The 1% rule is a calculation that investors can use to estimate the rental income of an investment property. The rule suggests that if you want to work out the expected rental income of a property, you can simply multiply the property price by 1% for a quick approximation.

Jump To:

The 1% Rule Formula

Monthly Rental Income = Property Price * 0,01

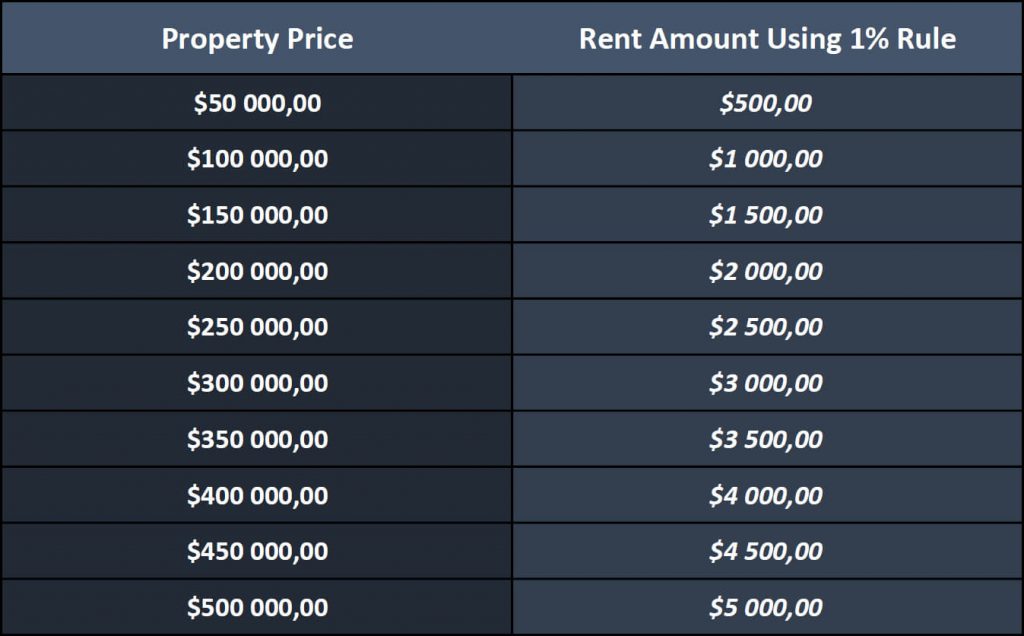

As you can see from the formula above, the maths involved isn’t too complex. To further illustrate the simplicity of the rule, consider the following chart. It depicts the expected rental income for properties of various prices when using the 1% rule.

1% Rule Example

Now that we have run through the basics, it may be valuable to analyze two different properties with this rule in mind.

Property A Details

- Property Price: $300,000

- 1 % Rule Formula: Property Price * 0,01

- Expected Rental Income: $3,000

Property B Details

- Property Price: $420,000

- 1 % Rule Formula: Property Price * 0,01

- Expected Rental Income: $4,200

Is The 1% Rule Realistic?

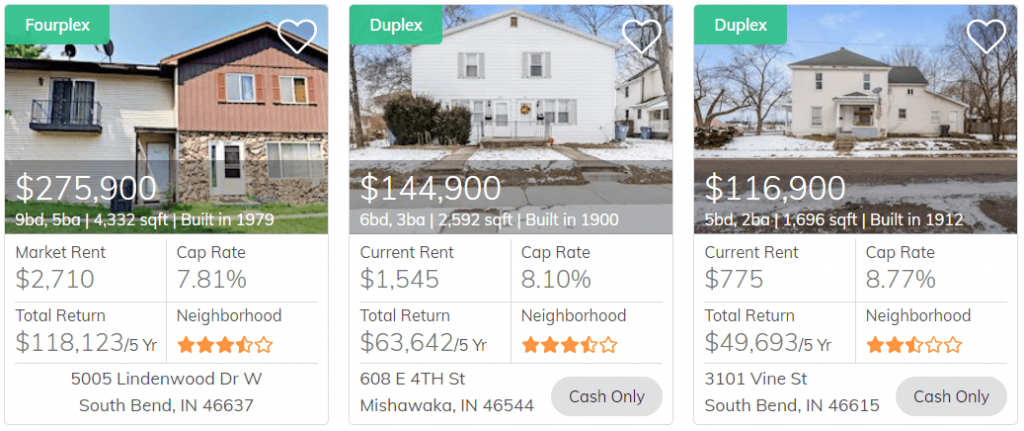

The 1% rule is realistic for certain rental markets because you can definitely find properties that meet this criteria. The screenshot below shows multiple listings on Roofstock which are all compliant with this rule.

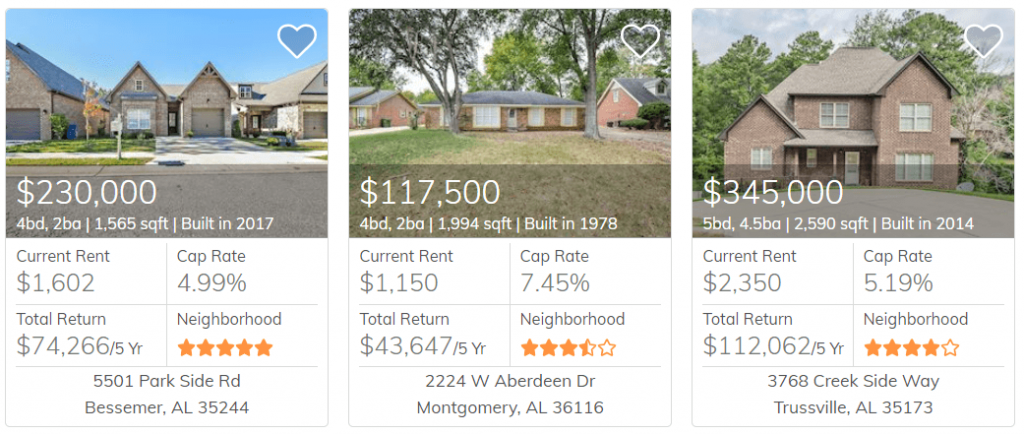

As you can see, there are definitely rental properties across the country that cater to investors that are committed to this rule. However, it is also true that you will find thousands of property listings that aren’t compliant with the rule. For instance:

Getting back to the question at hand, it is realistic to find properties that generate rental income which is equal to or greater than 1% of the property price. This should also make it clear how efficient the 1% rule can be as a screening mechanism. It gives you a valid reason to discard properties that could present cash flow issues from the moment you start collecting rent.

Does the 1% rule guarantee the property will be cash flow positive?

The rule does not guarantee that a property will be cash flow positive. However, it does vastly increase the likelihood of achieving positive cash flow if you find a rental property that abides by the rule.

To further explain, it will be helpful to use another example, showcasing the rental income, mortgage repayment, and expected property costs of a $250,000 investment property.

Cash Flow Example with $250,000 Property

| Income | Expenses |

|---|---|

| Monthly Rent: $2,500 | Mortgage Repayment: $1,450 |

| All Property Expenses: $700 | |

| Total: $2,500 | Total: $2,150 |

Monthly Cash Flow: $350

The example above was generated with realistic estimates for the mortgage repayment and the general property expenses (property tax, property insurance, utilities, and others). It’s clear to see that the property in this example is cash flow positive, generating a $350 profit per month.

Does the 1% rule factor in mortgage repayments and property costs?

Technically, the rule only looks at the expected rental income. However, the underlying assumption is that if you find a property that complies with the rule, there’s a strong possibility that the monthly rent will cover the mortgage costs and the general property expenses like tax, insurance, and utilities.

How can you find 1% rule properties?

The key to finding properties that fall within the boundaries of the rule is to use property listing websites that provide a clear indication of the expected rental income. In essence, you only need to know two pieces of information when analyzing properties with this filter, namely:

- Property Price

- Expected Rental Income

Roofstock in particular makes this very easy to do because they list the property price and the expected rental income on the same page. They even have a 1% rule filter on their site.

When using other sites like Zillow, Trulia, or Realtor.com you will need to gather data on the expected rental income for the area that you are investing in, to double-check if it is in line with the 1% rule.

1% Rule Pros vs Cons

PROS

- You can quickly assess if a rental property is likely to be profitable from the get-go

- You screen a large number of properties in very little time

- It can help you discard properties that may present cash flow issues

CONS

- It doesn’t work for all rental property markets

- It is only a starting point. You will need to conduct deeper cash flow and investment property analysis

- There are times when it makes sense to break the rule (if the property price or rental fee is likely to appreciate in time)

Can you break the 1% rule?

There are certain situations where it makes sense to break the 1% rule. More specifically:

If the property value is likely to increase in value over time: In this situation, it could definitely be viable to acquire an investment property with a rental income that is less than 1%. However, this would be a buy and hold strategy that would only become profitable when you eventually sell the property for a healthy profit margin.

If you are determined to invest in a particular area: There are certain areas in the US where you are extremely unlikely to find a property that can generate rental income that is equal to or more than 1% of the property price. In this scenario, it is likely that the rental income will only cover the mortgage cost and property expenses after several years of rental increases. This situation is not advisable for investors that are primarily interested in cash flow.

Final Thoughts

All in all, the 1% rule is a good rule of thumb for quickly assessing the potential rental income of a residential property. When properties meet this criteria, it greatly increases the likelihood of achieving positive cash flow every month.

That being said, it is only a starting point. Once you have pooled together a number of potential properties, you need to complete a more thorough analysis of the numbers. When you reach this point, a rental property calculator can be very useful, and it will also pay to have a concrete understanding of the property’s cap rate.