Banks That Offer Construction Loans

US Banks That Offer Construction Loans

In the dynamic world of real estate investment, reliable financing is a key part of a successful project. When it comes to construction loans, there are various US banks providing different options for real estate investors. Here’s a closer look at 10 of the most commonly used banks for construction loans and the possibilities that are available with each, including credit score requirements and loan details.

1. Wells Fargo

When it comes to construction loan lenders in the US, Wells Fargo is a name that often surfaces as a major player in the financial landscape. Wells Fargo offer a range of loan options for construction on both residential and commercial properties. Property types that are applicable for construction loans are: single-family, townhome, and mixed-use commercial real estate.

The minimum credit score for a construction loan is 620, the average closing time is anywhere between 30 and 90 days. Wells Fargo also offers an Interest Lock program which means that borrowers can lock their interest rate for up to 24 months. The loan terms offered are between 1 and 3+ years, and builder loans start at $10 million and go up to $100+ million.

2. U.S. Bank

U.S. Bank provides construction loans for various property types. They offer fixed and adjustable-rate options to suit borrowers’ preferences. U.S. Bank emphasizes personalized service, guiding borrowers through each step of the process. The minimum credit score for conventional loans is 620 and the minimum credit score for jumbo loans is 740. The minimum down payment varies depending on the loan.

U.S. Bank offers prequalification on the same day as your application, and closing can take anywhere between 30 and 45 days. The bank offers an incentive for existing customers by giving them a closing cost credit of $1,000. Borrowers can apply online, via the phone or in-person for construction loans.

3. Bank of America

While Bank of America does not provide construction financing for homeowners, they do offer highly competitive terms for permanent financing on newly constructed homes once the construction is completed. These construction to permanent mortgage options offer borrowers a smooth transition from a construction loan to a mortgage.

Bank of America offers a National Builder Division which specifically provides construction loans for new construction. The bank offers a Builder Rate Lock Advantage, which is a drawcard for builders who would like to lock their construction loan rates in for a maximum of 12 months. The division works with builders and their homebuyers, to help buyers get the best mortgage.

4. J.P.Morgan Chase & Co.

J.P.Morgan Chase offer commercial construction and permanent loans, which include construction to permanent mortgage options and fixed-rate permanent loans for stabilized properties. The bank collaborates with a diverse range of real estate developers, encompassing national, regional, and local entities that are engaged in projects involving the construction, renovation, refinancing, or acquisition of affordable housing.

J.P.Morgan Chase aims to assist borrowers with obtaining stable, fixed-rate permanent financing to refinance current debt, support capital enhancements, and explore investment prospects through their simplified process. There is no maximum loan amount, however there is a maximum exposure limit on sponsors/guarantors.

5. Citizens Bank

For borrowers who are looking to build a new property, renovate an existing property, or tear down and start fresh, Citizens Bank offers a construction to permanent loan. This loan allows borrowers to combine their construction or renovation financing and permanent mortgage into one loan. This means that borrowers can save on closing costs and time.

Borrowers can lock in their permanent mortgage rate before the construction project begins, and then make interest only payments during the construction phase. Borrowers’ don’t need to make any principal payments until after the construction is complete and their loan moves to the permanent phase.

6. TD Bank

TD Bank offers various loans for building or renovating a home. Their construction loans are aimed specifically at residential properties, and they provide financing with fixed or adjustable rates. TD Bank has flexible construction loan down payment options and offers interest only payments during the construction phase. The minimum loan amount on a construction loan is $100,000 and rates vary depending on the loan program and the borrower’s qualifications.

TD Bank has multiple locations which make it a convenient option for borrowers in many areas. The flexible construction loan terms are attractive to borrowers who want to get terms suited to their real estate project. Constructions loans from TD Bank can also be added to existing mortgages, which streamlines the process for borrowers.

7. Flagstar Bank

Flagstar Bank offers financing options for both residential and commercial construction projects. For new house building and remodeling, Flagstar Bank provides three loan types: renovation loan, construction draw, and one-close construction loans. The bank’s renovation loans are aimed at those who are simply renovating an existing property and require funding for the project. These include FHA (203)k standard loans, FHA (203)k limited loans and HomeStyle renovation loans.

Construction draw loans are special loans that are given to borrowers who are building a primary residence of up to $3 million. During the construction period, only interest payments need to be made, and once the construction project is complete the loan is converted to another loan type.

The one-close construction loans include a one-close conforming loan, a one-close jumbo fixed loan, and a one-close ARM. The one-close construction loans also offer an interest only payment option during the construction phase, with just one set of closing costs and fees for both the construction and permanent loans.

8. NBKC Bank

NBKC Bank provides construction loans with flexible terms for borrowers, with quick approvals and a transparent application process. The bank is focused on customer satisfaction, which is a big plus for borrowers.

The minimum credit score on conventional loans with NBKC Bank is 620, however the bank’s construction to permanent loans are only available in Kansas City. NBKC Bank offers online applications and easy access to mortgage rates by answering just 5 simple questions on their website.

9. Valley Bank

Valley Bank specializes in real estate financing and offers construction loans with one closing at the beginning of construction. These loans require interest only payments during the construction phase, and the bank handles all builder payments. Valley Bank offers both residential and commercial real estate loans.

Valley Bank will assess each construction project, to determine which loan is the best fit. This includes looking at the building plans, timetables and all costs associated with the new property. Valley Bank’s construction loan options have one interest rate that is applicable across both the construction phase, and the permanent loan thereafter.

10. Federal Savings Bank

Federal Savings Bank offers construction loan options to those who are building their own home, adding onto an existing home, or renovating their home. The bank supports different types of construction, from stick built to system built and even modular homes. The bank has a straightforward application process and full commitment to supporting real estate projects.

Federal Savings Bank offers both fixed-rate and adjustable-rate loans, so that borrowers can choose the terms that best align with their financial goals. The bank makes an effort to provide borrowers with transparent terms and conditions, and they have local branches in many locations.

Alternate Ways To Fund Construction Projects

A) Use Construction Loan Lenders

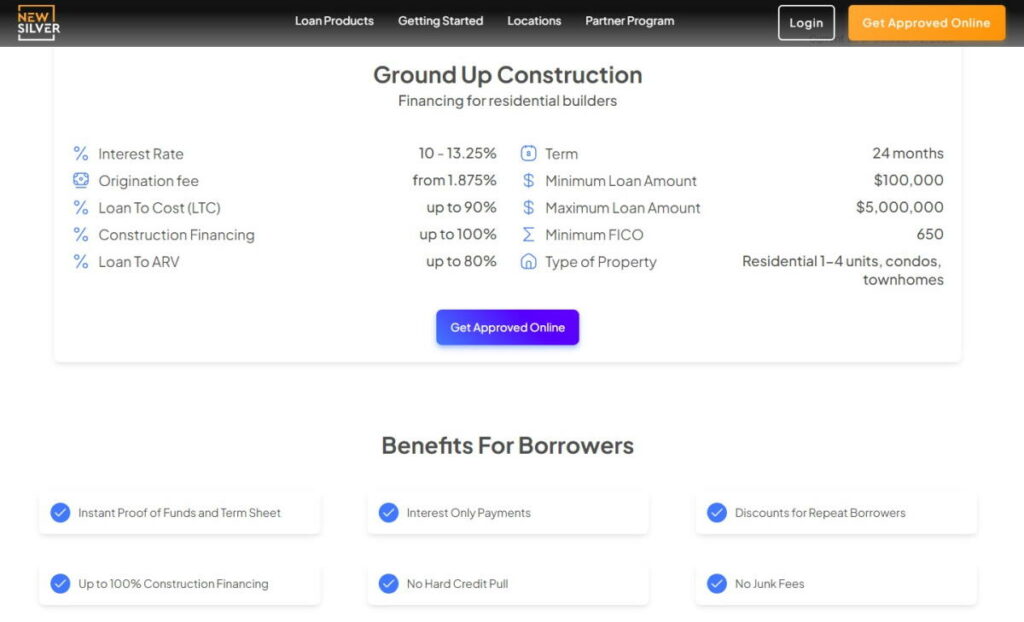

Construction Loan Lender 1: New Silver

New Silver is among the top construction loan lenders because they offer loan closing in a matter of days, and an all-online process. The hard money lender offers Ground Up Construction loans that are geared towards residential builders, with a maximum loan amount of $5 million, and a minimum loan amount is $100,000.

The loan terms are up to 24 months and the minimum credit score is 650. The types of properties that are covered by the construction loan include residential 1-4 unit properties, condos and townhomes. New Silver provides instant term sheets and proof of funds, discounts for repeat borrowers, up to 100% construction financing and interest only payments.

Construction Loan Lender 2: Nationwide Home Loans Group

Nationwide home loans group, another top contender in the list of best construction loan lenders, offers both one-time and two-time close construction loans. The lender has made it to the top of the list based on their loan offerings and they offer up to 100% financing of the construction. Nationwide Home Loans Group provides funding for primary residences, second homes, ADUs and 1-4 unit multi-family properties.

The lender facilitates all parts of the process, from searching for a property to communicating with builders. Nationwide Home Loans Group provide fixed-rate and interest-only terms on their construction loans. The one-time close construction loan requires only one appraisal and no-requalification once the construction is complete.

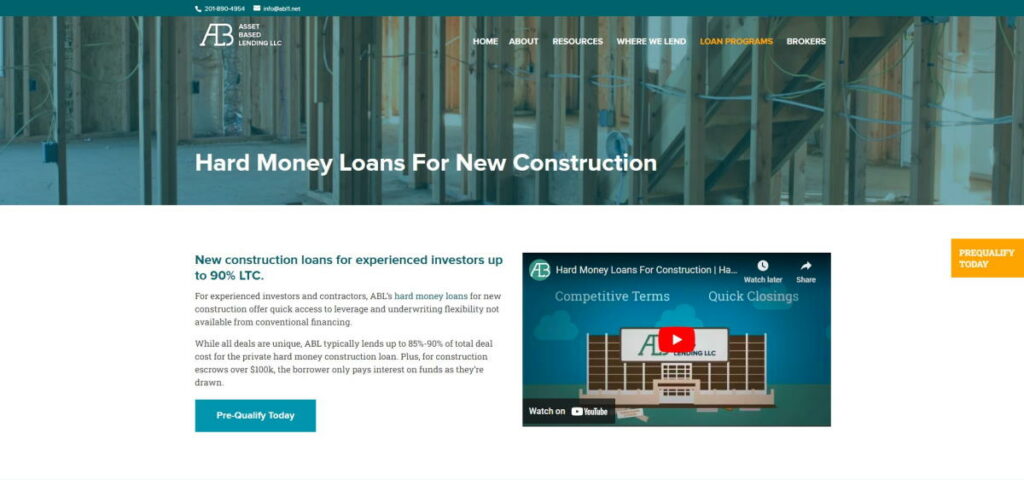

Construction Loan Lender 3: Asset Based Lending

ABL provides construction loans that are asset-based, to experienced investors with up to 90% LTC value. The quick funding and flexible underwriting offered by ABL isn’t available with traditional loans. ABL lends up to 85%-90% of the total deal cost, and for construction deals where the escrow is over $100,000, the borrower will only pay interest on the funds that they have drawn. ABL requires a minimum credit score of 660, and a construction loan is typically closed in 10 days.

B) Tap Into Home Equity For Renovation Projects

For those who already have a property in which they have generated equity, this can be tapped into using the following options:

Home Equity Loan: A home equity loan is paid out as a lump sum, with a fixed interest rate. A specific amount is borrowed against the home equity, and this is then repaid in installments.

Home Equity Line of Credit: A HELOC is a revolving line of credit that can be accessed similar to a credit card. Borrowers can use as much as they need, and only pay interest on the amount that they have used.

Cash-out refinance: This involves refinancing an existing mortgage for a larger amount than you owe and taking the difference in cash. Borrowers will have a new mortgage with new terms.

Additional Resources

This Construction Loan Calculator quickly works out the maximum loan amount that you can qualify for when applying for a Construction Loan.

Find out the latest Construction Loan Rates here. This guide explores what rate you are likely to qualify for.

First and foremost, you need to know the location of the development and you also need to have building plans and permits.

The typical down payment on a construction loan is between 10% and 20% of the total project cost.

Some lenders are better than others. This guide reveals the Best Construction Lenders at this moment in time.

This guide explains out how you can get started in the Construction Industry.

On average construction workers make over $50,000 annualy.This resource explores how much construction pays, on average.

This is a step-by-step guide which explains how to start a Construction Business.

There are 3 main types of Construction Loan. This guide highlights the differences between them.

There are a number of differences between a Construction Loan and Mortgage. Each difference is fully explored in this guide.