Best Construction Loan Lenders

Up to 100% Financing

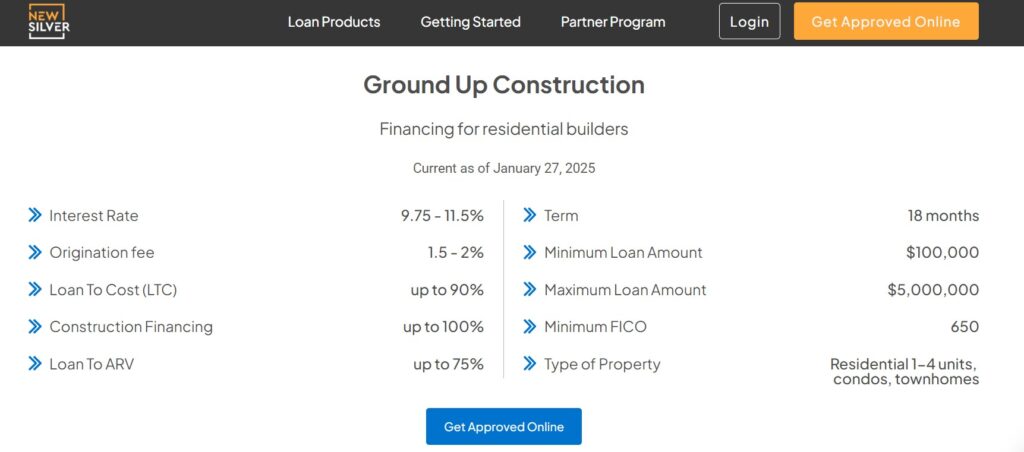

For residential builders

Interest Rate

10.5 - 11.5%

Origination fee

from 1.5 - 2%

Loan To Cost (LTC)

up to 90%

Construction Financing

up to 100%

Loan To ARV

up to 75%

Term

18 months

Minimum Loan Amount

$100,000

Maximum Loan Amount

$5,000,000

Minimum FICO

650

Type of Property

Residential 1-4 units, condos, townhomes

Top 3 Construction Loan Lenders

Construction loans are a great solution for those who are doing a construction or renovation project because they offer interest only payments, short loan terms and a customized option for each deal. The financial partner you select can significantly impact your construction project’s success. So, we’ll outline 3 of the best construction loan lenders below.

1. New Silver Lending

New Silver is one of the best construction loan lenders, offering financing for residential builders. With approval in just 5 minutes and funding in as little as 5 days, New Silver offers builders the fastest funding. Along with this, the lender provides instant term sheets and proof of funds, there’s no need to wait for a phone call. Borrowers can quickly get approved online and download a term sheet, which allows them to secure their real estate deal faster and beat the competition.

New Silver’s Ground Up Construction loans offer builders and investors interest only payments during the construction phase, with no junk fees, no hard credit pull and up to 100% construction financing. The types of properties that New Silver’s construction loan cover are Residential 1-4 units, condos, townhomes. New Silver offers a minimum credit score of 650 for construction loans, and a maximum loan amount of $5,000,000.

New Silver provides a data-driven approach to lending with quantitative tools for investors and borrowers to use in their decision-making. New Silver uses data to originate and underwrite real estate investment loans with more efficiency, which gives borrowers a smoother and easier loan process.

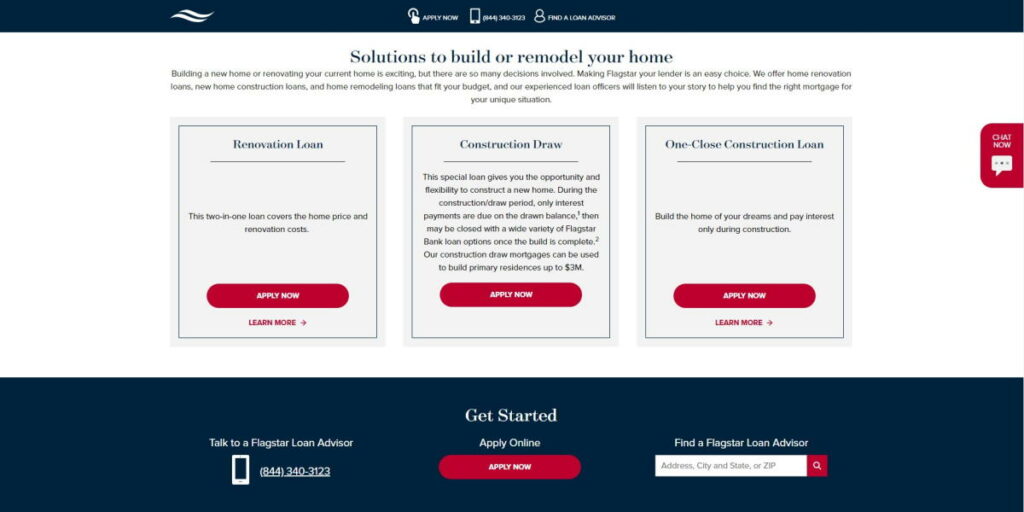

2. Flagstar Bank

Flagstar Bank offers a range of construction loans to suit various purposes. These include:

Renovation loan: This loan is designed to cover the repairs and the mortgage on a property, within a single loan. This can simplify the process significantly as borrowers only have one set of closing costs and one monthly repayment.

Construction draw loan: These are short-term loans used during the construction phase of the project and they allow for interest-only payments. Once construction is complete however, a new mortgage will need to be taken out to cover the principal loan amount and interest.

One-close construction loan: This loan is similar to the construction draw loan in that interest only payments are required during the construction phase. However, the one-close construction loan seamlessly converts into a traditional mortgage upon completion of the building project. This means that borrowers only need one application and only pay closing costs once.

3. Nationwide Home Loans Group

Nationwide home loans group, another top contender in the list of best construction loan lenders, offers both one-time and two-time close construction loans. The lender has made it to the top of the list based on their loan offerings and they offer up to 100% financing of the construction. Nationwide Home Loans Group provides funding for primary residences, second homes, ADUs and 1-4 unit multi-family properties.

The lender facilitates all parts of the process, from searching for a property to communicating with builders. Nationwide Home Loans Group provide fixed-rate and interest-only terms on their construction loans. The one-time close construction loan requires only one appraisal and no-requalification once the construction is complete.

Full List of Construction Loan Lenders

Each construction loan lender has unique benefits and will suit different real estate deals. So, it’s important to choose the right lender for your construction project, by comparing lenders and weighing up the pros and cons of each. More of the best construction loan lenders are:

FMC Lending

Nationwide home loans group, another top contender in the list of best construction loan lenders, offers both one-time and two-time close construction loans. The lender has made it to the top of the list based on their loan offerings and they offer up to 100% financing of the construction. Nationwide Home Loans Group provides funding for primary residences, second homes, ADUs and 1-4 unit multi-family properties.

FMC Lending, also known as Fund Mortgage Capital, is a private lender specializing in real estate financing. They offer a range of loan products, including construction loans, to help investors and developers achieve their property goals. FMC is known for its flexible lending solutions.

The construction loans provided by this lender include both construction and rehab loans. These typically cover the cost of construction, and terms and rates may vary based on the project and borrower’s qualifications.

The biggest drawcard for FMC Lending is that they provide construction loans to those who have bad credit, because there is no minimum credit score required to qualify for these loans. However, there are relatively high down payment requirements to bear in mind.

Abl1.net

ABL (Asset Based Lending) is one of the prominent construction loan lenders focused on helping small business owners, real estate investors, and commercial contractors finance their business activities. These loans are tailored to each person’s needs and ABL provides hard money construction loans in over 29 states across the US.

ABL’s new construction loans are used for land acquisition and construction or rebuilding of existing property. Previous experience is an essential element when applying for these loans. New construction loans can be used for single family, multi-family, and mixed-use properties.

Lending One

LendingOne is a direct lender for real estate investors, with loans that are tailored to each investor’s strategy and is one of the top ranked Construction Loan Lenders in 2023.

Lending One offers ground up construction loans which are between 12 and 24 months. These require interest-only payments for a period of time and are applicable for single-family detached properties, condos, townhomes, multi-family properties

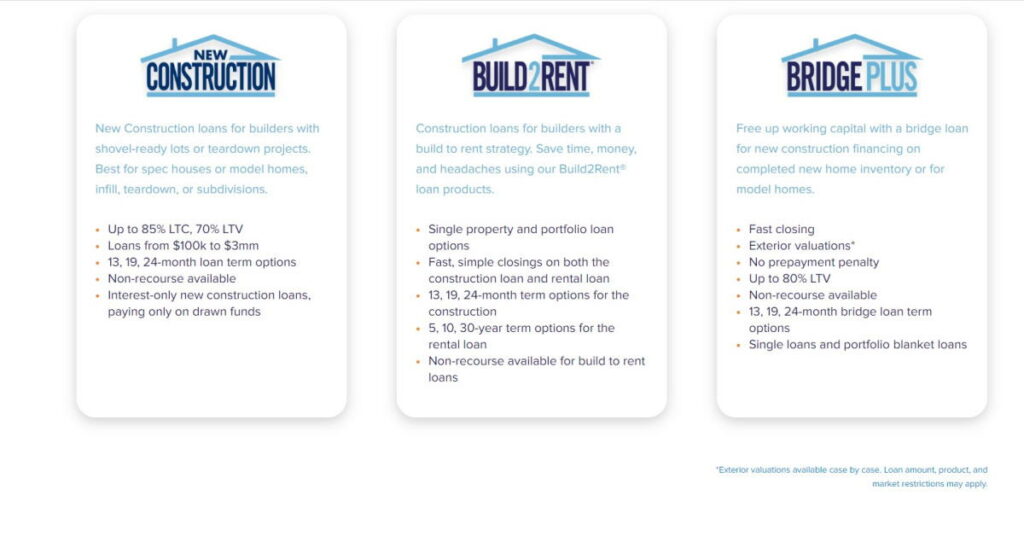

Lima One

Lima One Capital is a private lender offering investment property loans for various investing strategies. Borrowers can work together on their deals with the in-house team of experts at Lima One, which speeds up the hard money lending process and cuts out any middlemen.

Lima One offers new construction loans for builders who are ready to begin a ground-up project, or a tear-down. Up to 85% LTC is offered, along with 70% LTV. Loans begin at $100,000 and the maximum amount that can be borrowed is $3 million. Lima One also has a Build to Rent loan product which offers longer loan terms.

Citizens Bank Mortgage

Citizens Bank offers new construction loans to use for building new properties, renovating, or tearing down and starting fresh. The Construction To Permanent loan offered by Citizens Bank combines the financing for construction with a permanent mortgage to streamline the borrowing process.

During the construction phase, borrowers only need to cover the interest on the loan, and once this phase is completed, the loan transforms into a traditional fixed-rate or adjustable-rate mortgage. Citizens Bank offers flexible loan terms that can be adjusted to the rate structure that best suits the borrower.

Frequently Asked Questions

Do All Construction Lenders Offer Interest Only Payments?

Lenders differ when it comes to construction loan payments, however typically borrowers are only expected to make interest payments during the construction phase. After the construction phase is completed, a construction loan (such as a construction only loan) would usually need to be converted into a more permanent loan, unless this is automatically happening as part of a construction to permanent loan.

Can You Get A Construction Loan From A Bank?

Yes, there are several banks that offer construction loans. Some of the most prominent banks offering construction loans have been mentioned above in our list of best construction loan lenders and there are many more, including US Bank and Wells Fargo.

What Happens To The Loan After The Building Is Completed?

The next step in a construction loan, once the building is complete, depends on the type of loan. For example, a construction only loan does not automatically convert into a permanent mortgage like a construction to permanent loan would do.

In the case of a construction only loan, the borrower would need to take out an end loan in order to fund the remainder of the loan. A construction only loan would therefore require another set of closing costs and a new loan application.

Either way, due to the fact that interest only payments are made during the construction phase, after this is complete, borrowers need to convert the loan or take a new loan to cover the balance.

How To Apply For A Construction Loan

Applying for a construction loan differs from a traditional mortgage loan application. Here’s a step-by-step guide.

Step 1: Project Preparation

Clearly define your construction project, including the type of property you plan to build or renovate, project scope, budget, and timeline. With this, evaluate your financial situation by looking at your credit score, income and debt, to determine the size of the loan you’ll need.

Step 2: Choose A Lender

Compare the rates and terms of a few construction loan lenders once you’ve done detailed research on this. Select a lender that is experienced in construction lending.

Step 3: Gather Required Information

Your next step is to gather all the documents that the lender will require. These include a project plan, financial documents that will demonstrate that you can repay the loan, a credit report, and an estimate of the down payment that you’ll be able to make. Ensure that you have all the relevant documents that the lender needs, then complete the loan application.

Step 4: Accept Loan Terms

Once the lender has reviewed your application and supporting documentation, the loan terms will be provided. These include the loan rates, repayment period, loan amount and fees. Make sure that you understand and have read everything that has been outlined here as you will be bound to this.

Step 5: Loan Closing

Once you’re satisfied with this, you’ll sign the loan agreement and pay the closing costs that are associated with the loan. These costs can include origination fees, appraisal fees, and other administrative expenses. Your down payment will also be due, and from there you’ll receive the funds.

Additional Resources

This Construction Loan Calculator quickly works out the maximum loan amount that you can qualify for when applying for a Construction Loan.

Find out the latest Construction Loan Rates here. This guide explores what rate you are likely to qualify for.

First and foremost, you need to know the location of the development and you also need to have building plans and permits.

The typical down payment on a construction loan is between 10% and 20% of the total project cost.

This guide explains out how you can get started in the Construction Industry.

On average construction workers make over $50,000 annualy.This resource explores how much construction pays, on average.

This is a step-by-step guide which explains how to start a Construction Business.

There are 3 main types of Construction Loan. This guide highlights the differences between them.

There are various US banks providing different Construction Loan options for real estate investors

There are a number of differences between a Construction Loan and Mortgage. Each difference is fully explored in this guide.