What Is Backflip Lending?

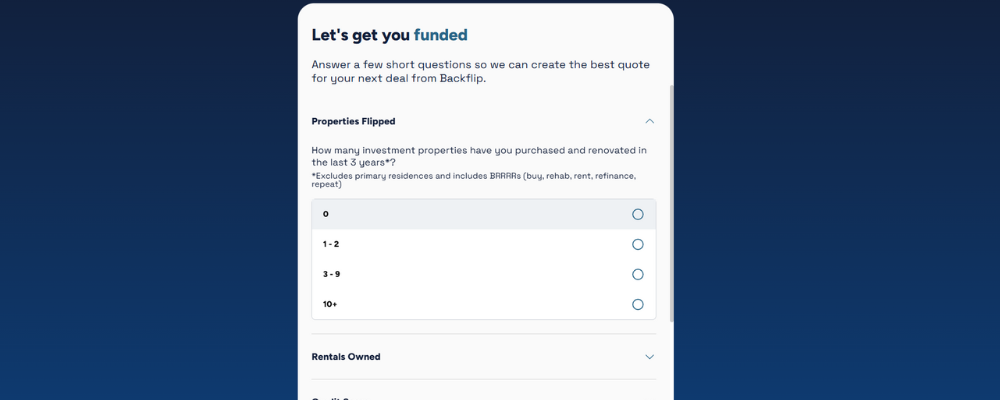

Backflip is a fintech lender that launched publicly in 2022 after being founded in 2020. The company specializes in short-term hard money loans geared toward residential fix and flip real estate deals. Rather than offering a broad suite of real estate loan products, Backflip is focused specifically on rehab lending, with an emphasis on speed and simplicity for the loan process, and investor tools.

As of 2024, Backflip has funded over $390 million in loans across more than 43 states. Headquartered in Dallas with an additional office in Denver, the company operates through its lending subsidiary, Double Backflip, LLC. What sets Backflip apart from traditional hard money lenders is its integrated platform—investors can access a mobile and web-based app that includes property analysis tools, comparable sales data, and curated deal leads.

This combination of lending and technology positions Backflip as more than just a capital provider. The platform is structured to support investors throughout the lifecycle of a flip, from evaluating the deal to securing funding. While it won’t be the right fit for every investor—particularly those seeking long-term rental financing or new construction loans—it may appeal to those who value speed, digital tools, and higher-leverage options for short-term residential projects.

Skip To

What Kind Of Loans Does Backflip Lending Offer?

Backflip’s lending model is centered on a single product: short-term fix-and-flip loans for residential real estate investors. These loans are designed to finance both the acquisition and renovation of 1–4 unit properties, typically with a resale or BRRRR (buy, rehab, rent, refinance, repeat) investment strategy in mind.

Loan terms usually range from 6 to 12 months, with interest-only payments and no prepayment penalties—giving investors the flexibility to exit early through a sale or refinance without incurring extra fees. Borrowers can finance up to 90% of the purchase price and 100% of the rehab budget, subject to a combined cap of approximately 75% of the property’s after-repair value (ARV). A minimum 10% down payment is required at closing, and rehab funds are typically held in escrow and released in draws.

Backflip structures its loans into three tiers, each tailored to different investor profiles and capital needs:

1. The New Standard

Aimed at first-time or newer investors, this option provides moderate leverage at Backflip’s lowest available rates.

- Interest rates start around 9%

- Maximum loan-to-cost (LTC) is 85%

- Requires a minimum FICO score of 640

- No previous project experience required

This tier is best suited for investors who can bring more cash to the table in exchange for better pricing and lower overall borrowing costs.

2. Double Double

This loan combines a first and second lien structure to offer higher leverage with partial interest deferral.

- Maximum LTC remains 85%, but structured across two loans

- Borrowers make no monthly payments on the second lien

- Interest rates start around 12.75%

- Minimum FICO score of 670

- Experience is required—generally at least a few completed projects

The second lien component allows borrowers to keep more cash on hand during the project, though the higher rate and structure may increase total borrowing costs.

3. Zero Gravity

This program is designed for experienced investors who want to maximize leverage and defer all interest payments until the project sells or is refinanced.

- No monthly interest payments for up to 6 months

- No upfront lender fees

- Interest is accrued and paid at payoff, which can improve project cash flow

- Requires a FICO of 670+ and prior flipping experience

This is Backflip’s highest-leverage, most investor-friendly option in terms of cash flow, but it carries higher all-in interest costs due to the deferred payment structure.

Pros and Cons of Backflip Lending

Pros

1. High Leverage Financing

Backflip offers leverage that exceeds what most traditional lenders provide. Investors can finance up to 90% of the purchase price and 100% of the renovation budget, with a cap at 75% of the property’s after-repair value (ARV). This structure reduces the amount of upfront capital needed, which is especially helpful for those looking to scale their business or take on multiple projects at once.

2. No Monthly Interest Paymesnts (Zero Gravity Program)

Backflip’s Zero Gravity loan removes one of the biggest friction points in fix-and-flip financing: monthly interest payments. Instead, interest accrues over the life of the loan and is paid in a single lump sum at the end. This setup allows investors to focus their cash on the renovation itself, without the stress of monthly debt payments. While total interest costs may be slightly higher, the improved cash flow during the project is a major benefit.

3. Fast Closings

Backflip is built for speed. Loans can close in as little as 7 to 14 days, which is essential in competitive markets. The digital platform streamlines everything from deal analysis to application and underwriting, and most loans don’t require income or employment verification. This allows investors to move quickly when a good opportunity comes along.

4. Open to First-Time Flippers

Unlike many lenders that require prior experience, Backflip is willing to work with first-time investors. If the deal metrics are strong and you meet their credit and down payment requirements, experience is not a barrier to entry. This makes it a viable option for those getting started in real estate investing.

5. Investor-Focused Technology

The Backflip app includes real-time comps, deal calculators, and lead sourcing tools that help investors evaluate properties more efficiently. By combining financing and deal analysis in one place, the platform eliminates the need for separate software and gives investors more confidence in their numbers. This kind of built-in support is especially valuable for those who rely on data to guide decision-making and gaining more of their own market knowledge.

Cons

1. Interest Charged on Undrawn Rehab Funds

Backflip loans use a “Dutch interest” structure, which means borrowers pay interest on the full loan amount from the day of closing. This includes rehab funds that haven’t been drawn yet. In other words, even if your renovation budget is sitting in escrow, you’re still paying interest on it. Many competing lenders use an “as-disbursed” model, where interest only applies to funds that have actually been drawn. For investors managing tight budgets or slow draw schedules, this structure can increase holding costs early in the project.

2. Higher Starting Interest Rates

Although Backflip’s rates are in line with the hard money industry, their lowest advertised rate starts at 9 percent. In practice, many borrowers see rates in the 10 to 12 percent range. By comparison, some lenders—New Silver included—offer lower starting rates for qualified borrowers, with fix and flip loans at 9.25. Investors with strong credit and experience may be able to find better pricing elsewhere, especially if they don’t need the maximum leverage Backflip provides.

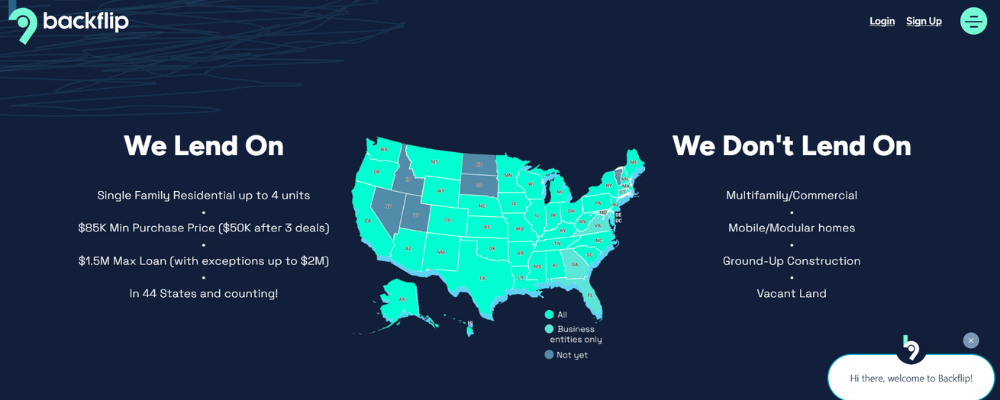

3. Limited Loan Offerings

Backflip focuses entirely on short-term residential rehab loans. They do not offer 30-year rental financing, new construction loans, or ground-up development funding. For investors planning to hold properties long-term, this means refinancing with another lender after the rehab is complete. That extra step adds another transaction, along with additional closing costs and underwriting.

4. Second Lien Loan Structure

To offer higher leverage, Backflip uses a structure that includes both a first and second lien on the property, known as the “Double Double” loan. While this setup can reduce the amount of cash needed at closing, some investors are cautious about second-lien financing. It can introduce slightly higher interest rates, additional fees, and less flexibility if adjustments to the loan are needed during the project.

Backflip Lending Alternatives

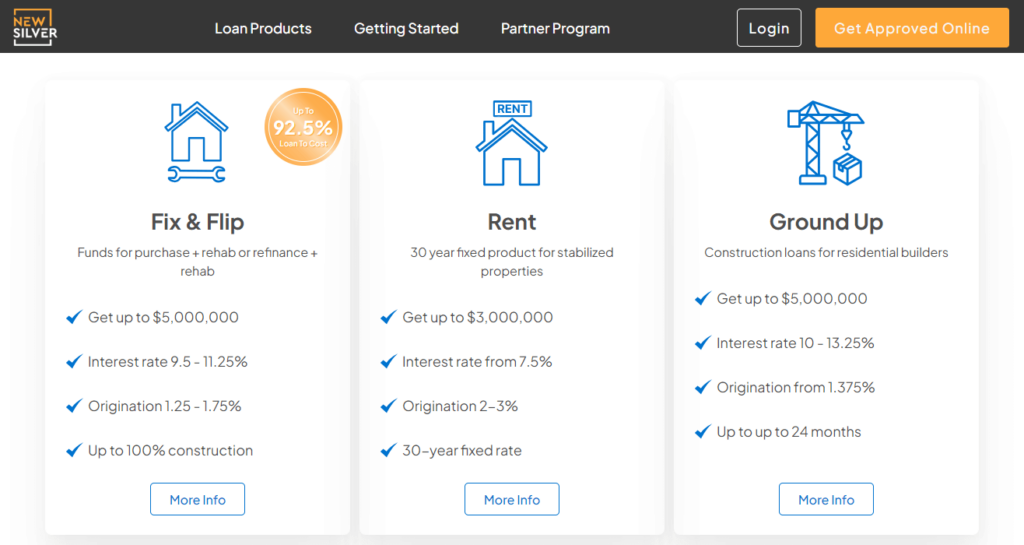

New Silver is a hard money lender offering fix and flip loans, rent loans, ground up loans and personal loans for real estate investors. New Silver’s interest rates start at 9.5%, and loan terms range from 12 months on fix and flip loans to 30 years on rent loans. New Silver offers instant online pre-approval, proof of funds letters and closing within as little as 5 days.

New Silver’s platform has a variety of resources for real estate investors, these are aimed at making the investment process easier and helping investors make more informed decisions. Investors can find profitable investment properties using FlipScout, which is New Silver’s own platform where properties are listed. Other resources include a hard money loan calculator, ARV calculator (to find the deal’s potential profit), BRRR calculator, informative blog and much more.

New Silver operates in over 40 states and pride themselves on being one of the fastest funding providers in the real estate space. They operate entirely online, which means that any real estate investor in the US can get funded with them, and the investment process is quick and easy. Fast hard money loans are the name of the game for New Silver.

Alternative 2: Kiavi

Kiavi is a lender that provides capital to real estate investors. The lender provides bridge loans (fix and flip) and rental loans. The bridge loan rates start at 6.95%, and a borrower can get funding from $100,000 to $1.5 million. Kiavi has flexible loan terms on their long-term rental financing which is 30 years. The interest rates on these loans begin at 6.875%. There two loan options, either a 5/1 ARM or a 7/1 ARM, and both are fully amortized.

Kiavi doesn’t require an application fee or appraisal for bridge loans. Kiavi also doesn’t do income or employment verification, and there is no asset verification which saves time and money. Loan terms are flexible and based on each the needs of each borrower.

Alternative 3: Lima One Capital

Lima One is a private lender for real estate investors, providing fix and flip loans, new construction loans, rental loans and multi-family financing. The lender offers in-house underwriting and construction management. Lima One provides loans in about 40 states across the US.

Lima One’s rates range between 9.5% and 12%, and their loan terms are flexible. There is a maximum LTV of 70% and loan terms range from 13 months to 2 years. While various loan requests are considered, the lender focuses primarily on single family residences and multi-family residences. Loan amounts begin around $250,000 and go up to about $5million.

Final Thoughts - Should You Use This Hard Money Lender?

Backflip Lending brings a unique combination of tech-driven tools and short-term financing to the table, making it a compelling option for residential real estate investors focused on fix-and-flip projects and a fast loan process. The platform stands out for its high leverage, fast funding, and flexible approach to borrower experience, especially with programs like Zero Gravity. However, its narrower loan offerings, Dutch interest model, and second-lien structure may not be ideal for every investor—particularly those seeking long-term rentals or ground-up construction. For investors who prioritize speed, built-in analysis tools, and lower cash-to-close requirements, Backflip can be a valuable resource, especially when paired with other lenders that fill in the gaps for more diverse financing needs.