Construction Loans West Virginia

Up To 100% Construction Financing

Can You Get A Construction Loan In West Virginia

In a word, yes. You can apply for a Construction Loan in West Virginia.

However, for your application to be successful, you need to have detailed knowledge of the land that you are hoping to purchase and build on.

More specifically, you need an exact location, together with plans for development.

Get Approved Online

What You Need To Know About Building In West Virginia

There are plenty of reputable construction loan lenders in West Virginia, but for your application to get approved, you need to have building plans.

- Most Construction Loans in West Virginia offer interest only payments.

- Importantly, you are required to pay back 100% of the loan amount, when the loan terms end.

To pay back the loan in full, you need to have a clearly defined exit strategy. Either you need to sell the development for a healthy profit, or you need to refinance the property based on the revised value of the building once it is completed.

In addition, there other important factors that a lender will consider when assessing a loan application, including:

FICO Score: Typically, there will be a minimum FICO score that the borrower needs to meet in order for the loan to be granted. At the current moment in time, the minimum FICO is 650.

Cost of Project: A reputable lender should be willing to cover a substantial portion of the project cost. This ratio is called Loan To Cost, and it is a quick way to assess how much capital you can access to complete the building project. At this moment in time, New Silver offers up to 90% Loan To Cost (LTC).

Best Construction Loan Lenders In West Virginia

1. New Silver

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

- Interest rates 10 – 12.75%

- Instant proof of funds letter

- Credit score 650+

- Interest only payments

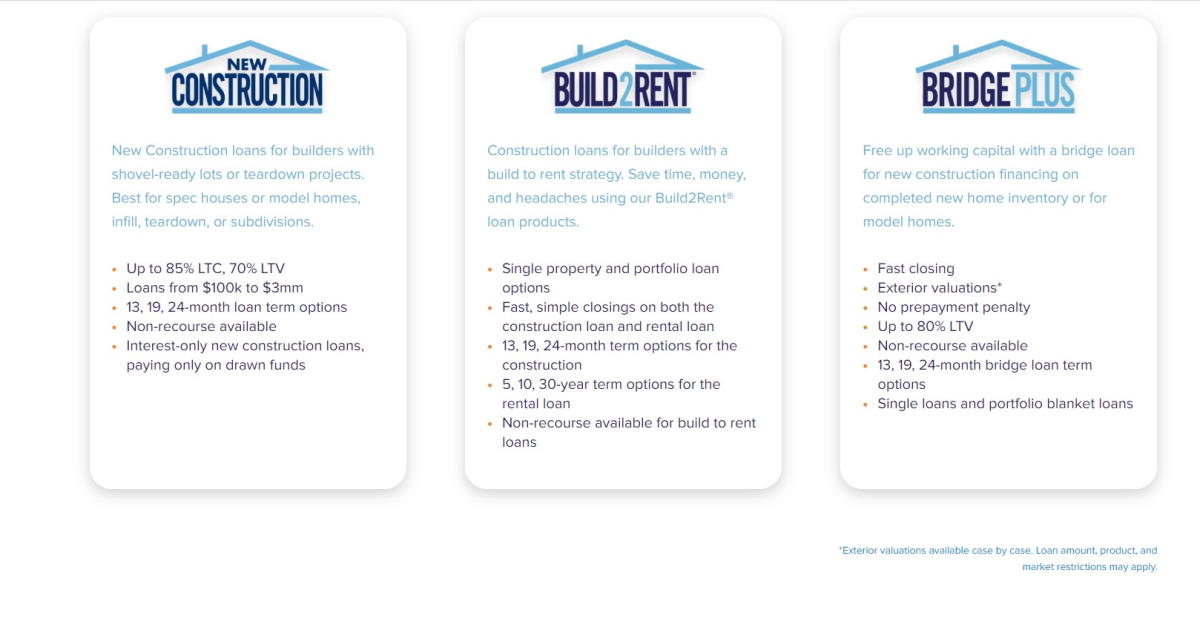

2. Lima One

Lima One Capital is a private lender offering investment property loans for various investing strategies. Borrowers can work together on their deals with the in-house team of experts at Lima One, which speeds up the hard money lending process and cuts out any middlemen.

Learn MoreRequirements For A Construction Loan In West Virginia

- Interest Rate: The interest rate for this financing option falls in the range of 10 to 13.25%.

- Origination Fee: An origination fee is applicable, starting from 1.375% of the loan amount.

- Loan To Cost (LTC): You can secure a loan for up to 90% of the total project cost.

- Construction Financing: This option offers financing of up to 100%of your construction expenses.

- Loan To ARV: You can borrow up to 75% of the property’s estimated value after repairs (ARV).

- Term: The loan term for this option is set at 24 months.

- Minimum Loan Amount: The minimum loan amount you can request is $100,000.

- Maximum Loan Amount: The maximum loan amount available is $5,000,000.

- Minimum FICO: To qualify, you must have a minimum FICO credit score of 650.

- Type of Property: This financing is suitable for various property types, including residential properties with 1-4 units, condos, and townhomes.

How To Complete A Building Project In West Virginia

Step 1 – Identify A Piece Of Land That Can Deliver A Positive ROI

First and foremost, you need to identify a piece of land in West Virginia that is suitable for ground up construction.

To ensure that the building project will be profitable, you need to be able to accurately estimate how much the building will be worth once the project is completed.

Step 2 – Complete Building Plans & Apply For Building Permit

For your construction loan to be approved, most lenders will require building plans to be submitted during the application. In addition to building plans, you will also need to submit a building permit. Without an official permit, the loan application cannot proceed to closing. This is a key item to attend to.

Step 3 – Select A Construction Loan Lender

After finding the land and sorting out the plans and the permits, the next task is to select a Construction loan lender that can meet your needs as a developer.

If you are a residential developer looking for a simple online approval process together with lightning-fast closing, New Silver Lending could be the right fit.

With that being said, there are numerous lenders to choose from. This article highlights the best Construction loan lenders.

Step 4 – Apply For Your West Virginia Construction Loan

The final step is to apply for the loan. If you have followed all the steps outlined above and you meet the minimum credit score requirements, there is a strong likelihood your loan will be approved.

West Virginia Real Estate Market Analysis

Over the last 12 months, home prices in West Virginia have increased by 2.7%, with an average home value of $158,103. This is 201,000 less than the average home value in the US, which is currently $349,770.

- The Median sale to list ratio is 0.999.

- The percent of sales over list price is 30.9%.

- The percent of sales under list price is 48.4%

West Virginia Has The Lowest Average Property Value In The US: The average property in WV ($158,103) is worth less than half the average property value in the US ($349,770). For first time property owners, West Virginia can provide one of the best entry points to the US property market. Housing prices, property taxes, and overall cost of living are lower than most US states, which attracts homebuyers looking for more budget-friendly options.

Limited Profit Potential: One of the primary concerns when developing properties in West Virginia is that the market value of the completed development may be limited by the value of comparable properties in the area.

Simply put, there is a low ceiling on the post construction value of property developments in West Virginia. This may be a red flag for some developers. To overcome this particular issue, it is best to focus on multi-unit property developments which can scale the profitability of project.

Low Property Taxes: In comparison to some other states, West Virginia has relatively low property taxes. This can be a significant advantage for homeowners looking to minimize their ongoing expenses and it can increase the profit margin when building property developments in WV.

Residential Sales Have Slowed Down: In 2022, there were 10,771 residential sales in WV. As of November 2023, there have only been 6,439 residential sales. This represents a steep drop in the number of homes sold in the last year. A challenging economic environment and historically high interest rates have ultimately led to decreased home buying activity in the Mountain State.

Data Sourced From – Zillow.com | Attom Data

Construction Loans Near You

New Silver Offers Construction Loans Across The US

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington DC

- West Virginia

- Wisconsin

- Wyoming

Additional Resources

Construction Loan Calculator

Use our Construction Loan Calculator to estimate your monthly payments. Enter the loan amount, interest rate, and the term of the loan to calculate your monthly payment.

Construction Loan Rates

Find out the latest Construction Loan Rates here. This guide explores what rate you are likely to qualify for.

Construction Loan Requirements

First and foremost, you need to know the location of the development and you also need to have building plans and permits.

Construction Loan Down Payment

The typical down payment on a construction loan is between 10% and 20% of the total project cost.

Best Construction Loan Lenders

Some lenders are better than others. This guide reveals the Best Construction Lenders at this moment in time.

How To Get Into Construction

This guide explains out how you can get started in the Construction Industry.

How Much Does Construction Pay

On average construction workers make over $50,000 annualy.This resource explores how much construction pays, on average.

How To Start A Construction Business

This is a step-by-step guide which explains how to start a Construction Business.

Types Of Construction Loans

There are 3 main types of Construction Loan. This guide highlights the differences between them.

Banks That Offer Construction Loans

There are various US banks providing different Construction Loan options for real estate investors.

Construction Loan vs Mortgage

There are a number of differences between a Construction Loan and Mortgage. Each difference is fully explored in this guide.