The Short Answer

Mortgage funds are investment vehicles that pool capital from individual and institutional investors to finance real estate projects, offering a blend of security and yield. These funds operate like mutual funds but focus on real estate loans, including residential and commercial mortgages. Investors receive returns primarily from the interest on these loans, providing a stable income stream.

A key component is mortgage backed securities (MBS), which are bundles of mortgages sold as investment products, diversifying risk across multiple loans rather than relying on individual properties. Mortgage funds generally offer a balanced risk-return profile, with more consistent returns compared to direct real estate investments, though they remain susceptible to market downturns, interest rate fluctuations, and credit risks.

Investors must carefully evaluate fund strategies, past performance, fees, and liquidity options. Due diligence includes reviewing the fund’s portfolio diversity, management team, and adherence to regulatory standards. While mortgage funds can enhance portfolio diversification and provide steady income, they require a strategic approach and awareness of their inherent risks and market dynamics.

Skip To

How Do Mortgage Funds Work?

Mortgage funds represent a sophisticated financial mechanism in real estate, offering a unique convergence of security and yield for investors that is more stable than investing in mere stocks.

Mortgage funds pool capital from individual and institutional investors to finance real estate projects. This investment approach enables a fund to distribute risks and rewards across a broader spectrum, making it an attractive option for diversifying a portfolio.

The structure of a mortgage fund is like a mutual fund tailored to real estate investments. Investors buy units or shares in the fund, and the fund managers allocate these pooled resources to finance real estate projects—from residential developments to commercial real estate. The return on investment primarily comes from the interest paid on these loans, producing a relatively stable income stream.

Role of Mortgage Backed Securities

A pivotal element in the functioning of mortgage funds is the use of mortgage-backed securities (MBS). These securities are essentially bundles of mortgages that are sold as investment products. When a mortgage fund invests in MBS, it’s buying a stake in a pool of real estate loans. This diversification further mitigates risk as the performance of the fund is not tied to a single property or borrower.

Risk and Return Profile

The risk-return profile of mortgage funds tends to be more balanced than direct real estate investments. While returns might not reach the highs of booming property markets, they tend to be more consistent, protected by regular interest payments from borrowers. However, investors need to understand that these funds are not immune to risk. Market downturns, default rates, and interest rate fluctuations can impact a mortgage fund’s performance.

Market Dynamics and Economic Impacts

Mortgage funds are sensitive to broader economic trends and market dynamics. As stated above, factors such as interest rate changes, housing market fluctuations, and even broader economic conditions can influence the performance of these funds. For instance, a rise in interest rates can increase borrowing costs for real estate projects, potentially cutting their returns.

Finding The Right Fund To Invest In

Investing in a mortgage fund can prove a strategic move for real estate investors, but it requires diligent care and research. Here we outline the process of finding and evaluating mortgage fund opportunities that align with your investment goals.

Finding Mortgage Funds

The first step is to identify potential funds. Investors can start by researching online, consulting financial advisors, or exploring offerings from investment platforms. It’s important to look for funds with a strong track record, transparent operations, and a management team with proven expertise in the real estate finance industry.

Due Diligence

Due diligence involves scrutinizing the fund’s past performance, investment strategy, loan portfolio, and risk management practices. Investors should examine its historical return rates, default rates, and how it has navigated various market conditions. Understanding its fee structure is also crucial to gauge the net returns on investment.

Evaluating Mortgage Fund Opportunities

When evaluating a mortgage fund, you should consider several key factors:

Investment Strategy: Does its orientation align with your risk tolerance and exit horizon?

Portfolio Diversity: A fund with a diverse loan portfolio can spread risk across different property types and geographical locations. How diversified is it?

Liquidity: Probe its terms regarding investment liquidity and withdrawing funds.

Regulatory Compliance: Ensure that it strictly adheres to regulatory standards and practices transparent reporting.

Seeking Out Reputable Fund Managers

Choosing a fund managed by a reputable and experienced team is crucial. Seek fund managers with a solid background in real estate, finance, and risk management. Look for those who are proactive in communicating with you, providing regular updates and insights into the fund’s performance and market conditions. If they don’t deliver, ask questions.

Portfolio Integration

Mortgage funds should be integrated thoughtfully into a broader investment portfolio. They can provide a balance to more volatile investments and contribute to a well-rounded investment strategy. Potentially, mortgage funds tend to have lower risk than alternatives, but they still require thorough due diligence and a strategic approach. By carefully selecting and evaluating mortgage funds, you can add a valuable interest-based income stream, capitalizing on the relative stability of real estate financing.

The Best US Mortgage Funds To Invest In

Some of the most popular mortgage funds to invest in, are mortgage-backed securities indexes like:

Vanguard Mortgage Backed Securities Index

The Vanguard Mortgage Backed Securities Index is a low-cost index fund that invests in U.S. mortgage-backed pass-through securities issued by the Government National Mortgage Association (GNMA), the Federal National Mortgage Association (FNMA), and the Federal Home Loan Mortgage Corporation (FHLMC). In addition to other bond market risks, the Vanguard mortgage backed securities index is subject to prepayment risk.

When mortgage refinance activity is high, the yield on the fund is likely to decrease. The fund is managed by the Vanguard Fixed Income Group, with a minimum investment price of $3,000.

JP Morgan Mortgage Backed Securities Fund

JP Morgan’s mortgage backed securities fund utilizes diversified portfolio of debt securities backed by pools of agency and non-agency residential and commercial mortgages. JP Morgan’s mortgage backed securities fund has 3 experienced managers, with over $5 billion in fund’s assets. The 12 month rolling dividend yield is 3.70%, and the minimum investment is $1 million.

There are a variety of mortgage funds to choose from, within the US investing space. Branching out from the larger mortgage backed securities index options, there are many other mortgage funds to invest in that can also provide good yields. Let’s take a closer look at a few of these…

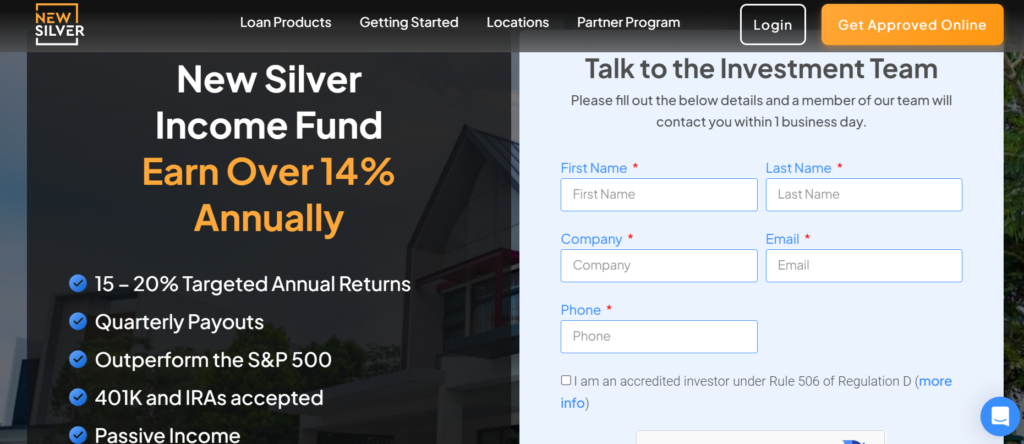

Fund 1: New Silver’s Income Fund

New Silver’s Income Fund generates a high income return from a diversified portfolio of loans underwritten and originated by New Silver Lending LLC. The fund has target returns of 15-20%, with a preferred return of 14%. The Performance Fee, after preferred return, is 80% investor and 20% manager.

All loans are short-duration and secured with a first priority, perfected lien on residential investment properties in the United States. Notes are held in an indentured trust for the benefit of investors, Ankura Trust Company serving as trustee. Distributions are made quarterly.

New Silver’s Income Fund returns are enhanced by committed senior leverage at a competitive cost of capital. New Silver Lending has $3mm+ of equity invested pari passu with the Fund.

Fund 2: BlackRock’s Mortgage Fund

Blackrock offers a mortgage fund for investors in the US. The mortgage funds provided by Blackrock invest primarily in mortgage-related securities index options of any maturity, including U.S. government securities, U.S. government agency securities, securities issued by U.S. government instrumentalities and U.S. government-sponsored enterprises and other mortgage-backed securities or mortgage-related securities issued by the U.S. government or by private issuers.

The total returns offered by BlackRock on their US mortgage funds are around 5.28% for 1 year, with over $400 million in the funds.

Fund 3: American Funds Mortgage Fund

American Funds Mortgage Fund is focused on high-quality mortgage-backed securities that are either guaranteed or sponsored by the U.S. government, this fund may provide a higher level of income than U.S. Treasuries as well as diversification during equity market downturns.

There are 3 portfolio managers, and the fund has been around for over 5 years. The worst average yield is 4% and this fund seeks to add value by actively managing sector allocation, security selection, duration and yield curve.

Fund 4: BNY Mellon US Mortgage Fund

The BNY Mellon fund normally invests at least 80% of its net asset value, plus any borrowings for investment purposes, in U.S. mortgage-related securities. It will invest at least 65% of its net asset value in Ginnie Maes. The fund can invest in privately issued mortgage-backed securities with a “BBB” or higher credit quality, but currently the advisor intends to invest in only those securities with an “A” or higher credit quality. It is not subject to any maturity or duration restrictions.

Benefits Of Investing In Mortgage Funds

Mortgage funds are a kind of investment vehicle that is a stabilizing force and a dynamic player in today’s real estate investment scene. For investors, it’s another option for building a diversified investment portfolio, amongst other significant advantages.

Reliable returns

The income earned from mortgage funds is both reliable and consistent. The income distributions from mortgage funds are usually monthly or quarterly. These returns are generated from the interest paid on the underlying loans, offering a relatively steady cash flow, which can be particularly attractive in a volatile market. Essentially, mortgage funds provide a secure, reliable income for investors.

Diversification

One of the biggest advantages of investing in mortgage funds is the diversification that is provided. These funds typically invest in a variety of loans, which helps mitigate the risk, in comparison to investing in a single property. Mortgage funds often invest in the likes of residential mortgages, commercial mortgages, and real estate-backed securities.

Professional management

Mortgage funds are managed by seasoned real estate professionals who are experienced with selecting quality loans, minimizing risk and optimizing returns. This experience is invaluable for investors, who can rest assured that their investment is being managed by knowledgeable and experienced professionals.

High yields

Compared to traditional fixed-income investments like government bonds, mortgage funds often offer higher yields. This is especially true for funds that focus on non-conventional or higher-risk mortgages, which come with higher interest rates.

Liquidity

When investing in a mortgage fund, you have the flexibility to choose the amount and timing of your investment. If you wish to withdraw your investment, you can submit a request to the fund manager, though it’s important to be aware that most funds have specific restrictions on how and when investor capital is returned.

Risks Of Investing In Mortgage Funds

While mortgage funds provide a great opportunity for real estate investors when their goals align with the fund’s investment objective, however they also come with some risks.

While mortgage funds provide a great opportunity for real estate investors when their goals align with the fund’s investment objective, they also come with some risks.

Lack of control

One of the largest risks of investing in mortgage funds is that investors give up control to the fund manager. The success of a mortgage fund largely relies on the fund manager. So, investors need to pick a fund manager with the right expertise, so that they can get the most out of their investment.

Credit risk

The primary risk with investing in mortgage funds, is the risk of borrowers defaulting on their loans, which will impact your investment ultimately. High default rates can negatively impact the fund and lead to a decrease in the returns for investors. These can occur from changes to certain influential factors like interest rates.

Market risk

Mortgage fund performance is linked to the real estate market, which is notoriously variable. This means that a downturn in the market or interest rates can have a negative effect on borrowers who could default on their loan repayments, and this in turn impacts the returns that investors can get from mortgage funds and the principal value.

Return changes

Mortgage fund investments come with the risk that the anticipated rate of return may not be met. Investors should understand that any target returns provided are merely goals, with no assurance of actual performance. Investors should also be aware of any prepayment risk.

Is This Strategy Right For You?

As the real estate market continues to evolve, mortgage funds exemplify the innovative ways investors can profit from this ever-changing landscape. By embracing these insights, investors can capitalize on the opportunities that mortgage funds present while navigating the associated risks and regulatory landscapes.

When choosing whether this is the right strategy for you, bear in mind that:

- For those who are looking to diversify their portfolio, investing in mortgage funds is a great way to do it. The risk is spread across multiple investments and investors can diversify their portfolio into various real estate investment types.

- If liquidity is important to you, bear in mind that mortgage funds are a longer term investment which may not be liquid within a short time frame. Some fund managers may charge a penalty for early investment withdrawal.

- Assess your investment risk tolerance because investing in mortgage funds comes with various risks, and choose a fund that suits your risk profile. Some mortgage funds invest in higher risk loans that may not align with your risk tolerance, instead you may consider low-volatility investments.

- Investors who are looking for a more regular, passive income, should consider mortgage funds as they offer monthly or quarterly distributions.

- Consider the current real estate market before investing in mortgage funds, and be cautious if the market is seeing rising interest rates or a decline in property prices.

- Review the fund expenses and fees, including management fees and performance fees. High fund expenses and fees can eat into your returns, so ensure they are justified by the fund’s performance and strategy.

- Assess how the fund fits into your overall portfolio, these funds should provide positive diversification and complement the other investments you already have.

- Consider whether a mortgage fund aligns with your goals. A fund should fit with your investment objectives, whether for income, growth, or capital preservation. This includes looking at a fund’s assets, past performance, principal value and the fund’s investment objective.