Many US homeowners aren’t sure if they should commit to paying off their mortgage early, or simply pay the minimum monthly amount until the loan expires after 20 or 30 years. In this post, we present several reasons to eliminate your bond as quickly as possible, together with a few compelling reasons not to.

Table of Contents

Key Reasons to Payoff Your Mortgage Early

1. Instant Compounding

You don’t have to wait 30 years to experience the benefit of compounding if you pay off your mortgage early.

Instead, every extra dollar that you put into your bond instantly compounds in the form of savings. Instead of having to pay interest on that dollar for years and decades to come, you instantly eliminate the future interest that you would be obliged to pay.

This can be extremely motivating for impatient people that can’t face the thought of waiting several decades for their investment decisions to pay off.

2. Debt free living can you reduce your stress levels

For many Americans, a mortgage represents the biggest financial investment that they will ever make. The most popular loan term in this day and age is 30 years, meaning 360 loan payments over the course of 3 decades.

To put that in perspective, a life prison sentence in the US is only 15 years. For some people, the thought of a seemingly never-ending debt burden is simply too much to bear. If you fall into this camp, paying off your mortgage could be psychologically freeing. Instead of being weighed down by the constant pressure of your bond repayment, you can remove this psychological burden from your life entirely. For many, this can lead to a reduction in stress levels, and greater peace of mind.

3. Paying off your mortgage can make it easier to acquire an investment property

There are a number of ways in which being mortgage free can help you acquire an investment property.

Firstly, because it reduces your monthly expenses, it can help you acquire better loan terms with a bank or rental property loan provider.

Secondly, it gives you the option of converting your paid-off home into a rental property. This is an attractive proposition because if you then decide to purchase a new home as your primary residence, you can use a traditional, low-interest rate loan to do so.

Thirdly, it also gives you a huge amount of flexibility in terms of funding the investment property. You could leverage the existing equity in your home using a heloc (home equity line of credit), or take out some of the money you’ve paid in to make a substantial deposit on the rental property. Alternatively, you could implement a cash-out refinance loan with a hard money loan provider like New Silver.

The point is, even if your home isn’t completely paid off, all the extra funds and equity that you have built up in the property can be used to finance the purchase of a second home. You can then start harnessing the power of home appreciation to increase your net worth, using two properties rather than one.

4. Your capital isn't subjected to the volatility of the stock market

While there is definitely money to be made investing stocks, ETFs, mutual funds, and other stock-based investment vehicles, there is also an element of risk that comes with the territory. Although real estate is not immune to such risks, the track record of residential property and commercial property is significantly more stable than the stock market.

Historically speaking property prices may not rise as fast as shares, but when the market falters, real estate tends to hold steady and bounce back strong, even in extreme cases such as the global financial crisis of 2008 (which was ultimately caused by extremely irresponsible lending practices rather than the depreciation of real estate as an asset class).

5. Each extra repayment increases home equity

One of the most attractive aspects of buying a home is that you can look forward to property appreciation. Even if you make no extra payments toward your mortgage, your property is likely to increase in value over the long term.

In addition to the natural appreciation that you can look forward to when the property market is rising, you can further increase the equity in your home by making extra payments. Equity is defined as “the difference between the market value of your home and the amount you owe the lender who holds the mortgage”. When your property increases in value, the equity available to you increases.

In effect, this allows you to leverage two forces that are both working to increase your net worth.

Property appreciation naturally increases the equity available to you as the market value of the property increases, while making extra payments decreases the total debt that you are liable to pay the mortgage provider. Combining these two forces can accelerate your journey to becoming a high-net-worth individual.

Key Reasons to Avoid Paying Off Your Mortgage Early

1.You can potentially increase your net worth faster investing in the stock market

Historically speaking, the US stock market has outperformed the US real estate market, provided you take a long-term view. For instance, according to the Case Shiller Housing index, the stock market trounced housing for almost a century from 1928 to 2018. During this time period:

- The annualized rate of return for housing was 3.7%

- The annualized rate of return for the S&P 500 was 9.5%

If you then account for compounding over that period, the performance of the S&P 500 was 5 times better than the housing market.

Importantly, you will quickly discover a similar trend if looking at more recent data.

- Average US Home Price Jan 1990: $76,527.00 –

- Average US Home Price Dec 2020: $234,319.00

- Lump-sum invested in S&P 500 Jan 1990: $76,527.00

- Value of lump sum invested in S&P 500 Dec 2020: $1,322,868.97

In the example above, it is clear to see that if you had invested a lump sum of $76,527 into the stock market in January 1990, it would be worth approximately 5.6 times more than the equivalent sum of money invested in residential real estate in the US.

2. You have more pressing debt burdens to tackle

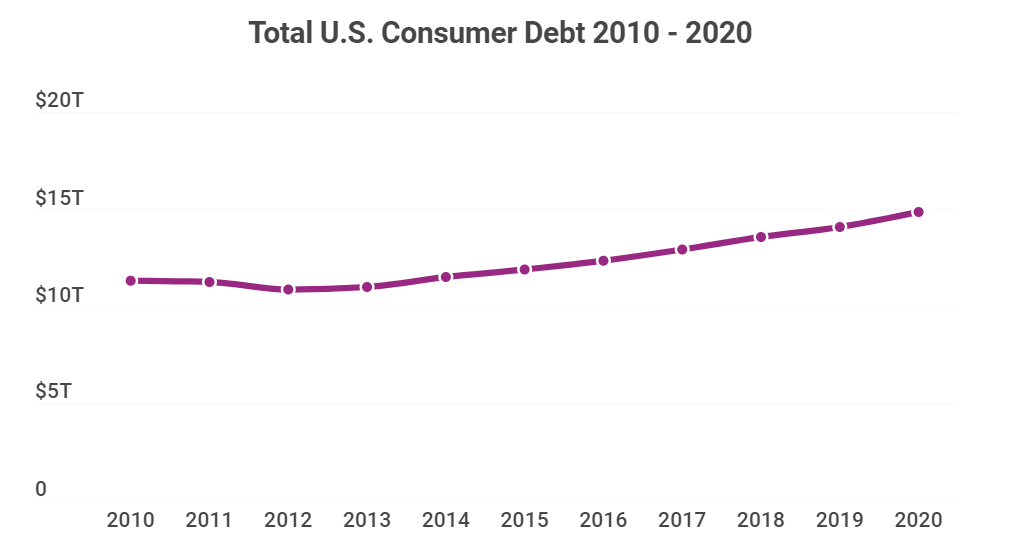

According to data from experian, US Consumer debt reached record levels in 2020.

Importantly, mortgage loan debt is not the only contributor to these record-setting debt levels. The full pool of American debt is comprised of:

- Mortgage loans

- Auto loans

- Student loans

- Credit card debt

- Home equity lines of credit

- Personal loans

This is important, because of all the debt categories listed above, your residential mortgage is likely to have the lowest interest rate. If this applies to you, it may be in your best interests to follow the Dave Ramsay debt snowball method, where you tackle your smallest debts first (like credit cards, student loans, and car loans) before moving onto your biggest debt, which is usually your home loan.

3. Your investment portfolio may lack diversity

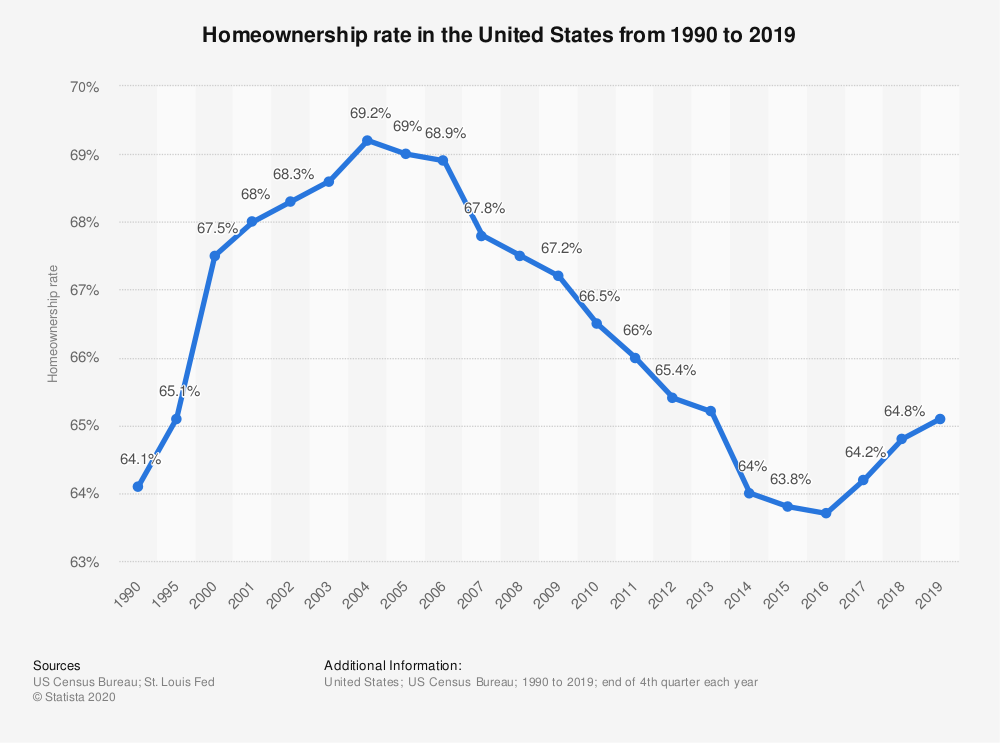

Although real estate is traditionally one of the most stable asset classes, it is not immune from dips and crashes. For instance, the crash of Wall Street in 1929 served as a catalyst for the great depression, with US real estate prices falling as much as 67% during this period. More recently, the global financial crisis of 2008 saw real estate prices plummet by as much as 18%, with thousands of homes falling into foreclosure and the US homeownership rate dropping by 3.5% between 2007 and 2014.

The underlying point is that if all your money is tied up in real estate, it can be catastrophic if the market takes a massive downturn or you lose the ability to cover the monthly repayments. Losing your house to foreclosure can destroy your net worth and your credit score in one fell swoop. This is why most financial advisors recommend a diverse portfolio of assets rather than a single stock or house in this instance.

4. You lose the power of leverage

Leverage is one of the most underappreciated aspects of real estate investing. The Corporate Finance Institute defines leverage as “ the use of borrowed money (debt) to finance the purchase of assets with the expectation that the income or capital gain from the new asset will exceed the cost of borrowing.”

With real estate specifically, leverage is almost always built into the financial structure of the mortgage. In most cases, a borrower will put down between 10-20% of the purchase price, and use mortgage debt to fund the rest.

In other words, to purchase a $100,000 home, you only need to put down $10,000 of your own capital. If the property price increases by 5%, the $10,000 that you put down has effectively generated a $5,000 return. When you factor in the power compounding, the equity growth that you can experience with a leveraged position can create life-changing wealth. However, if you choose to pay off your mortgage early, you are no longer using the power of financial leverage to your advantage.

Final Thoughts

From a purely financial perspective, there is compelling evidence to suggest that you can grow your net worth faster by investing in the stock market while paying the minimum monthly amount on your bond.

However, the possibility of mortgage-free living remains an attractive proposition for many US homeowners, and there are both psychological and financial benefits to look forward to if you choose the mortgage-free option.