A Short Summary

Zillow, the popular real estate platform, has over 110 million properties on the platform and provides Zestimates for over 104 million. While Zillow claims to have a 1.9% median error rate for on market homes, and a 6.9% median error rate on off market homes, there is still room for inaccuracies. For the most part, however, Zillow’s Zestimate is used widely as a quick and convenient way to get a ballpark estimate of the market value of a home for real estate agents and home buyers or sellers, with a low nationwide median error rate.

Zillow uses the following factors in their algorithm to determine a home’s value estimate:

- Property Information – square footage, number of bedrooms and bathrooms and more

- Comparative Market Analysis – homes recently sold in the same area

- Tax Assessment – for useful financial information on a property

- Location Details – the quality and desirability of an area

- Historical Price Trends – a property’s value trajectory over time

- User Information – any upgrades, renovations and other improvements made to a property that the user shares with Zillow

- Machine Learning – algorithm learning from past estimates to gauge future ones

Jump To

What Is A Zestimate?

Zillow, one of the most popular online real estate marketplaces, has developed the Zillow Estimate or Zestimate, which provides home value information. The Zillow Zestimate is a widely recognized feature in the real estate industry, and it is essentially an automated valuation model (AVM). While it may not be perfectly accurate, the Zestimate is a useful tool for getting a ballpark figure of a property’s value, for a real estate agent, home buyer or seller.

How Is Zestimate Calculated?

The Zillow Zestimate is calculated by a complex algorithm, the inner workings of which are proprietary information. However, it essentially uses the recent property data provided by the platform’s millions of users, along with property tax information, location-specific data such as neighborhood trends and amenities, and property-specific data. The algorithm combines these factors and more to determine a fairly good property estimate.

Zestimate is a useful tool for those who need quick access to a rough estimate of a property’s value, which includes real estate agents. However, it’s still advisable to conduct a thorough analysis of the property, to complement the Zestimate and find out a more accurate value.

Factors That Influence Zillow Zestimates

The Zillow Zestimate is calculated using a complex algorithm that takes into account a wide range of data points and variables. While the exact details of the algorithm are proprietary and not disclosed by Zillow, we can provide an overview of the key factors that influence the Zestimate calculation:

Property Information

If there’s one thing that’s certain, it’s that Zillow has access to myriad property data, from the plethora of listings and information on the platform. In fact, the platform has data for over 110 million properties, including on market homes and off market homes! As such, Zillow uses much of this data to form the backbone of the Zestimate.

The algorithm factors in the property’s square footage, the number of bedrooms and bathrooms, the size of the lot, and any unique features or characteristics that make the property stand out. In addition to this, the year that the property was built is also factored into the equation as this plays an important part of determining the property’s value.

The combination of these pieces of data helps paint a comprehensive picture of the property’s physical attributes. This ultimately determines the price of a property, but these aren’t the only factors that need to be considered. So, Zillow’s algorithm uses a number of other factors that we’ll outline below.

Comparative Market Analysis (CMA)

A comparative market analysis looks at on market homes in the same location that have been sold within the last 6 months. These comparable sales serve as benchmarks for estimating value.

The Zestimate algorithm assesses how closely the subject property matches the characteristics of the comparable sales. It’s even intelligent enough to account for differences in size, condition, and features.

Beyond individual property comparisons, the algorithm tracks broader market trends. It considers whether property values in the area are trending upward, downward, or remaining stable. These market trends are an important part of working out an accurate home value estimate.

Tax Assessment

The tax assessment of a property provides useful insights into the financial aspects of the property. The algorithm takes into account the property’s assessed value for tax purposes. This value, determined by local tax authorities, may not always align perfectly with the market value but provides an additional reference point.

The assessed value provides context for the property’s financial standing in relation to the local tax requirements and is off-market data. The local tax requirements can affect the cost of ownership and impact property values.

Location Details

The algorithm does an assessment of the neighborhood where the property is located. To work out the quality and desirability of the area, the algorithm evaluates crime rates, school ratings, and access to parks and amenities. A property’s appeal can be impacted by its proximity to shopping centers, public transportation, and healthcare facilities.

The algorithm will also factor in local economic conditions, such as job growth and unemployment rates. These will play a big role in property values, as they impact the demand for housing in the area. The local real estate market is also a part of the location details that are factored in by the algorithm, with supply and demand, inventory levels, and recent sales trends contributing to the calculation.

Historical Price Trends

A property’s value trajectory over time can provide valuable insights into the current value. The Zestimate algorithm will analyze property values in the area to determine any trends or patterns that may influence property values currently.

Seasonal fluctuations in the real estate market are also considered, as they can impact property values in different ways, at various times of the year.

User Information

Zillow encourages homeowners to provide information to the platform about their properties. As such, the platform has generated a lot of information on millions and millions of homes.

Users can contribute data on any renovations, upgrades, or improvements made to the property. This user-generated information helps keep the Zestimate current and reflects the property’s condition accurately. However, if users don’t keep this information up to date, there may be room for error in the property value estimate.

Machine Learning

Machine learning techniques are one of the most dynamic aspects of the Zestimate calculation. These techniques continuously analyze vast amounts of data and learn from past Zestimate accuracy. They also evolve, along with changing market conditions and property features, to provide as accurate a property value estimate as possible.

By incorporating all of these factors, the Zestimate algorithm aims to provide an estimate of a property’s value that reflects its unique characteristics and its position within the broader real estate market. While these factors are vital in establishing the value of a property, they do not reflect the intricacies of each particular property and should therefore not be used alone.

Most Importantly, Are Zillow Zestimate's Accurate?

Automated tools like the Zestimate don’t account for certain factors that can impact property prices, such as unique features, renovations, and more. Stan Humphries, former Chief Analytics at Zillow vouches for the Zestimate by saying that it’s a great starting point for understanding a home’s value but adding that it should be accompanied by a professional appraisal and a real agent’s insight to gain the most accurate valuation.

According to Humphries the median error rate for Zestimates on off market homes, across the US, is 6.9%. This means that half of all the estimated value numbers are within 6.9% of the final sale price. Meanwhile, the nationwide median error rate for on market homes is just 1.9%, at this point in time.

Zillow has made great strides with their accuracy, with their median error rate improving from 13.6% on 50 million homes in 2006 when it launched, to 6.9% currently. Zillow continuously strives to improve their median error rate, and with time their algorithm has gotten significantly more accurate.

Reasons To Trust Zillow's Price Estimates

Zillow’s Zestimates can be a valuable resource for the following reasons:

Data Driven Approach

Zillow uses a data-driven approach to include a vast array of information, property details, comparable sales, tax assessments, and more. This method is specifically designed to provide as accurate an estimate as possible, that is unbiased and objective. For homeowners, this means that the estimate is free of human opinion and bias of any kind.

Reliable Platform

Zillow is one of the most widely used real estate platforms in the US. With millions of home buyers, sellers and real estate professionals relying on Zillow for accurate and reliable property information. This means that most of the properties on Zillow have Zestimates, and these are used by many people in the real estate industry as they are considered a credible source.

Transparency

Zillow provides full transparency on the fact that the Zestimate is not a professional appraisal or opinion of a real estate agent and is just an estimate of home values. While the exact algorithm details are not disclosed, Zillow provides open information on all the factors that impact the estimate, and how they arrive at their numbers. This transparency allows users to know the ins and outs of the algorithm and how each estimated value is calculated.

Continuous Improvement

Zillow strives to improve their Zestimate through the use of machine learning and data analysis techniques. The popular platform designed the algorithm keeps learning from past estimates and use this information in conjunction with the new data, to generate more accurate estimates in the future. Essentially, this means that the Zestimate will get more accurate with time.

User Data

The data that the algorithm uses to determine property values is supplied by the platform’s users. Zillow encourages homeowners to update their property information, particularly with regards to renovations and home improvements that have been done. The data generated by users means that the Zestimate can be up to date, using the latest information about the condition of properties.

Third-party Validation

Zillow’s Zestimates have been subject to third-party validation and accuracy assessments. While no estimate is perfect, such validations indicate that Zestimates generally provide a reasonable approximation of property values, albeit without the professional opinion of a real estate agent.

Reasons To Question Zillow's Price Estimates

While Zillow’s Zestimate is used by millions, there are also some drawbacks that can lead to apprehension about the estimator’s accuracy.

Limited Property Information

There are important details about properties that Zillow’s Zestimate may not be able to gain access to. These include the condition of the interior, unique architectural features, or recent renovations. These details are a key part of working out the most accurate home value, so without these details, an estimate won’t be as accurate.

For example, a kitchen remodel can add major value to a home, and if this isn’t reflected in the estimate, then the estimate may be quite inaccurate.

Algorithm Limitations

Due to the fact that Zillow’s Zestimate algorithm is proprietary and the inner workings of it remain undisclosed, this raises questions about the Zestimate overall. Users can’t be quite sure of the exact variables that are being included, and without all the information being shared, this can create skepticism about the algorithm’s functionality.

Market Fluctuations

Real estate markets can change rapidly, depending on the economic shifts at the time, local developments, and supply or demand variations. These market fluctuations may be accurately captured by Zestimate’s algorithm, which means that the estimates that are being given won’t align with the current market situation. Market fluctuations can play a crucial role in determining home values, so this is a key aspect of the overall estimate that could be missing, which other professionals, such as a real estate agent, would include.

Inaccuracies with User Data

While the property data provided by users can be useful in generating an accurate estimate, this all hinges on users providing accurate and up-to-date information. This is, of course, not always possible, and user errors or omissions can happen. As such, the estimates generated would be less accurate, particularly when property updates haven’t been included. This leaves Zestimates open to inaccuracies as they rely on users to supply the complete and correct information.

Regional Variations

The nature of Zillow’s Zestimate algorithm lends itself to regional variations in estimation accuracies. This means that in regions where the real estate market is well established and there are strong data sources, Zestimates are likely to be more accurate. This is also due to easily identifiable market trends in these areas.

However, in regions where the real estate market is weaker and the area is less developed, Zestimates are likely to be less reliable due to limited data. This makes Zestimates relatively unreliable for those who are looking for estimates in less developed areas.

Alternate Home Value Estimator's Worth Trying

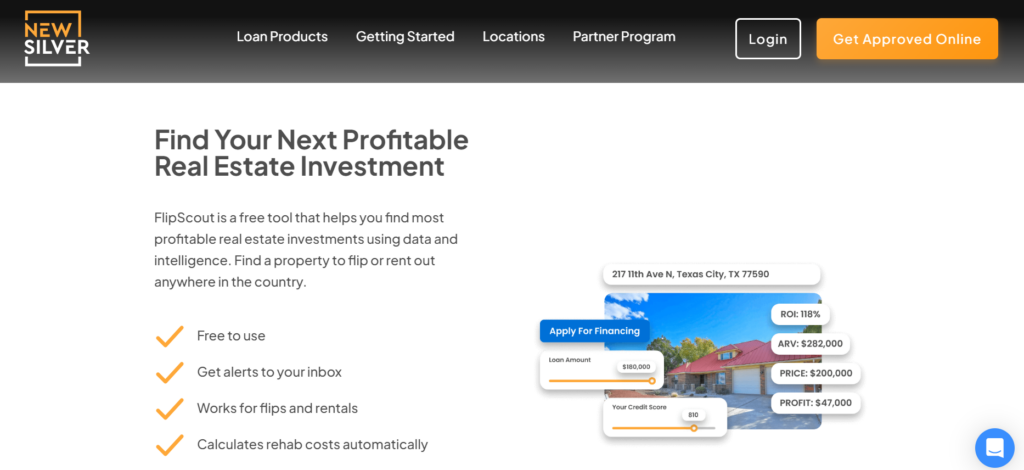

FlipScout

Although relatively new among home value estimation tools, FlipScout’s distinctive qualities should not be underestimated. Developed by the lending company New Silver, FlipScout was purpose-built to identify undervalued or pre-foreclosure properties ripe for flipping. This complimentary tool harnesses publicly accessible data and additional intelligence resources to assist investors in pinpointing distressed properties with substantial flip potential.

Through the FlipScout platform, users can conveniently calculate rehabilitation costs, assess estimated rental income, and access a wealth of property-related information across the country.

One of FlipScout’s notable features is its email notification system. In cases where an ideal property meeting your criteria isn’t readily available, you can configure search parameters that will promptly alert you via email once a suitable listing becomes available.

What sets FlipScout apart is its streamlined funding option directly accessible within the search portal. This ensures swift access to financing for lucrative opportunities, enabling you to expedite the deal-closing process effectively.

HomeLight

HomeLight is a real estate technology company that offers a range of services to help homeowners connect with real estate agents and make informed decisions in the real estate market.

HomeLight’s home value estimator uses a combination of property details that the user supplies, including address, size, and features, and the estimator analyzes local real estate data. It then conducts a comparative market analysis, to identify properties in the area that have sold recently. The tool factors in market trends, user-generated data on renovations or unique features, and the property’s condition.

Redfin

Redfin currently offers one of the most precise home value estimators available in the real estate market, with a nationwide median error rate of 2.28% for on market homes at the time of writing. This accuracy is attributed to their unique approach in handling data. Powered by their real estate brokerage, the Redfin estimate provides remarkably precise insights into home prices compared to other alternatives. The key to their accuracy lies in their frequent data updates; they refresh their website and app data every 5 minutes, drawing information from MLS databases and other publicly accessible sources.

This rapid access to MLS data significantly reduces the median error rate in property valuations, making it even more precise than Zillow’s estimate. Much like other similar tools, Redfin employs the property’s address to provide an accurate estimate of its current market value and extends its predictions to estimate the property’s worth over the next five years. Ultimately, it’s Redfin’s direct access to MLS data and exceptional predictive capabilities that position it as a leading online home value estimator for any real estate agent or home buyer or seller.

FAQ

The Zestimate provided by Zillow is an automated estimate of a property’s market value, and it cannot be directly manipulated or increased by homeowners or users. However, if homeowners don’t agree with the market value provided by the Zestimate, they can contact Zillow and provide more information to support this. This may influence the Zestimate but it can only be done for off market homes, not on market homes.

If you feel that the Zestimate on your off market home is too low, you can contact Zillow’s customer service to provide the appropriate documents. For example, proof of any home improvements. Alternatively, if there is property information that needs correcting or updating, this can be done directly on Zillow’s website.