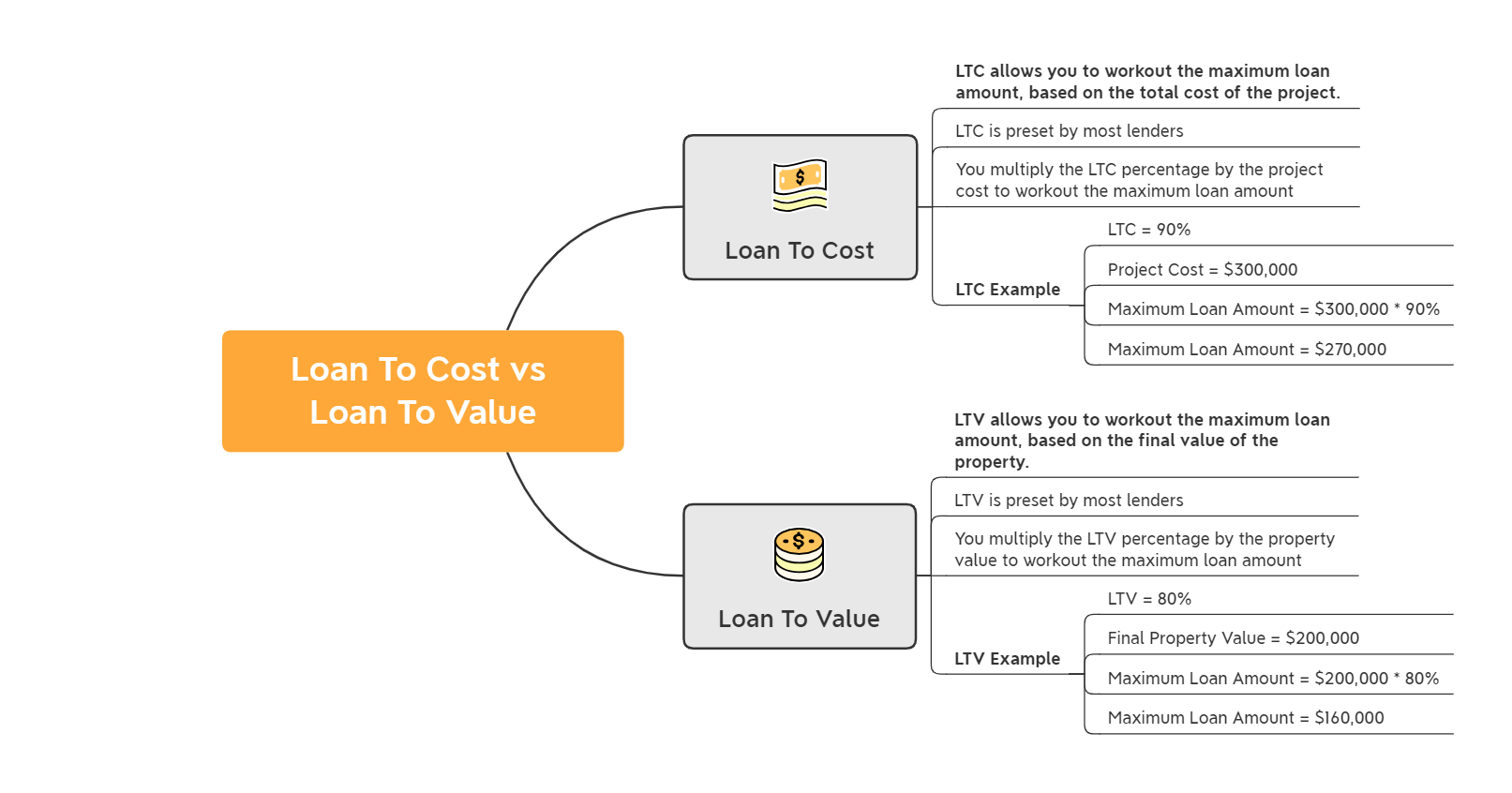

- Loan To Cost allows you to workout the maximum loan amount, based on the total cost of the project.

- Loan To Value allows you to workout the maximum loan amount, based on the value of the property.

- Both Loan To Cost and Loan To Value are used to workout the maximum loan amount that can be issued to a borrower. They simply use a different metric to determine this amount.

Quick Summary

It is important to note that most lenders have preset values for LTC (often 90%) and LTV (often 80%).

For instance, if the lender’s maximum LTC value is 90%, and the project is expected to cost $300,000, it means that you can potentially qualify for a $270,000 loan to fund the project ($300,000 * 90%).

Similarly, if the lender’s maximum LTV is 80% and the property value is $200,000, it means that you can potentially qualify for a $160,000 loan to fund the property purchase ($200,000 * 80%). Your down payment would then cover the difference between the loan amount and the property price.

Both of these ratios allow you to quickly workout the maximum loan amount.

With LTC It is literally a case of multiplying the total project cost by the maximum LTC percentage of the lender to calculate loan amount.

With LTV, you simply need to multiply the property value by the maximum LTV percentage of the lender to calculate the loan amount.

Table of Contents

New real estate investors are often overwhelmed by the amount of number-crunching that takes place in real estate transactions, and that includes real estate loan applications. This becomes even more confusing when certain cost ratios and formulas are similarly named, and have similar purposes, but are used for completely different reasons.

Loan to value and loan to cost are two such formulas that investors will come across when applying for a loan, and the terms are often used interchangeably. This is not correct; loan to value and loan to cost are both two vital parts of the real estate financing process but are used for very different purposes.

Both of these formulas are measures that mortgage lenders use to establish the level of risk involved before they provide funding for a real property project, residential or commercial. In turn, these formulas are also commonly the deciding factor in the size of the amount the lender is willing to grant the borrower as a loan.

Keep reading to find out everything that real estate investors need to know about calculating the loan to cost (LTC) versus the loan to value (LTV) of a project – and what the difference is.

What is Loan To Cost?

Loan To Cost (LTC) is a ratio which determines the value of the loan, compared to the value of the Total Project Cost.

The LTC Ratio is actually quite straight forward. Loan To Cost = Loan Amount / Total Project Cost

So, if you apply for a $80,000 Construction Loan, and the Total Project Cost is $100,000, the Loan To Cost would be 80% (ie $80,000/$100,000 * 100)

It is important to understand that when dealing with hard money loans and construction loans, the Total Project Cost Includes:

- Property Acquisition Costs

- Construction Costs

- Development Costs

In other words, total project cost is sum of all the acquisition costs, development costs and construction costs.

LTC is most typically used in financing for commercial real estate to determine how much of a project will be funded by either debt or equity. Common costs in real estate projects can include the purchase price of the property, the materials needed, labor, and other additional costs like insurance.

The LTC of a development can generally be thought of as the value of a total loan amount sought from the lender, divided by how much the project is projected to cost. The LTC ratio of a development is then used to calculate the loan amount percentage that a lender is willing to grant a borrower based on the total cost of their project.

Lenders use this as a metric by which they can limit the amount of risk they will accept on a mortgage loan when taking on a new project. These lenders are oftentimes not just traditional lenders like banks, but hard money lenders, funds, or private financing options. Commercial real estate borrowers will often work with a hard money lender, as these lenders work with higher risk loans than conventional lenders like banks have an appetite for. The risk in the transaction applies to both the borrower and the lender because these types of loans are short-term and high-interest.

As the risk in these transactions is higher than in traditional loans, hard money lenders will also charge higher interest rates as a measure of protection should the borrower default. The majority of real estate projects which are found to be at a higher level of risk will have lower loan to cost and loan to value ratios.

On average, the higher the LTC is, the higher the risk will be for the lender if the development were to fail for any reason. LTC values are affected significantly by current market rates and effectively allow the investors of the project to know how much equity they will retain.

The LTC formula looks like this:

Loan To Cost = Loan Amount / Total Project Cost

It’s important to note however that post-construction, a project will have a new valuation which will differ from the total calculated above. Other cases in which LTC can be used include specific deals in which closing or escrow needs to be settled immediately.

Beyond the LTC ratio, lenders will also consider other factors when approving loans, such as the location of the construction project, the borrower’s previous real estate experience, and their credit score. Borrowers with solid experience and a high credit score, will usually be approved for a lower interest rate than borrowers with less experience and a poor credit history.

What is Loan To Value?

Loan To Value = Loan Amount / Property Value

As you can see from the LTV Formula above, you simply need the loan amount and the property value in order workout the LTV. Alternatively, you can also assess the maximum loan amount that a lender is willing to provide, using the LTV percentage that the lender offers.

The Loan To Value ratio is similar to LTC in that it is also a formula used by lenders to determine value and risk in a loan project and forms a critical part of the loan underwriting process. LTV, in simple terms, is the ratio of the property’s value in relation to the total loan amount needed to complete the acquisition and rehab (if any is needed.) Another way to think of it is that the LTV dictates how much of the property you owe versus how much you already own.

Another way to think of it is that the LTV dictates how much of the property you owe versus how much you already own.

The higher the LTV ratios are for the mortgage lender, the higher the investment risk will be, potentially increasing the cost of the loan for the borrower due to the increased interest rate that forms part of the transaction. Therefore, the majority of lenders prefer to take on projects with LTV ratios that are under 80% to protect themselves from unforeseen financial burdens.

Some exceptions can, however, be made for borrowers that have higher personal incomes, no debt and other factors that are beneficial to their loan application. When the LTV ratio goes above 100%, the loan becomes larger than the actual value of the property or asset that secures it, in which case no profit could be made from the deal, and the loan would be extremely risky. This is also known as an underwater home loan and should be avoided at all costs.

In layman’s terms, the LTV is the total loan amount divided by the appraised value of the property. The main factors that affect the LTV ratio are the needed down payments that secure the property, the actual property sale or contract price and the appraisal value to name a few. The formula for calculating the LTV for a property is similar to the LTC formula, with one major difference:

The value of a property is generally assessed by a professional real estate appraiser , who considers the condition of a property’s interiors, any amenities it has, the layout of the rooms, the exterior and other factors when estimating the final appraisal value. The appraisal process will typically include a walkthrough of the property’s interior and exterior, the examination of amenities like swimming pools and in a commercial transaction, an additional business valuation may be done. A mortgage lender will often help the borrower determine the appraised value, by making use of a professional appraiser during the loan origination process.

LTV vs LTC - What’s The Difference?

With both tools acting as measures of value and sometimes used interchangeably between lenders, what’s the difference to the borrower? The difference ultimately comes down to what the formulas are used for.

For construction projects, loan to cost is the better measure as it factors in the cost of construction along with the required financing to complete the project.

On the other hand, for fix and flip projects or turn-key rental properties, the loan to value formula is preferred due to the final price of the property being significantly higher than the original purchase price.

The main difference between the two formulas ultimately comes down to the type of project the loan will be used for – a construction project versus a project concerning the renovation of an existing property. This difference is particularly important when it comes to fix and flip projects, as fix and flip investors will commonly need funds to not only close the deal but also to do a renovation and then market the property for sale.

By gaining a better understanding of the two different formulas and their varying applications, it becomes easier for the borrower to navigate the loan process and its associated costs with ease.

LTV vs LTC - Key Similarities

- Both LTV and LTC Are Used To Calculate The Maximum Loan Amount

- Both Values Are Used Specifically For Real Estate Loans

- The LTC Percentage Is Preset By Most Lenders

- The LTV Percentage Is Preset By Most Lenders

Loan To Cost Example

To get a better understanding of the LTC formula, take a close look at this LTC example: A borrower identifies a construction project they would like to undertake, which will cost them $200,000 to take on and complete. The borrower could take out a loan for the full amount, but they ideally want to retain some personal equity in the project as well. Therefore, the borrower approaches a hard money lender like New Silver and takes out a loan to cost $160,000 from the lender, funding the remaining $40,000 themself to retain equity. As both parties have a stake in the success of the project, it creates an incentive for them both to see the project through to completion.

Based on the numbers given in the above example, the lenders LTC calculation will look like this:

- LTC Formula = Loan Amount/Total Project Cost

- Loan Amount = $160,000

- Total Project Cost = $200,000

- LTC = $160,000 / $200,000

- LTC = 80%

In this case, the formula results in 80% loan to cost – falling within the ideal range for the lender to go ahead and grant the loan.

Loan To Value Example

To break down the LTV formula, picture the following as an example: A borrower identifies a property that has already been constructed and is a few years old, but that can become more valuable through some renovation. This property, in its current state, is appraised at a value of $300,000. The borrower approaches a hard money lender, applies for funding, and gets approved for a loan of $270,000.

- LTV Formula = Loan Amount/Property Value

- Loan Amount = $270,000

- Appraised Property Value = $300,000

- LTV = $270,000.00/$300,000

- LTV = 90%

The numbers given in this example will result in an LTV of 90% for the lender and borrower.

Final Thoughts

While both of these measuring tools are similar, LTC is better used to measuring the “skin in the game” equity a borrower brings to a project, while LTV is a better measure of the overall value, especially when construction might be required. Both are used frequently by lenders to measure risk, and it’s worth paying attention to both of them when applying for loans, or making buying decisions.

Keen To Learn More About Real Estate Investing?

In Achieving Wealth Through Real Estate: A Definitive Guide To Controlling Your Own Financial Destiny Through a Successful Real Estate Business, author and entrepreneur Kirill Bensonoff takes you through the process of starting your own real estate business, step-by-step.