It is common for experienced house flippers to achieve a return on investment that ranges from 10-20%, after factoring in all the expenses involved when flipping a house. If you assume a 15% return, that would mean a net profit margin of:

- $100,000 House Flip = $15,000

- $250,000 House Flip = $37,500

- $400,000 House Flip = $60,000

In addition, the latest data from Attom Data Solutions indicates that on average house flippers make approximately $73,766 in gross profit per flip. The only issue with this number is that it fails to identify the costs involved during most flips , which makes the net profit figures hard to assess.

The goal of this post is to provide more insight into how much house flippers actually make per flip, and how much they make over the long term. Let’s get started.

How Much Is The Average Gross Profit Per Flip

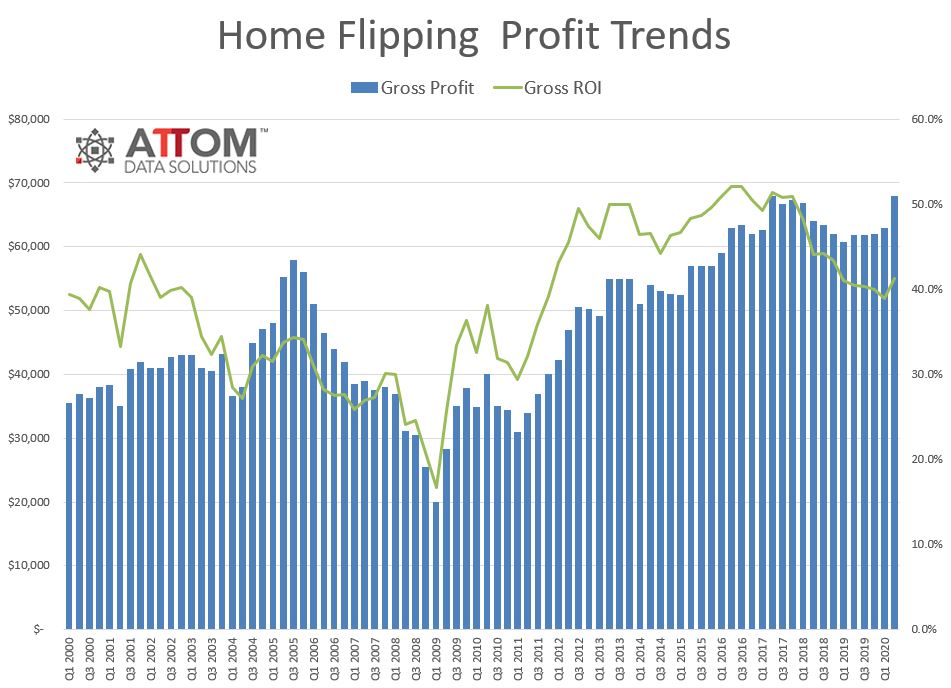

Attom Data Solutions has been providing excellent real estate investing data for years. For example, here are some of the latest numbers from their home flipping profit trend report.

Average House Flipping Profit Per Quarter:

- Q3 2020: $73,766

- Q1 2020: $69,000

- Q3 2019: $61,800

- Q1 2019: 61,200

As you can see from the bullet points and the image above, we already have access to public and accurate data on how much house flippers make on average. However, Attom’s information is only really good for working out the gross profit of a flip.

This is a useful starting point, but it’s pretty clear that people want a better sense of both the income and all the expenses involved in a typical fix and flip. Fortunately, it is possible to arrive at a realistic estimate of the average net profit that house flippers make, by utilizing:

- Industry standards

- The 70% Rule In Reverse

- An estimate of the renovation costs

From there, it should be pretty easy to approximate how much money you can make flipping houses, based on average net profit, and the total number of flips that a house flipper can realistically complete in a single year.

How Much Is The Average Gross Profit Per Flip

Method 1: Using Industry Averages For Net Profit

According to veteran real estate agent Dustin Parker, 15% is a realistic margin to expect when flipping properties. This matches up with industry averages, with 10-20% being a perfectly reasonable range, after factoring in the cost of renovations and financing costs.

Based on a 15% margin, you can expect to make:

- $15,000 when selling a $100,000 Property

- $37,500 when selling a $250,000 Property

- $60,000 when selling a $400,000 Property

- $90,000 when selling a $600,000 Property

On this point, it’s worth mentioning that the median resale value of most flips in America is approximately $215,810 according to the latest figures from Attom. This would result in a net margin of $32,371.00, based on the 15% industry guideline.

Method 2: Using The 70% Rule To Workout Net Profit

Another way to estimate the average net profit per flip is to use the 70% rule in reverse. The 70% rule is a popular guideline that real estate investors use to calculate how much you should offer on a house.

The 70 rule is relatively simple. To calculate how much you should pay for a house that you intend to flip, you multiply the current price of the home by 70%, then deduct the expected repair costs.

Maximum Offer Price = After Repair Value * 70% – Repair Costs

Now we have all the ingredients we need to approximate the average net profit per flip.

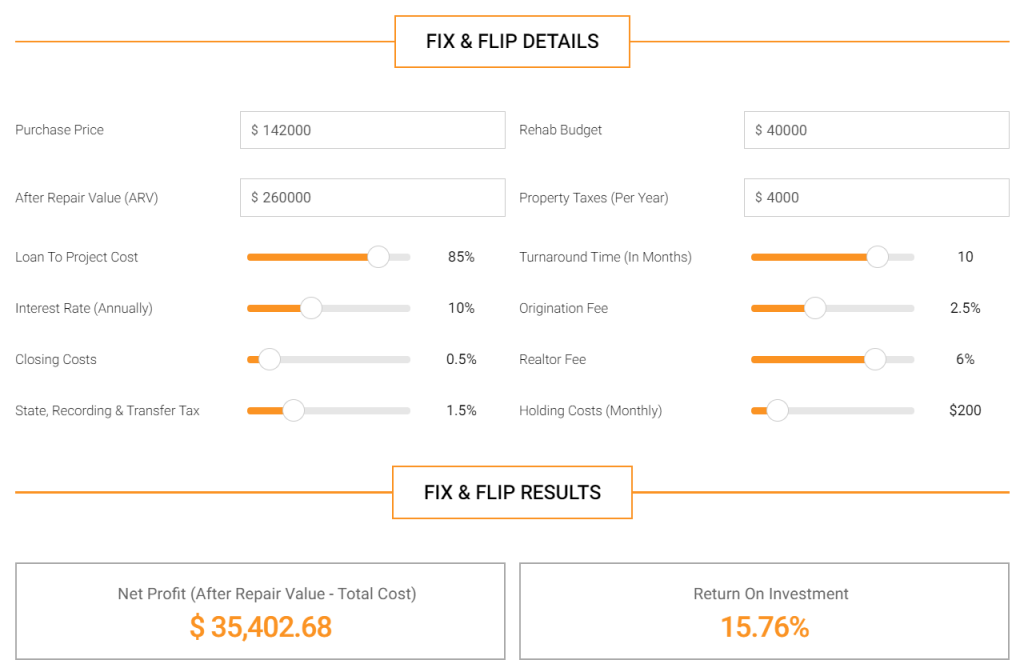

- Average home price in the US = $260,000

- Expected Renovation Costs = $40,000

- Asking price using 70% Rule = $260,000 * 70% – $40,000

- Asking price = $142,000

Now, all we need to do is plug this data into a hard money calculator , to assess all the costs involved, including financing costs, real estate commissions, property taxes, and holding costs.

As you can see from the image above, you need to factor in all the costs involved in a typical flip to get a better sense of the final net profit that you can potentially make during the deal.

Based on both of the methods outlined above, it is realistic to make approximately $32,000 or more net profit per flip. If you flip inexpensive homes, you are likely to make less than this amount, but if you focus on higher-end homes, you can potentially make more.

How Many Homes Can You Flip In A Year

When people first get started with real estate investing, it is very easy to underestimate how long everything takes. This is particularly true when flipping homes.

According to FlippingProspertity.com , “the average full-time flipper can expect to flip somewhere between 2 and 7 houses a year “. To put that in perspective, that means highly experienced investors are able to flip 1 house every 2 months over the course of a year.

In order to achieve such an efficient ‘flipping rate,’ your project management skills need to be exceptional, and you need to able to run multiple projects at the same time. From our perspective, it is better to have more conservative expectations in the beginning phase of your real estate investing career. 1-3 flips per year is an achievable goal for a real estate investor with limited experience.

With that covered, we can officially say that:

- 1 Flip = $32,000

- 2 Flips = $64,000

- 3 Flips = $96,000

- 4 Flips = $128,000

- 5 Flips = $160,000

- 6 Flips = $192,000

At this point, one thing should be pretty clear. The number of flips that you can complete in a year is one of the primary determinants of how much money you can make flipping houses. While some may view this limitation in a negative light, it can also be viewed as one of the best benefits of this real estate investment strategy. Unlike earning a salary, flipping homes allows you to stack your income multiple times in a single year. Good luck asking your boss to double or triple your salary.

Can you lose money flipping houses?

In a word, YES. While there is every chance that you can make a sizeable profit, the possibility of losing money in a deal most certainly exists. To help prevent this from happening, you need to be mindful of the three biggest risks, namely:

Risk 1: The Renovations Prove To Be More Expensive Than You Think

As a real estate investor, the onus is on you to complete due diligence on the house that you intend to purchase. However, even experienced flippers will run into projects that end up costing significantly more than they initially budgeted for. In most cases, it boils down to house faults that weren’t picked up during the house inspection. This resource from theZebra.com lists the most expensive home repairs that could derail the financial success of your flip:

- Foundation Repairs

- Roof Repairs

- HVAC Repairs

- Water/Sewerage Issues

- Mold Removal

- Fixing The Driveway

Risk 2: You Fail To Sell The House Quickly

According to Zillow, ‘the average time it takes to sell a house is 55-70 days in the U.S.” However, there are exceptions to every rule, and it may take as long as 6 months to sell a house after listing it on popular real estate websites.

This is problematic because every month spent on the market translates to another month of holding costs that you are responsible for paying. Furthermore, if the house takes a very long time to sell, you could lose the house to foreclosure, depending on the length of your loan agreement and the flexibility of your loan provider.

Risk 3: You Miscalculate the ARV (After Repair Value)

Of all the mistakes you can make, miscalculating the ARV is arguably the least forgivable. Formulating an accurate estimate of the market value of the house after the renovations have been completed is crucial to completing a successful deal. It is the metric that dictates how much you can spend on financing, renovations, holding costs, and closing costs. If you fail to get this right, your flip could quite literally turn into a flop.

Final Thoughts

In the end, it should be pretty clear that there are plenty of real estate investors making very respectable sums of money through property flipping. In the US, the average revenue per flip ranges from $61,000 to $74,000, while the average net profit is somewhere between $25,000 and $35,000. More importantly, it is entirely possible to achieve exponential income growth if you flip multiple houses per year.

With that being said, there are definitely risks associated with this investment strategy. You could potentially lose money if fail to sell the house quickly, miscalculate renovation costs, or overestimate the after repair value of the home.

Lastly, if you are ready to start your property flipping journey, New Silver can provide the house flip loan you need to get started. We offer an extremely efficient loan closing process, together with highly competitive interest rates. We are a tried and trusted hard money lender that can get you the capital you need in 7 days or less.