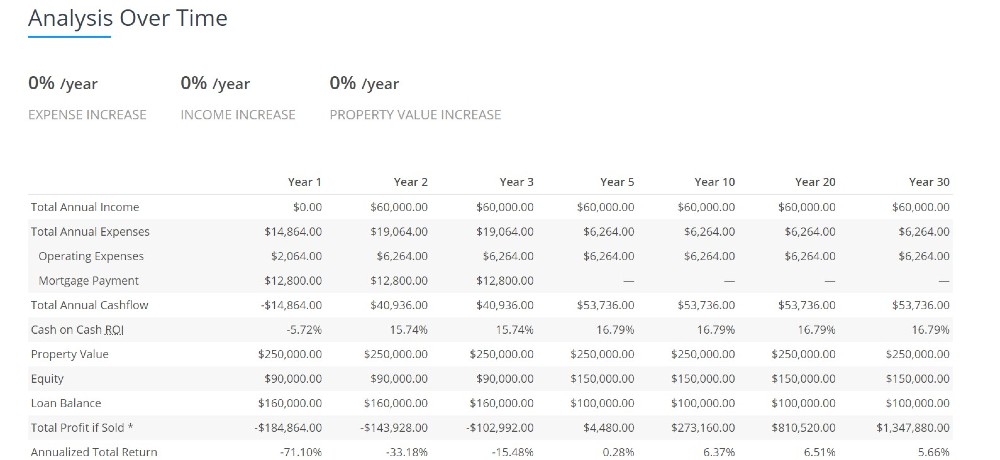

The rental property calculator is used to determine the profitability of purchasing a single-family, multi-family or commercial property to rent out. The calculator factors in the location of the property, the purchase price, your down payment, the details of your loan, the rental income and the expenses. The detailed analysis that BiggerPockets produces encompasses a breakdown of all the information plugged into each year, and what your return will be. Along with information on the 50% rule, and all of this mapped out into graphs and charts for clarity.

The BRRRR (buy, rehab, rent, refinance, repeat) calculator helps you evaluate the profitability of a potential fixer-upper property. This option has downloadable PDFs available for Pro and Premium members and can be used to plan for future expenses and estimate your potential monthly and annual cash flow. The results produced by this calculator feature a detailed look at your expenses, income, cash flow, and cap rate in the rehab period, initial rental period and with regards to refinancing. Then it provides an analysis over time up until year 30, so that you can figure out if your annualized return makes the deal worthwhile.

The mortgage payment calculator is straight forward and easy-to-use, to work out what your mortgage payment should be. It simply takes into account your loan amount and what period you’re paying it over, along with your interest rate, as well as any taxes or insurance. From there it works out what your monthly rental payment should be from the property.

House Flipping Calculators

The fix and flip analysis and reporting tool helps you estimate the potential profit you could make from a fix and flip house, so that you can make a more informed decision on your next property purchase. The results give you a succinct look into your purchase, sales and rehab costs, and give you an estimate as to what your repairs will add up to.

The rehab estimator calculator works similarly to the fix and flip one, to help you work out your total rehab costs. This factors in labor, materials, and factors in over 40 repairs, both interior and exterior.

The 70% rule calculator is based on the 70% rule of thumb which states that if you are buying a property to rehab, you should pay no more than 70% of the after-repair value, minus the repair costs and any other profits you need to make. This calculator will allow you to see where your purchase would fit into this.

Other Real Estate Calculators

The BiggerPockets wholesaling calculator is useful for those analyzing a wholesale property to purchase for house flipping or as a rental property. Printable PDFs can be created for lenders or partners if you’re on the Pro or Premium memberships, and you can estimate your cash flow or profit for a cash buyer. The results will tell you exactly what you can afford to offer on your desired property, in order to get the profit that you and anyone else involved may need. There is a breakdown of all the costs involved, along with the repairs and what the hypothetical profits would be for the next few months and years.

The AirBnb calculator is a handy way to determine how much money you could make from being an AirBnb host by estimating your rent and giving you all the information you need on how to become an AirBnb host.

Free Alternatives To BiggerPockets Calculators

New Silver offers a variety of real estate calculators that offer similar features to those enjoyed by BiggerPockets Pro Members.

FlipScout: FlipScout is a free search engine for property flippers. It lets you find properties that you can earn the highest return on when completing a fix and flip or fix-to-rent project. You can learn more about FlipScout here.

ARV Calculator: Quickly assess the After-Repair Value of a property with our user friendly ARV Calculator.

Rental Property Calculator: Workout the potential profitability of an investment property with our Rental Property Calculator.

Hard Money Calculator: To figure out the ROI of a fix and flip, you need a comprehensive Hard Money Calculator. It allows you to workout the monthly repayments, analyze net operating income, calculate the return on investment when you sell the property.

BRRRR Calculator: Each step in the Buy, Rehab, Rent, Refinance, Repeat (BRRRR) requires detailed analysis before you proceed with the deal. Fortunately our BRRRR Calculator breaks the process down into simple phases that are pretty easy to understand.

Home Appreciation Calculator: To workout how much your home will be worth in the future, you simply need to know the interest rate and how long you expect to hold the property for. With our simple Home Appreciation Calculator, you can workout the future value of your home very quickly.

Cap Rate Calculator: Cap Rate is a simple formula that helps investors work out how profitable an investment property is likely to be. Our Cap Rate Calculator makes this easy to do, in very little time.

Final Thoughts

BetterPockets could be a good place to visit if you’re thinking about entering the real estate investing game, already on your investing journey, or looking to connect and network with like-minded individuals. It’s free so you can easily give it a try and see if it’s worth your while, before committing to a payment. If you’re looking for a community and a variety of educational resources, there’s no harm in trying the BiggerPockets free option.

If you’re looking for more information on buying, selling, fixing and flipping properties and more, New Silver has a variety of educational articles on all of these topics. Along with the above-mentioned calculators and more, which are all completely free to use. New Silver is a great place for property investors to begin their education, calculate their costs and apply for a short-term loan for their purchase.